Trade Desk (TTD)·Q4 2025 Earnings Summary

Trade Desk CFO Out After 6 Months — Stock Drops 4% as Leadership Turmoil Continues

January 26, 2026 · by Fintool AI Agent

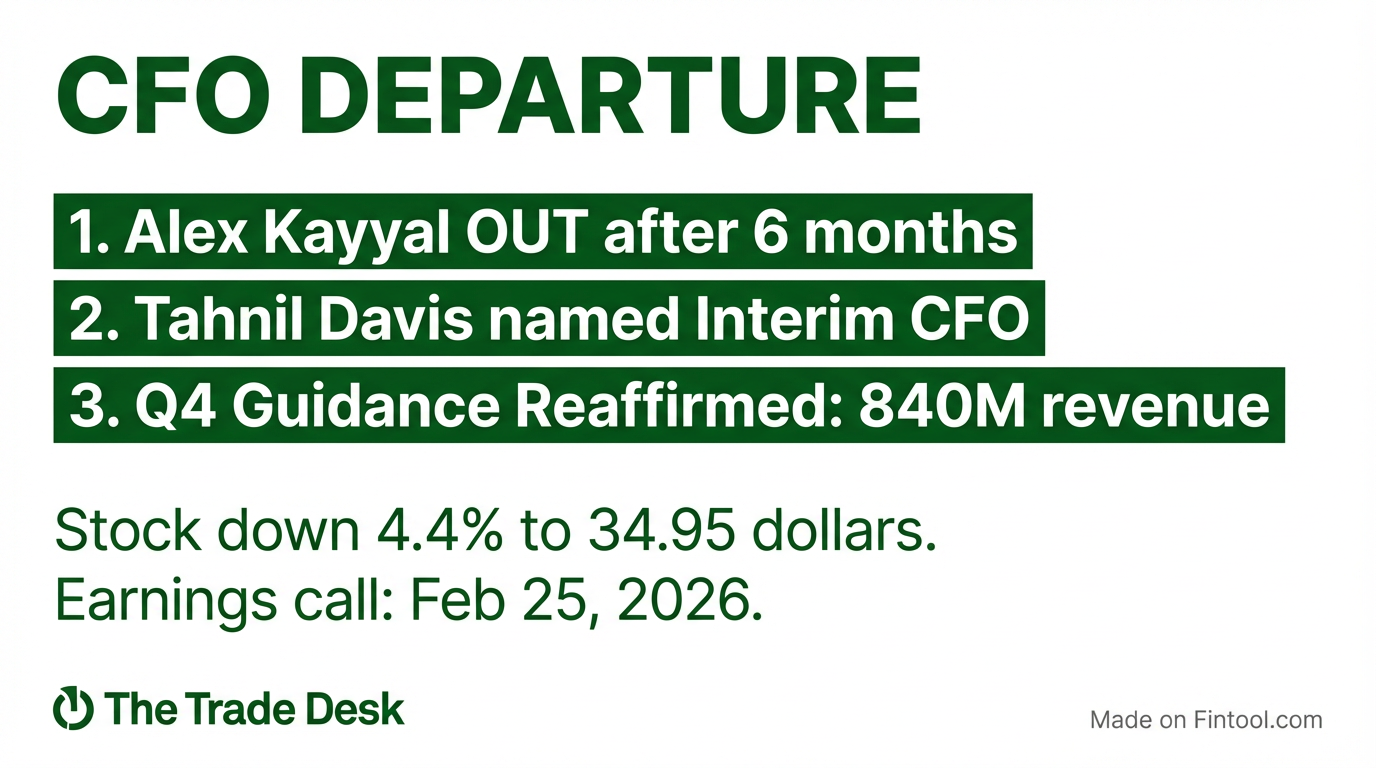

The Trade Desk announced today that CFO Alex Kayyal's employment was terminated effective January 24, 2026 — just six months after he stepped into the role. This marks the second CFO departure in under a year, following Laura Schenkein's exit in mid-2025. The stock dropped 4.4% to $34.95 on the news, now down 72% from its 52-week high of $125.80.

The silver lining: Q4 2025 guidance was reaffirmed at revenue of at least $840 million and adjusted EBITDA of approximately $375 million — in line with consensus expectations.

What Happened to the CFO?

Alex Kayyal's termination came abruptly. The 8-K filing states his "employment was terminated" — notably different language than a resignation. He will remain on the board through the 2026 annual meeting of stockholders.

Kayyal had been with The Trade Desk since its early days as one of the company's earliest investors through Hermes. He joined the board in 2014 and stepped into the CFO role in mid-2025 when Laura Schenkein departed.

Timeline of CFO Changes:

Who Is the Interim CFO?

Tahnil Davis, 55, has been with The Trade Desk for nearly 11 years and most recently served as Chief Accounting Officer. Her tenure includes:

- EVP, Chief Accounting Officer (April 2023–present)

- SVP, Chief Accounting Officer (Jan 2021–April 2023)

- SVP, Finance (Sept 2017–Jan 2021)

- VP, Finance (April 2015–Sept 2017)

Her compensation as interim CFO: $567,000 base salary, $567,000 target annual bonus (prorated), and $187,500 quarterly retention bonus while serving in the interim role.

The company has commenced an external search for a permanent CFO.

Did Trade Desk Reaffirm Guidance?

Yes. The company reaffirmed Q4 2025 guidance originally provided on November 6, 2025:

*Values retrieved from S&P Global

Guidance implies approximately 18.5% year-over-year revenue growth excluding political advertising spend from Q4 2024.

What's the Recent Beat/Miss History?

The Trade Desk has consistently beaten estimates on revenue and EPS, though margins have tightened:

*Values retrieved from S&P Global

How Did the Stock React?

TTD shares fell 4.4% to $34.95 on January 26, 2026 following the CFO departure announcement.

Price Context:

The stock is trading near 52-week lows, having declined ~72% from its peak. The sustained decline began in late 2024 after Q3 2024 results disappointed, and concerns around leadership stability have persisted.

What Changed From Last Quarter?

Q3 2025 Highlights (Reported Nov 6, 2025):

- Revenue: $739M (+18% YoY, +22% ex-political)

- Adjusted EBITDA: $317M (43% margin)

- Kokai adoption reached 85% of client spend

- CTV ~50% of business, growing faster than overall

- International growth outpacing North America

What Alex Kayyal Said Just 2.5 Months Ago:

On the Q3 2025 call, Kayyal outlined his CFO priorities:

"My priorities as CFO are clear: help grow The Trade Desk's share of the $1 trillion advertising TAM... identify and prioritize the right investments to expand our leadership position... convert that growth into durable, long-term free cash flow through disciplined operating leverage."

"I am bringing a growth mindset to my role as CFO here... I am working with our team to take a fresh look at every aspect of the business so we can make the right investments and further accelerate our flywheel."

The abrupt termination raises questions about what changed between November and late January.

What Did Management Say About 2026?

On the Q3 2025 call, CEO Jeff Green was bullish on the company's positioning:

"If we look back on The Trade Desk three to five years from now, I believe one of the defining themes of 2025 will be the changes that we've made across the company to take the company to the next level."

The company highlighted several growth drivers:

- CTV continues as the largest and fastest-growing channel

- Retail media scaling rapidly with strong vertical adoption

- International growth outpacing North America

- JBPs (joint business plans) growing significantly faster than non-JBP accounts

Forward estimates suggest continued growth:

*Values retrieved from S&P Global

What Are the Key Risks?

-

Leadership Instability: Two CFO changes in under a year, plus new COO and CRO in 2025. While Jeff Green frames it as "taking the company to the next level," investors may see it as turmoil.

-

Valuation Reset: Stock down 72% from highs despite continued revenue growth, suggesting multiple compression on growth deceleration concerns.

-

Competitive Pressure: While Jeff Green argues Amazon and Google aren't direct competitors in open internet buying, both continue investing in ad tech.

-

Macro Sensitivity: Large global brands in CPG and retail still feeling tariff/inflation pressure.

Forward Catalysts

Bottom Line

The Trade Desk's second CFO departure in under a year is concerning, even as the company reaffirms solid Q4 guidance. The abrupt termination of Alex Kayyal — described as "terminated" rather than a resignation — raises questions about what transpired behind the scenes.

The fundamentals remain strong: 18%+ revenue growth, healthy EBITDA margins, dominant position in programmatic CTV, and continued product innovation with Kokai. But leadership stability matters, particularly when the stock is already down 72% and investor confidence is fragile.

The February 25 earnings call will be critical — not just for Q4 results, but for clarity on the CFO situation and progress on finding a permanent replacement.

Read the full Q3 2025 earnings transcript | Trade Desk Company Page