Earnings summaries and quarterly performance for Virtu Financial.

Executive leadership at Virtu Financial.

Board of directors at Virtu Financial.

Christopher Quick

Director

David Urban

Director

Joanne Minieri

Director

John Nixon

Director

Joseph Grano Jr.

Director

Michael Viola

Chairman of the Board

Vincent Viola

Director

Virginia Gambale

Director

William Cruger Jr.

Director

Research analysts who have asked questions during Virtu Financial earnings calls.

Kenneth Worthington

JPMorgan Chase & Co.

5 questions for VIRT

Christopher Allen

Citigroup

4 questions for VIRT

Craig Siegenthaler

Bank of America

4 questions for VIRT

Patrick Moley

Piper Sandler & Co.

4 questions for VIRT

Alexander Blostein

Goldman Sachs

3 questions for VIRT

Daniel Fannon

Jefferies Financial Group Inc.

3 questions for VIRT

Eli Abboud

Bank of America

3 questions for VIRT

Michael Cyprys

Morgan Stanley

3 questions for VIRT

Dan Fannon

Jefferies & Company Inc.

2 questions for VIRT

Ken Worthington

JPMorgan

2 questions for VIRT

Ritwik Roy

Jefferies

2 questions for VIRT

Will Cops

Piper Sandler

2 questions for VIRT

Aditya

Goldman Sachs

1 question for VIRT

Chris Allen

Citi

1 question for VIRT

Recent press releases and 8-K filings for VIRT.

