Twist Bioscience (TWST)·Q1 2026 Earnings Summary

Twist Bioscience Beats Q1, Raises Guidance as DNA Synthesis Growth Accelerates

February 2, 2026 · by Fintool AI Agent

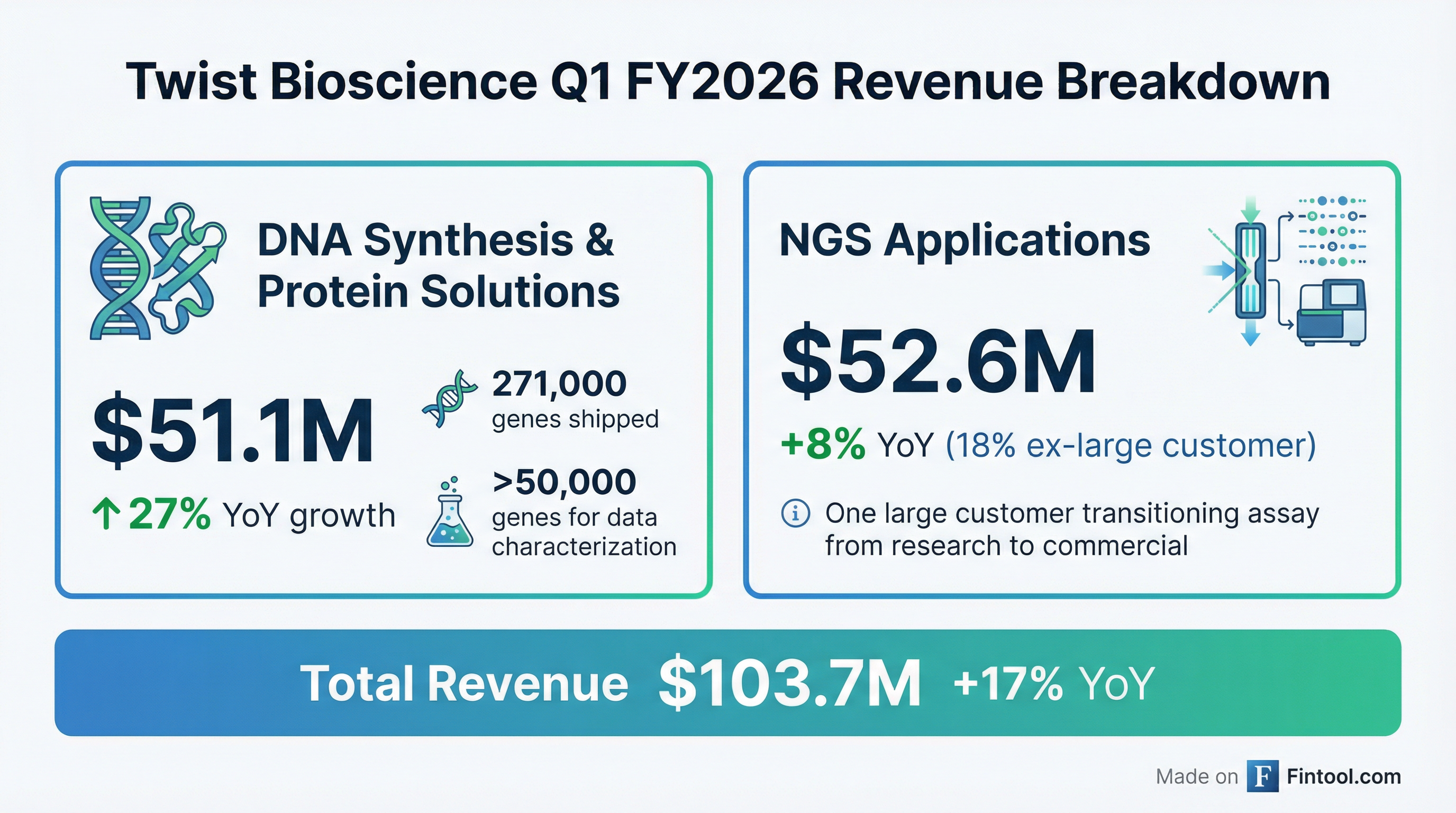

Twist Bioscience delivered a strong Q1 FY2026, posting revenue of $103.7 million (+17% YoY) that beat guidance by over 3% and marked the company's 12th consecutive quarter of revenue growth. The DNA synthesis specialist raised its full-year guidance to $435-440M and reaffirmed its path to Adjusted EBITDA breakeven by Q4 FY2026. Over the last three years, Twist has delivered a 24% revenue CAGR and improved margins by 20 percentage points on relatively flat OpEx.

Did Twist Bioscience Beat Earnings?

Yes — Twist beat on both revenue and margins:

The revenue beat was driven by exceptional strength in DNA Synthesis & Protein Solutions, which grew 27% year-over-year to $51.1 million. Gross margins expanded meaningfully to 52%, with 74% of incremental revenue growth dropping to the gross margin line.

How Did Each Segment Perform?

DNA Synthesis & Protein Solutions delivered standout performance:

- Revenue: $51.1M (+27% YoY)

- Shipped ~271,000 genes (+32% YoY)

- Additional 50,000+ genes manufactured for data characterization — first disclosure

- Driven by AI-enabled discovery demand from large pharma, tech companies, and biotechs

NGS Applications showed solid underlying growth:

- Revenue: $52.6M

- Excluding one large customer: +18% growth

- Top 10 NGS customers = ~36% of segment revenue

- Large customer that caused air pocket is "back" with orders in

What Did Management Guide?

Twist raised full-year guidance and maintained breakeven targets:

The guidance raise was "more than double the beat at the midpoint" , reflecting confidence across both segments. Management noted the increase is "generally balanced across DSPS and NGS."

