CVR PARTNERS (UAN)·Q4 2025 Earnings Summary

CVR Partners Posts Q4 Loss on Turnaround Impact, FY2025 EBITDA Tops $200M

January 26, 2026 · by Fintool AI Agent

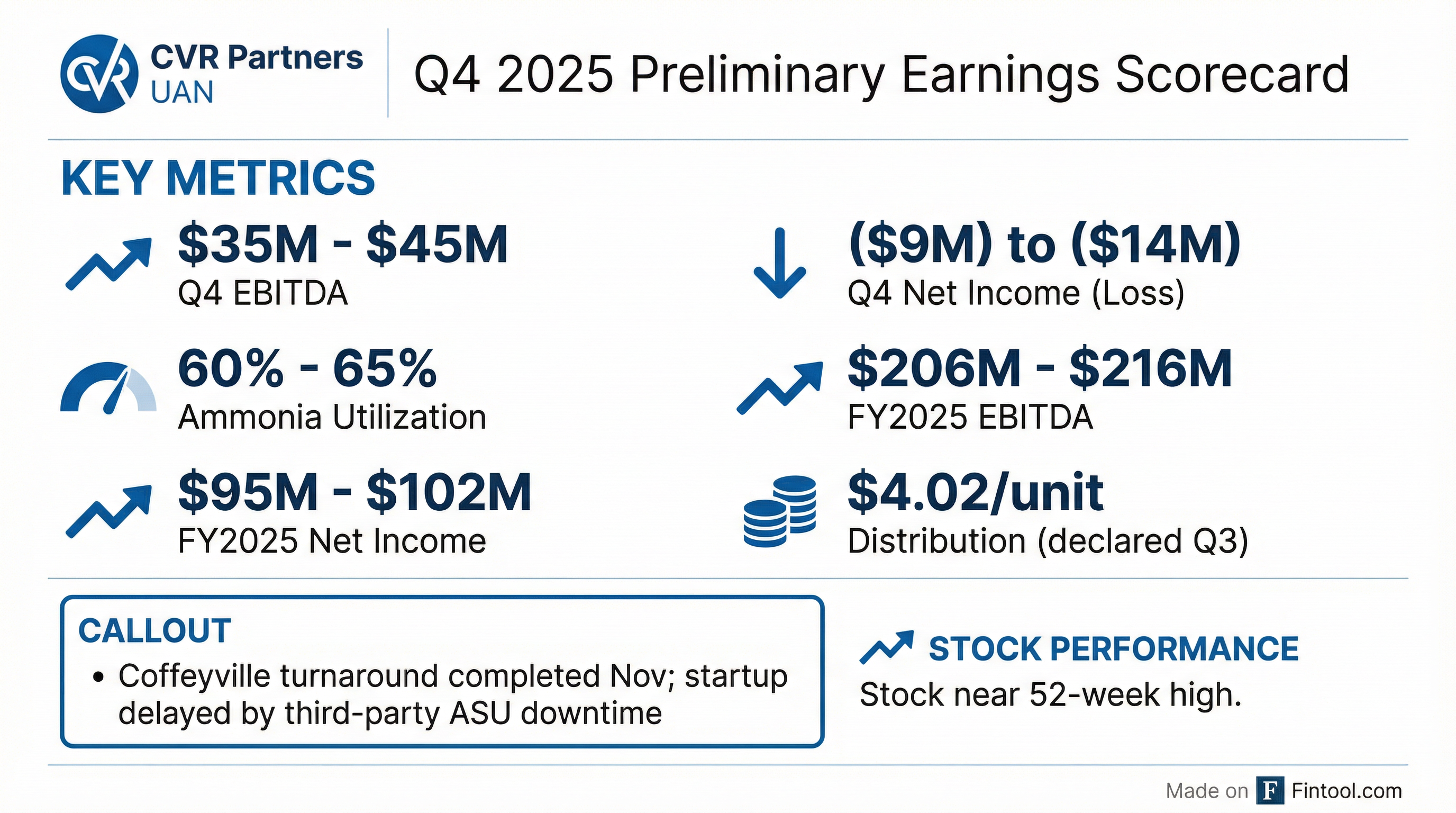

CVR Partners (NYSE: UAN) released preliminary Q4 2025 results showing a net loss of ($7M) to ($14M) and EBITDA of $15-25M, significantly below Q3's $71M EBITDA due to the planned Coffeyville turnaround. Full-year 2025 performance remained strong with EBITDA of $206-216M and net income of $95-102M, demonstrating solid execution despite the Q4 headwind.

