Usio (USIO)·Q4 2025 Earnings Summary

USIO Shares Preliminary FY 2025 Results: Record Transaction Volume but Profitability Challenges Persist

January 27, 2026 · by Fintool AI Agent

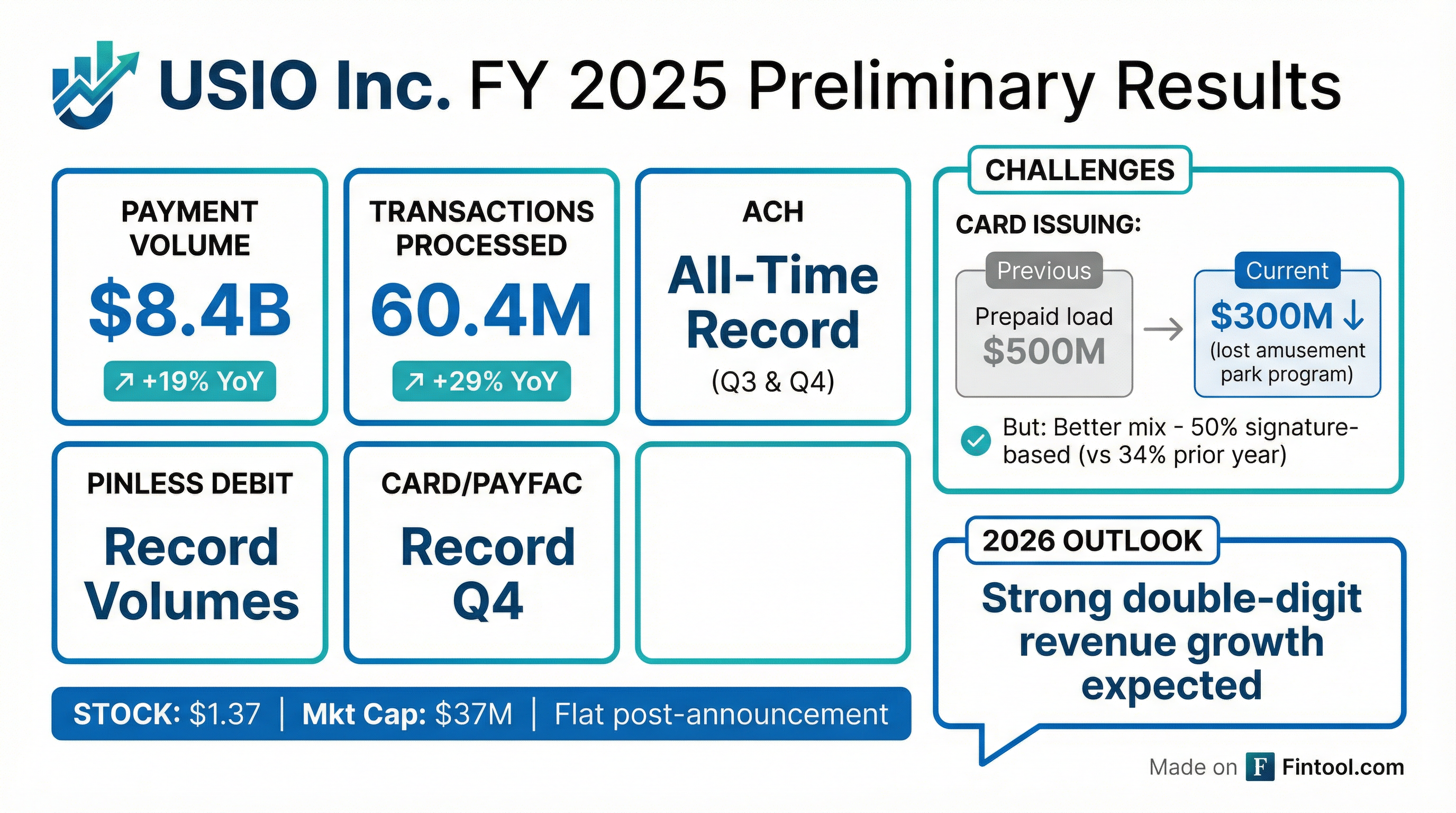

USIO Inc. (NASDAQ: USIO) published its annual shareholder letter on January 21, 2026, providing preliminary FY 2025 results ahead of the finalized audit . The FinTech payment processor reported record operational metrics with $8.4 billion in payment volume (+19% YoY) and 60.4 million transactions (+29% YoY), though official financial results remain pending . The stock has been flat following the announcement, trading at $1.37.

Did USIO Beat Earnings?

Status: Preliminary results only — USIO has not released final Q4 2025 or FY 2025 financials. The shareholder letter provides operational metrics but notes that "we are finalizing our financial 2025 results and the completion of the audit by our independent public accounting firm" .

Based on recent quarterly performance, USIO has faced challenges meeting Street expectations:

Estimates from S&P Global

The company expects to report "record revenues" for FY 2025 driven by payment volume momentum, while maintaining positive adjusted EBITDA .

What Were the Key Operational Highlights?

USIO set multiple all-time records across its payment processing segments :

Record Metrics (Preliminary FY 2025):

- Payment Volume: $8.4B (+19% vs $7.1B in 2024)

- Transactions Processed: 60.4M (+29% vs 47M in 2024)

- ACH: All-time quarterly records in both Q3 and Q4 2025; Q4 showed 14% sequential growth

- PINless Debit: Record quarterly transaction volumes and dollars processed

- Card/PayFac: Expected all-time quarterly records in Q4 2025

Challenge Area — Card Issuing:

- Prepaid load volume declined to ~$300M from $500M in 2024

- Prepaid transactions fell to 8M from 11M prior year

- Root cause: Loss of reseller's amusement park card program

- Silver lining: Transaction mix improved — 50% signature-based (2% interchange per dollar) vs 34% in 2024

What Did Management Guide for 2026?

CEO Louis Hoch expressed optimism for "strong double-digit revenue growth" in 2026 . Key growth drivers include:

- Card Issuing Recovery: Multiple high-volume card programs slated for 2026 launch, including a large state school voucher payment program

- PostCredit Integration: Recent acquisition enables banking services for existing customer base through bank sponsor relationships

- Usio One Platform: Unified go-to-market approach designed to drive cross-selling and customer stickiness

- Real-time Payments: Continued expansion of PINless debit and other real-time payment technologies

The forward estimates from analysts show modest growth expectations:

Estimates from S&P Global

How Did the Stock React?

The stock has been essentially flat since the shareholder letter was published on January 21, 2026:

The muted reaction suggests the market was not surprised by the preliminary results. USIO trades near its 52-week low, down approximately 40% from its 2025 high of $2.30.

What Changed From Prior Guidance?

Management's tone shifted meaningfully from previous quarters:

The company acknowledged 2025 revenue growth was limited by "the loss of a significant account of one of our resellers and lower interest rates" .

Historical Financial Performance

Revenue has remained relatively flat in the $20-22M quarterly range, while profitability has turned negative in 2025 after a strong Q3 2024 ($2.85M net income).

Key Risks and Concerns

- Reseller Concentration: The loss of a single reseller's amusement park program caused a 40% decline in Card Issuing volume

- Profitability Pressure: Net losses in all three reported quarters of 2025 after positive earnings in Q3-Q4 2024

- Interest Rate Sensitivity: Lower rates cited as a headwind to 2025 revenue

- Execution Risk: 2026 guidance depends on successful launch of new card programs and PostCredit integration

What to Watch Going Forward

- Final FY 2025 Results: Audited financials will provide clarity on actual vs. preliminary numbers

- Card Issuing Pipeline: Conversion of "several high-volume card programs" into revenue

- State Voucher Program: Potential catalyst if secured — could be material to a $37M market cap company

- Q1 2026 Guidance: First test of "strong double-digit growth" commitment

This analysis is based on USIO's 8-K filing dated January 21, 2026, containing preliminary and unaudited financial information. Final results may differ materially. See the full filing for complete disclosures and risk factors.