Earnings summaries and quarterly performance for Trane Technologies.

Executive leadership at Trane Technologies.

David Regnery

Chief Executive Officer

Christopher Kuehn

Executive Vice President and Chief Financial Officer

Donald Simmons

Group President, Americas

Elizabeth Elwell

Vice President and Chief Accounting Officer

Mairéad Magner

Senior Vice President, Chief Human Resources Officer

Mauro Atalla

Senior Vice President, Chief Technology and Sustainability Officer

Raymond Pittard

Executive Vice President, Chief Integrated Supply Chain Officer

Board of directors at Trane Technologies.

Ana Assis

Director

Ann Berzin

Director

April Miller Boise

Director

John Hayes

Director

John Surma

Lead Independent Director

Kirk Arnold

Director

Linda Hudson

Director

Mark George

Director

Matthew Pine

Director

Melissa Schaeffer

Director

Myles Lee

Director

Research analysts who have asked questions during Trane Technologies earnings calls.

Christopher Snyder

Morgan Stanley

6 questions for TT

Julian Mitchell

Barclays Investment Bank

6 questions for TT

Nigel Coe

Wolfe Research, LLC

6 questions for TT

Scott Davis

Melius Research

6 questions for TT

Amit Mehrotra

UBS

5 questions for TT

Noah Kaye

Oppenheimer & Co. Inc.

5 questions for TT

Andrew Kaplowitz

Citigroup

4 questions for TT

Andrew Obin

Bank of America

4 questions for TT

Deane Dray

RBC Capital Markets

3 questions for TT

Jeffrey Sprague

Vertical Research Partners

3 questions for TT

Joe Ritchie

Goldman Sachs

3 questions for TT

Joseph Ritchie

Goldman Sachs

3 questions for TT

Steve Tusa

JPMorgan Chase & Co.

3 questions for TT

Thomas Moll

Stephens Inc.

3 questions for TT

Andy Kaplowitz

Citigroup Inc.

2 questions for TT

C. Stephen Tusa

JPMorgan Chase & Co.

2 questions for TT

Jeffrey Hammond

KeyBanc Capital Markets

2 questions for TT

Jeff Sprague

Vertical Research

2 questions for TT

Tommy Moll

Stephens Inc.

2 questions for TT

Sahil Manocha

RBC Capital Markets

1 question for TT

Recent press releases and 8-K filings for TT.

