Earnings summaries and quarterly performance for Tronox Holdings.

Executive leadership at Tronox Holdings.

John Romano

Chief Executive Officer

Amy Webb

Vice President, Chief Human Resources Officer

D. John Srivisal

Senior Vice President, Chief Financial Officer

Emad AlJunaidi

Senior Vice President, Integrated Supply Chain and Digital Transformation

Jeffrey Engle

Senior Vice President, Commercial and Strategy

Jeffrey Neuman

Senior Vice President, General Counsel and Secretary

Jennifer Guenther

Vice President, Chief Sustainability Officer, Head of Investor Relations and External Affairs

Jonathan Flood

Vice President, Corporate Controller and Principal Accounting Officer

Board of directors at Tronox Holdings.

Fawaz Al-Fawaz

Director

Ginger M. Jones

Independent Director

Ilan Kaufthal

Independent Chair of the Board

Jean-Francois Turgeon

Director

Lucrèce Foufopoulos-De Ridder

Independent Director

Moazzam Khan

Director

Peter B. Johnston

Independent Director

Sipho Nkosi

Independent Director

Stephen Jones

Independent Director

Research analysts who have asked questions during Tronox Holdings earnings calls.

Hassan Ahmed

Alembic Global Advisors

6 questions for TROX

John Ezekiel Roberts

Mizuho Securities

6 questions for TROX

David Begleiter

Deutsche Bank

5 questions for TROX

Peter Osterland

Truist Securities

5 questions for TROX

Roger Spitz

Bank of America

5 questions for TROX

Justin Pellegrino

Morgan Stanley

4 questions for TROX

Aaron Rosenthal

JPMorgan Chase & Co.

3 questions for TROX

Caleb Boehnlein

BMO Capital Markets

3 questions for TROX

Frank Mitsch

Fermium Research

3 questions for TROX

Jeffrey Zekauskas

JPMorgan Chase & Co.

3 questions for TROX

John McNulty

BMO Capital Markets

3 questions for TROX

Josh Spector

UBS Group

3 questions for TROX

Michael Leithead

Barclays

3 questions for TROX

Duffy Fischer

Goldman Sachs

2 questions for TROX

Jeff Zekauskas

JPMorgan

2 questions for TROX

Joshua Spector

UBS

2 questions for TROX

Patrick Fischer

Goldman Sachs

2 questions for TROX

Aziza Gazieva

Fermium Research

1 question for TROX

Edward Brucker

Barclays Capital

1 question for TROX

James Cannon

UBS Securities

1 question for TROX

Vincent Andrews

Morgan Stanley

1 question for TROX

Recent press releases and 8-K filings for TROX.

- Tronox Holdings reported a net loss of $470 million and a negative free cash flow of $281 million for the full year 2025, with adjusted EBITDA at $336 million.

