Earnings summaries and quarterly performance for UTAH MEDICAL PRODUCTS.

Executive leadership at UTAH MEDICAL PRODUCTS.

Board of directors at UTAH MEDICAL PRODUCTS.

Research analysts covering UTAH MEDICAL PRODUCTS.

Recent press releases and 8-K filings for UTMD.

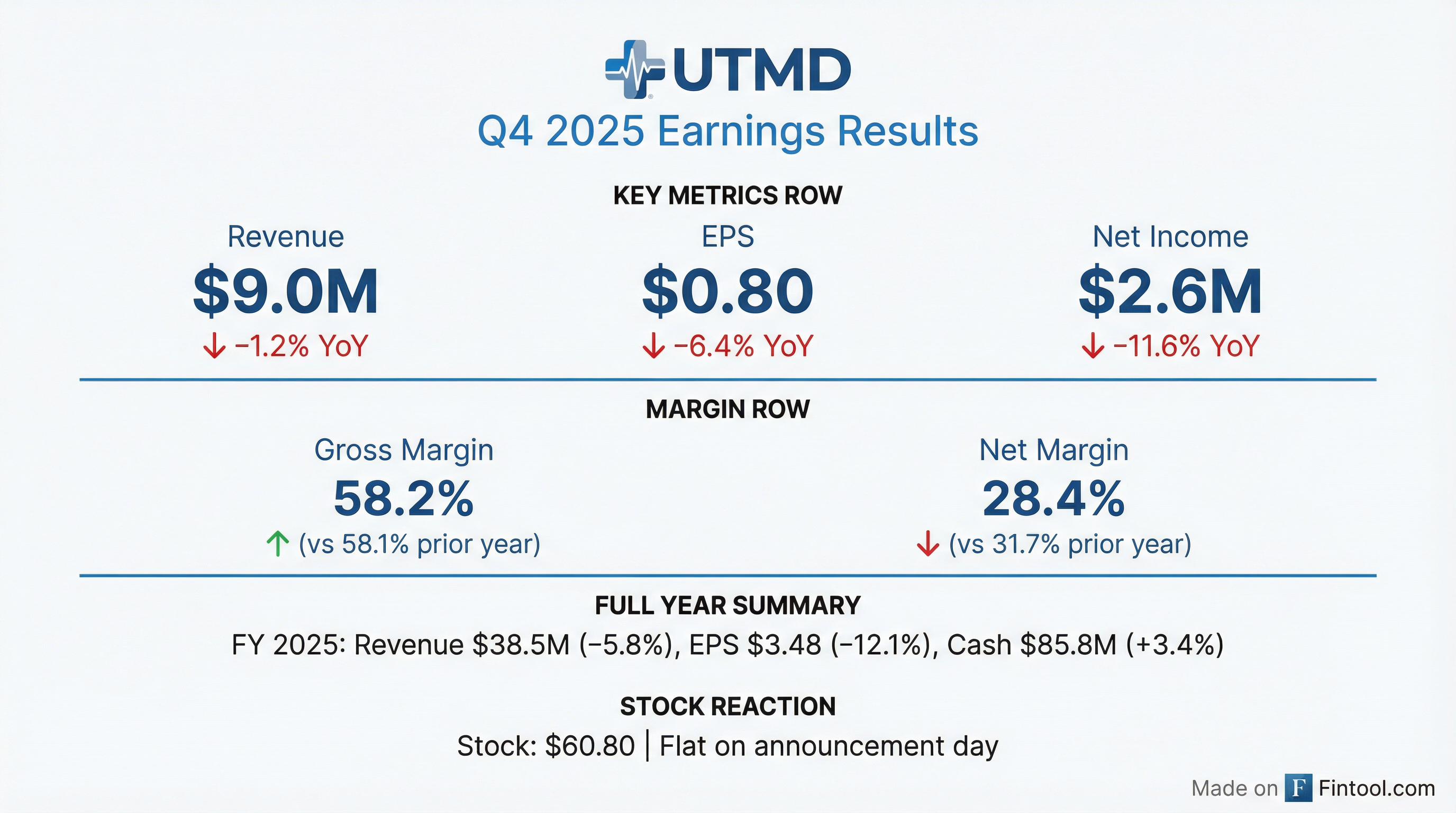

Utah Medical Products Reports Q4 and Full-Year 2025 Financial Results

UTMD

Earnings

Share Buyback

Guidance Update

- Utah Medical Products, Inc. (UTMD) reported a 5.8% decline in total consolidated worldwide sales to $38,520 thousand for the year 2025, with diluted earnings per share (EPS) decreasing by 12.1% to $3.483 compared to 2024.

- The company's net income for 2025 was $11,286 thousand, an 18.7% decrease from 2024, despite maintaining a gross profit margin of 57.1% for the year.

- UTMD increased its year-ending cash balances to $85.8 million as of December 31, 2025, after paying $4.0 million in dividends and repurchasing $8.4 million of its shares in the open market during the year.

- The decline in annual revenues for 2025 was primarily attributed to an 85% decrease in OEM sales to PendoTECH and an unexpected 5% decrease in OUS distributor sales, including lower sales to its China distributor.

- For 2026, OEM sales to PendoTECH and blood pressure monitoring kits to China are expected to be zero, compared to $2.5 million in 2025, though UTMD plans to offset these losses with new product sales and organic business growth.

Jan 29, 2026, 8:11 PM

Utah Medical Products Appoints Director and Increases Quarterly Dividend

UTMD

Board Change

Dividends

- Utah Medical Products, Inc. (UTMD) has appointed Kevin C. Timken, Esq. to its Board of Directors, increasing the board size from five to six members. Mr. Timken will serve on the Audit Committee and Compensation and Benefits Committee.

- The Board of Directors approved a quarterly cash dividend of $0.31 per share of common stock, representing a 1.6% increase over the prior regular quarterly cash dividend.

- This dividend is payable on January 5, 2026, to shareholders of record at the close of business on December 16, 2025.

Nov 4, 2025, 6:42 PM

Utah Medical Products Reports Q2 and First Half 2025 Financial Results

UTMD

Earnings

Share Buyback

Demand Weakening

- For the second calendar quarter (2Q) 2025, consolidated total revenues were $447 (4.3%) lower than in 2Q 2024, and for the first half (1H) 2025, revenues were $2,077 (9.6%) lower than in 1H 2024, primarily due to a continued decline in sales to PendoTECH.

- Gross Profit Margin contracted to 56.2% in 2Q 2025 (from 60.1% in 2Q 2024) and 56.6% in 1H 2025 (from 59.9% in 1H 2024), mainly due to lower sales and an unfavorable product mix for UTMD’s Ireland operations.

- Net Income for 2Q 2025 was $3,048 thousand, a 11.7% decrease from 2Q 2024, and for 1H 2025 was $6,089 thousand, a 17.8% decrease from 1H 2024. Diluted Earnings Per Share (EPS) decreased 4.0% to $0.939 in 2Q 2025 and 10.3% to $1.858 in 1H 2025, with the decline significantly mitigated by share repurchases.

- UTMD maintained a strong balance sheet with no debt, reporting $82.2 million in Cash and Investments as of June 30, 2025. The company repurchased $6.7 million of common stock and paid $2.0 million in dividends during 1H 2025.

Jul 24, 2025, 12:00 AM

Utah Medical Products Reports Q1 2025 Financial Performance

UTMD

Earnings

Share Buyback

- Net sales dropped 14.4% to $9,710 thousand in Q1 2025 versus Q1 2024, driven largely by a significant OEM sales decline, especially from PendoTECH.

- Profitability metrics fell with gross profit down by 18.1%, operating income decreasing 18.8% to $3,154 thousand, and net income falling 23.1% to $3,041 thousand; EPS declined 16% to $0.919.

- The company offset some margin pressure by reducing operating expenses and executed share repurchases, which helped moderate the EPS impact, while maintaining strong liquidity with cash equivalents at $83.3 million and nearly unchanged stockholders’ equity.

Apr 29, 2025, 12:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more