Earnings summaries and quarterly performance for USA Rare Earth.

Research analysts who have asked questions during USA Rare Earth earnings calls.

Recent press releases and 8-K filings for USAR.

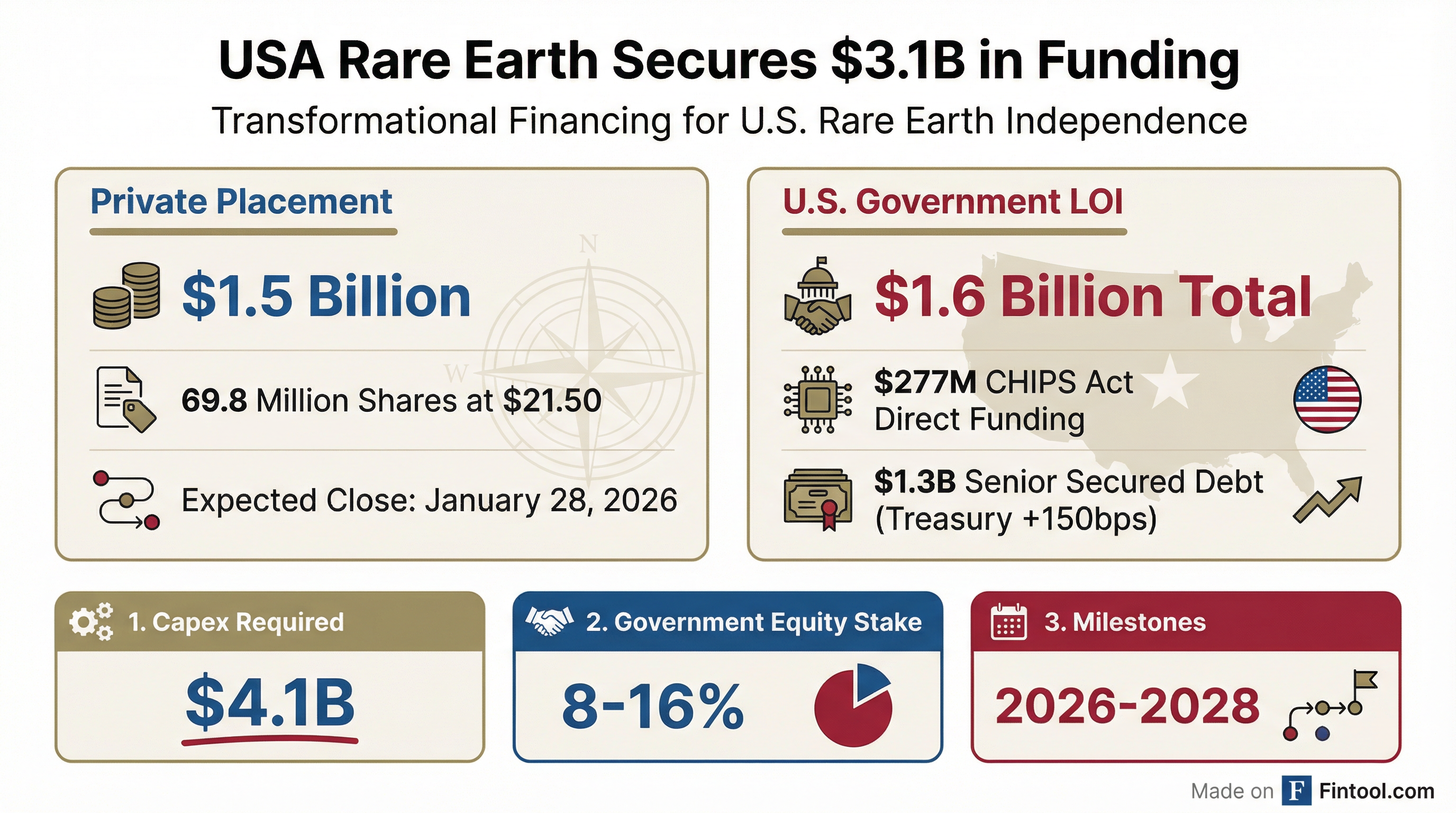

USA Rare Earth Secures $3.1 Billion for Mine-to-Magnet Platform Development

USAR

New Projects/Investments

Debt Issuance

- USA Rare Earth entered a non-binding Letter of Intent with the U.S. Department of Commerce for $1.6 billion under the CHIPS Act, comprising $277 million in proposed federal funding and a $1.3 billion proposed senior secured loan.

