USA Rare Earth Secures $1.6B in CHIPS Act Funding, Triggering 30% Stock Surge

January 26, 2026 · by Fintool Agent

USA Rare Earth stock surged more than 30% in premarket trading Monday after the company announced a landmark $1.6 billion funding proposal from the U.S. Department of Commerce—the Trump administration's largest investment yet in the rare earth sector and a clear signal that Washington is aggressively moving to break China's stranglehold on critical minerals.

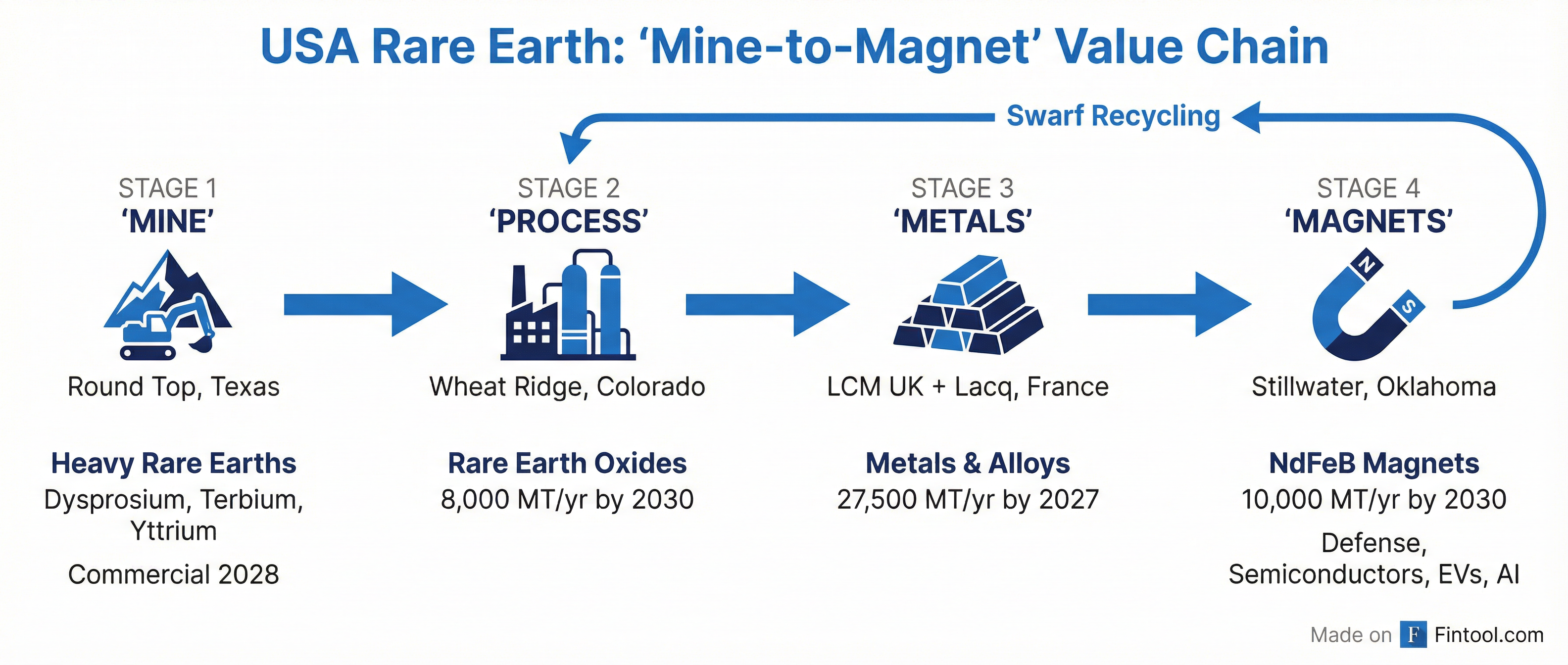

The deal, paired with a concurrent $1.5 billion private PIPE transaction anchored by Inflection Point, gives USA Rare Earth access to approximately $3.5 billion in total capital—enough to accelerate its "mine-to-magnet" strategy and potentially reshape America's rare earth supply chain.

The Deal Structure

Under the letter of intent signed with the Commerce Department's CHIPS Program, USA Rare Earth will receive:

| Component | Amount | Details |

|---|---|---|

| Federal Incentives | $277M | Direct funding |

| Senior Secured Loan | $1.3B | CHIPS Act loan |

| Total Government | $1.6B | LOI pending finalization |

| Private PIPE | $1.5B | 69.8M shares at $21.50 |

| Combined Access | ~$3.5B | Including French government support |

In exchange for the government funding, the Commerce Department will receive 16.1 million shares of USAR common stock and 17.6 million warrants, representing an 8% to 16% stake depending on warrant exercise.

A Milestone-Based Approach

What sets this deal apart from prior government investments is its structure. CEO Barbara Humpton emphasized that disbursements are tied to operational milestones rather than delivered upfront:

"The intent of our colleagues at the Department of Commerce was to make sure that taxpayers, the public sector, would always be following the investments of the private sector. This is why our PIPE was so important—to have the funds to progress our plan, and then as we achieve milestones, taxpayer support continues to build, but the American taxpayer is never over-committed on this plan."

CFO Rob Steele confirmed that the majority of funding will be disbursed between 2026 and 2028, with a small tail into 2029—all within the current administration's timeline.

