Earnings summaries and quarterly performance for UNIVERSAL TECHNICAL INSTITUTE.

Executive leadership at UNIVERSAL TECHNICAL INSTITUTE.

Jerome Grant

Chief Executive Officer

Bruce Schuman

Chief Financial Officer

Carolyn Frank

Senior Vice President, Chief Human Resources Officer

Adrienne DeTray

Chief Information Officer

Christine Kline

Chief Accounting Officer

Christopher Kevane

Executive Vice President, Chief Legal Officer

Kevin Prehn

Senior Vice President, Concorde Division President

Sherrell Smith

Executive Vice President, Chief Academic Officer

Todd Hitchcock

Chief Operating Officer

Tracy Lorenz

Senior Vice President, UTI Division President

Board of directors at UNIVERSAL TECHNICAL INSTITUTE.

Christopher Shackelton

Director

George Brochick

Director

Linda Srere

Director

Loretta Sanchez

Director

Michael Slubowski

Director

Robert DeVincenzi

Chairman of the Board

Shannon Okinaka

Director

William J. Lennox, Jr.

Director

Kenneth Trammell

Director

Research analysts who have asked questions during UNIVERSAL TECHNICAL INSTITUTE earnings calls.

Jasper Bibb

Truist Securities

7 questions for UTI

Mike Grondahl

Lake Street Capital Markets

6 questions for UTI

Raj Sharma

Texas Capital Bank

5 questions for UTI

Eric Martinuzzi

Lake Street Capital Markets

4 questions for UTI

Griffin Boss

B. Riley Securities

4 questions for UTI

Alexander Paris

Barrington Research Associates, Inc.

2 questions for UTI

Alex Paris

Barrington Research Associates

2 questions for UTI

Bruce Goldfarb

Lake Street Capital Markets

2 questions for UTI

Steve Frankel

Rosenblatt

2 questions for UTI

Rajiv Sharma

B. Riley Securities

1 question for UTI

Steven Frankel

Rosenblatt Securities

1 question for UTI

Recent press releases and 8-K filings for UTI.