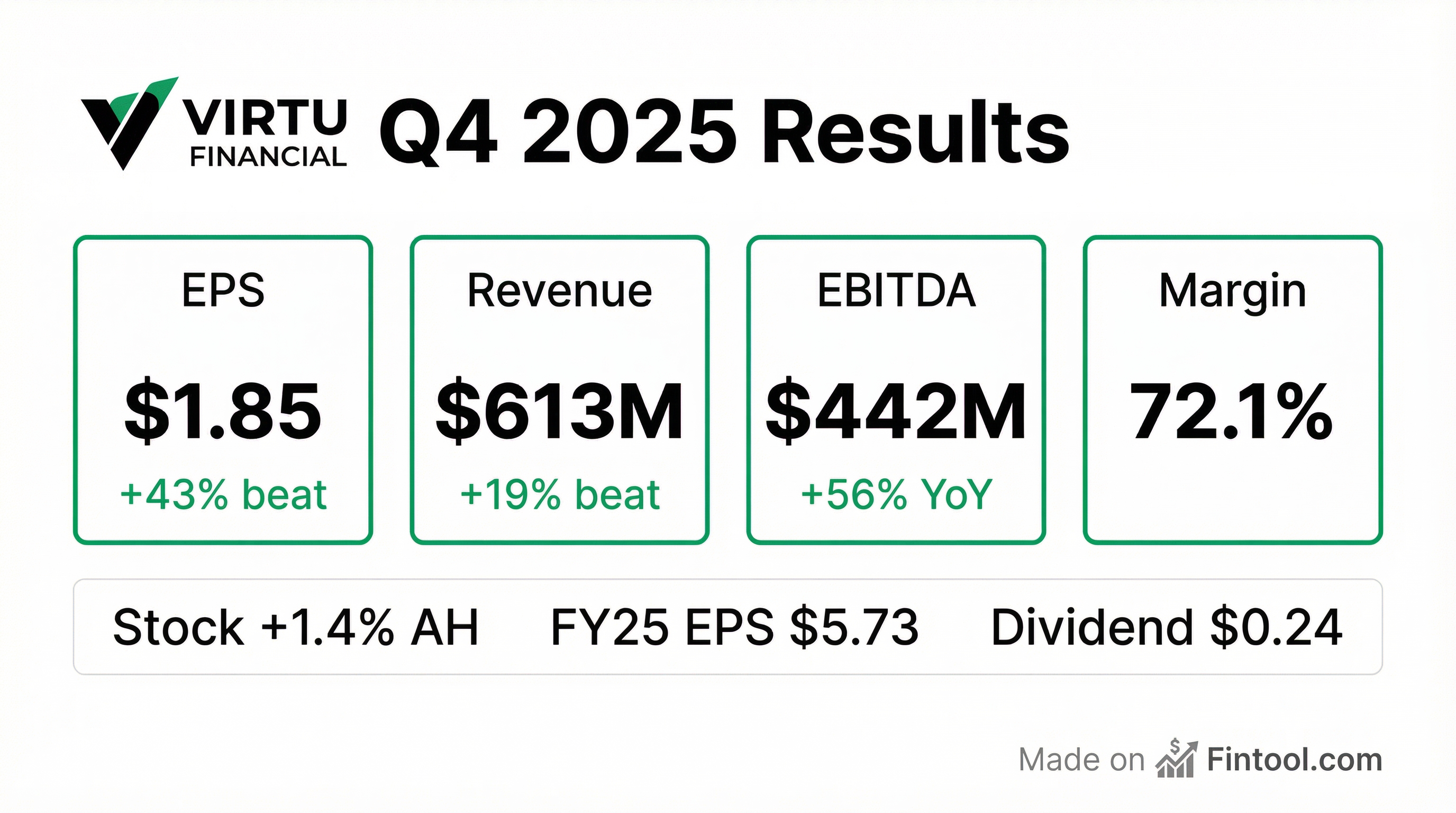

- Virtu Financial reported a Normalized Adjusted EPS of $1.85 for Q4 2025 and $5.73 for the full year 2025.

- Adjusted Net Trading Income reached $613 million in Q4 2025 and $2,145 million for FY 2025.

- Adjusted EBITDA for Q4 2025 was $442 million, with an Adjusted EBITDA Margin of 72%.

- The company's invested capital increased by $625 million in FY 2025, reaching $2,464 million by December 31, 2025.

- The Debt to LTM Adjusted EBITDA ratio stood at 1.5x at the end of Q4 2025.

- Virtu Financial reported adjusted net trading income of $613 million for Q4 2025, or $9.7 million per day, which was the highest quarterly total since Q1 2021. The company also achieved adjusted EPS of $1.85 for the quarter.

- For the full year 2025, Virtu generated $2.1 billion in adjusted net trading income, $1.4 billion in adjusted EBITDA with a 65% margin, and $5.73 in adjusted EPS. These figures represent highs since 2021 for adjusted EBITDA, margin, and EPS.

- Virtu Execution Services (VES) recorded $2 million per day in adjusted net trading income for Q4 2025, marking its seventh consecutive quarter of growth and a high watermark since early 2022.

- The company increased its invested capital by $625 million in 2025, with $448 million added in the second half, and generated an average return of 100% over the year. Virtu Financial will continue to expand its capital base and maintain a quarterly dividend of $0.24 per share.

- Virtu Financial reported adjusted net trading income of $613 million for Q4 2025, or $9.7 million per day, marking its highest quarterly total since Q1 2021. For the full year 2025, adjusted net trading income was $2.1 billion, or $8.6 million per day.

- The company achieved $442 million in Adjusted EBITDA for Q4 2025, representing a 72% margin, and Adjusted EPS of $1.85. Full-year 2025 Adjusted EBITDA was $1.4 billion with a 65% margin, and Adjusted EPS was $5.73.

- Market Making reported adjusted net trading income of $7.8 million per day for Q4 2025, while Virtu Execution Services (VES) reached $2 million per day for the quarter, its seventh consecutive quarter of increased NT and a high watermark since early 2022.

- Virtu increased its invested capital by $625 million in 2025, with $448 million added in the second half, generating an average return of 100% over the year. The company plans to continue expanding its capital base and maintaining its quarterly dividend of $0.24 per share.

- Virtu Financial reported strong Q4 2025 financial results, with Adjusted Net Trading Income (NT) of $613 million and Adjusted EPS of $1.85, marking the highest quarterly NT total since Q1 2021.

- For the full year 2025, the company achieved $2.1 billion in Adjusted NT, $1.4 billion in Adjusted EBITDA, and $5.73 in Adjusted EPS, with all these figures representing highs since 2021.

- Virtu Execution Services (VES) recorded $2 million per day in NT for Q4 2025, its seventh consecutive quarter of increased NT and a high watermark since early 2022, driven by investments in technology, client acquisition, and product expansion.

- The company increased its invested capital by $625 million in 2025, with $448 million in the second half, yielding an average return of 100% over the year, and plans to continue expanding its capital base.

- Management reiterated a broad growth strategy focused on investing in infrastructure, acquiring talent, and dynamically deploying an expanded capital base to seize market opportunities, aiming for a long-term goal of $10 million a day in NT through the cycle.