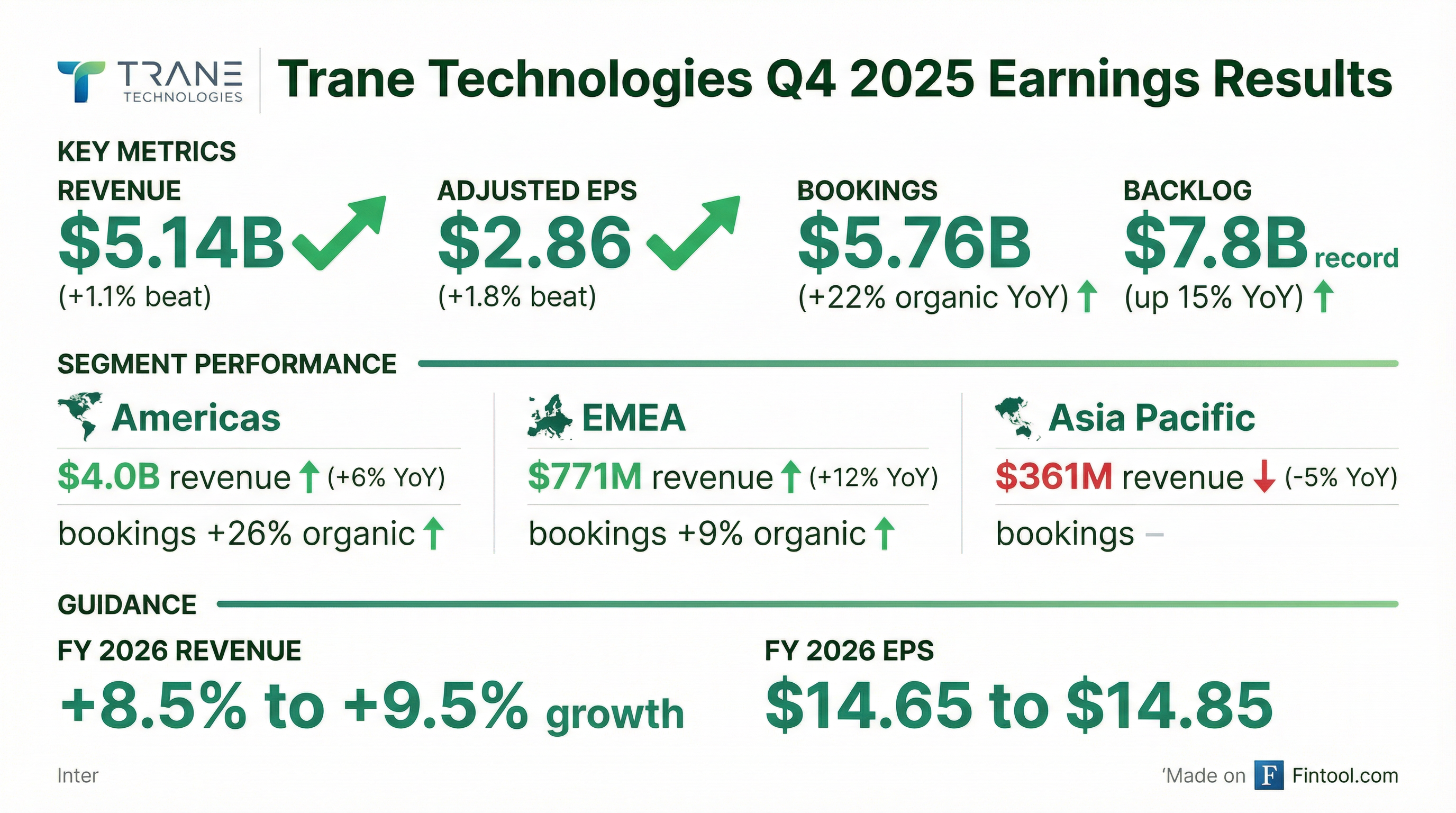

- Record bookings: Enterprise organic bookings up 22%, driving a record backlog of $7.8 billion at year-end, with Americas Commercial HVAC bookings +35% and Applied Solutions bookings +120% (200% book-to-bill).

- Solid Q4 financials: Organic revenue +4%, adjusted EPS +10%, and robust free cash flow funding strategic M&A, dividend growth, and share repurchases.

- 2026 guidance: Organic revenue growth of 6–7%, adjusted EPS of $14.65–$14.85 (up 12–14%), and reported revenue growth of 8.5–9.5%; Q1 adjusted EPS ~$2.50.

- Capital allocation: Deployed ~$3.2 billion in 2025 (dividends $840 million, M&A $720 million, repurchases $1.5 billion); plans to deploy $2.8–$3.3 billion in 2026, with $4.7 billion remaining under repurchase authorization and closing the Stellar Energy acquisition in Q1.

- Strong bookings: Q4 enterprise organic bookings up 22%, record backlog of $7.8 billion; Applied Solutions bookings +120%, book-to-bill 200%.

- Q4 organic revenue +4% (Americas +5%), with margins pressured by residential inventory normalization and growth investments.

- 2026 guidance: 6–7% organic revenue growth, Adjusted EPS $14.65–$14.85 (+12–14%); Q1 EPS ~$2.50.

- Capital allocation: 2025 deployed ~$3.2 billion (dividends, M&A, buybacks); 2026 plan $2.8–3.3 billion spend with $4.7 billion remaining buyback authorization.

- 2025 results: Exceeded adjusted EPS guidance and delivered robust free cash flow, funding strategic M&A, an increasing dividend, and significant share repurchases; commercial HVAC backlog increased by $1.3 billion, up ~25% in Americas and ~40% in EMEA year-over-year.

- Q4 highlights: Enterprise organic bookings rose 22%, driving a record backlog of $7.8 billion; organic revenue grew 4% and adjusted EPS increased 10%.

- 2026 guidance: Initiates organic revenue growth of 6–7%, adjusted EPS of $14.65–$14.85 (up 12–14%), and reported revenue growth of 8.5–9.5%; expects Q1 adjusted EPS of $2.50.

- Capital allocation: Deployed $3.2 billion in 2025 (including $840 million in dividends, $720 million on M&A, and $1.5 billion on share repurchases); plans to deploy $2.8–$3.3 billion in 2026 and close the acquisition of Stellar Energy in Q1.

- Q4 enterprise organic bookings rose 22%, delivering a record backlog of $7.8 B, while organic revenue grew 4% and adjusted EPS reached $2.86 (+10% YoY).

