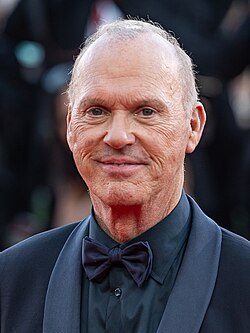

Michael Thomson

About Michael Thomson

Michael M. Thomson (age 56) is Chief Executive Officer and President of Unisys effective April 1, 2025; he previously served as President & COO since 2022, CFO from 2019–2022, and Corporate Controller from 2015–2019. He joined the Unisys Board as a director effective April 1, 2025 and is not independent as a management director . In 2024, Unisys delivered revenue of $2,008.4M (-0.3% y/y), operating profit margin of 4.8%, adjusted EBITDA margin of 14.5%, operating cash flow of $135M, and free cash flow of $55M; cash and equivalents were $377M at year-end . Relative TSR outcomes tied to 2024 LTI tranches were strong (one-year rTSR 174.50% payout; absolute TSR 38.02%), while the three-year 2022–2024 rTSR tranche paid 0% amid earlier stock underperformance .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Unisys | Chief Executive Officer and President | 2025–present | CEO transition effective Apr 1, 2025 |

| Unisys | President & Chief Operating Officer | 2022–2025 | Led global operations prior to CEO role |

| Unisys | Chief Financial Officer | 2019–2022 | Senior finance leadership |

| Unisys | Corporate Controller | 2015–2019 | Corporate accounting and reporting leadership |

| Towers Watson & Co. | Corporate Controller; Principal Accounting Officer | 2010–2015 | Corporate accounting oversight |

| Towers Perrin | Corporate Controller; Director of Financial Systems; Assistant Controller | 2001–2010 | Financial systems and control roles |

| RCN Corporation | Director of Financial Reporting & Financial Systems | 1997–2001 | Financial reporting and systems |

External Roles

- The proxy does not list other current public-company directorships for Mr. Thomson .

Fixed Compensation

| Component | 2023 | 2024 | Notes |

|---|---|---|---|

| Base Salary ($) | $669,327 | $670,000 | 2024 base unchanged vs 2023 |

| CEO Base Salary from 4/1/2025 ($) | — | — | $800,000 under new CEO offer letter effective Apr 1, 2025 |

| Target Bonus (% of base) | — | 110% | EVC plan target for 2024 |

| Target Bonus ($) | — | $737,000 | 110% of base |

| Actual EVC Payout ($) | — | $869,365 | 117.96% of target based on 2024 results |

| All Other Compensation ($) | $11,407 | $12,711 | Includes 401(k) match and minor perqs |

| Total Reported Compensation ($) | $4,168,292 | $4,435,079 | SCT total |

Performance Compensation

Short-Term Incentive (EVC – 2024)

| Metric | Weight | Threshold | Target | Max | 2024 Actual vs Target | Payout (per metric) |

|---|---|---|---|---|---|---|

| Revenue | 50% | 90% | 100% | 110% | 95% | 80.9% |

| Non-GAAP Operating Profit | 50% | 65% | 100% | 130% | 120% | 155.0% |

| Plan Funding (weighted) | — | — | — | — | — | 117.96% |

| Thomson EVC Details | Value |

|---|---|

| 2024 EVC Target ($) | $737,000 |

| 2024 EVC Paid ($) | $869,365 |

Notes:

- 2024 STI performance measures: 50% Revenue, 50% Non-GAAP Operating Profit; max 200% of target; plan funded at 117.96% .

Long-Term Incentive (2024 Grants, at target)

| Vehicle | Weight in LTI | 2024 Grant Value ($) | Design / Vesting | 2024 Tranche Payout |

|---|---|---|---|---|

| Time-Based RSUs | 33% | $700,000 | Vest 1/3 annually on grant anniversary | N/A |

| rTSR-Based RSUs | 25% | $525,000 | 1-, 2-, 3-year rTSR vs Russell 2000; 0–200% payout; cap at 100% if absolute TSR negative | 174.50% for 2024 one-year tranche |

| rTSR-Based Cash | 8.3% | $175,000 | Same rTSR structure as above | 174.50% for 2024 one-year tranche |

| Non-GAAP Op Profit – PB Cash | 33% | $700,000 | 1-, 2-, 3-year NGOP goals; 0–200% payout | 179.46% for 2024 one-year tranche |

| Total 2024 Target LTI | 100% | $2,100,000 | Multi-tranche over 2024–2027 | — |

Additional LTI details:

- 2024–2027 vesting cadence: 1/3 vests in 2025 (2024 performance), 1/3 vests in 2026 (2024–2025), 1/3 vests in 2027 (2024–2026) .

- 2022–2024 three-year rTSR tranche paid 0% (Unisys rTSR -62.42%; 24th percentile) .

- 2023–2024 two-year rTSR tranche paid 189.19% (Unisys rTSR 61.82%; 77th percentile) .

2025 program changes:

- Shift to full 3-year performance for performance LTI; mix: 50% time RSUs, 25% rTSR cash, 25% NGOP cash .

Equity Ownership & Alignment

| Ownership / Awards | Amount |

|---|---|

| Beneficial Ownership (shares) | 812,650 (≈1.14% of common) |

| Unvested Time/Earned RSUs (shares; 12/31/24) | 228,256; MV $1,444,860 at $6.33 |

| Unearned Performance RSUs at Target (shares; 12/31/24) | 323,933; MV $2,050,496 at $6.33 |

| Upcoming Scheduled Vesting Dates (select) | 2/25/2025; 2/26/2025; 2/28/2025; 2/26/2026; 2/28/2026; 5/08/2026; 2/26/2027 (share counts detailed per grant) |

| Exec Stock Ownership Guidelines | CEO: 3.0x salary; CFO & COO: 1.5x; NEOs achieved or on track |

| Hedging/Pledging | Prohibited (anti-hedging, no margin/pledge) |

| Options Outstanding | None disclosed for NEOs (no options in awards table) |

Note: Vesting events cluster around late February annually; while policy prohibits hedging/pledging, these dates can create natural liquidity windows as RSUs deliver .

Employment Terms

| Term | Pre-CEO Severance (through 3/31/2025) | CEO Offer Letter (effective 4/1/2025) | Change-in-Control (CIC) |

|---|---|---|---|

| Base Salary | $670,000 (2024) | $800,000 | — |

| Target Bonus | 110% of base | 120% of earned base | See CIC multiple |

| LTI Target | $2.1M (2024 grant) | $3,881,250 target grant value (from 2025 cycle) | Equity treatment below |

| Severance (no CIC) | 1x base + 1x target bonus; up to 1 year medical/dental/vision at employee rates | 2x (base + target bonus); up to 24 months subsidized healthcare | — |

| CIC Cash Severance | — | 2.5x (base + “applicable bonus”); pro-rata bonus; outplacement; 2 years health coverage and reimbursements | 2x (base + Highest Annual Bonus) for other NEOs; pro-rata bonus; similar benefits |

| Equity on CIC | Double-trigger: if terminated for Good Reason/without Cause within 24 months post-CIC, time RSUs vest; performance awards vest at target | Double-trigger (as left) | Double-trigger (as left) |

| Clawback | SEC/NYSE-compliant incentive compensation clawback | Same | Same |

Board Governance (Director Service, Committees, Dual-role)

- Board service: Elected director effective April 1, 2025; management (non-independent) director .

- Committee roles: Management directors are not assigned to Board committees in the proxy’s committee matrix; Thomson has no disclosed committee memberships .

- Dual-role implications: CEO and Chair roles are separated as of April 1, 2025 (Chair remains Peter Altabef); Lead Independent Director is Nathaniel A. Davis; regular executive sessions are held, and all directors (in 2024) met ≥75% attendance .

- Director compensation: Employee directors receive no additional Board compensation .

Performance & Track Record (Company context during Thomson’s operating tenure)

| Metric | 2024 Outcome |

|---|---|

| Revenue | $2,008.4M |

| Operating Profit Margin | 4.8% |

| Adjusted EBITDA Margin | 14.5% |

| Operating Cash Flow | $135M |

| Free Cash Flow | $55M |

| Cash & Equivalents (12/31/24) | $377M |

| 2024 rTSR Tranche Payout | 174.50% (one-year) |

| 2022–2024 rTSR Tranche Payout | 0% (three-year) |

| Value of $100 (TSR, 2019–2024 path) | $53.37 Company; $158.59 Peer Index |

Director/Executive Compensation Program & Shareholder Feedback (Context)

- 2024 pay mix: 2/3 of LTI performance-based; STI tied 50% Revenue/50% Non-GAAP Op Profit; caps at 2x; robust governance practices (no option repricing, no CIC tax gross-ups, anti-hedging/pledging) .