CEO Emily Leproust: "We are committed to Adjusted EBITDA break-even in the fourth quarter of Fiscal 2026. On top of this, we see an opportunity to increase our growth rate, and we have titrated our operating expenses up by about $10 million per quarter, without putting Adjusted EBITDA break-even at risk."

What Changed From Last Quarter?

Key sequential improvements:

The uptick in operating expenses reflects deliberate investments in commercial expansion and digital capabilities. Management described these as both "structural" (sales hiring) and "transient" (digital infrastructure) investments.

How Did the Stock React?

Stock Performance:

- Pre-earnings close (Jan 30): $41.07

- After-hours (Feb 2): $42.01 (+2.3%)

- 52-week range: $23.30 - $54.74

- Market cap: ~$2.5B

The stock has rallied ~76% from its 52-week low, driven by improving margins and the path to profitability. The after-hours move suggests investors are encouraged by the guidance raise and continued sequential growth.

Why Is DNA Synthesis Growing So Fast?

Twist highlighted that AI-enabled drug discovery is driving significant demand:

- $25M+ orders in FY2025 specifically tied to AI discovery

- Three customer types: Large pharma building LLMs, tech "dry lab" companies, and well-funded biotechs

- Customers are coming back with repeat orders — "not a flash in the pan"

AI Discovery Economics (from Q&A):

- Gene fragment: ~$50

- Clonal genes: ~$100

- Antibody: $200+

- Full data characterization: $300-400

Market opportunity expanding:

- SAM expanded from ~$2B in 2020 to ~$7B today

- Clear path to $12B+ serviceable markets by 2030

- NGS Applications: >$3B SAM with ~7% market share today

- Protein expression market: $700M; Antibody discovery services: $1.5B

What's the Path to Profitability?

