Tronox Holdings (TROX)·Q4 2025 Earnings Summary

Tronox Stock Jumps 4% on China Plant Closure as Volumes Beat Expectations

January 26, 2026 · by Fintool AI Agent

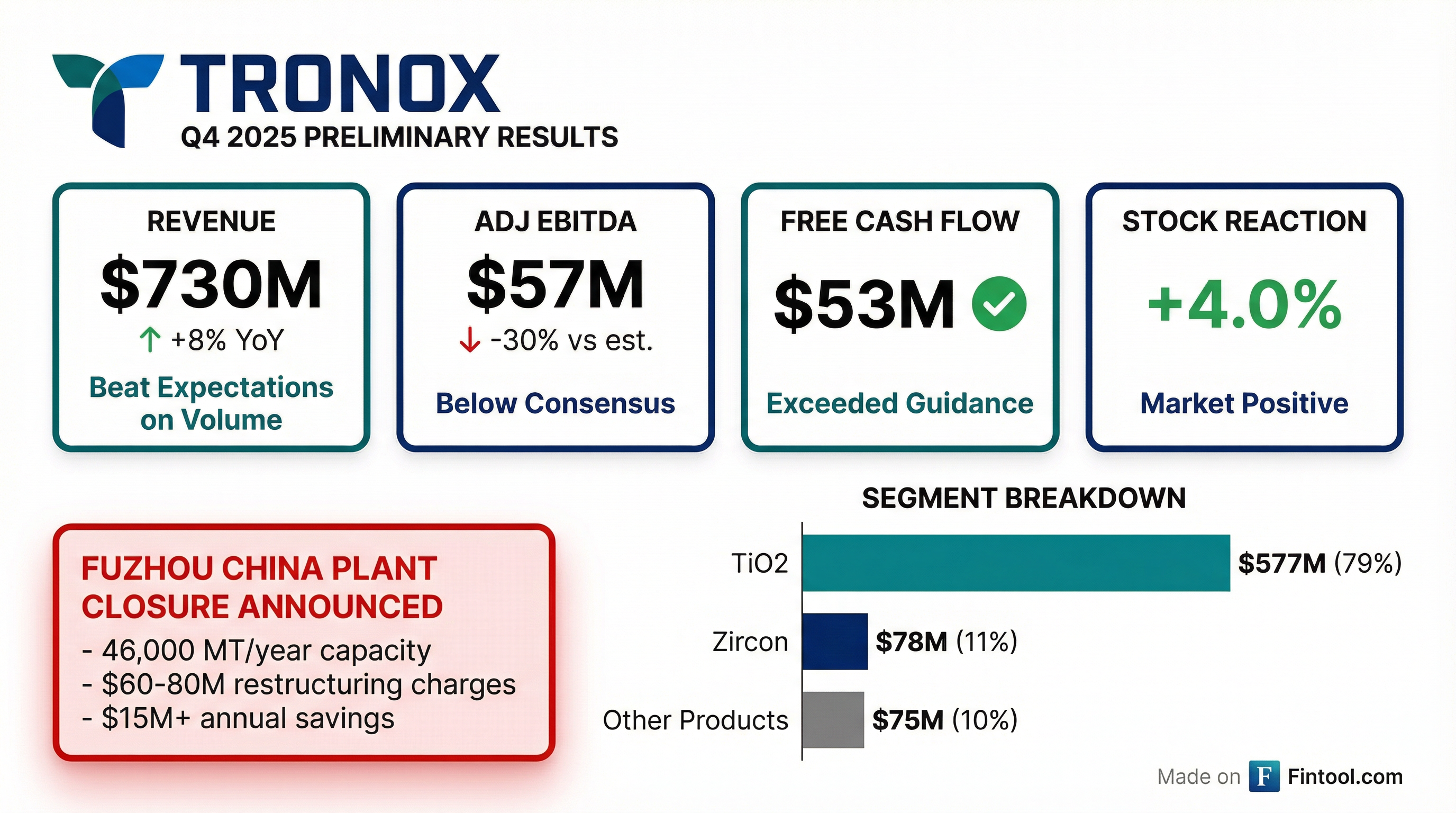

Tronox Holdings (NYSE: TROX) released preliminary Q4 2025 results today alongside a significant strategic announcement: the permanent closure of its TiO2 pigment plant in Fuzhou, China. Despite an EBITDA miss versus consensus, the stock rallied ~4% as investors welcomed the cost restructuring and stronger-than-expected volumes driven by anti-dumping tariff benefits in key markets.

Did Tronox Beat Earnings in Q4 2025?

Mixed results: Revenue beat prior year but missed consensus; EBITDA significantly missed expectations.

