Earnings summaries and quarterly performance for Usio.

Executive leadership at Usio.

Board of directors at Usio.

Research analysts who have asked questions during Usio earnings calls.

SB

Scott Buck

H.C. Wainwright

7 questions for USIO

Also covers: AEYE, ARQQ, BKSY +27 more

Jon Hickman

Ladenburg Thalmann

4 questions for USIO

Also covers: BLDE, BYRN, CLSK +9 more

BS

Barry Sine

Litchfield Research

2 questions for USIO

Also covers: LVO, PODC, UMAC +1 more

JH

John Hickman

Ladenburg

2 questions for USIO

Recent press releases and 8-K filings for USIO.

Usio Publishes 2025 Annual Shareholder Letter with Preliminary Results and 2026 Outlook

USIO

Guidance Update

Revenue Acceleration/Inflection

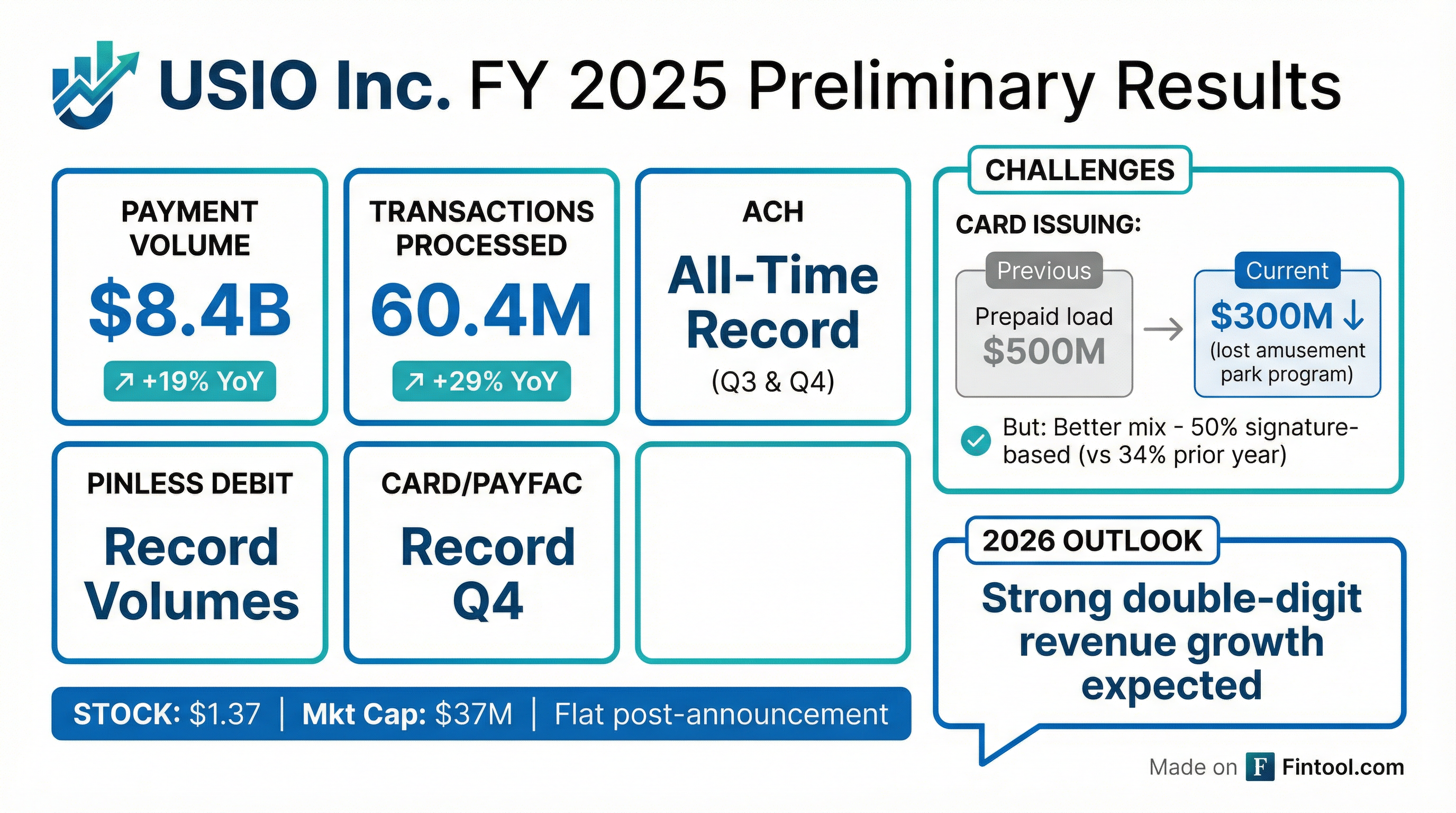

- Usio processed more than $8.4 billion in payment volume in 2025, a 19% year-over-year increase from $7.1 billion in 2024, and total payment transactions exceeded 60.4 million, up 29% from 47 million in the prior year.

- The company expects to report record revenues for 2025, although revenue growth is not expected to mirror the double-digit rates of prior years due to the loss of a significant reseller account and lower interest rates.

- The Card Issuing division experienced a decline in prepaid load volume to approximately $300 million in 2025 from $500 million in 2024, but saw an improvement in transaction mix with nearly 50% of loaded dollars spent through signature-based transactions compared to 34% in 2024.

- Usio anticipates strong double-digit revenue growth for 2026, with the Card Issuing business specifically expected to have a meaningful year of revenue growth due to new high-volume card programs.

Jan 27, 2026, 9:00 PM

Usio, Inc. Reports Preliminary 2025 Operational Highlights and 2026 Outlook

USIO

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Usio, Inc. processed more than $8.4 billion in payment volume in 2025, a 19% increase from $7.1 billion in 2024, and total payment transactions exceeded 60.4 million, up 29% from 47 million in the prior year. The company expects to report record revenues for 2025.

- Despite strong operational momentum and record revenues, 2025 revenue growth is not expected to mirror the double-digit rates of prior years due to the loss of a significant reseller account and lower interest rates.

- The Card Issuing division experienced a challenging 2025, with prepaid load volume declining to approximately $300 million from $500 million in 2024, and transactions falling to over 8 million from 11 million, primarily due to the loss of a reseller's amusement park card program. However, the division saw an improved transaction mix, with nearly 50% of loaded dollars spent through signature-based transactions in 2025, compared to 34% in 2024.

- Usio anticipates a strong recovery and meaningful revenue growth for its Card Issuing business in 2026, with several high-volume card programs expected to launch. Overall, the company expects strong double-digit revenue growth in 2026.

- The company maintained positive adjusted EBITDA over multiple consecutive quarters and generated operating cash flows in 2025.

Jan 21, 2026, 2:05 PM

USIO Reports Q3 2025 Results with Record Processing Volumes and Sequential Revenue Growth

USIO

Earnings

Revenue Acceleration/Inflection

Share Buyback

- USIO reported a solid Q3 2025 with seven quarterly processing volume records, including a record overall transaction volume of $16.2 million, up 8% year over year, and a $1.2 million sequential increase in revenues. The company also achieved positive profits and cash flow, with Adjusted EBITDA at $368,000 and operating cash flow at $1.4 million.

- The company noted a significant shift towards recurring revenue, with most new and total revenue now recurring in nature, and margins improved year over year, driven by the high-margin ACH business. This strong sequential momentum is expected to position Usio for a return to top-line growth in the fourth quarter and for the full year 2025, with Q3 marking the final quarter of difficult card issuing comparisons.

- USIO's cash balance increased to over $7.8 million at quarter end, anticipating continued growth to support organic expansion and potential opportunistic strategic acquisitions. The company also utilized $60,000 for share repurchases in Q3, bringing the year-to-date total to $750,000, with just over $3 million remaining on the current authorization.

Nov 12, 2025, 9:30 PM

Usio Reports Strong Q3 2025 Operational Performance with Record Processing Volumes and Sequential Revenue Growth

USIO

Earnings

Revenue Acceleration/Inflection

Share Buyback

- Usio reported a strong Q3 2025, achieving seven quarterly processing volume records, including a record overall transaction volume of $16.2 million, up 8% year-over-year. The company saw a $1.2 million sequential increase in revenues and anticipates a return to top-line growth in Q4 and for the full year 2025.

- The ACH business was a key driver, with revenues up 30% year-over-year for the third consecutive quarter, primarily from recurring business. The credit card segment also demonstrated robust growth, with dollars processed up 12% and transactions processed up 75% year-over-year.

- The company maintained positive profits and cash flow, reporting Adjusted EBITDA of $368,000 and operating cash flow of $1.4 million for Q3 2025. Cash on hand increased to over $7.8 million at quarter-end, with continued growth expected.

- Usio continued its share repurchase program, utilizing $60,000 in Q3 and a total of $750,000 year-to-date to repurchase shares, with over $3 million remaining on the current authorization.

Nov 12, 2025, 9:30 PM

USIO Reports Solid Q3 2025 Results with Record Processing Volumes and Anticipates Q4 Top-Line Growth

USIO

Earnings

Revenue Acceleration/Inflection

Share Buyback

- USIO reported a solid Q3 2025, setting seven quarterly processing volume records, including a record overall transaction volume of $16.2 million, up 8% year over year. Revenues increased $1.2 million sequentially, notably driven by ACH revenue, which grew 30% year over year, despite total revenues being relatively flat due to card issuing weakness.

- The company achieved $368,000 in Adjusted EBITDA and generated $1.4 million in operating cash flow, increasing its cash balance to over $7.8 million by quarter-end.

- USIO anticipates a return to top-line growth in Q4 and for the full year 2025, expecting improved card issuing performance and continued cash growth to fund organic expansion and potential strategic acquisitions. The company also repurchased $60,000 of shares in Q3, contributing to $750,000 year-to-date, with over $3 million remaining on the authorization.

Nov 12, 2025, 9:30 PM

Usio, Inc. Announces Third Quarter 2025 Financial Results

USIO

Earnings

Share Buyback

Revenue Acceleration/Inflection

- Usio, Inc. reported a net loss of approximately ($0.4) million, or ($0.02) per share, for the third quarter ended September 30, 2025, compared to net income of $2.9 million, or $0.10 per share, in the same period last year. Consolidated revenues were $21.2 million, a nominal decrease of 1% from the prior year quarter.

- Despite the slight overall revenue decline, the company experienced significant operational growth, with total payment transactions processed increasing 27% to 16.2 million and total payment dollars processed rising 8% to $2.18 billion in Q3 2025 compared to Q3 2024.

- This growth was primarily driven by the ACH division, which achieved all-time quarterly records for key processing metrics and saw its revenues increase 36%. However, Adjusted EBITDA for Q3 2025 was $0.4 million, down from $0.8 million in Q3 2024.

- As of September 30, 2025, Usio maintained a strong financial position with $7.7 million in cash and cash equivalents and had expended over $760,000 on share repurchases year-to-date.

Nov 12, 2025, 9:01 PM

Usio Announces Third Quarter 2025 Financial Results

USIO

Earnings

Demand Weakening

Share Buyback

- Usio reported consolidated revenues of $21.2 million for the third quarter ended September 30, 2025, a nominal 1% decrease from the prior year, primarily due to weakness in prepaid card issuance revenues, largely offset by 36% growth in ACH revenues.

- The company experienced a shift from profitability to a net loss of ($0.4) million, or ($0.02) per share, in Q3 2025, compared to net income of $2.9 million, or $0.10 per share, in Q3 2024, with Adjusted EBITDA also declining to $0.4 million from $0.8 million.

- Despite the revenue decline, total payment dollars processed through all channels increased 8% to $2.18 billion in Q3 2025, and total payment transactions processed grew 27% to 16.2 million.

- As of September 30, 2025, Usio held $7.7 million in cash and cash equivalents and repurchased over $760,000 of shares year-to-date.

Nov 12, 2025, 9:01 PM

Usio Reports Record Third Quarter 2025 Processing Volumes

USIO

Revenue Acceleration/Inflection

- Usio, Inc. announced record processing and transaction volumes across virtually all its businesses for the three months ended September 30, 2025.

- The company processed a quarterly record of 16.2 million transactions via all payment channels.

- The ACH business achieved records in Electronic Check Transactions, Check Dollars, Returned Checks processed, and PINless Debit transactions and dollars processed. PINless debit transactions and dollars processed saw year-over-year growth of 96% and 87%, respectively.

- The Credit Card business also achieved record transactions processed, driven by its PayFac business.

Nov 4, 2025, 2:05 PM

Quarterly earnings call transcripts for Usio.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more