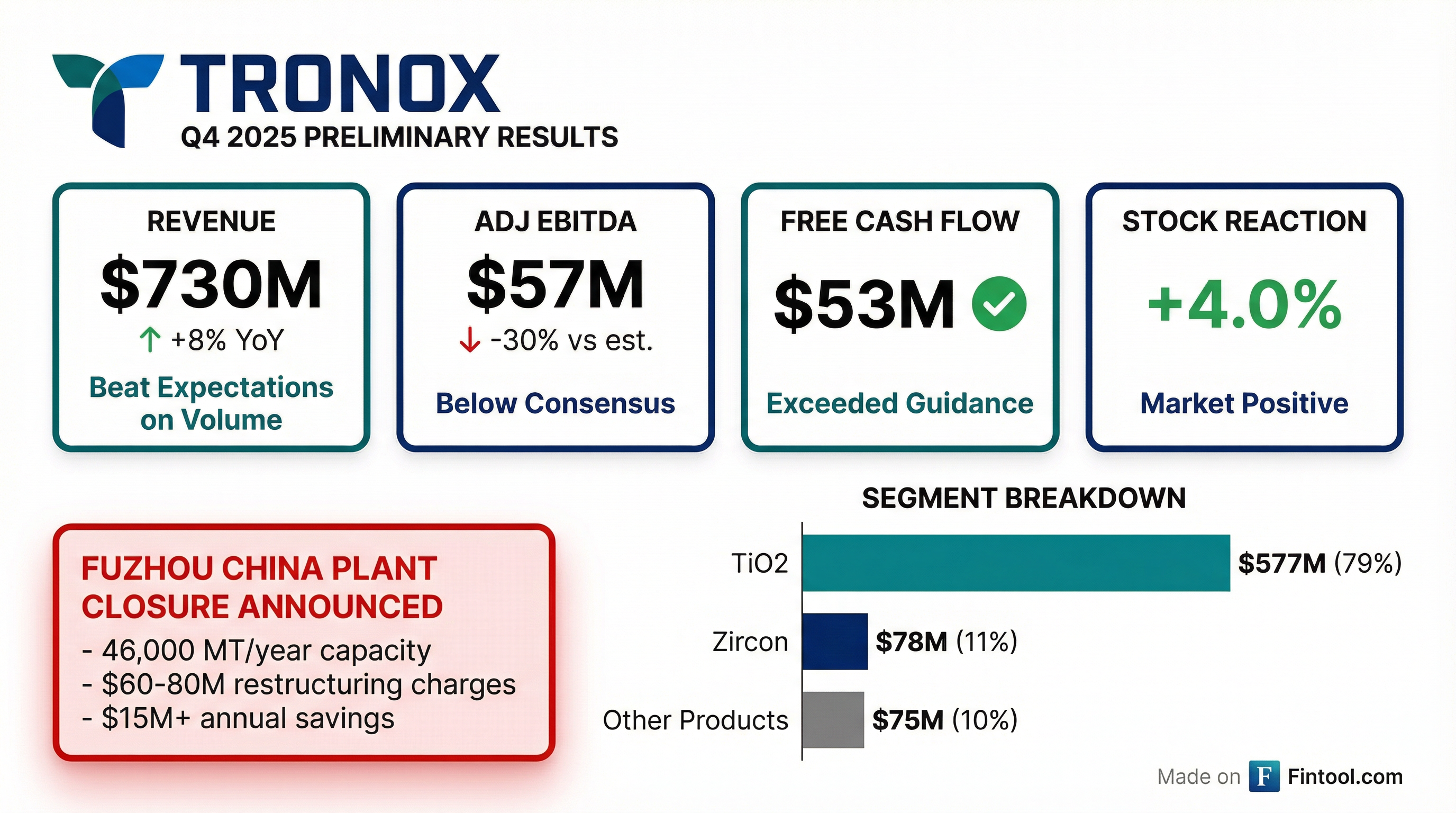

- The company delivered a stronger Q4 2025 than anticipated, achieving $53 million of free cash flow and the highest TiO2 volumes of the year, partially due to anti-dumping duties.

- Strategic actions included closing pigment plants in Fuzhou and Botlek to streamline operations and exiting 2025 with over $90 million in run rate savings, targeting $125 million-$175 million by the end of 2026.

- For Q1 2026, Tronox expects EBITDA between $55 million and $65 million, with TiO2 pricing anticipated to increase by 2%-4% sequentially.

- The company forecasts positive free cash flow for the full year 2026, with capital expenditures projected at approximately $260 million and working capital expected to be a source of cash exceeding $100 million.

- Tronox Holdings reported a full-year 2025 revenue decrease of 6% to $2,898 million, a net loss attributable to Tronox of $(470) million, and $(281) million in free cash flow use. The company also closed two pigment plants and achieved over $90 million in run-rate savings from its cost-improvement program by the end of 2025.

- In Q4 2025, the company saw an 8% year-over-year revenue increase to $730 million, driven by strong TiO2 and zircon volume growth, and generated $53 million in free cash flow.

- As of December 31, 2025, total debt stood at $3.2 billion, leading to a 9.0x net leverage ratio, and the company completed a $400 million senior secured notes issuance.

- For 2026, Tronox anticipates generating positive free cash flow, with Q1 2026 Adjusted EBITDA projected between $55 million and $65 million, and reduced capital expenditures of approximately $260 million for the full year.

- Tronox reported a net loss attributable to Tronox of $470 million and Adjusted EBITDA of $336 million for the full year 2025, with a use of $281 million in free cash flow. However, the company generated $53 million of free cash flow in Q4 2025.

- The company undertook strategic actions, including the closure of the Fuzhou and Bhilai pigment plants and exited 2025 with over $90 million in run rate savings from its sustainable cost improvement program, targeting $125 million-$175 million by the end of 2026.

- TiO2 volumes in Q4 2025 reached their highest point of the year, increasing 9% sequentially, driven by market share gains. While Q4 TiO2 prices were lower, the company is implementing price increases, with Q1 2026 TiO2 pricing expected to be up approximately 2%-4% sequentially.

- For Q1 2026, Tronox expects EBITDA to be in the range of $55 million-$65 million and anticipates positive free cash flow for the full year 2026, with capital expenditures projected at approximately $260 million.

- For the full year 2025, Tronox Holdings reported a net loss attributable to Tronox of $470 million and an adjusted diluted earnings per share loss of $1.50, with revenue of $2.9 billion and adjusted EBITDA of $336 million.

- In Q4 2025, the company achieved $53 million of free cash flow and $57 million in adjusted EBITDA, driven by stronger than anticipated TiO2 and zircon volumes, despite headwinds from lower pricing.

- Tronox is streamlining its operations by announcing the closures of two pigment plants (Fuzhou and Bhilai) and exited 2025 with over $90 million in run rate savings from its sustainable cost improvement program, targeting $125 million-$175 million by the end of 2026.

- The company expects Q1 2026 EBITDA to be in the range of $55 million-$65 million and anticipates positive free cash flow for the full year 2026, with TiO2 prices expected to be up 2%-4% sequentially and zircon price increases projected for Q2.

- Tronox Holdings plc reported Q4 2025 revenue of $730 million and full-year 2025 revenue of $2,898 million. The company experienced a GAAP diluted loss per share of $1.11 for Q4 2025 and $2.97 for the full year 2025.