The Mine-to-Magnet Strategy

USA Rare Earth is building what it calls the first integrated domestic heavy rare earth supply chain, from mine to finished magnet:

Round Top Mine (Texas) — The company's flagship asset is the Round Top deposit in Sierra Blanca, Texas, which contains 15 of the 17 rare earth elements. Critically, it holds high concentrations of dysprosium and terbium—heavy rare earths essential for high-performance magnets that are virtually unavailable outside China.

Based on positive pilot testing results, USA Rare Earth has accelerated the mine plan from a 2030 start to commercial production in late 2028—two years ahead of schedule.

Less Common Metals (UK) — Acquired in November 2025, LCM is the only proven ex-China producer of both light and heavy rare earth metals and alloys at scale. The company is already expanding, with a new plant announced last week in Lacq, France, with 3,750 metric tons of annual capacity.

Stillwater Facility (Oklahoma) — The magnet manufacturing facility is on track to begin commissioning in Q1 2026 and will produce both block and finished magnets for defense, semiconductor, and industrial customers.

2030 Financial Targets

Management laid out aggressive financial projections tied to full-scale production:

| Metric | 2030 Target |

|---|---|

| Revenue | $2.6B |

| EBITDA | $1.2B |

| Free Cash Flow | $900M |

| Milestone | Timeline |

|---|---|

| Gross Profit Breakeven | 2027 |

| EBITDA Breakeven | 2028 |

| Cash Flow Breakeven | 2029 |

The business model assumes a neodymium-praseodymium (NdPr) price of $125 per kilogram—notably higher than the $110 price floor the Department of Defense established for MP Materials.

Capacity Ramp by 2030

| Segment | Capacity Target | Timeline |

|---|---|---|

| Magnet Making | 10,000 MT/year | June 2030 |

| Metal Making | 27,500 MT/year (10,000 domestic) | December 2027 |

| Oxide Processing | 8,000 MT/year | 2030 |

No Price Floors, No Offtakes—By Design

Unlike MP Materials' DoD deal, USA Rare Earth's government agreement does not include price floors or offtake commitments. CFO Rob Steele explained the rationale:

"The minerals that we have are frankly in dramatic undersupply outside of China and are absolutely required for things like semiconductors, aerospace and defense. Dysprosium at $900 a kilogram, terbium at $3,500 a kilogram, hafnium at $1,500 a kilogram—and they're not available. We don't need price floors."

The company is pursuing a "safety stock" strategy, positioning itself as a resilience supplier for customers who may continue sourcing large orders from other providers but need guaranteed domestic supply.

New Leadership with Government Expertise

The deal comes just four months after USA Rare Earth appointed Barbara Humpton as CEO. Humpton spent 14 years at Siemens, including seven years as President and CEO of Siemens USA, where she led a $20 billion revenue operation.

Prior to Siemens, she held senior roles at Booz Allen Hamilton and Lockheed Martin focused on government technology and national security programs—experience directly relevant to navigating the federal funding landscape.

"There is nothing more critical to national and global security than securing a domestic supply chain for rare earth minerals and magnets," Humpton said in the conference call. "We're delivering a fully integrated rare earth value chain from mine to magnet, built around U.S. priorities."

Competitive Landscape: Government Picks Its Champions

The Trump administration has now taken stakes in multiple critical minerals companies as part of a coordinated push to reduce dependence on China:

| Company | Investment | Government Entity | Stake |

|---|---|---|---|

| MP Materials | $400M equity + $150M loan | Department of Defense | 15% |

| USA Rare Earth | $1.6B (LOI) | Department of Commerce | 8-16% |

| Lithium Americas | Equity stake | Federal government | 10% |

| Trilogy Metals | $35.6M | DoD + OUSD | 10% |

| Intel | $5.7B (CHIPS Act conversion) | Department of Commerce | 10% |

MP Materials stock rose 1% Monday to $72.48 after its own rally following recent DoD investments. The California-based company operates the Mountain Pass mine—the only operating rare earth mine in the U.S.—and is building magnet capacity in Texas.

Why Heavy Rare Earths Matter

While MP Materials dominates light rare earth production (primarily neodymium and praseodymium), USA Rare Earth is differentiated by its access to heavy rare earths—dysprosium, terbium, and yttrium—which are essential for:

- High-temperature magnets used in fighter jet guidance systems and missile defense

- Semiconductor manufacturing equipment requiring hafnium and zirconium

- Advanced electronics in radar, medical imaging, and AI robotics

The Round Top deposit also contains gallium, hafnium, and zirconium—critical minerals for semiconductor manufacturing that are on the U.S. government's list of essential materials.

2025 Preliminary Results

For fiscal year 2025, USA Rare Earth anticipates:

| Metric | Range |

|---|---|

| Operating Expenses | $56M - $62M |

| Operating Loss | $56M - $62M |

| Capital Expenditures | $37M - $43M |

| Year-End Cash | >$350M |

What to Watch

Near-term catalysts:

- PIPE closing expected January 28, 2026

- Stillwater facility commissioning in Q1 2026

- CHIPS funding finalization expected this quarter

- Accelerated mine plan completion in H2 2026

Execution risks:

- Total project capital requirements estimated at $4.1 billion—still ~$600M short of full funding

- Equipment supply chain dependencies, though management claims ex-China sourcing is secured

- Heavy rare earth pricing volatility given thin markets

- Permitting and environmental approvals for Round Top

Key question: Can USA Rare Earth actually deliver integrated mine-to-magnet production at scale by 2028? The company has never operated a mine, and its magnet facility is just beginning commissioning. The $3.5 billion in capital access provides runway, but execution remains the primary risk for a company trading at a multi-billion dollar market cap with no revenue.