- Concurrently, the company raised an additional $1.5 billion through a private sector PIPE transaction, bringing the total capital secured to $3.1 billion.

- This capital will accelerate the development of a mine-to-magnet platform at the Round Top deposit, targeting commercial production by 2028 and aiming to extract 40,000 metric tons per day of rare earth feedstock.

Feb 3, 2026, 3:22 PM

USA Rare Earth Announces Closing of $1.5 Billion PIPE Financing

USAR

New Projects/Investments

- USA Rare Earth, Inc. (USAR) announced the closing of its private investment in public equity (PIPE) financing on January 29, 2026.

- The PIPE generated approximately $1.5 billion in total gross proceeds from the issuance of 69,767,442 shares of common stock at a price of $21.50 per share.

- The company intends to use the net proceeds to accelerate the build-out of its mine-to-magnet value chain, encompassing the development and expansion of mining, processing, metal-making, and magnet manufacturing capabilities, as well as for general corporate purposes.

Jan 29, 2026, 12:07 PM

USA Rare Earth Closes $1.5 Billion PIPE Financing

USAR

New Projects/Investments

- USA Rare Earth, Inc. (USAR) announced the closing of its private investment in public equity (PIPE) financing on January 29, 2026.

- The PIPE generated approximately $1.5 billion in gross proceeds from the issuance of approximately 69.8 million shares of common stock at $21.50 per share.

- The financing was anchored by Inflection Point.

- USAR intends to use the net proceeds to accelerate the build-out of its mine-to-magnet value chain, including development and expansion of mining, processing, metal-making, and magnet manufacturing capabilities, as well as for working capital and general corporate purposes.

Jan 29, 2026, 12:01 PM

USA Rare Earth Announces $3.5 Billion Capital Infusion and Accelerated Mine-to-Magnet Value Chain Plan

USAR

New Projects/Investments

Debt Issuance

M&A

- USA Rare Earth announced a transformative proposed collaboration with the U.S. government, including $1.6 billion in incentives and loans, combined with a $1.5 billion private capital raise (PIPE), providing access to a potential $3.5 billion in capital to accelerate its mine-to-magnet value chain.

- The company is accelerating its mine plan for the Round Top deposit, anticipating commercial production in late 2028, two years earlier than planned, and aims for 10,000 metric tons of annual magnet-making capacity by June 2030.

- USA Rare Earth projects $2.6 billion in revenue, $1.2 billion in EBITDA, and $900 million in free cash flow by 2030, with gross profit breakeven in 2027, EBITDA breakeven in 2028, and cash flow breakeven in 2029.

- For the year ending December 31, 2025, the company anticipates operating expenses and an operating loss in the range of $56 million-$62 million and capital expenditures between $37 million-$43 million, ending the year with over $350 million of cash and cash equivalents.

- The Stillwater, Oklahoma magnet-making facility is on track to begin commissioning in Q1 2026, and the company closed the acquisition of Less Common Metals in November.

Jan 26, 2026, 1:30 PM

USA Rare Earth Announces Transformative Government Collaboration and Capital Raise

USAR

New Projects/Investments

Debt Issuance

Guidance Update

- USA Rare Earth announced a transformative proposed collaboration with the U.S. government, which would provide $1.6 billion in incentives and loans, alongside a $1.5 billion private capital raise, providing access to a potential $3.5 billion in capital.

- This funding will accelerate the company's "mine-to-magnet" value chain, targeting 10,000 metric tons of annual magnet-making capacity by June 2030 and commercial production at the Round Top mine by late 2028, two years ahead of schedule.

- For the year ending December 31, 2025, the company anticipates an operating loss between $56 million-$62 million and capital expenditures between $37 million-$43 million, ending the year with over $350 million in cash and cash equivalents.

- The company projects significant growth by 2030, targeting $2.6 billion in revenue, $1.2 billion in EBITDA, and $900 million in free cash flow.

Jan 26, 2026, 1:30 PM

USA Rare Earth Announces Proposed U.S. Government Collaboration

USAR

New Projects/Investments

Guidance Update

Revenue Acceleration/Inflection

- USA Rare Earth announced a proposed U.S. Government collaboration totaling approximately $1.6 billion, comprising $277 million in Federal Funding and a $1.3 billion Senior Secured Loan.

