Earnings summaries and quarterly performance for Trade Desk.

Executive leadership at Trade Desk.

Board of directors at Trade Desk.

Research analysts who have asked questions during Trade Desk earnings calls.

Justin Patterson

KeyBanc Capital Markets

7 questions for TTD

Shyam Patil

Susquehanna Financial Group

7 questions for TTD

Vasily Karasyov

Cannonball Research

7 questions for TTD

Jason Helfstein

Oppenheimer & Co. Inc.

5 questions for TTD

Matthew Swanson

RBC Capital Markets

5 questions for TTD

Youssef Squali

Truist Securities

5 questions for TTD

Jessica Reif Cohen

Bank of America Merrill Lynch

2 questions for TTD

Jessica Reif Ehrlich

Bank of America Securities

2 questions for TTD

Mark Mahaney

Evercore ISI

2 questions for TTD

Tim Nollen

Macquarie Group

2 questions for TTD

Alec Brondolo

Wells Fargo

1 question for TTD

Daniel Salmon

New Street Research

1 question for TTD

Eric Brondolo

Wells Fargo

1 question for TTD

Laura Martin

Needham & Company, LLC

1 question for TTD

Mark Kelley

Stifel, Nicolaus & Company, Incorporated

1 question for TTD

Shweta Khajuria

Wolfe Research, LLC

1 question for TTD

Recent press releases and 8-K filings for TTD.

- The Trade Desk reported Q4 2025 revenue of $847 million, a 14% year-over-year increase (19% excluding political spend), and full-year 2025 revenue of $2.9 billion, up 18% year-over-year.

- Q4 2025 adjusted EBITDA was $400 million (47% of revenue), with adjusted net income of $284 million or $0.59 per diluted share. The company ended the quarter with $1.3 billion in cash equivalents and no debt, and authorized an additional $500 million for share repurchases.

- For Q1 2026, revenue is projected to be at least $678 million (10% year-over-year growth) and adjusted EBITDA approximately $195 million, with full-year 2026 adjusted EBITDA margin expected to be in line with 2025.

- While CTV and audio channels showed strong growth, and verticals like medical health, technology, and business and finance performed well, the company noted continued softness in the CPG and auto categories due to macro pressures, which represent over a quarter of their business.

- The company is heavily investing in AI-driven innovation, including its Koa AI platform and the new Audience Unlimited product, to enhance decision-making and leverage data in the open internet.

- The Trade Desk reported Q4 2025 revenue of $847 million, a 14% year-over-year increase (or 19% excluding political spend), and full-year 2025 revenue of $2.9 billion, up 18% year-over-year.

- For Q4 2025, adjusted EBITDA was $400 million (47% of revenue), and adjusted net income was $284 million or $0.59 per diluted share.

- The company provided Q1 2026 revenue guidance of at least $678 million (10% year-over-year growth) and adjusted EBITDA of approximately $195 million, noting continued softness in CPG and auto verticals.

- The Trade Desk is heavily investing in AI-driven innovation with its Kokai platform, launching new products like Audience Unlimited and Deal Desk, and deepening relationships with advertisers and agencies, particularly in CTV and retail media.