- FY 2025 organic revenue increased 6%, adjusted EPS grew 16%, and free cash flow was ~$2.9 B with a 98% conversion of adjusted net earnings.

- FY 2026 outlook calls for ~6–7% organic revenue growth, adjusted EPS of $14.65–$14.85, and Q1 EPS of ~$2.50.

- In 2025, the company deployed ~$3.2 B of capital (including $1.5 B in buybacks and $840 M in dividends) and plans $2.8–$3.3 B in 2026.

- Q4 2025: organic bookings up 22%, record backlog of $7.8 billion (+15% YoY), revenues of $5.1 billion (+6% reported, +4% organic), GAAP continuing EPS of $2.74 and adjusted EPS of $2.86 (+10%)

- Full-year 2025: organic bookings up 11%, revenues of $21.3 billion (+7% reported, +6% organic), GAAP EPS $13.14 and adjusted EPS $13.06 (+16%), with free cash flow conversion of 98%

- 2026 guidance: revenue growth of 8.5–9.5% (organic 6–7%) and GAAP/adjusted EPS of $14.65–14.85

- Q4 bookings rose 24% y-o-y to $5.76 billion (organic +22%), and backlog reached a record $7.8 billion (+15%) entering 2026.

- Q4 net revenues were $5.145 billion (+6% reported; +4% organic), with GAAP EPS of $2.74 and adjusted EPS of $2.86 (+10%).

- FY 2025 revenues totaled $21.322 billion (+7% reported; +6% organic), with GAAP EPS of $13.14 and adjusted EPS of $13.06 (+16%).

- FY 2025 adjusted EBITDA margin reached 20.1% (+70 bps), and free cash flow conversion was 98%.

- Trading Technologies International, Inc. has acquired OpenGamma, a leader in derivatives margin analytics for buy-side and sell-side clients, for undisclosed terms.

- Integration of OpenGamma’s margin optimization and capital efficiency tools will enhance TT’s multi-asset platform by enabling automated trading workflows and real-time risk insights.

- The TT platform processed over 2.9 billion derivatives transactions in 2025 and offers access to 100+ global exchanges and venues through its EMS/OMS systems.

- OpenGamma’s top-tier client relationships with banks, hedge funds and CTAs will expand TT’s market reach, while TT’s global distribution will accelerate OpenGamma’s growth.

- 2025 guidance: 6% organic revenue growth, 7% reported growth, and 15–16% EPS increase, with robust free cash flow conversion.

- Commercial HVAC backlog of $7.2 billion as of Q3, up ~7% year-to-date, with over 90% in applied systems, underpinning 2026 visibility.

- Service segment (≈33% of revenues) is growing low double-digits with accretive margins; investments include two technician training centers and BrainBox AI digital tools delivering 15–40% energy savings.

- Residential HVAC volumes down ~20% in Q3–Q4 due to refrigerant pre-buys, canister shortages, and a shorter season; Thermo King transport in fourth year of downturn, with recovery expected in H2 2026.

- Geographic mix: Americas ~75% of revenue, EMEA ~15% (high single-digit commercial HVAC growth), Asia ~7% (90% commercial HVAC with leading margins).

- Reported Q3 2025 adjusted EPS of $3.88, beating expectations, while revenue of $5.74 billion slightly missed forecasts amid weakening residential sales.

- Cut full-year 2025 EPS guidance to $12.95–$13.05 and trimmed revenue growth outlook to 7%, down from about 9%.

- Achieved 5.5% year-over-year revenue growth with gross margin up 60 bps to 36.9%, driven by operational efficiency and strategic acquisitions.

- Generated $992.1 million in operating cash flow and $944.6 million in free cash flow in Q3, supported by a 15% rise in order bookings.

- Record Q3 bookings of $6 billion (+13% organic YoY); delivered 170 bps adjusted operating margin expansion and 15% adjusted EPS growth.

- Americas commercial HVAC bookings up 30% with applied bookings >100% YoY; Q3 backlog of $7.2 billion, up ~$800 million (15%) vs end-2024.

- Q3 organic revenue growth of 4%; residential revenues down ~20% YoY, resulting in a $100 million Q3 shortfall and a projected $150 million Q4 shortfall.

- 2025 guidance: ~6% organic revenue growth; adjusted EPS range of $12.95–$13.05; Q4 organic growth ~3% with EPS $2.75–$2.85; YTD capital deployment of $2.4 billion, including $1.25 billion in buybacks and $5 billion authorization remaining.

Quarterly earnings call transcripts for Trane Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more