- Virtu Financial reported total revenues of $969.9 million for Q4 2025, a 16.3% increase compared to the same period in 2024, with net income of $280.6 million and basic and diluted earnings per share of $1.54.

- For the full year 2025, total revenues increased 26.2% to $3,632.1 million, and net income reached $912.3 million, resulting in basic and diluted earnings per share of $5.14 and $5.13, respectively.

- Adjusted EBITDA increased 55.9% to $442.0 million for Q4 2025 and 52.3% to $1,399.2 million for the full year 2025.

- The Board of Directors declared a quarterly cash dividend of $0.24 per share, payable on March 16, 2026, and the company executed share buybacks of $135.3 million, or 3.5 million shares, during 2025.

- Naked Energy, a UK solar thermal energy company, is expanding its operations into Spain and Portugal with a new office in Madrid.

- This expansion follows a £17 million funding round financed by Barclays and E.ON Energy Infrastructure Solutions.

- The company's Virtu solar thermal collectors are highlighted for being up to ten times more efficient than traditional PV panels.

- Luis Guajardo has been appointed as the Business Development Director for Iberia to lead this expansion.

- Virtu Financial reported Normalized Adjusted EPS of $1.05 and Adjusted Net Trading Income (NTI) per day of $7.4 million for Q3 2025.

- The company achieved Adjusted EBITDA of $268 million with an Adjusted EBITDA Margin of 57% in Q3 2025.

- Virtu is shifting its capital management strategy to accelerate growth by retaining capital in market making and expanding its footprint, and accelerating multi-asset class initiatives for VES. This marks a change from previous years which included significant share buybacks.

- Previously identified growth businesses achieved a record $1.4 million of Adjusted NTI per day in Q3 2025, as the company pursues opportunities in areas like core equity, options, ETF Block, rates, and crypto.

- As of Q3 2025, Virtu's Debt to LTM Adjusted EBITDA stood at 1.7x.

- Virtu Financial reported normalized adjusted EPS of $1.05 and adjusted net trading income (ANTI) of $467 million, or $7.4 million per day, for Q3 2025. Market making ANTI was $344 million (or $5.4 million per day), and Virtu Execution Services (VES) ANTI reached $123 million (or $1.9 million per day), marking its best quarter since early 2021.

- With Aaron Simon taking over as CEO on August 1 , the company is shifting its strategy to an overall focus on growth, aiming to trend towards the higher end of its $6 million to $10 million per day ANTI range as a base case.

- To support this growth, Virtu plans to dial back share repurchases to build its capital base. The firm has already raised and deployed over $500 million of new trading capital in 2025 through retained earnings and debt financing. The long-term plan involves potentially doubling the capital base to double the P&L, with investments targeting areas such as crypto, options, and ETF block trading.

- Virtu Financial reported normalized adjusted EPS of $1.05 and Adjusted Net Trading Income (ANTI) of $467 million, or $7.4 million per day for Q3 2025. Market Making ANTI was $344 million or $5.4 million per day, while Virtu Execution Services (VES) reported $123 million or $1.9 million per day, marking its best quarter since early 2021.

- Aaron Simon took over as CEO on August 1st and announced a strategic pivot towards growing trading results by investing in infrastructure, talent acquisition, and expanding the capital base. The company's goal is to trend towards the higher end of the $6 million-$10 million per day adjusted net trading income range as a base case.

- To support this growth, the company will dial back share repurchases to build capital. In 2025, over $500 million of new trading capital has already been raised through retained earnings and debt financing and immediately deployed. The long-term plan is to potentially double the capital base to significantly grow the P&L.

- Growth opportunities are seen across the firm, particularly in crypto options, ETF block trading, and rates, with strong performance noted in global equities, crypto, currencies, and commodities. The company is also aggressively hiring developers, quants, and traders to support these initiatives.

- Virtu Financial, Inc. reported total revenues of $824.8 million for the third quarter ended September 30, 2025, an increase of 16.7% compared to the same period in 2024.

- Net income for the quarter was $149.1 million, with basic and diluted earnings per share of $0.86.

- Normalized Adjusted Net Income reached $166.5 million, resulting in a Normalized Adjusted EPS of $1.05 for the quarter.

- The Board of Directors declared a quarterly cash dividend of $0.24 per share, payable on December 15, 2025, to shareholders of record as of December 1, 2025.

- The company executed share buybacks totaling $20.9 million, or 0.5 million shares, during the third quarter of 2025.

Quarterly earnings call transcripts for Virtu Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more