The stock is trading near its 52-week high at $118.36, up from a 52-week low of $63.45, as the market has priced in the temporary turnaround impact and favorable nitrogen fertilizer dynamics heading into 2026.

What Happened in Q4 2025?

The Coffeyville turnaround was the key story. The planned maintenance was completed in early November as scheduled, but the subsequent startup was delayed by several weeks due to downtime at the third-party owned air separation unit.

*Values retrieved from S&P Global

The 60-65% ammonia utilization rate reflects the turnaround impact—well below Q3's 95% rate and the Q4 guidance of 80-85% provided in October.

How Strong Was Full-Year 2025?

Despite the Q4 setback, full-year 2025 was a strong year:

*Values retrieved from S&P Global

The strong results were driven by elevated nitrogen fertilizer pricing as geopolitical tensions kept global supply tight. In Q3, UAN prices averaged $348/ton (+52% YoY) and ammonia averaged $531/ton (+33% YoY).

How Did the Stock React?

The stock closed at $118.36 on January 23 (last trading day), with after-hours trading at $119.19—near the 52-week high of $119.90. Key price context:

The stock has rallied significantly over the past year, reflecting:

- Strong nitrogen fertilizer pricing environment

- Consistent distribution payments ($4.02/unit in Q3)

- Tight global supply due to geopolitical tensions and production outages

What Changed From Last Quarter?

Q3 vs Q4 Operational Differences:

Management noted that "despite this delay, we saw strong demand for nitrogen fertilizers in the fourth quarter and pricing remained robust as inventories continue to be tight amid ongoing geopolitical tensions."

Key Management Commentary

CEO Mark Pytosh highlighted the operational headwind and constructive market backdrop:

"The planned turnaround at our Coffeyville facility was completed as scheduled in early November; however, the subsequent startup was delayed by several weeks due to downtime at the third-party owned air separation unit. Despite this delay, we saw strong demand for nitrogen fertilizers in the fourth quarter and pricing remained robust as inventories continue to be tight amid ongoing geopolitical tensions."

Prior quarter outlook (from Q3 call):

- Expected Q4 ammonia utilization of 80-85%

- Q4 direct operating expenses of $58-$63M

- Q4 turnaround expense of $15-$20M

The actual utilization of 60-65% came in below guidance due to the third-party ASU delays.

Quarterly Performance Trend

*Values retrieved from S&P Global

Balance Sheet Snapshot

*Values retrieved from S&P Global

The ~$80M decline in cash reflects turnaround spending, capital expenditures, and the Q3 distribution payment of ~$42M ($4.02/unit × 10.57M units).

What's Next?

Near-Term Catalysts:

- Q4 Final Results & Distribution: Expect finalized Q4 results and Q4 distribution declaration in February 2026

- East Dubuque Turnaround: Planned 35-day turnaround in Q3 2026

- Coffeyville Natural Gas Feedstock Project: Detailed engineering underway; could expand ammonia capacity by up to 8%

Market Outlook:

- Management expects favorable market conditions through H1 2026

- Global nitrogen inventories remain tight due to geopolitical tensions

- Nutrien Trinidad plant shutdown reduces import supply

- Potential tariffs on Russian fertilizer could significantly impact pricing

About CVR Partners

Headquartered in Sugar Land, Texas, CVR Partners, LP is a Delaware limited partnership focused on the production, marketing and distribution of nitrogen fertilizer products. It primarily produces urea ammonium nitrate (UAN) and ammonia, which are predominantly used by farmers to improve the yield and quality of their crops.

Facilities:

- Coffeyville, Kansas: 1,300 ton/day ammonia unit, 3,100 ton/day UAN unit, dual-train gasifier complex

- East Dubuque, Illinois: 1,075 ton/day ammonia unit, 950 ton/day UAN unit

Links: