Earnings summaries and quarterly performance for UNITED PARCEL SERVICE.

Executive leadership at UNITED PARCEL SERVICE.

Carol Tomé

Chief Executive Officer

Brian Dykes

Chief Financial Officer

Bala Subramanian

Chief Digital and Technology Officer

Kate Gutmann

President International, Healthcare and Supply Chain Solutions

Nando Cesarone

President U.S. and UPS Airline

Norman Brothers

Chief Legal and Compliance Officer

Board of directors at UNITED PARCEL SERVICE.

Angela Hwang

Director

Christiana Smith Shi

Director

Eva Boratto

Director

Franck Moison

Director

John Morikis

Director

Kate Johnson

Director

Kevin Clark

Director

Kevin Warsh

Director

Rodney Adkins

Director

Russell Stokes

Director

Wayne Hewett

Director

William Johnson

Independent Board Chair

Research analysts who have asked questions during UNITED PARCEL SERVICE earnings calls.

Jordan Alliger

Goldman Sachs

9 questions for UPS

David Vernon

Sanford C. Bernstein & Co., LLC

8 questions for UPS

Ken Hoexter

BofA Securities

8 questions for UPS

Ariel Rosa

Citigroup

6 questions for UPS

Brian Ossenbeck

JPMorgan Chase & Co.

6 questions for UPS

Christian Wetherbee

Wells Fargo

6 questions for UPS

J. Bruce Chan

Stifel

6 questions for UPS

Ravi Shanker

Morgan Stanley

6 questions for UPS

Scott Group

Wolfe Research

6 questions for UPS

Stephanie Moore

Jefferies

5 questions for UPS

Bascome Majors

Susquehanna Financial Group

4 questions for UPS

Brandon Oglenski

Barclays

4 questions for UPS

Jason Seidl

TD Cowen

4 questions for UPS

Thomas Wadewitz

UBS

4 questions for UPS

Tom Wadewitz

UBS Group

4 questions for UPS

Conor Cunningham

Melius Research

3 questions for UPS

Jonathan Chappell

Evercore ISI

3 questions for UPS

Bruce Chan

Stifel Financial Corp.

2 questions for UPS

Chris Wetherbee

Wells Fargo & Company

2 questions for UPS

Joseph Lawrence Hafling

Jefferies

2 questions for UPS

Richa Harnain

Deutsche Bank

2 questions for UPS

Ari Rosa

Citigroup Inc.

1 question for UPS

Ben Mohr

Citigroup Inc.

1 question for UPS

Daniel Imbro

Stephens Inc.

1 question for UPS

Jake Lacks

Wolfe Research, LLC

1 question for UPS

Justine Weiss

Bernstein

1 question for UPS

Ken Hoekster

Bank of America

1 question for UPS

Ravi Shankar

Morgan Stanley

1 question for UPS

Rob Salmon

Wells Fargo & Company

1 question for UPS

Recent press releases and 8-K filings for UPS.

- UPS will eliminate 30,000 operational roles in 2026 via attrition and a voluntary separation program for full-time drivers, alongside closure of roughly two dozen facilities and network consolidation.

- These cuts follow approximately 48,000 job eliminations in 2025 as UPS continues to unwind about 1 million Amazon packages per day, shifting toward higher-margin shipments.

- The restructuring delivered $3.5 billion in savings in 2025 and is expected to yield an additional $3 billion in cost reductions in 2026.

- UPS recorded a $137 million non-cash after-tax charge to retire its MD-11 fleet and projected 2026 revenue of about $89.7 billion, sending its shares up roughly 2.8% in early trading.

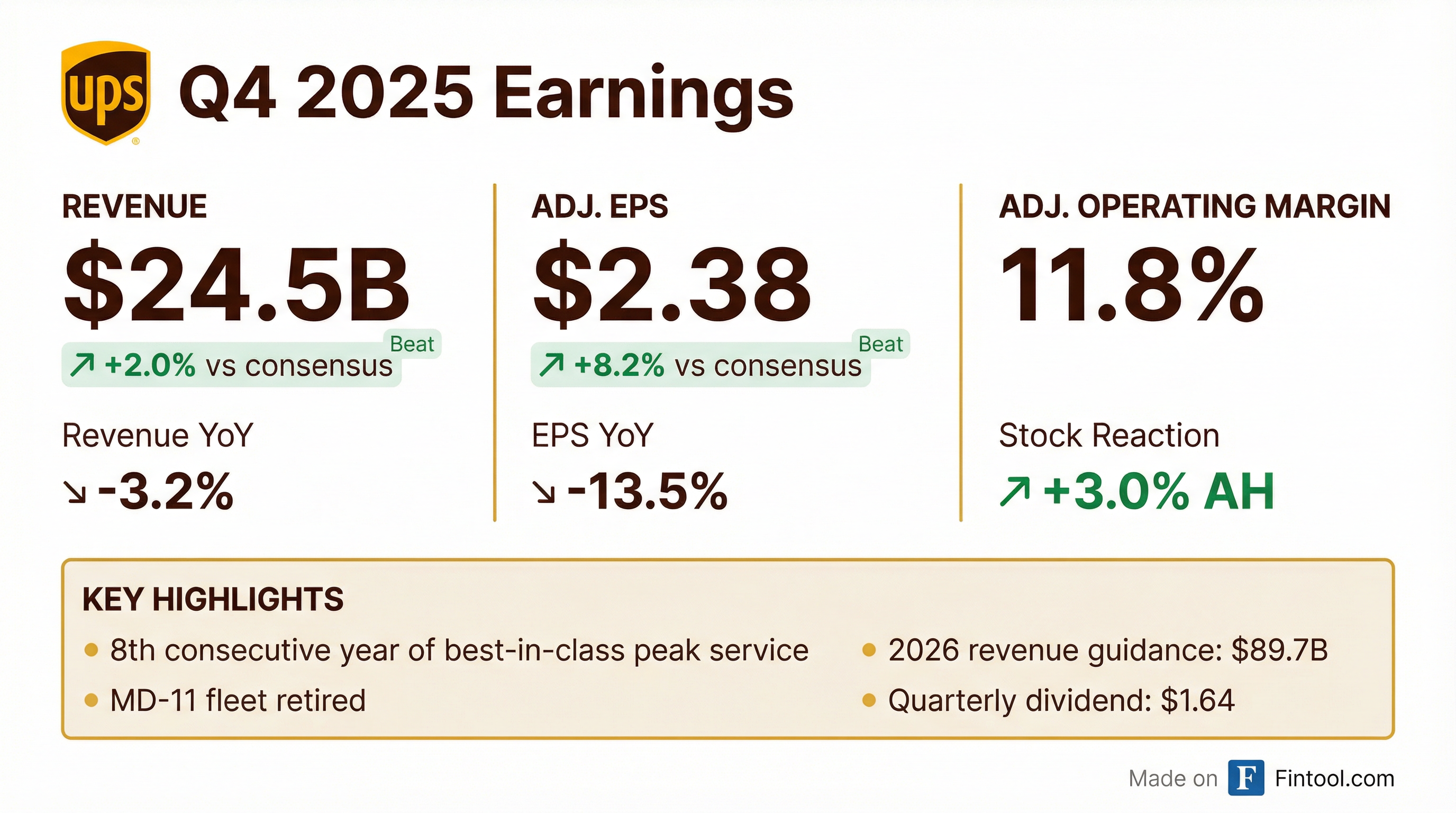

- UPS reported Q4 2025 consolidated revenue of $24.5 billion, operating profit of $2.9 billion (11.8% margin), and diluted EPS of $2.38; FY 2025 revenue was $88.7 billion with $8.7 billion in operating profit (9.8% margin).

- U.S. Domestic Q4 revenue declined 3.2% YoY to $16.8 billion on a 10.8% ADV drop, offset by an 8.3% increase in revenue per piece; operating margin was 10.2%.

- International segment Q4 revenue rose 2.5% YoY to $5.0 billion (ADV down 4.7%), delivering an 18% operating margin; Supply Chain Solutions revenue was $2.7 billion (–$388 million YoY) with a 10.3% margin.

- For full-year 2026, UPS expects revenue of $89.7 billion, operating margin of 9.6%, and flat EPS vs. 2025.

- UPS reported Q4 2025 consolidated revenue of $24.5 billion, operating profit of $2.9 billion, and an operating margin of 11.8%; full-year 2025 revenue was $88.7 billion with operating profit of $8.7 billion and a 9.8% margin

- U.S. Domestic Q4 revenue was $16.8 billion (–3.2% YoY) on an average daily volume decline of 10.8%, offset by 8.3% growth in revenue per piece; segment operating margin was 10.2%

- International Q4 revenue rose 2.5% to $5.0 billion despite a 4.7% volume decline, delivering an operating margin of 18%; Supply Chain Solutions generated $2.7 billion in revenue with a 10.3% margin

- For 2026, UPS expects consolidated revenue of ~$89.7 billion, operating margin of ~9.6%, and diluted EPS to be flat to 2025; the company will reduce Amazon volume by another 1 million pieces/day and target $3 billion in related savings

- Q4 consolidated revenue of $24.5 billion, operating profit of $2.9 billion, and operating margin of 11.8%; FY 2025 revenue $88.7 billion, operating profit $8.7 billion, margin 9.8%.

- Delivered $3.5 billion in savings from network reconfiguration, reduced Amazon volume by ~1 million pieces/day, and grew U.S. revenue per piece by 7.1%; SMB penetration reached 31.8% of U.S. volume.

- Took a $137 million after-tax charge to retire the MD-11 fleet, planning to take delivery of 18 Boeing 767 aircraft over the next 15 months.

- Issued 2026 guidance: revenue ~$89.7 billion, operating margin ~9.6%, EPS ~flat to 2025; expects U.S. ADV down mid-single digits offset by mid-single-digit revenue-per-piece growth, with first-half margin pressure and second-half profit rebound.

- Completed acquisitions of Frigo-Trans and Andlauer Healthcare, expanding healthcare cold chain capabilities, with global healthcare revenue of $11.2 billion in 2025.

- UPS completed accelerated retirement of its McDonnell Douglas MD-11 freighters during Q4 2025, as part of a broader fleet modernization after the Nov. 4, 2025 crash.

- The retirements led to a $137 million noncash, after-tax charge, contributing to $238 million in total special charges for the quarter.

- UPS will replace much of the retired capacity with newer Boeing 767s and other freighters over the coming year, underscoring a safety-driven fleet pivot.

- UPS delivered adjusted EPS of $2.38 on $24.5 billion in revenue, topping expectations and driving a ~4% stock rise on the upbeat outlook.

- Reported diluted EPS of $2.10 after $0.28 per share in one-off charges from MD-11 fleet write-offs and restructuring costs.

- Domestic U.S. package revenue declined about 3.2% to $16.8 billion, while international package revenue rose 2.5% to $5.1 billion, with revenue per piece up 7.1%.

- Issued 2026 guidance of $89.7 billion in revenue and a non-GAAP adjusted operating margin near 9.6%, alongside planned capital spending and dividends; CEO Tomé labels 2026 an “inflection point” as Amazon business declines.

- Consolidated revenue of $24.5 billion and GAAP operating margin of 10.5%; diluted EPS of $2.10 (non-GAAP $2.38) for Q4 2025.

- Fiscal-year 2025 revenue of $88.7 billion, operating profit of $7.9 billion (non-GAAP $8.7 billion), and diluted EPS of $6.56 (non-GAAP $7.16).

- GAAP Q4 results include $238 million in charges (or $0.28/share) for the write-off of the MD-11 aircraft fleet and transformation costs.

- Board declares first-quarter 2026 dividend of $1.64 per share, payable March 5, 2026.

- UPS reported 4Q 2025 consolidated revenue of $24.5 B, GAAP operating margin of 10.5% (non-GAAP 11.8%) and diluted EPS of $2.10 (non-GAAP $2.38).

- Declared a quarterly dividend of $1.64 per share.

- U.S. Domestic revenue declined 3.2% to $16,756 M with a GAAP operating margin of 8.5%, while International revenue rose 2.5% to $5,045 M with a 17.5% margin.

- Incurred $238 M in total Q4 charges, including a $137 M non-cash write-off of its MD-11 fleet and $101 M of transformation costs.

- Management expects 2026 to be an inflection point in executing its strategy upon completion of the Amazon glide-down.

- UPS has completed its $1.6 billion acquisition of Canadian healthcare logistics firm Andlauer Healthcare Group, with AHG shareholders receiving CAD 55.00 per share in cash (approx. CAD 2.2 billion).

- The deal enhances UPS Healthcare’s cold chain transportation capabilities, offering reduced transit times, improved end-to-end visibility and expanded global reach for temperature-sensitive treatments.

- AHG founder and CEO Michael Andlauer will lead UPS Canada Healthcare and AHG to further develop specialized services.

- AHG’s subordinate voting shares will be delisted from the Toronto Stock Exchange, and the company will cease being a reporting issuer in Canada.

- UPS completed the acquisition of Andlauer Healthcare Group Inc. for USD 1.6 billion, representing CAD $55.00 per share and a total purchase price of CAD 2.2 billion.

- The deal expands UPS Healthcare’s specialized cold chain and third-party logistics capabilities across North America and globally, enhancing transit times, visibility, and quality assurance in healthcare delivery.

- Michael Andlauer, founder and CEO of AHG, will lead UPS Canada Healthcare and AHG to drive further innovation and meet growing customer needs.

- The acquisition underscores UPS’s commitment to advancing complex healthcare logistics and strengthening its global specialty services.

Fintool News

In-depth analysis and coverage of UNITED PARCEL SERVICE.

Quarterly earnings call transcripts for UNITED PARCEL SERVICE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more