- Say-on-Pay: 84.5% support in 2023; 90.5% in 2024 .

- Peer group (for benchmarking): Amdocs, Box, CACI, EPAM, ICF, KBR, MAXIMUS, NetApp, NetScout, Perficient, Teradata, Thoughtworks, TTEC, Tyler, V2X, Verint .

Vesting Schedules (Selected Future RSU Schedules for Thomson)

| Vesting Date | Time-Based/Earned RSUs (shares) | Performance RSUs at Target (shares) |

|---|---|---|

| 2025-02-25 | 8,422 | 8,422 |

| 2025-02-26 | 42,042 | 31,531 |

| 2025-02-28 | 46,854 | 14,056 |

| 2026-02-26 | 42,042 | 31,532 |

| 2026-02-28 | 46,854 | 14,057 |

| 2026-05-08 | — | 192,803 |

| 2027-02-26 | 42,042 | 31,532 |

Note: Market value of unvested awards as of 12/31/24 reflected $6.33 stock price for disclosure purposes .

Deferred Compensation (Thomson)

| Item | 2024 Amount |

|---|---|

| Aggregate Balance (12/31/2024) | $25,981 |

| 2024 Aggregate Earnings | $2,065 |

Compensation Structure Analysis (Signals)

- Increased CEO-target LTI and 2.5x CIC multiple in the CEO offer letter align with CEO market practice, while maintaining double-trigger equity vesting and explicit clawback—balanced retention and alignment with shareholders .

- Shift of performance LTI to full three-year measurement in 2025 tightens long-term focus and reduces one-year volatility risk in payout outcomes .

- Anti-hedging/pledging, lack of CIC tax gross-ups, and prohibition of option repricing reduce governance red flags .

Related Party Transactions; Legal/Red Flags

- Company disclosed no related party transactions requiring reporting for 2024 .

- Anti-hedging/pledging in place; no option repricing; no automatic single-trigger vesting on CIC; compensation risk reviewed by independent consultant .

Equity Plan Supply/Dilution (Program Context)

- 2024 Equity Plan amendment seeks +3.1M shares; 2024 burn rate 4.04%; estimated potential dilution (plan + outstanding) ~17.8% if fully utilized (per proxy calculation) .

Employment Contracts, Severance, and Change-of-Control Economics (Summary Table)

| Feature | Term |

|---|---|

| CEO Offer (effective 4/1/2025) | Base $800k; 120% target bonus; target LTI $3.881M; 2x (base+target) severance and up to 24 months healthcare if terminated without cause; CIC: 2.5x (base+applicable bonus), pro-rata bonus, 2 years health, outplacement |

| Equity on CIC | Double-trigger vesting; time-based vests; performance awards vest at target upon qualifying termination within 24 months of CIC |

| Pre-CEO Severance (through 3/31/2025) | 1x base + 1x target bonus; up to 1-year benefits at employee rates (for involuntary without cause/Good Reason) |

Investment Implications

- Pay-for-performance alignment improved: 2024 STI funded at 118% and 2024 LTI one-year rTSR/NGOP tranches >170% reflect operational improvement and stock recovery; 2025 shift to full three-year metrics should temper short-term volatility and strengthen long-horizon alignment .

- Retention risk mitigants: CEO contract features market-standard 2x severance (no CIC) and 2.5x (CIC) with double-trigger equity, plus ownership guidelines and anti-hedging/pledging—supportive of stability without shareholder-unfriendly gross-ups .

- Potential selling pressure windows: Multiple large RSU vesting dates (late February annually; sizable May 2026 performance tranche) can create episodic liquidity, though hedging/pledging prohibitions and ownership guidelines moderate misalignment risk .

- Governance balance: CEO/Chair split with an empowered Lead Independent Director and strong committee structure ease dual-role independence concerns as Thomson assumes CEO and Board director roles .

- Execution watch items: Despite 2024 profitability gains, three-year TSR trough (0% payout for 2022–2024 tranche) underscores the need for sustained multi-year delivery; 2025 plan design and larger CEO LTI emphasize durable value creation over optics .