Earnings summaries and quarterly performance for CVR PARTNERS.

Executive leadership at CVR PARTNERS.

Mark Pytosh

Detailed

President and Chief Executive Officer

CEO

DN

Dane Neumann

Detailed

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Secretary

DL

David Lamp

Detailed

Executive Chairman

JC

Jeffrey Conaway

Detailed

Vice President, Chief Accounting Officer and Corporate Controller

MB

Melissa Buhrig

Detailed

Executive Vice President, General Counsel and Secretary

Board of directors at CVR PARTNERS.

Research analysts who have asked questions during CVR PARTNERS earnings calls.

Recent press releases and 8-K filings for UAN.

CVR Partners Reports Q4 2025 Results Amid Operational Challenges and Positive Market Outlook

UAN

Earnings

Guidance Update

New Projects/Investments

- CVR Partners reported a net loss of $10 million and EBITDA of $20 million for Q4 2025, with a $0.37 per common unit distribution. For the full year 2025, EBITDA was $211 million and distributions totaled $10.54 per common unit.

- Ammonia plant utilization in Q4 2025 was 64%, significantly impacted by a plant turnaround and delayed startup at the Coffeyville facility due to issues with a third-party air separation unit.

- Management remains optimistic about the spring planting season, anticipating strong demand for nitrogen fertilizers with an estimated 95 million acres of corn to be planted in 2026, supported by tight global supply.

- For Q1 2026, ammonia utilization is estimated at 95% to 100%, and direct operating expenses are expected to be between $57 million and $62 million.

- The company plans $35 million-$45 million in maintenance capital and $25 million-$30 million in growth capital for 2026, including projects for feedstock diversification and ammonia expansion at Coffeyville.

Feb 19, 2026, 4:00 PM

CVR Partners Reports Q4 and Full Year 2025 Financial Results

UAN

Earnings

Guidance Update

Management Change

- CVR Partners reported Q4 2025 net sales of $131 million, a net loss of $10 million, and EBITDA of $20 million, declaring a distribution of $0.37 per common unit.

- For the full year 2025, the company achieved net sales of $606 million, net income of $99 million, and EBITDA of $211 million, with total distributions of $10.54 per common unit.

- Q4 2025 ammonia plant utilization was 64%, significantly impacted by a planned turnaround and subsequent delayed startup at the Coffeyville facility, though full-year utilization was 88%.

- The company introduced Mike Wright as the new Chief Operating Officer.

- Looking ahead to Q1 2026, the company estimates ammonia utilization between 95% and 100%, direct operating expenses between $57 million and $62 million, and total capital spending between $25 million and $30 million.

Feb 19, 2026, 4:00 PM

CVR Partners Reports Q4 and Full-Year 2025 Results, Provides 2026 Outlook

UAN

Earnings

Guidance Update

New Projects/Investments

- CVR Partners reported net sales of $131 million, a net loss of $10 million, and EBITDA of $20 million for Q4 2025, with a declared distribution of $0.37 per common unit. For the full year 2025, the company achieved net sales of $606 million, net income of $99 million, EBITDA of $211 million, and total distributions of $10.54 per common unit.

- Q4 2025 ammonia plant utilization was 64%, primarily impacted by a plant turnaround and subsequent delayed startup at the Coffeyville facility. However, the company projects Q1 2026 ammonia utilization to be between 95% and 100%.

- For 2026, estimated maintenance capital spending is $35 million-$45 million and growth capital spending is $25 million-$30 million.

- Management is optimistic about the upcoming spring planting season, anticipating continued strong demand for nitrogen fertilizers, and notes that market conditions remain constructive with robust pricing, despite expected higher volatility in 2026.

Feb 19, 2026, 4:00 PM

CVR Partners Reports Fourth Quarter and Full-Year 2025 Results

UAN

Earnings

Dividends

Guidance Update

- CVR Partners reported a net loss of $10 million (or $0.97 per common unit) and EBITDA of $20 million on net sales of $131 million for the fourth quarter of 2025.

- For the full-year 2025, the company achieved net income of $99 million (or $9.33 per common unit) and EBITDA of $211 million on net sales of $606 million.

- A cash distribution of 37 cents per common unit was declared for Q4 2025, bringing the cumulative cash distributions for 2025 to $10.54 per common unit.

- The fourth quarter 2025 results were impacted by a 32-day planned turnaround and subsequent three weeks of startup issues at a third-party air separation plant.

- CVR Partners provided a Q1 2026 outlook, projecting an ammonia utilization rate of 95% to 100%, direct operating expenses between $57 million and $62 million, and total capital expenditures between $25 million and $30 million.

Feb 18, 2026, 9:29 PM

CVR Partners Reports Fourth Quarter and Full-Year 2025 Results

UAN

Earnings

Dividends

Guidance Update

- CVR Partners reported a net loss of $10 million (or 97 cents per common unit) and EBITDA of $20 million on net sales of $131 million for the fourth quarter of 2025.

- For the full-year 2025, the company achieved net income of $99 million (or $9.33 per common unit) and EBITDA of $211 million on net sales of $606 million.

- The fourth quarter 2025 results were impacted by a 32-day planned turnaround and subsequent three weeks of startup issues at the Coffeyville fertilizer plant, resulting in a 64% ammonia utilization rate.

- CVR Partners declared a cash distribution of 37 cents per common unit for the fourth quarter of 2025, bringing the cumulative cash distributions for the full year 2025 to $10.54 per common unit.

- The company provided a Q1 2026 outlook with an ammonia utilization rate between 95% and 100%, direct operating expenses between $57 million and $62 million, and total capital expenditures between $25 million and $30 million.

Feb 18, 2026, 9:27 PM

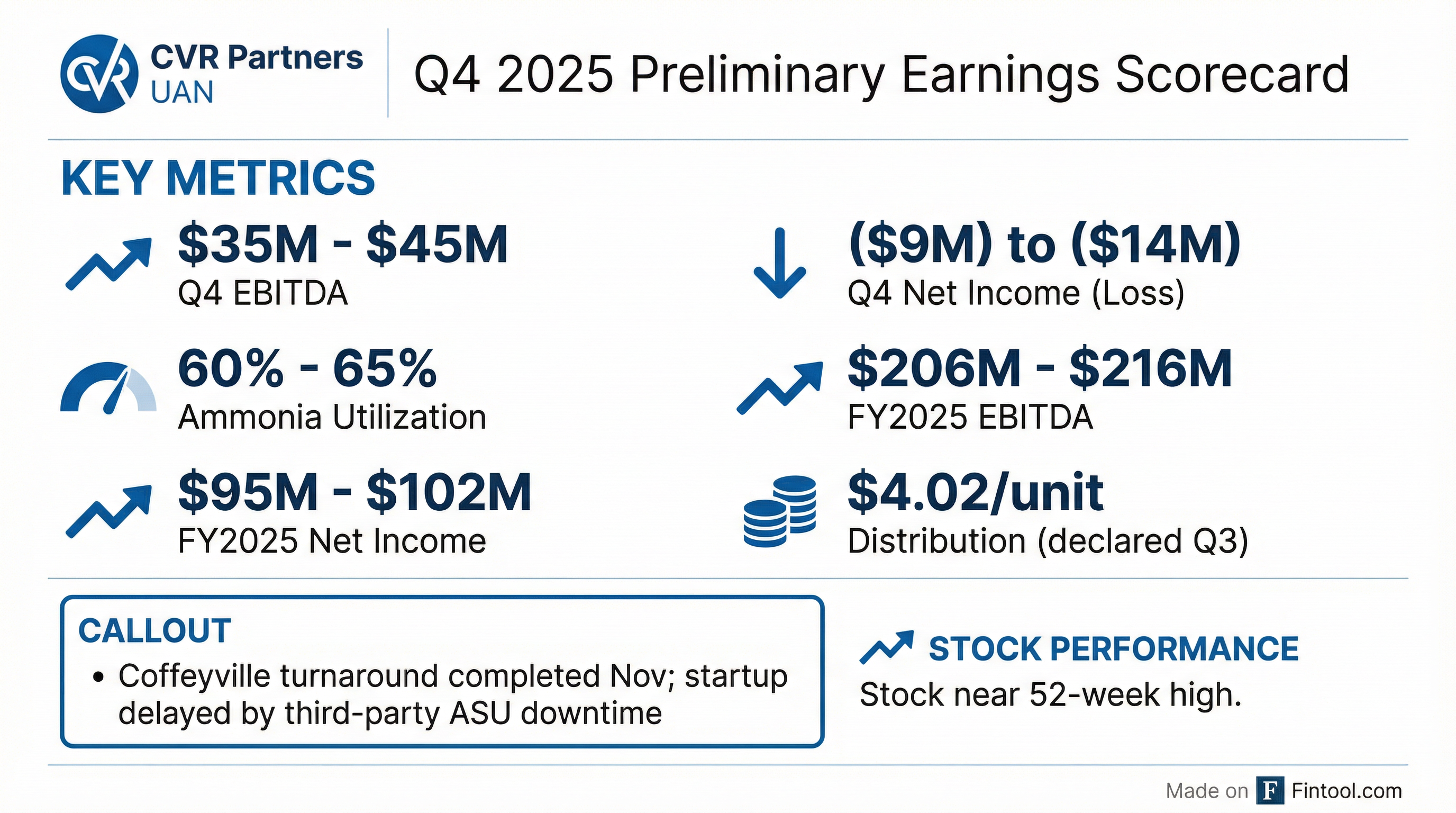

CVR Partners Reports Preliminary Estimated Q4 and Full-Year 2025 Results

UAN

Earnings

Guidance Update

- CVR Partners announced preliminary estimated financial results for the fourth quarter and full-year 2025.

- For the fourth quarter 2025, the company expects net income (loss) between $(14) million and $(7) million and EBITDA between $15 million and $25 million.

- For the full-year 2025, preliminary estimated results include net income (loss) between $95 million and $102 million and EBITDA between $206 million and $216 million.

- The planned turnaround at the Coffeyville facility was completed as scheduled, but the subsequent startup was delayed by several weeks due to downtime at a third-party air separation unit. Despite this, the company observed strong demand for nitrogen fertilizers and robust pricing in the fourth quarter.

Jan 26, 2026, 12:23 PM

CVR Partners Announces Preliminary 2026 Capital Spending Plan

UAN

New Projects/Investments

Guidance Update

- CVR Partners, LP announced preliminary capital spending estimates for 2026 ranging from $60 million to $75 million.

- The estimated capital expenditures for 2026 include $35 million to $45 million for maintenance capital and $25 million to $30 million for growth capital.

- Growth capital projects are intended to improve reliability and production rates, including ammonia expansion and feedstock diversification at the Coffeyville facility, water quality upgrades, and expansion of diesel exhaust fluid (DEF) production and loadout capacity.

- The company aims to operate its plants at utilization rates above 95 percent of nameplate capacity, excluding turnarounds, through these investments.

Jan 5, 2026, 9:24 PM

CVR Partners Reports Strong Q3 2025 Results and Provides Q4 Outlook

UAN

Earnings

Guidance Update

New Projects/Investments

- CVR Partners reported net sales of $164 million, net income of $43 million, and EBITDA of $71 million for Q3 2025, with a declared distribution of $4.02 per common unit.

- Consolidated ammonia plant utilization was 95% in Q3 2025, with UAN sales of 328,000 tons at an average price of $348 per ton and ammonia sales of 48,000 tons at an average price of $531 per ton.

- For Q4 2025, the company estimates ammonia utilization between 80% and 85% due to a planned turnaround at the Coffeyville facility, with total capital spending projected to be between $30 million and $35 million.

- The company is progressing with a project at its Coffeyville facility to utilize natural gas and additional hydrogen, which could expand ammonia production capacity by up to 8%.

- Management expects tight nitrogen fertilizer inventory levels and supportive higher prices to persist into the spring of 2026, with Q4 pricing anticipated to be higher than Q3.

Oct 30, 2025, 3:00 PM

CVR Partners Reports Strong Third Quarter 2025 Results

UAN

Earnings

Dividends

Guidance Update

- CVR Partners reported net income of $43 million, EBITDA of $71 million, and net sales of $164 million for the third quarter of 2025, significantly up from $4 million, $36 million, and $125 million, respectively, in Q3 2024. Basic and diluted earnings per common unit were $4.08 for Q3 2025, compared to $0.36 in Q3 2024.

- The company announced a cash distribution of $4.02 per common unit for Q3 2025. Operations were strong with a combined ammonia production rate of 95 percent, and average realized gate prices for ammonia and UAN increased by 33 percent to $531 per ton and 52 percent to $348 per ton, respectively, over the prior year.

- For Q4 2025, CVR Partners anticipates an ammonia utilization rate between 80% and 85%, direct operating expenses between $58 million and $63 million, and total capital expenditures between $30 million and $35 million.

Oct 29, 2025, 8:24 PM

CVR Partners Reports Strong Third Quarter 2025 Results

UAN

Earnings

Dividends

Guidance Update

- CVR Partners reported strong financial performance for the third quarter of 2025, with net income of $43 million (or $4.08 per common unit), EBITDA of $71 million, and net sales of $164 million. This represents a significant increase from Q3 2024, which had net income of $4 million, EBITDA of $36 million, and net sales of $125 million.

- The company declared a cash distribution of $4.02 per common unit for the third quarter of 2025, to be paid on November 17, 2025.

- Operational highlights included a combined ammonia production rate of 95 percent, and average realized gate prices for ammonia and UAN increased by 33 percent to $531 per ton and 52 percent to $348 per ton, respectively, over the prior year.

- For the fourth quarter of 2025, CVR Partners anticipates an ammonia utilization rate between 80% and 85% and total capital expenditures between $30 million and $35 million.

Oct 29, 2025, 8:21 PM

Quarterly earnings call transcripts for CVR PARTNERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more