- This collaboration is intended to accelerate and scale domestic production of rare earth critical minerals, metals, and magnets, with projected 2030 capacities of ~8,000 tpa for Mining & Processing, ~27,500 tpa for Metal Making, and ~10,000 tpa for Magnet Making.

- The company targets significant financial growth by 2030, including ~$2.6 Billion in Revenue, ~$1.2 Billion in EBITDA, and ~$900 Million in Free Cash Flow.

- Preliminary FY 2025 results show cash and cash equivalents of >$350 million, operating expenses and loss between $56 million and $62 million, and capital expenditures between $37 million and $43 million.

- Operational progress includes the Stillwater, Oklahoma magnet facility on track for commissioning in 1Q 2026 and accelerated commercial production at Round Top in late 2028.

Jan 26, 2026, 1:30 PM

USA Rare Earth Announces $1.6 Billion Government Collaboration and $1.5 Billion PIPE Transaction

USAR

Debt Issuance

New Projects/Investments

Guidance Update

- USA Rare Earth (USAR) announced a proposed collaboration with the U.S. government, which would provide $1.6 billion in incentives and loans, alongside a $1.5 billion private capital raise.

- The government's contribution includes $277 million in federal incentives and a $1.3 billion senior secured loan, in exchange for 16.1 million shares of common stock and 17.6 million warrants.

- The company is accelerating its mine plan for Round Top, with commercial production now anticipated in late 2028, two years earlier than planned.

- USA Rare Earth targets $2.6 billion in revenue, $1.2 billion in EBITDA, and $900 million in free cash flow by 2030, with gross profit breakeven in 2027, EBITDA breakeven in 2028, and cash flow breakeven in 2029.

- For the year ending December 31, 2025, the company anticipates an operating loss between $56 million-$62 million and capital expenditures between $37 million-$43 million, expecting to end the year with over $350 million in cash and cash equivalents.

Jan 26, 2026, 1:30 PM

USA Rare Earth Secures $3.1 Billion in Government and Private Funding

USAR

New Projects/Investments

Debt Issuance

Revenue Acceleration/Inflection

- USA Rare Earth (USAR) announced a non-binding Letter of Intent with the U.S. Department of Commerce for $1.6 billion in funding, comprising $277 million in federal funding and a $1.3 billion senior secured loan, alongside a $1.5 billion private sector PIPE investment, totaling $3.1 billion in capital.

- This capital is intended to accelerate USAR's mine-to-magnet platform, aiming to establish a domestic heavy rare earth value chain to support U.S. semiconductor, defense, and energy industries.

- By 2030, USAR targets extracting 40,000 metric tons per day from its Round Top deposit (with commercial production expected by 2028), processing 8,000 tpa of rare earth elements, and achieving 10,000 tpa in both heavy REE metal-making and NdFeB magnet-making capacity.

- The company projects $2.6 billion in revenue, $1.2 billion in EBITDA, and $900 million in free cash flow by 2030, with an estimated total required capital expenditure of $4.1 billion.

Jan 26, 2026, 12:07 PM

USAR to Launch Metal and Alloy Production Facility in France with Government Support

USAR

New Projects/Investments

- USA Rare Earth (USAR), through its subsidiary Less Common Metals (LCM) Europe SAS, announced plans to develop a 3,750 metric ton per annum (mtpa) metal and alloy production facility in Lacq, France.

- The French government has committed to provide direct credits to LCM Europe, covering up to 45% of eligible equipment costs and up to €130 million for real estate under the C3IV program.

- This new facility, which will be co-located with Carester SAS’ oxide processing facility, aims to establish a comprehensive rare earth processing, metal, and alloy production supply chain in Europe.

Jan 20, 2026, 12:01 PM

USA Rare Earth Accelerates Round Top Commercial Production Timeline

USAR

New Projects/Investments

Guidance Update

- USA Rare Earth (USAR) announced it will begin commercial production at its Round Top heavy rare earth deposit in Texas in late 2028, two years earlier than previously anticipated.

- This acceleration is attributed to the planned operation of its Hydromet demonstration facility in Colorado in early 2026, which is expected to save tens of millions of dollars and enable the completion of the definitive feasibility study by early 2027.

- The Round Top deposit is identified as the richest known U.S. deposit of heavy rare earth elements, gallium, and beryllium, forming a key part of USAR’s integrated mine-to-magnet value chain.

Dec 10, 2025, 1:21 PM

Fintool News

In-depth analysis and coverage of USA Rare Earth.

Quarterly earnings call transcripts for USA Rare Earth.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more