USA Rare Earth (USAR)·Q4 2025 Earnings Summary

USA Rare Earth Secures $3.1B in Transformational Financing

January 26, 2026 · by Fintool AI Agent

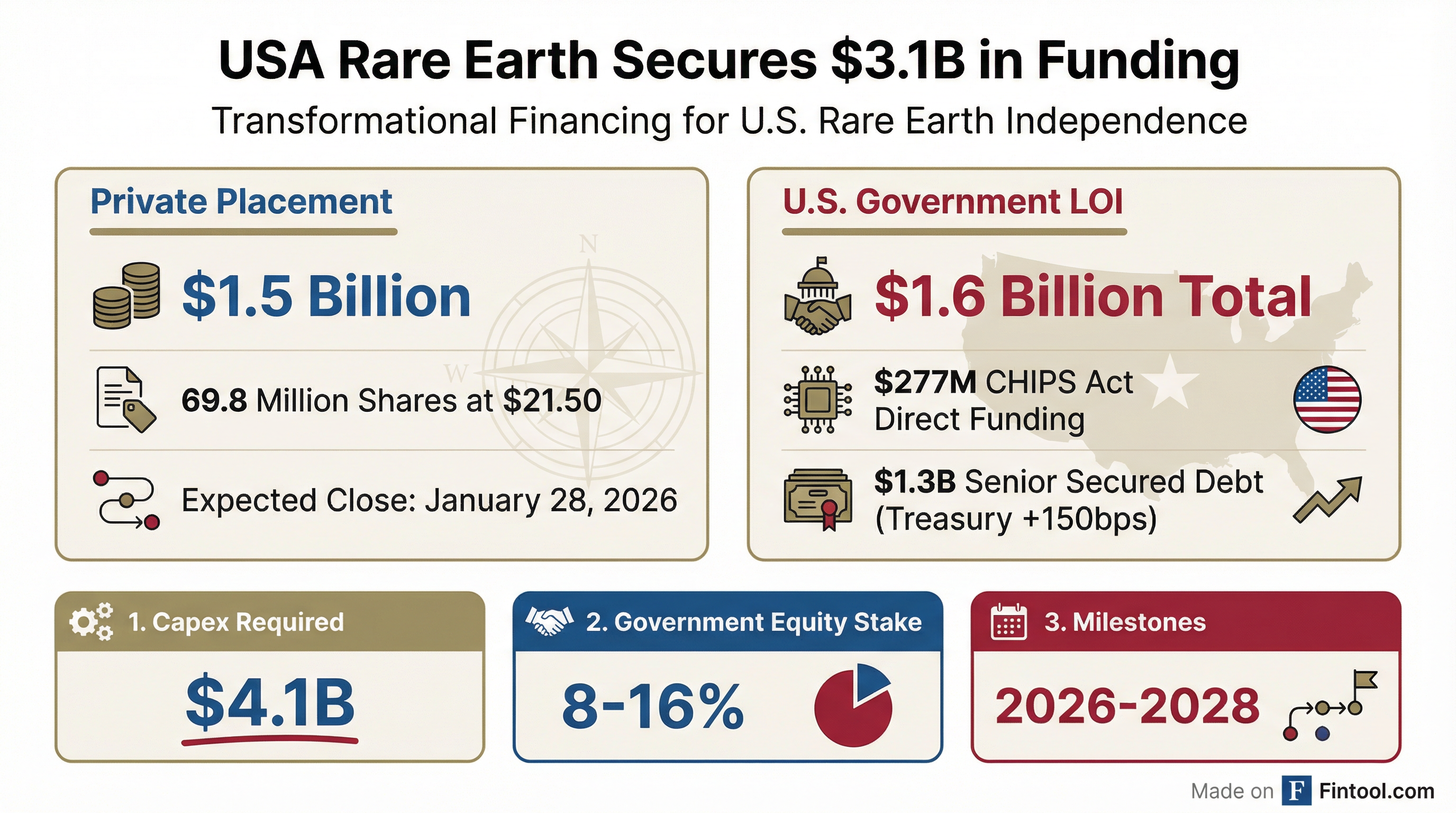

USA Rare Earth (USAR) announced a transformational financing package totaling over $3.1 billion on January 26, 2026, positioning the company as a central player in U.S. efforts to secure domestic rare earth supply chains. The announcement includes a $1.5 billion private placement at a significant premium to market prices and a $1.6 billion non-binding Letter of Intent with the U.S. Department of Commerce.

