UNIVERSAL TECHNICAL INSTITUTE (UTI)·Q1 2026 Earnings Summary

UTI Beats on All Metrics But Stock Drops 2% as Growth Investments Weigh on Profits

February 04, 2026 · by Fintool AI Agent

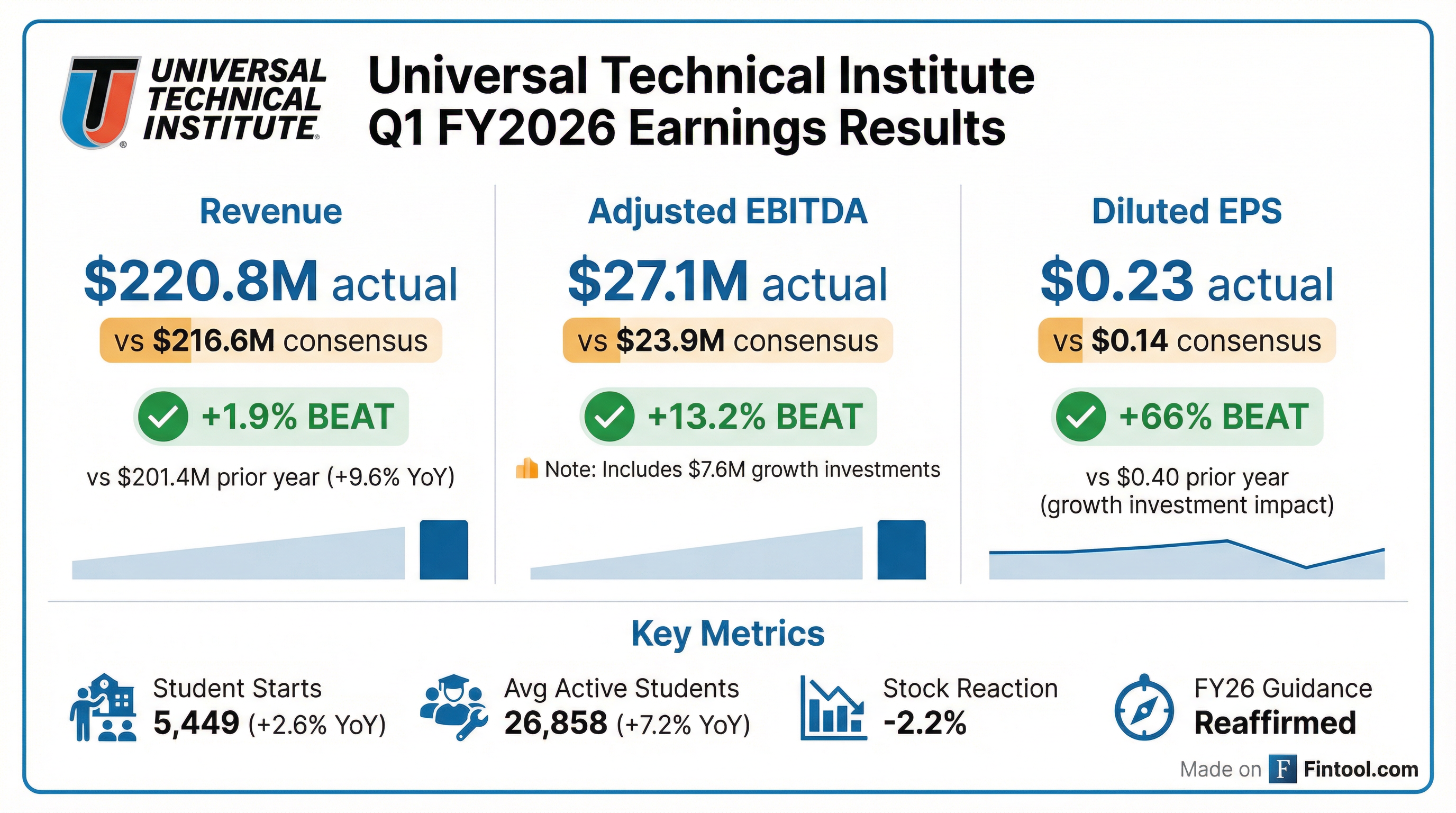

Universal Technical Institute (UTI) delivered a triple beat in its fiscal first quarter, exceeding consensus on revenue, EBITDA, and EPS. Yet shares fell 2.2% as investors focused on the significant year-over-year profit decline driven by $7.6 million in strategic growth investments under the company's "North Star Strategy" Phase II expansion.

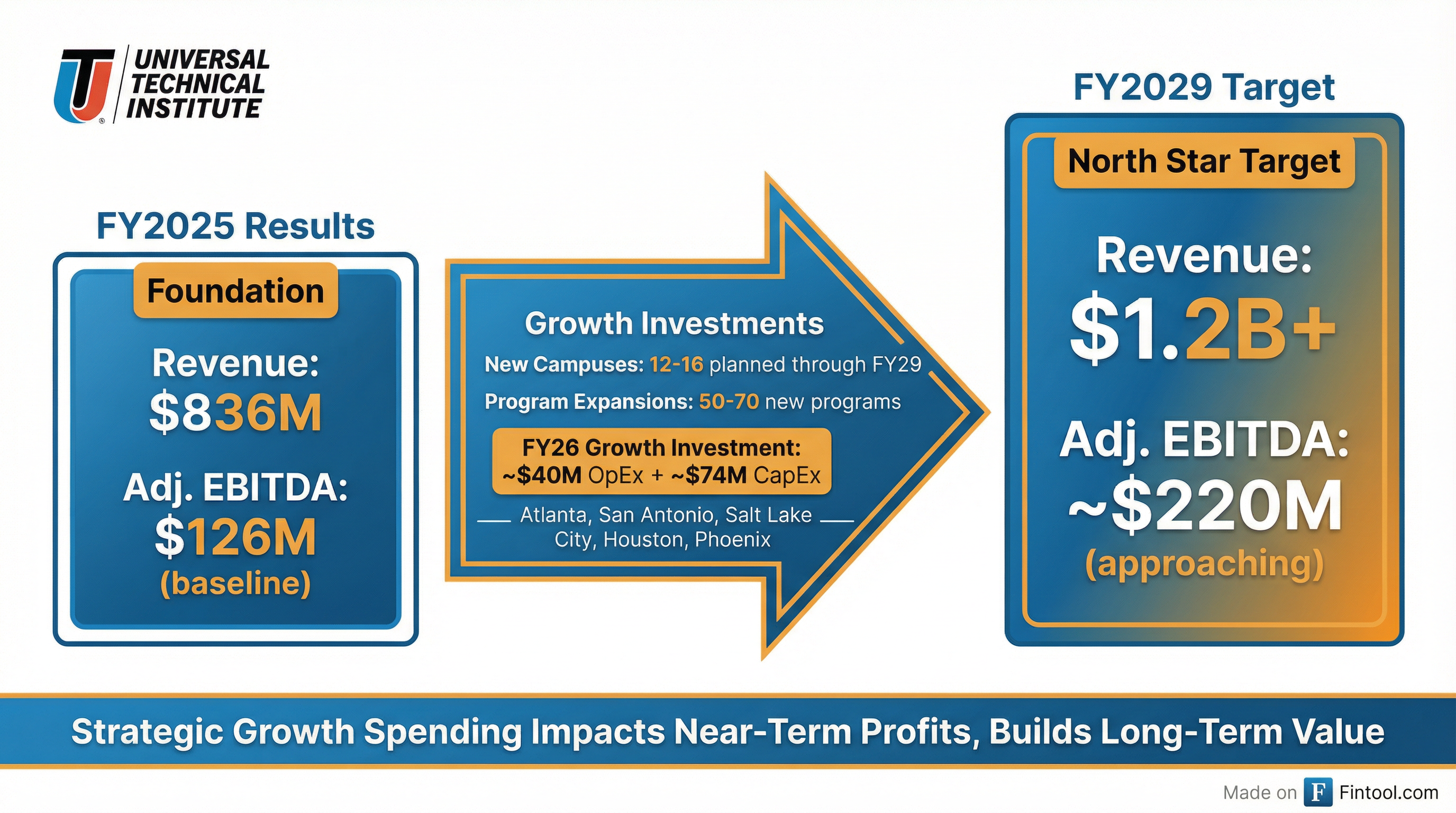

The results illustrate the near-term trade-off UTI is making: sacrificing short-term profitability to fund aggressive campus expansion and program additions that management believes will drive the company to $1.2 billion in revenue and $220 million in Adjusted EBITDA by FY2029.

Did UTI Beat Earnings?

Yes — UTI beat across all key metrics:

*Estimates retrieved from S&P Global

Revenue growth of 9.6% YoY was driven by 7.2% growth in average full-time active students to 26,858, with both the UTI division (transportation/skilled trades) and Concorde division (healthcare) contributing.

However, operating expenses surged 17.9% YoY to $205.2 million, primarily due to strategic growth expenses for new campus launches and program expansions. This compressed operating income from $27.5M to $15.7M.

How Did the Stock React?

UTI shares closed at $27.85 on earnings day, down 2.2% from the prior close of $28.51. The stock had been trading in a tight range ahead of the report and remains well off its 52-week high of $36.32.

The negative reaction despite the triple beat reflects investor concern about the significant profit compression. Net income declined 42% YoY and EPS fell from $0.40 to $0.23 — even though this was planned and communicated as part of the North Star growth strategy.

What Did Management Guide?

UTI reaffirmed full FY2026 guidance:

*Baseline Adj. EBITDA excludes growth investments

CFO Bruce Schuman emphasized the company's financial flexibility: "Our financial position provides the flexibility to fund this growth without compromise, resulting in sustainable enrollment growth and operating leverage, positioning the company for long-term shareholder value in the years ahead."

Key point: While reported Adj. EBITDA is guided to decline YoY ($114-119M vs $126M), the underlying baseline business is expected to grow from ~$133M to ~$156M — the difference is the ~$40M in growth investments flowing through OpEx.

What Changed From Last Quarter?

Acceleration of North Star Strategy Phase II:

-

Four new campus locations announced across both divisions — Atlanta (UTI), Atlanta (Concorde), Houston (Concorde), and Phoenix (Concorde) — joining previously announced San Antonio and Salt Lake City (UTI).

-

Growth investment ramp: Q1 included $7.6M of strategic growth expenses, on track for the full-year ~$40M OpEx investment plan plus ~$74M in growth CapEx.

-

Heartland Dental partnership launched: In November 2025, UTI launched its first co-branded campus with Heartland Dental — a first-of-its-kind model that validates employer partnerships as a growth pathway.

Segment Performance

UTI operates two reportable segments:

UTI Division (65% of revenue): 5.7% growth in average students, 5.1% growth in new starts. Programs include auto/diesel technician, welding, aviation maintenance, and skilled trades.

Concorde Division (35% of revenue): 9.5% growth in average students despite flat new starts (-0.2%). Programs include dental hygiene, nursing, medical assisting, and allied health.

Key Management Commentary

CEO Jerome Grant struck an optimistic tone on execution:

"We entered the year on strong operational and financial footing, and the first quarter tracked in line with our plans and exceeded our expectations for disciplined execution on our North Star strategy. Through new and optimized campuses as well as program expansions we are scaling a durable, repeatable operating model."

On validation of the expansion playbook:

"The performance of Austin and Miramar, the rapid demand at Fort Myers, and the strong early momentum in San Antonio and Atlanta validate our site selection, program mix, and execution playbook, while maintaining the student and employer outcomes that define our brand."

Balance Sheet & Capital Allocation

*Includes $70.4M available on revolving credit facility

CFO Schuman noted that of the $24M in Q1 CapEx, "a full $19 million of that was growth CapEx" focused on new campus buildouts and program launches. Management expects ~$100M CapEx again in FY2027 to support the next wave of campus openings.

Historical Performance

UTI has now beaten revenue consensus for 8+ consecutive quarters, demonstrating consistent execution.

Q&A Highlights

On new campus momentum — San Antonio is opening in approximately one month with over 300 students already enrolled, ahead of the 600 annual run rate target. Atlanta recruiting has been "quite impressive" since launching one month ago.

On Heartland partnership expansion — CEO Grant confirmed "active conversations" with Heartland and other DSOs for additional co-branded campuses: "Their needs are not declining... we're having some very healthy conversations." The model has also sparked interest from major employers in the UTI division.

On marketing efficiency — Management reported continued improvement in marketing yield with AI-driven targeting: "Our targeting is much more precise, and therefore, we're able to get more leads for the buck." Marketing as a % of revenue is up about 1 point YoY due to new campus launches.

On macro tailwinds — CEO Grant highlighted the skilled trades momentum:

"The CEO of AI company saying, 'AI is one thing, but I can't build data centers 'cause I don't have electricians and welders, and my data centers are falling behind.' Those are the kind of things that are making people say, 'Being a welder is a great thing to do. Being an electrician is a great thing to do.'"

On acquisition appetite — Limited acquisition opportunities exist as peers see the same favorable macro conditions: "There aren't that many people in the space who are saying, 'I've got to get out of this business,' because they're seeing what we're seeing."

Forward Catalysts & Risks

Catalysts to Watch:

- New campus openings: San Antonio and Atlanta (UTI) expected to ramp through FY26; Salt Lake City to follow

- Concorde expansion: Houston, Atlanta, and Phoenix locations in pipeline

- Co-branded campus model: Heartland Dental partnership could be template for future employer collaborations

- FY2029 North Star targets: Revenue of $1.2B+ and Adj. EBITDA approaching $220M

Key Risks:

- Regulatory risk: Title IV federal student aid compliance remains critical; 90/10 ratio at ~81% for UTI, ~76% for Concorde. However, CEO Grant noted the current DOE has approved Title IV applications within 72 hours (vs. months previously), and emphasized regulatory risks are administrative, not legislative, so less sensitive to midterm elections.

- Execution risk: Aggressive expansion (12-16 new campuses by FY29) requires sustained operational excellence

- Profitability pressure: Near-term earnings headwinds as growth investments peak in FY26-27

- Macro sensitivity: Enrollment tied to labor market conditions and employment rates for graduates

The Bottom Line

UTI's Q1 FY2026 results underscore the classic growth vs. profitability trade-off. The company beat consensus handily, but the stock sold off because investors are weighing near-term profit declines against long-term growth ambitions.

Bull case: UTI is executing well on a clearly articulated strategy. Revenue grew 9.6%, student enrollment accelerated, and the company is expanding its geographic footprint with a proven playbook. If North Star Phase II delivers, UTI could nearly double EBITDA by FY2029.

Bear case: Profitability is deteriorating significantly (net income down 42% YoY) and will remain pressured for multiple years as growth investments peak. The stock may struggle until investors see evidence of margin recovery.

For current holders: Results were in line with expectations. The question is whether you believe in the long-term transformation story and can tolerate 2-3 years of compressed earnings.

View the full Q1 FY2026 earnings call transcript | Company Profile | Prior Quarter: Q4 FY2025