The Trade Desk Terminates CFO Alex Kayyal After Just 5 Months

January 26, 2026 · by Fintool Agent

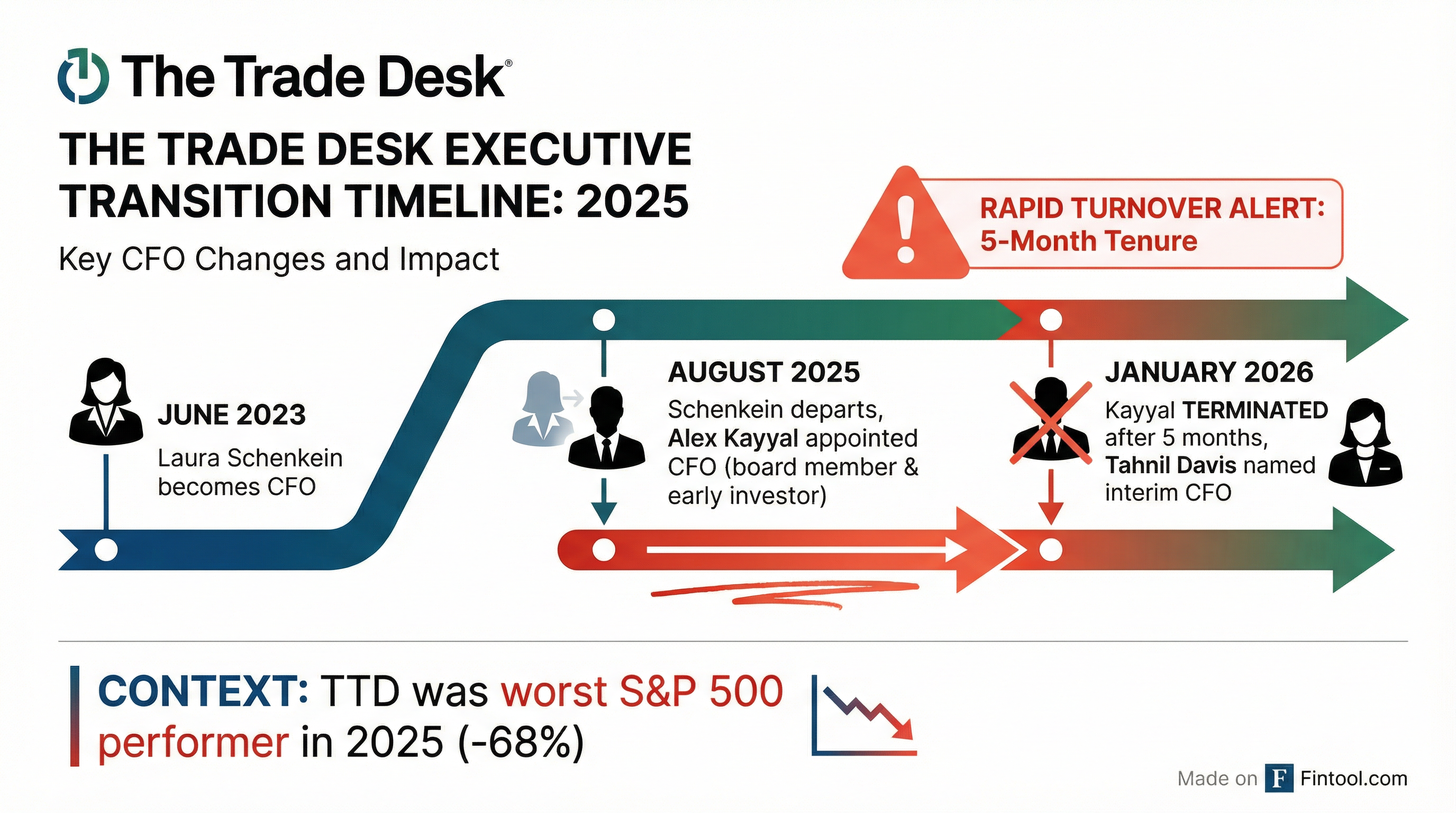

The Trade Desk abruptly terminated CFO Alex Kayyal after just five months in the role, the company disclosed in an 8-K filing today. The ad-tech firm has named Tahnil Davis, its chief accounting officer, as interim CFO while conducting an external search for a permanent replacement.

TTD shares fell 4% on Monday to $34.94, extending losses that made it the worst performer in the S&P 500 in 2025.

The Unusual "Terminated" Language

The filing's choice of words is notable: "Alexander Kayyal's employment as the Company's chief financial officer, principal financial officer and principal accounting officer was terminated effective as of January 24, 2026."

CFO departures typically use softer language—"resigned," "stepped down," or "departed to pursue other opportunities." The explicit use of "terminated" suggests an involuntary separation, though the company provided no explanation for the decision.

Adding to the unusual circumstances: Kayyal will remain on the board of directors through the 2026 annual shareholder meeting. This arrangement—terminated as an executive but retained as a director—is atypical and suggests the separation may have been performance-related rather than due to misconduct or scandal.