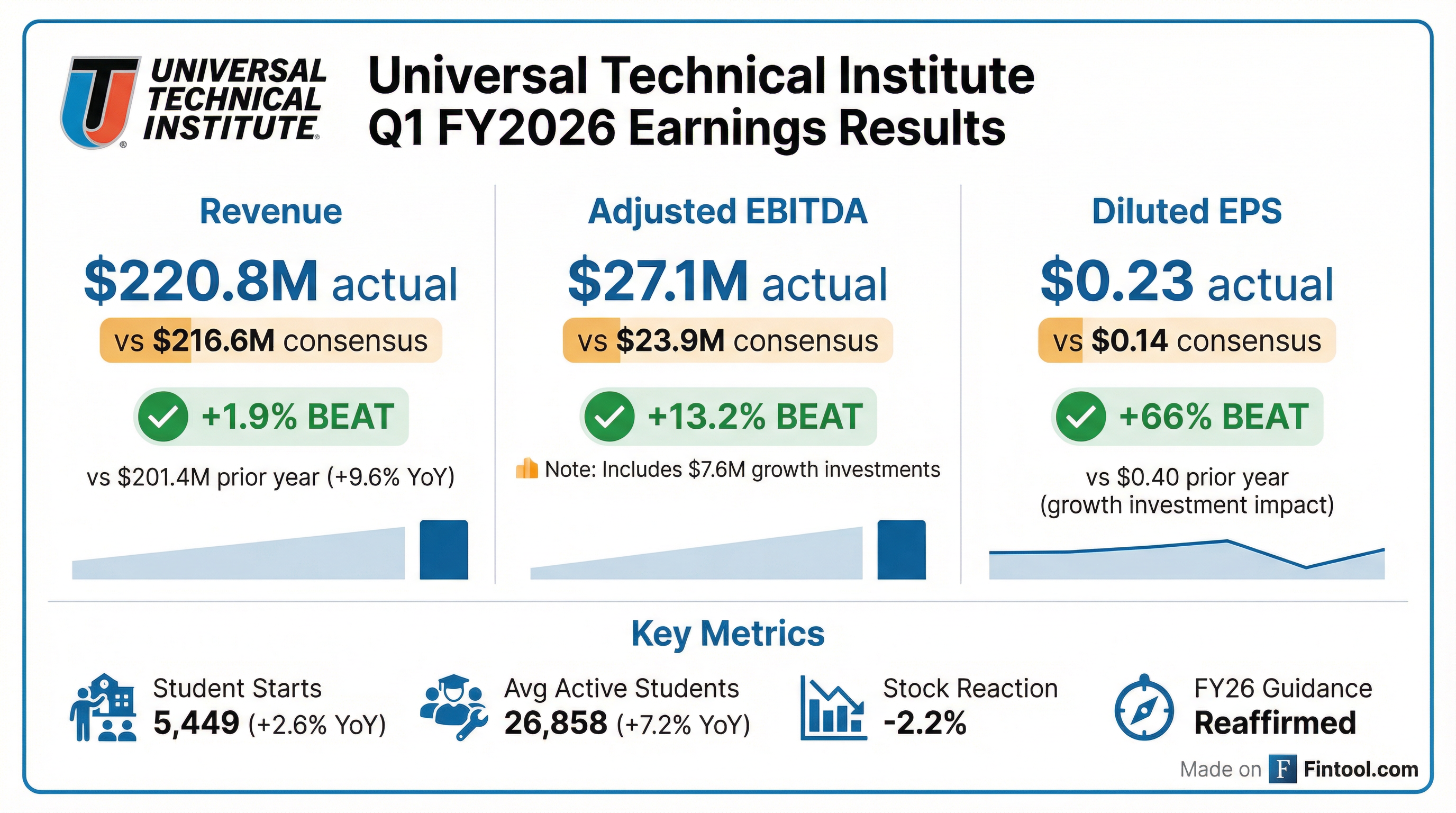

- Universal Technical Institute (UTI) reported Q1 2026 revenue of $220.8 million, a 9.6% increase year-over-year, and reported Adjusted EBITDA of $27.1 million.

- Average full-time active students grew 7.2% to 26,858, and total new student starts increased 2.6% to 5,449 in Q1 2026.

- The company reiterated its fiscal 2026 guidance, projecting revenue between $905 million and $915 million (approximately 9% year-over-year growth at the midpoint) and reported Adjusted EBITDA between $114 million and $119 million.

- UTI plans significant growth investments in fiscal 2026, including approximately $40 million in growth investments for baseline Adjusted EBITDA and an annual capital expenditure of about $100 million to support new campuses and program expansions. These investments are expected to cause net income and Adjusted EBITDA contraction in Q2 and Q3, with stronger growth anticipated in Q4.

- New campuses in Fort Myers and San Antonio have recently opened or are about to open, with the Atlanta campus slated for the second half of fiscal 2026, contributing to expected acceleration in student starts and revenue later in the year.

- Universal Technical Institute (UTI) provided FY2026 guidance projecting revenue of $905-915 million, net income of $40-45 million, and adjusted EBITDA of $114-119 million. Diluted EPS is expected to be $0.71-$0.80, and new student starts are forecast at 31.5k-33.0k.

- The company's North Star Strategy Phase II aims to surpass $1.2 billion in annual revenue and approach $220 million in adjusted EBITDA by fiscal 2029.

- The FY2026 guidance incorporates significant growth investments in both capital and operating expenditures, which are noted to impact year-over-year comparability and affect both profitability and cash flows for the year.

- Strategic initiatives include the addition of three new campuses announced for 2026, along with past acquisitions like MIAT (FY2022) and Concorde (FY2023), and ongoing program expansions.

- Universal Technical Institute (UTI) reported strong Q1 2026 results, with revenue increasing 9.6% to $220.8 million and reported adjusted EBITDA at $27.1 million. Average full-time active students grew 7.2% to 26,858, and new student starts increased 2.6% to 5,449.

- The company reiterated its fiscal 2026 guidance, expecting revenue between $905 million and $915 million and reported adjusted EBITDA between $114 million and $119 million. Diluted earnings per share are projected to be $0.71 to $0.80, and total new student starts are anticipated to be 31,500 to 33,000.

- UTI is making significant growth investments in new campuses and programs, with $24 million in capital expenditures in Q1 2026, contributing to an expected $100 million in CapEx for the full year. These investments are expected to lead to near-term profitability contraction in Q2 and Q3 before accelerating growth in Q4 and beyond.

- Strategic execution of the North Star plan is on track, with new campuses like Fort Myers already exceeding expectations, and San Antonio and Atlanta slated to open in fiscal 2026. The company also plans to launch over 20 new programs in FY26 and is seeing a positive regulatory environment for Title IV funding approvals.

- UTI reported strong Q1 2026 financial results, with revenue increasing 9.6% to $220.8 million and reported Adjusted EBITDA reaching $27.1 million. Average full-time active students grew 7.2% and total new student starts increased 2.6% year-over-year.

- The company reiterated its fiscal 2026 guidance, projecting revenue between $905 million and $915 million (approximately 9% year-over-year growth at the midpoint) and reported Adjusted EBITDA between $114 million and $119 million.

- UTI is making significant growth investments, totaling $7.6 million in Q1 2026 and an anticipated $40 million for the full year, to launch new campuses and expand programs under its North Star strategy. These investments are expected to drive long-term value despite short-term profitability impacts.