- The Adjusted EBITDA for Q4 2025 was $57 million, with an Adjusted EBITDA margin of 7.8%, and for the full year 2025, Adjusted EBITDA was $336 million with a margin of 11.6%.

- For 2026, Tronox expects to generate positive free cash flow and projects Q1 2026 Adjusted EBITDA to be between $55 million and $65 million. The company also anticipates TiO2 pricing to improve in Q1 2026 and zircon pricing to improve in Q2 2026.

- In 2025, Tronox took decisive actions including the closure of its Botlek and Fuzhou pigment plants and achieved over $90 million of sustainable run-rate savings, remaining on track to reach a $125-$175 million target by the end of 2026. The company also enhanced liquidity through the issuance of $400 million of senior secured notes.

- Tronox Holdings plc reported revenue of $730 million and a net loss attributable to Tronox of $176 million for the fourth quarter ended December 31, 2025. Adjusted EBITDA for the quarter was $57 million.

- For the full year 2025, the company's revenue was $2,898 million, with a net loss attributable to Tronox of $470 million and Adjusted EBITDA of $336 million.

- The company expects Q1 2026 Adjusted EBITDA to be in the range of $55 million to $65 million and anticipates generating positive free cash flow for the full year 2026.

- In 2025, Tronox achieved over $90 million of sustainable run-rate savings from its cost improvement program and took decisive actions on its footprint, including announcing the closure of two pigment plants.

- Tronox Holdings plc (TROX) announced the permanent closure of its Fuzhou, China TiO2 pigment plant due to weak Chinese domestic demand, rising costs, and excess production, impacting approximately 550 staff.

- The closure is expected to result in restructuring charges of approximately $60-80 million in Q4 2025, including $35-45 million in non-cash write-downs, but is projected to yield annual cost savings exceeding $15 million.

- For Q4 2025, preliminary revenue is expected to be $730 million, an 8% increase year-over-year, driven by 13% higher TiO2 volumes and 27% higher zircon volumes year-over-year.

- Preliminary Adjusted EBITDA for Q4 2025 is expected to be $57 million, and free cash flow is expected to be $53 million, exceeding guidance, despite an anticipated net loss of $176 million.

- Tronox Holdings plc announced the permanent closure of its 46,000 metric ton per year TiO2 plant in Fuzhou, China, attributing the decision to weak Chinese domestic demand, increasing costs, and excess Chinese TiO2 production.

- The company anticipates restructuring and other related charges of approximately $60-80 million, including $35-45 million of non-cash write-downs, primarily in the fourth quarter 2025, with estimated annual cost savings exceeding $15 million.

- For the fourth quarter 2025, Tronox expects revenue of $730 million, an 8% increase compared to the prior year, a net loss attributable to Tronox of $176 million, and Adjusted EBITDA of $57 million.

- Free cash flow for Q4 2025 is expected to be $53 million, which substantially exceeded guidance due to positive impacts from lower inventory levels and working capital initiatives.

- TiO2 volumes increased 13% year-over-year and zircon volumes increased 27% year-over-year, while TiO2 pricing declined 8% year-over-year and zircon pricing was down 23% year-over-year.

- On December 9, 2025, Tronox Holdings plc announced it received coordinated, non-binding, and conditional Letters of Support/Interest from Export Finance Australia (EFA) and Export-Import Bank of the United States (EXIM).

- The Letters indicate potential financing of up to US$600 million to support the development of Tronox's rare earth supply chain.

- This financing is intended for mine extensions, infrastructure support, and cracking and leaching capacity, including a proposed facility in Western Australia.

- This initiative aligns with the United States–Australia Framework for Securing of Supply in Critical Minerals and Rare Earths, aiming to advance Tronox's role as a rare earth elements supplier.

- Tronox reported Q3 2025 revenue of $699 million, a 13% decrease year-over-year, and a net loss of $99 million (adjusted diluted EPS loss of $0.46). Adjusted EBITDA was $74 million, and free cash flow was a use of $137 million.

- The quarter was impacted by weaker demand, downstream destocking, heightened competitive dynamics, and a temporary stay on anti-dumping duties in India. A significant zircon shipment was also rolled from Q3 to Q4.

- The company is implementing a cost improvement program, on track to deliver over $60 million in annualized savings by the end of 2025, and targeting $125-$175 million by the end of 2026. Operational measures include temporarily idling the Fuzhou pigment plant, adjusting Stallingborough, and temporarily shutting down a Namaqua furnace and West mine.

- For Q4 2025, Tronox expects revenue and adjusted EBITDA to be relatively flat to Q3, with TiO2 volumes projected to increase 3%-5% and zircon volumes 15%-20% sequentially. The company anticipates positive free cash flow in Q4 2025 and 2026.

- Strategic initiatives include progress on anti-dumping duties in Brazil and Saudi Arabia, with India's duties expected to be reinstated. Tronox also took a 5% equity interest in Lion Rock Minerals in October to advance its rare earth strategy.

Quarterly earnings call transcripts for Tronox Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more