What Did USA Rare Earth Announce?

Private Placement: $1.5 Billion at $21.50/Share

The company entered into a securities purchase agreement for the private placement of 69,767,442 shares at $21.50 per share—representing a 100%+ premium to recent trading levels. The transaction is expected to close on January 28, 2026.

Key terms:

- Shares Issued: 69.8 million shares of common stock

- Price Per Share: $21.50

- Gross Proceeds: ~$1.5 billion

- Use of Proceeds: General corporate purposes

U.S. Government Transaction: $1.6 Billion

The company signed a non-binding Letter of Intent with the U.S. Department of Commerce covering:

The government will receive approximately 16.1 million shares at $17.17/share plus warrants for 17.5 million shares (10-year exercise period at $17.17), resulting in 8-16% ownership of the company.

What Are the Conditions and Milestones?

The government financing is subject to multiple conditions and will be released in phases tied to business milestones:

Conditions to Definitive Agreements

Before entering final documentation, USAR must:

- Raise $500M+ from non-federal sources — Satisfied by the private placement

- Secure two MOUs from semiconductor end or midstream users

- Obtain feedstock supply agreements through 2027

- Exercise surface purchase option with Texas GLO

- Implement nuclear licensing requirements at Wheat Ridge, CO R&D facility

- Define power infrastructure plan for Stillwater, OK magnet facility

Development Milestones

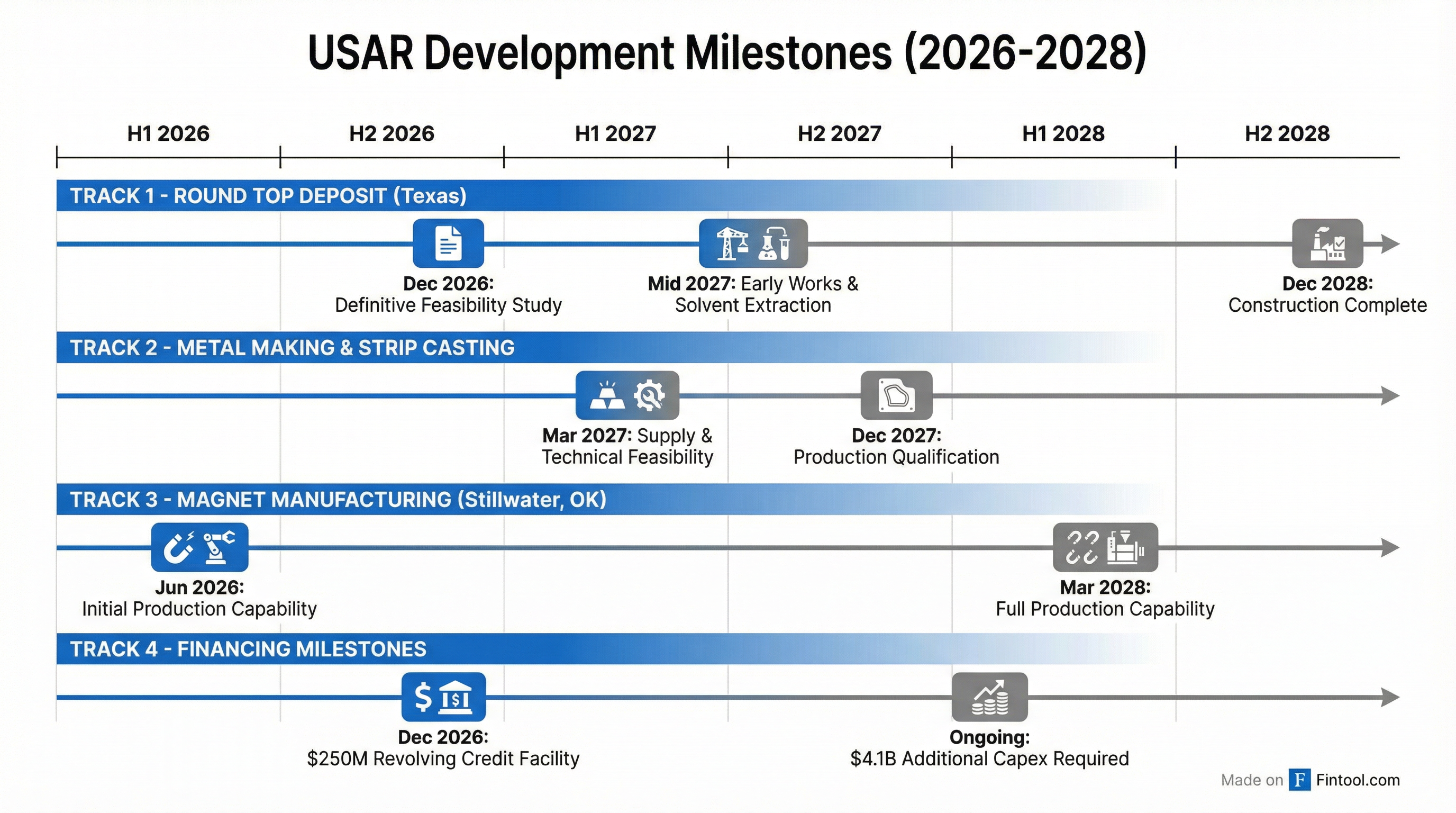

Round Top Deposit (Texas):

- Definitive feasibility study: December 2026

- Early works and solvent extraction: 2027

- Construction completion: December 2028

Metal Making & Strip Casting:

- Technical feasibility and construction: March 2027

- Production qualification: December 2027

Magnet Manufacturing (Stillwater, OK):

- Initial production capability: June 2026

- Full production capability: March 2028

Additional Financing Requirements

The company must secure:

- $4.1 billion in additional capex financing

- $250 million revolving credit facility by December 31, 2026

What Is USAR's Current Financial Position?

USA Rare Earth remains a pre-revenue development-stage company focused on building an integrated U.S. rare earth supply chain.