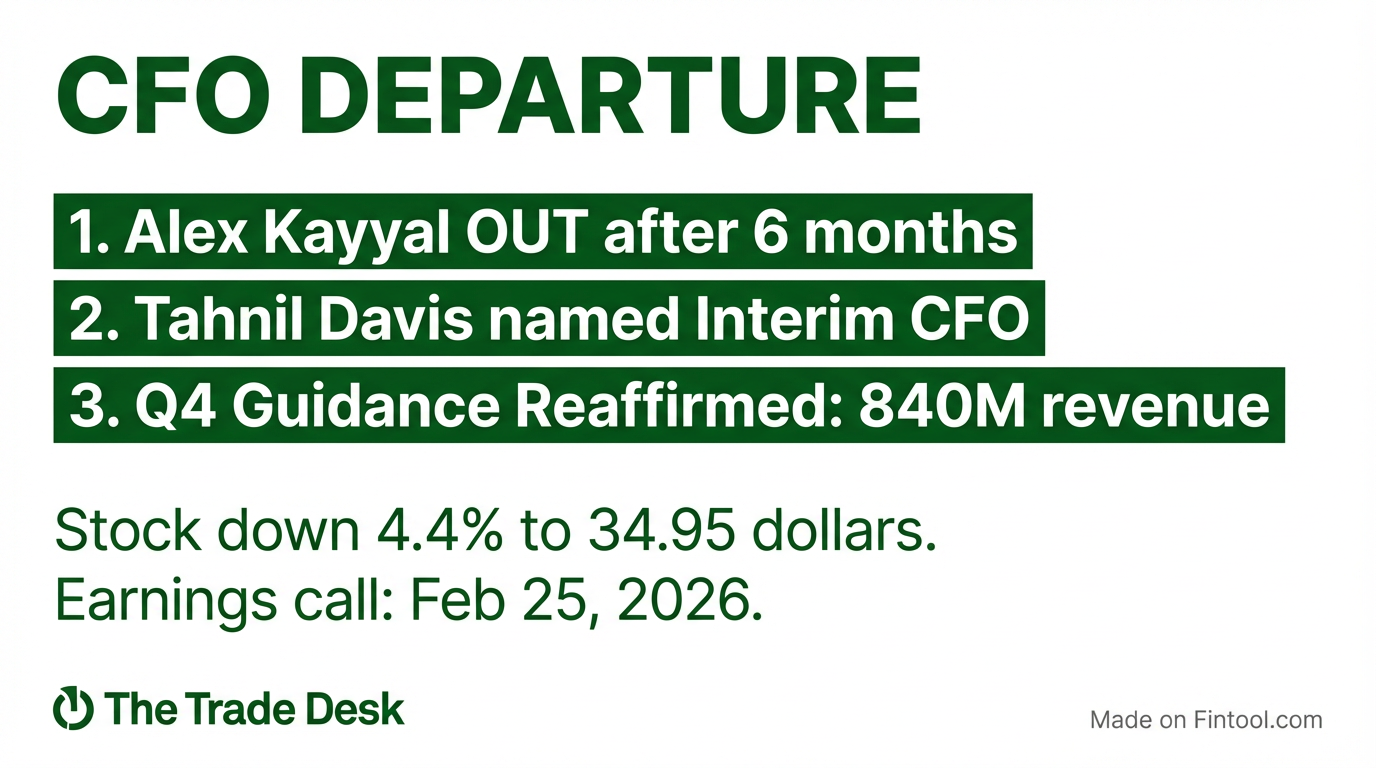

- The company utilized $423 million for share repurchases in Q4 2025 and authorized an additional $500 million for its share repurchase program. Tahnil Davis was appointed Interim CFO and Chief Accounting Officer.

- The Trade Desk reported Q4 2025 revenue of $847 million, a 14% year-over-year increase (19% excluding political spend), contributing to full-year 2025 revenue of $2.9 billion (18% year-over-year growth).

- Q4 2025 Adjusted EBITDA reached $400 million (47% of revenue), and adjusted net income was $284 million or $0.59 per diluted share.

- CTV and audio channels drove strong growth, with CTV comprising approximately 50% of Q4 business, while CPG and auto verticals experienced softness that is expected to continue into Q1 2026.

- For Q1 2026, revenue is projected to be at least $678 million (10% year-over-year growth) and adjusted EBITDA approximately $195 million. The company expects full-year 2026 adjusted EBITDA margin percentage to be in line with 2025, with continued investments in AI and infrastructure.

- The company repurchased $423 million of Class A common stock in Q4 2025 and authorized an additional $500 million for its share repurchase program.

- The Trade Desk reported full year 2025 revenue of $2.9 billion, representing 18% year-over-year growth, with Q4 2025 revenue at $847 million, a 14% year-over-year growth (or 19% excluding political spend).

- For Q1 2026, revenue is guided to be at least $678 million, representing 10% year-over-year growth, with adjusted EBITDA expected at approximately $195 million.

- Q4 2025 performance was driven by strong growth in CTV (50% of business) and international markets, despite softness in the CPG and auto verticals, which together represent roughly a quarter of the business and are expected to remain soft into Q1 2026.

- The company is strategically investing in AI through Kokai, launching the new product Audience Unlimited, and strengthening advertiser relationships via Joint Business Plans, which accounted for over half of the business exiting 2025.

- The Trade Desk ended Q4 2025 with $1.3 billion in cash equivalents and repurchased $423 million of Class A common stock during the quarter, with an additional $500 million authorization for future share repurchases.

- The Trade Desk reported Q4 2025 revenue of $847 million and full-year 2025 revenue of $2.9 billion, with net income of $187 million and $443 million for the respective periods.

- Adjusted EBITDA for Q4 2025 was $400 million, contributing to a full-year 2025 Adjusted EBITDA of $1,196 million.

- The company provided Q1 2026 guidance, expecting revenue of at least $678 million and Adjusted EBITDA of approximately $195 million.

- The board approved an additional $350 million for its share repurchase program, increasing the total authorized for future repurchases to $500 million. The company repurchased approximately $1.4 billion of Class A common stock in 2025.

- Customer retention remained over 95% for the year, and gross spend reached $13.4 billion in 2025.

- The Trade Desk reported fiscal year 2025 revenue of $2.9 billion and Adjusted EBITDA of $1.196 billion. For the fourth quarter of 2025, revenue was $847 million and Adjusted EBITDA was $400 million.

- Net income for fiscal year 2025 was $443 million, with Non-GAAP diluted earnings per share of $1.77. Fourth quarter 2025 net income was $187 million, and Non-GAAP diluted EPS was $0.59.

- For the first quarter of 2026, the company anticipates revenue of at least $678 million and Adjusted EBITDA of approximately $195 million.

- The board authorized an additional $350 million for share repurchases, bringing the total authorized to $500 million. The company repurchased approximately $1.4 billion of Class A common stock in 2025.

- The company achieved $13.4 billion in gross spend in 2025 and maintained customer retention at over 95%.

- The Trade Desk reported Q3 2025 revenue of $739 million, an 18% year-over-year increase, or 22% excluding political spend. Adjusted EBITDA was $317 million, representing 43% of revenue, and adjusted net income was $221 million, or $0.45 per diluted share.

- For Q4 2025, the company expects revenue to be at least $840 million and adjusted EBITDA to be approximately $375 million.

- The company utilized $310 million for share repurchases in Q3 2025, and the board subsequently approved a new authorization of $500 million.

- Product innovations, including Kokai, have delivered significant performance improvements, such as 26% better cost per acquisition and 94% better click-through rate compared to previous versions. New products like OpenPath, Open Ads, an overhauled data marketplace, trading modes, and Audience Unlimited were also introduced.

- Since March 2025, the company has welcomed a new COO, Vivek Kundra, a new CFO, Alex Cailliau, and a new CRO, Anders Mortensen.

| Metric | Q3 2025 | Q4 2025 (Guidance) |

|---|---|---|

| Revenue ($USD Millions) | $739 | At least $840 |

| Adjusted EBITDA ($USD Millions) | $317 | Approximately $375 |

| Adjusted Net Income ($USD Millions) | $221 | N/A |

| Adjusted EPS ($USD) | $0.45 | N/A |

| Free Cash Flow ($USD Millions) | $155 | N/A |

- The Trade Desk reported Q3 2025 revenue of $739 million, an 18% year-over-year increase (or 22% excluding political spend), with adjusted EBITDA of $317 million (43% of revenue) and adjusted diluted EPS of $0.45.

- For Q4 2025, the company projects revenue of at least $840 million and adjusted EBITDA of approximately $375 million.

- CTV and retail media continue to be key growth drivers, with CTV representing approximately 50% of the business in Q3, and international growth outpacing North America.

- Since March 2025, the company has welcomed a new COO, CFO, and CRO, and in Q3, it repurchased $310 million of Class A Common stock, with the board approving a new $500 million repurchase authorization.

- The Trade Desk reported Q3 2025 revenue of $739 million, an 18% year-over-year increase, with GAAP diluted earnings per share of $0.23 and Adjusted EBITDA of $317 million.

- The company announced an additional $500 million share repurchase authorization in October 2025, having used $310 million for repurchases in Q3 2025.

- For Q4 2025, The Trade Desk anticipates revenue of at least $840 million and Adjusted EBITDA of approximately $375 million.

- Customer retention remained over 95% during Q3 2025, and Anders Mortensen was appointed Chief Revenue Officer.

- The Trade Desk's stock surged approximately 14% in after-hours trading following the announcement of its inclusion in the S&P 500 index, where it will replace Ansys effective July 18.

- Despite a 36% year-to-date stock price decline, the company holds a $37 billion market cap, and analysts maintain an optimistic outlook with an average one-year price target of $88.10 and an 'Outperform' recommendation.

- The company reported adjusted net income of $165 million or $0.33 per fully diluted share and expects Q2 revenue of at least $682 million, reflecting 17% year-over-year growth.

- This S&P 500 addition is an off-schedule replacement triggered by Synopsys' acquisition of Ansys, impacting other candidates like Robinhood Markets and Applovin.

Fintool News

In-depth analysis and coverage of Trade Desk.

Quarterly earnings call transcripts for Trade Desk.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more