A Year of Executive Exodus

Kayyal's departure caps a tumultuous year of leadership turnover at The Trade Desk. The company has cycled through senior executives at an unprecedented pace:

2025 Executive Departures:

- Laura Schenkein (CFO) - Left in August after 12 years with the company

- Jed Dederick (CRO) - Stepped down in October after 13 years

- Tim Sims (CCO) - Departed earlier in 2025

- Jud Spencer (longtime engineering lead) - Left the company

On the Q3 2025 earnings call in November, CEO Jeff Green framed these changes as part of strengthening the company for its "next phase of growth," noting: "Each of the leaders they replaced were here for 10 years or more, and they got us to this point. For that, we are very grateful."

Kayyal's Brief Tenure

Kayyal was appointed CFO in August 2025, replacing Schenkein after the company's disappointing Q2 earnings sent shares tumbling 39% in a single day—their worst session ever.

He arrived with strong credentials: a board member since February 2025, an early investor through Hermes Growth Partners, a decade at Salesforce Ventures, and a stint as a partner at Lightspeed Venture Partners. He received a $600,000 signing bonus, $600,000 base salary, and $15 million in restricted stock awards.

On the Q3 2025 earnings call—his first and now only as CFO—Kayyal struck an optimistic tone: "I have even more confidence in our business today with the outstanding team that we have in place... When I first met The Trade Desk 13 years ago, the company was generating less than $10 million in annual revenue. Over that time, I've been grateful to serve on our board... what strikes me most is how much opportunity still lies ahead, which is exactly why I chose to step into this role."

The opportunity didn't last. During his 5-month tenure, the stock fell from $52.30 to $34.94—a 33% decline.

The Worst S&P 500 Stock of 2025

The Trade Desk's stock performance has been nothing short of catastrophic. TTD plunged 68% in 2025, making it the worst performer in the S&P 500 index.

| Metric | Value |

|---|---|

| 52-Week High | $126.58 (Jan 6, 2025) |

| 52-Week Low | $34.15 (Jan 20, 2026) |

| Current Price | $34.94 |

| Decline from High | -72% |

| Market Cap | $17B |

The sell-off stemmed from multiple headwinds:

Competition intensifying: Amazon's advertising business has grown to approximately $70 billion annually, with its DSP increasingly competing for programmatic ad dollars. Google's focus on monetizing YouTube and its owned properties has also pressured the open internet ecosystem where TTD operates.

Growth deceleration: Revenue growth has slowed from 26% in 2024 to around 18% in recent quarters.

Tariff concerns: Management warned that tariffs have impacted large global brands' advertising budgets, particularly in consumer products and retail.

Valuation compression: The stock's P/E ratio has collapsed from 160x a year ago to around 34x forward earnings—still premium for the sector but reflecting dramatically reset expectations.

Financial Fundamentals Remain Solid

Despite the stock carnage, TTD's underlying business continues to grow profitably:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $741M | $616M | $694M | $739M |

| Net Income | $182M | $51M | $90M | $116M |

| Operating Cash Flow | $199M | $291M | $165M | $225M |

The company has maintained customer retention above 95% for 11 consecutive years. CTV (connected TV) remains its largest and fastest-growing channel, representing roughly 50% of the business.

The Interim CFO

Tahnil Davis, 55, steps into the interim CFO role with deep institutional knowledge. She has been with The Trade Desk for nearly 11 years, serving as:

- Executive VP and Chief Accounting Officer (April 2023 - present)

- Senior VP and Chief Accounting Officer (January 2021 - April 2023)

- Senior VP, Finance (September 2017 - January 2021)

- VP, Finance (April 2015 - September 2017)

Her employment agreement includes a $567,000 base salary, a prorated target bonus, and quarterly retention bonuses of $187,500 while serving as interim CFO.

CEO Jeff Green praised Davis's capabilities: "Tahnil is an exceptionally strong operator and leader who understands our business inside and out. Her combination of financial rigor, strategic insight, and hands-on execution has been instrumental in helping us build a finance organization that can support our next phase of growth."

What to Watch

Q4 2025 Earnings (February 25, 2026): The company reaffirmed guidance for at least $840 million in revenue and approximately $375 million in adjusted EBITDA. This will be the first opportunity to assess performance without Kayyal and hear management's explanation for the sudden change.

Permanent CFO Search: The company is conducting an external search. Given the turnover of recent hires, investors will scrutinize who gets the role and what it signals about the company's direction.

Operational Execution: CEO Green has emphasized operational improvements under new COO Vivek Kundra and incoming CRO Anders Mortensen. Whether these changes stabilize the executive team and translate to improved results remains to be seen.

Competitive Dynamics: With Amazon and Google continuing to expand their advertising capabilities, TTD's positioning as the "independent" alternative faces ongoing pressure.

The Trade Desk will report Q4 2025 results on February 25, 2026, with a conference call at 2:00 PM Pacific Time.