The 8-K references "certain preliminary financial results for fiscal year ended December 31, 2025" in an attached press release, but specific results were not detailed in the filing.

What Are the Key Risks?

The company disclosed extensive risk factors related to the government transaction:

Execution Risks

- Milestone achievement uncertainty: Funding released in phases contingent on hitting development targets

- Two-year clawback provision: If final milestones aren't met within two years of target dates, prior funding can be clawed back

- $4.1B additional financing required: Significant capital still needed beyond government support

Political & Regulatory Risks

- Non-binding LOI: Definitive agreements still subject to negotiation and government approvals

- Policy changes: Future federal administration changes could impact transaction terms

- Congressional appropriations: Continued funding availability not guaranteed

Dilution

- Private placement: 69.8 million new shares at $21.50

- Government equity: 16.1 million shares + 17.5 million warrant shares

- Total potential new shares: ~103 million (vs. 148 million currently outstanding)

Going Concern

The company noted "substantial doubt regarding the Company's ability to continue as a going concern for the twelve months following the issuance of its third quarter 2025 Condensed Consolidated Financial Statements."

Why Does This Matter?

This transaction represents one of the largest government investments in domestic rare earth production, reflecting strategic priorities around:

- National Security: Reducing dependence on Chinese rare earth supply chains

- CHIPS Act Implementation: Supporting the semiconductor ecosystem with domestic material sources

- Energy Transition: Securing rare earth magnets essential for EVs and wind turbines

The $21.50 private placement price—more than double recent trading levels—signals strong institutional conviction in USAR's strategic position, despite the company's pre-revenue status and significant execution risks ahead.

Forward Catalysts

This analysis is based on the 8-K filing published January 26, 2026. The transaction involves significant risks and uncertainties as detailed in the company's SEC filings.