*Values retrieved from S&P Global

The revenue miss versus consensus was driven by pricing headwinds, but volumes significantly outperformed:

- TiO2 volumes: +13% YoY, +9% sequentially (driven by higher volumes in India)

- Zircon volumes: +27% YoY, +42% sequentially (China buyers reentered market earlier than expected)

- TiO2 pricing: -8% YoY, -2% sequentially, plus 2% unfavorable mix from higher Asia sales

- Zircon pricing: -23% YoY, -10% sequentially (greater headwind than anticipated)

Revenue Breakdown by Segment

What Did Management Announce About the China Plant?

The headline announcement was the permanent closure of the Fuzhou, China TiO2 plant — a significant strategic decision reflecting the structural challenges in Chinese markets.

Key details:

- Capacity impacted: 46,000 metric tons per year

- Employees affected: ~550 permanent staff

- Restructuring charges: $60-80M (including $35-45M non-cash write-downs)

- Expected annual savings: >$15M

- Customer impact: None expected due to globally diversified manufacturing footprint

CEO John Romano explained the rationale: "The prolonged market downturn combined with rising production costs eroded the financial and commercial viability of continued operations. The closure was also necessitated by Chinese competitors' continued excess production and unsustainable pricing."

How Did the Stock React?

TROX shares rallied approximately 4% on the preliminary results announcement, closing at $6.54 on January 26, 2026.

The positive reaction suggests the market is pricing in:

- Cost discipline and restructuring benefits

- Free cash flow exceeding guidance ($53M vs expectations)

- Volume improvements signaling market share gains in protected markets

- Confidence in 2026 positive free cash flow guidance

What Changed From Last Quarter?

Q3 2025 vs Q4 2025 Comparison:

*Estimated from segment disclosure

Key improvements:

- TiO2 volumes +9% sequentially despite Fuzhou-related volume headwind

- Zircon volumes +42% sequentially as China buyers returned

- Free cash flow swung from negative $137M to positive $53M

- Working capital improvements and inventory reductions

Key deteriorations:

- EBITDA declined 23% sequentially on continued pricing pressure

- Stallingborough site took longer to come back online, adding incremental costs

- Unfavorable product mix from higher Asia sales

What's the Beat/Miss Track Record?

Tronox has missed earnings estimates for 8 consecutive quarters:

The consistent misses reflect the prolonged industry downturn, but management has maintained that the industry is reaching an inflection point.

What Did Management Guide For 2026?

While full guidance will be provided on the February earnings call, management offered key forward-looking commentary:

Positive signals:

- "As pricing and costs improve as a result of actions underway, I expect free cash flow to be positive in 2026" — CEO John Romano

- TiO2 prices improving due to price increase announcements effective Q1 2026

- Favorable mix expected from sales into higher-priced regions

- Capital expenditures expected to be <$275M in 2026 (catch-up from 2025 delays)

Industry tailwinds:

- Anti-dumping duties now in effect across markets representing 2.7M tons of TiO2 consumption

- Over 1.1M tons of global TiO2 supply taken offline since 2023 (mostly permanent)

- Brazilian duties finalized with higher rates; Saudi Arabia implemented definitive duties

Rare earths strategy update: Management continues advancing mineral processing operations to produce rare earth elements: "We continue to progress our work to assess the feasibility of a cracking and leaching facility in Australia to process monazite bearing tailings from our existing mining operations, producing a feedstock intended for a potential U.S. refinery capable of delivering both heavy and light rare earth oxides."

Historical Financial Trends

*Values retrieved from S&P Global

The deteriorating margin profile reflects the challenging pricing environment, but Q4 2025 marks a potential inflection with volumes returning and pricing stabilizing.

Key Risks and Concerns

Near-term headwinds:

- Restructuring charges of $60-80M will impact Q4 results

- Stallingborough downtime cost overruns

- Continued pricing pressure despite volume recovery

- High leverage (~$3.5B total debt)

Structural concerns:

- Chinese competitors' excess production continues

- Dependence on anti-dumping enforcement effectiveness

- India anti-dumping duties temporarily stayed (expected to be reinstated)

- Rising raw material costs (particularly sulfur)

What to Watch on the Full Earnings Call

The full Q4 2025 earnings call is scheduled for February 2026. Key items to monitor:

- Final EBITDA and EPS — Income tax provision not finalized in preliminary results

- 2026 full-year guidance — Revenue, EBITDA, capex, and free cash flow targets

- TiO2 pricing trajectory — Extent of Q1 2026 price increases realized

- India duty status — Update on anti-dumping duty reinstatement timeline

- Rare earth strategy — Progress on Australia cracking/leaching facility feasibility

- Balance sheet — Debt paydown and liquidity position

Preliminary results are unaudited and subject to change based on completion of quarter-end close processes. EPS not available at this time pending finalization of income tax provision.

Related Links: