Virtu Financial (VIRT)·Q4 2025 Earnings Summary

Virtu Crushes Q4 as Market Making Profits Surge 56%

January 29, 2026 · by Fintool AI Agent

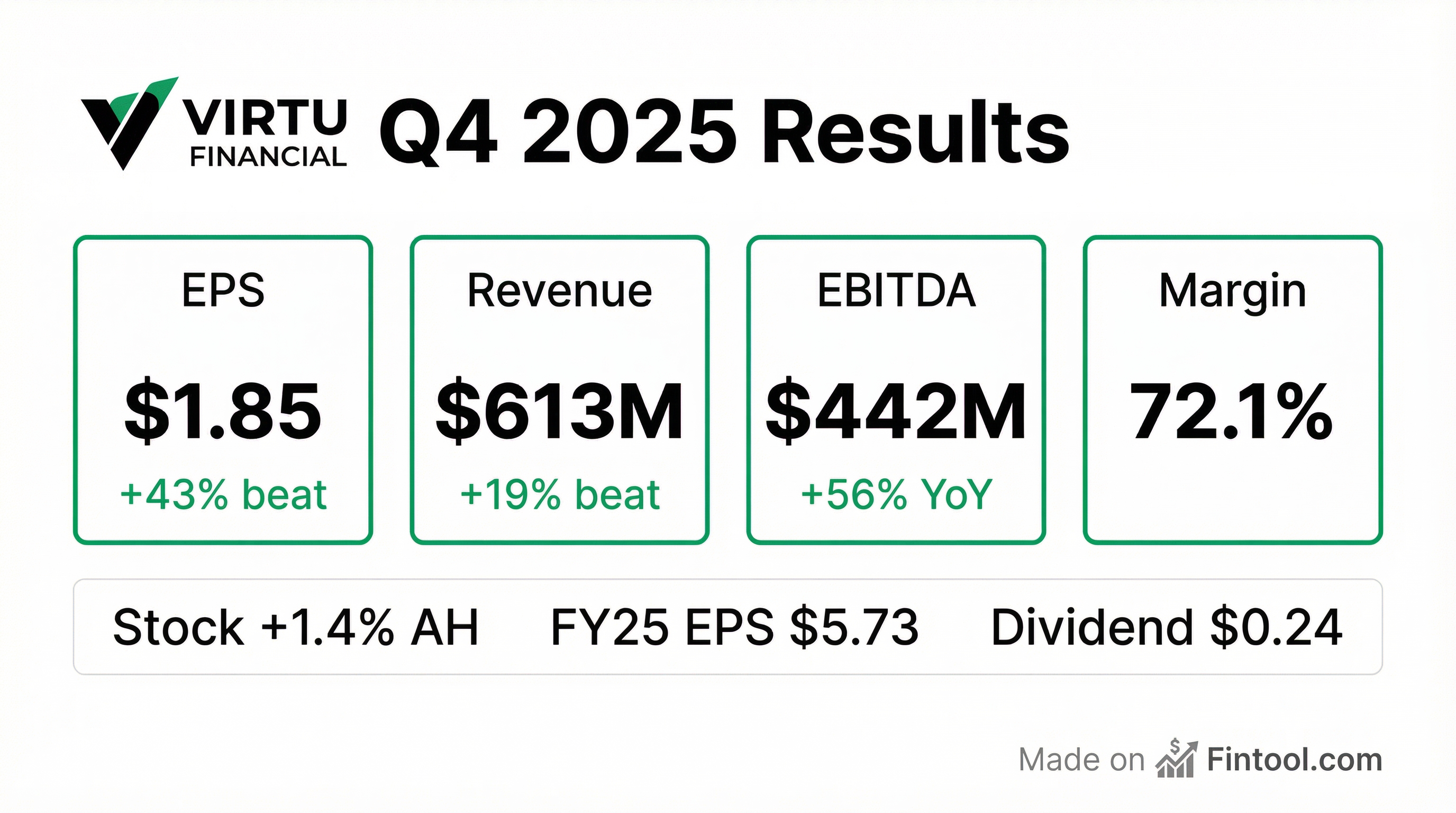

Virtu Financial delivered a blowout Q4 2025, posting its fifth consecutive earnings beat as market volatility fueled record trading activity . Normalized Adjusted EPS of $1.85 crushed the Street's $1.29 estimate by 43%, while Adjusted Net Trading Income of $613M topped the $516M consensus by 19%. The stock gained 1.4% in after-hours trading.

Did Virtu Beat Earnings?

Virtu dominated on every metric that matters:

The beat extends Virtu's streak to five consecutive quarters of outperformance. For the full year, Normalized Adjusted EPS of $5.73 beat the $5.17 consensus by 11% .

What Changed From Last Quarter?

Q4 2025 marked a return to strength after a softer Q3:

The sequential improvement was driven by higher market volatility in Q4, particularly around the U.S. election period and year-end rebalancing activity .

How Did Segments Perform?

Market Making remains the profit engine, generating 80% of Adjusted Net Trading Income:

This was the highest quarterly Adjusted Net Trading Income since Q1 2021 . Management emphasized that the strength came from multiple sources beyond retail market making:

"We are more than just the retail flow business that shows up in the 605 reports... the non-customer businesses did very well."

Virtu Execution Services (VES) reached $2M/day for Q4, marking the seventh consecutive quarter of increased net trading income . Management highlighted accelerating client engagement, new client onboarding, and existing clients doing more business across all products and geographies .

How Did the Stock React?

VIRT shares rose 1.4% in after-hours trading to $38.03, following a close of $37.49. The muted reaction likely reflects the stock's strong run-up in January (+15% MTD ahead of earnings).

Earnings Reaction History:

The pattern shows consistent beats followed by modest stock moves, suggesting the market has been pricing in strong results.

What About Capital Deployment?

Capital deployment was a major theme on the call. Virtu increased invested capital by $625M in 2025, with $448M added in the second half . The incremental capital generated a 100% return in Q4 .

Management expects 50-70% returns on incremental capital through the cycle, noting the 100% Q4 return was exceptionally strong .

Capital Returns:

- Dividend: $0.24/share quarterly maintained

- Buybacks: $135.3M of shares repurchased in FY 2025

At current prices, the $0.96 annual dividend yields approximately 2.6%.

Full Year 2025 Performance

FY 2025 was a banner year for Virtu:

The margin expansion reflects operating leverage as trading income scaled faster than fixed costs .

Q&A Highlights: What Analysts Asked

On Prediction Markets (Polymarket): Management confirmed they are "in the process of connecting, understanding how the venues work, establishing relationships" for prediction markets . However, they are proceeding cautiously given regulatory uncertainty. CEO Aaron Simons noted that complexity in market structure is a competitive advantage: "Anytime there's sort of multiple products with the same underlayer, that's a relative tailwind for us" .

On ETF Expansion: With ETF fund launches expected to hit a record in 2026 and an SEC proposal for ETF share classes, analysts asked about Virtu's exposure. Management noted they are "a very large player across all of our businesses in ETFs" and serve as an Authorized Participant in a large number of funds .

On Strategic Priorities for 2026: Management declined to highlight specific initiatives, instead emphasizing a broad growth strategy:

"We're not focusing on a very small number of growth initiatives. We're really just focusing on growing everywhere in the firm and responding dynamically to the market opportunities that are available."

On Non-Equity Performance: The 605 retail flow business—while strong—was only part of the story. Management emphasized their "broad market-making business that includes global equities, which did very well" alongside fixed income, currencies, commodities, options, and crypto .

Key Risks and Considerations

While Q4 was exceptional, investors should note:

- Volatility Dependence: Virtu's results are highly correlated with market volatility. A return to the low-volatility environment of 2023 would pressure earnings

- Regulatory Risk: The company faces ongoing scrutiny around market structure, payment for order flow, and off-exchange trading

- Technology Risk: Maintaining competitive technology infrastructure requires continuous investment

- Valuation: At ~6.5x FY25 Adjusted EBITDA, VIRT trades at a discount to historical averages but premium to normalized earnings power

Forward Outlook

Analysts expect moderation in 2026, with consensus estimates implying:

*Values retrieved from S&P Global

The step-down reflects expectations for lower volatility, though Virtu's track record of exceeding estimates (10 of last 12 quarters) suggests potential for upside.

Related: VIRT Company Profile | Q3 2025 Earnings Call Transcript