Management's bridge to breakeven:

- Sustained revenue growth: 12th consecutive quarter of revenue growth; 24% 3-year CAGR

- Margin expansion: 52% gross margin with 75-80% of incremental revenue dropping to gross profit

- Operating leverage: 20 percentage point margin improvement on relatively flat OpEx over 3 years

- Q4 FY26 target: Adjusted EBITDA breakeven — management says this is "a given"

Key focus metrics (from CEO):

- Revenue growth

- Gross margin

- Adjusted EBITDA breakeven

"Our management team and every employee at Twist are measured and incentivized on these three metrics."

Historical Adjusted EBITDA progression:

The trajectory shows clear improvement: from ($152.8M) in FY22 to targeting breakeven in Q4 FY26.

Customer and Geographic Trends

Customer base expanding:

- Gene shipments: ~271,000 in Q1 (+32% YoY)

- Plus 50,000+ genes for internal data characterization

- Therapeutics revenue up 39% as more large pharma and biotech adopt AI-enabled discovery

- Global supply partner revenue up 50% driven by new NGS partner, diagnostics OEMs, and APAC distributors

Industry revenue breakdown (Q1 FY26):

Excluding the large customer impact, diagnostics grew +12% YoY.

Geographic revenue breakdown (Q1 FY26):

Balance Sheet & Liquidity

With $198M in cash and improving operating leverage, the company appears adequately funded to reach profitability. Management noted they are "managing the business, keeping an eye on the cash and the growth like hawks."

Q&A Highlights

On AI Discovery Durability:

"Those customers are coming back. So there's definitely high confidence that it's not a one-time thing. It's not a flash in the pan." — CEO Emily Leproust

On Competitive Positioning:

"We're weeks faster than the competition as it stands today... We know them at a very, very intimate level in the hand-to-hand combat of selling." — COO Patrick Finn

On Profitability:

"Q4 adjusted EBITDA breakeven is a given for us now. So now it's all about how much growth can we expect." — CEO Emily Leproust

"We'd much rather build a multi-billion-dollar business at a 50+% gross margin than a $500 million business at a 60%." — CFO Adam Laponis

On Strategic Investments:

- Structural investments in sales/commercial hiring ahead of anticipated growth

- Launched e-commerce platform for NGS Applications (first-ever for that segment)

- Digital infrastructure investments expected to taper as they complete automation

On NGS Customer Dynamics:

- The one large customer that caused the Q4/Q1 air pocket is "back" with orders in

- New diagnostic partnerships in progress for FY2027/28 growth — not needed for FY26

- Academic market expected to return to growth in Q2 with increased NIH funding confidence

Risks and Concerns

- Customer concentration: One large NGS customer transition masked underlying growth (+18% ex-customer vs reported +8%)

- OpEx increase: Operating expenses rose to $86.9M from $77.5M YoY

- Competitive risk: Rapidly changing technologies in synthetic biology

- Macro sensitivity: Economic uncertainty could impact biotech/pharma R&D spending

- Cash burn: Net cash used in operating activities was $24.8M in Q1

Forward Catalysts

Near-term:

- Investor Day in May 2026 — deeper look at product roadmap, market expansion, and financial frameworks beyond EBITDA breakeven

- Q2 FY26 results (expected May 2026)

- New product launches including gene fragments in 2-4 days, IgG characterization

Key milestones to watch:

- Q4 FY26 Adjusted EBITDA breakeven — management says this is "a given"

- Continued margin expansion toward/above 52%

- AI discovery customer expansion beyond initial wave of orders

- New diagnostic partnerships for FY27/28 growth

Key Takeaways

- Beat and raise: Revenue beat guidance by 3.2%; FY26 guidance raised to $435-440M

- DNA Synthesis accelerating: +27% YoY growth driven by AI drug discovery demand

- Margin expansion continues: 52% gross margin, +370 bps YoY improvement

- Profitability in sight: Q4 FY26 Adjusted EBITDA breakeven target maintained

- 12 consecutive quarters of growth: Demonstrating durable demand and execution

For more details, see Twist Bioscience's Q1 FY2026 Earnings Call Transcript and Investor Presentation.