- Capital expenditures for fiscal 2026 are projected at $100 million, with $75 million allocated to growth CapEx, and adjusted free cash flow is expected to be in the $20 million to $25 million range.

- Universal Technical Institute, Inc. reported Q1 2026 revenue of $220.8 million, an increase of 9.6% over the comparable period, with net income of $12.8 million and diluted earnings per share of $0.23. Adjusted EBITDA decreased 23.5% to $27.1 million due to $7.6 million in strategic growth expenses.

- Operational highlights for Q1 2026 include an increase in average full-time active students by 7.2% to 26,858 and total new student starts of 5,449, up 2.6% over the comparable period.

- The company reiterated its fiscal 2026 guidance, expecting revenue between $905 million and $915 million, reported adjusted EBITDA of $114 million to $119 million, and total new student starts between 31,500 and 33,000.

- As of December 31, 2025, total available liquidity was $233.2 million, comprising $93.6 million in cash and cash equivalents, $69.2 million in short-term investments, and $70.4 million available from the revolving credit facility, with total debt at $101.4 million.

- Universal Technical Institute (UTI) reported Q1 FY2026 revenue of $220.8 million, marking a 9.6% increase over the comparable period, while net income decreased to $12.8 million due to strategic growth expenses.

- Diluted earnings per share for the quarter were $0.23, compared to $0.40 in the prior comparable period.

- Adjusted EBITDA decreased 23.5% to $27.1 million, primarily attributed to $7.6 million in strategic growth expenses.

- The company experienced operational growth, with average full-time active students increasing 7.2% to 26,858 and total new student starts rising 2.6% to 5,449.

- UTI reiterated its fiscal 2026 guidance, projecting revenue between $905 million and $915 million and reported adjusted EBITDA of $114 million to $119 million.

- Universal Technical Institute (UTI) concluded fiscal year 2025 with revenue of $835.6 million, marking a 14% year-over-year growth, and adjusted EBITDA of $126.5 million. The company also saw a 10.8% increase in new student starts, reaching 29,793.

- For fiscal year 2026, UTI projects revenue between $905 million and $915 million and adjusted EBITDA between $114 million and $119 million. This guidance incorporates approximately $40 million in planned growth investments for campus expansions and program development.

- Operationally, UTI plans to open three new campuses and launch approximately 20 new programs in fiscal year 2026. These significant investments are expected to temporarily moderate reported margins in 2026 and 2027, with returns accelerating from fiscal year 2028 onwards.

- Looking ahead, UTI anticipates achieving over $1.2 billion in annual revenue and approaching $220 million in adjusted EBITDA by fiscal year 2029, representing a substantial increase from 2024 figures.

- Universal Technical Institute (UTI) provided FY2026 revenue guidance of $905-915 million, net income guidance of $40-45 million, and adjusted EBITDA guidance of $114-119 million.

- As part of its North Star Strategy Phase II, the company expects to surpass $1.2 billion in annual revenue and approach $220 million in adjusted EBITDA by fiscal 2029.

- The North Star Strategy Phase II aims for continued growth through organic growth, 12-16 new campuses, and 50-70 new programs & expansions.

- Universal Technical Institute (UTI) reported strong fiscal year 2025 results, with revenue reaching $835.6 million, a 14% year-over-year increase, and adjusted EBITDA of $126.5 million.

- For fiscal year 2026, UTI projects revenue between $905 million and $915 million and reported adjusted EBITDA between $114 million and $119 million, reflecting approximately $40 million in planned growth investments.

- The company expects to open three new campuses and launch approximately 20 new programs in fiscal 2026, with plans for a minimum of two and up to five new campuses annually and 20 new programs annually through fiscal 2029.

- By fiscal year 2029, UTI anticipates achieving more than $1.2 billion in annual revenue and approaching $220 million in adjusted EBITDA.

- Universal Technical Institute, Inc. reported strong fiscal year 2025 results, with revenue increasing 14.0% to $835.6 million and net income rising 50.0% to $63.0 million, while Q4 2025 revenue grew 13.3% to $222.4 million and diluted EPS was $0.34.

- For fiscal year 2025, diluted EPS was $1.13, and adjusted EBITDA increased 22.9% to $126.5 million.

- The company provided fiscal year 2026 guidance, projecting revenue between $905 and $915 million and diluted EPS between $0.71 and $0.80, reflecting approximately $40 million in growth investments for new campuses and program launches.

- Operationally, FY 2025 saw a 10.5% increase in average full-time active students to 24,618 and a 10.8% increase in new student starts to 29,793; the company plans to open at least two and up to five new campuses and launch approximately 20 new programs annually as part of its Phase II North Star strategy, aiming for over $1.2 billion in annual revenue and around $220 million in adjusted EBITDA by FY 2029.

Quarterly earnings call transcripts for UNIVERSAL TECHNICAL INSTITUTE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more