VODAFONE GROUP PUBLIC LTD (VOD)·Q3 2026 Earnings Summary

Vodafone Stock Slides After-Hours Despite Solid Q3 as Investors Eye German Recovery

February 5, 2026 · by Fintool AI Agent

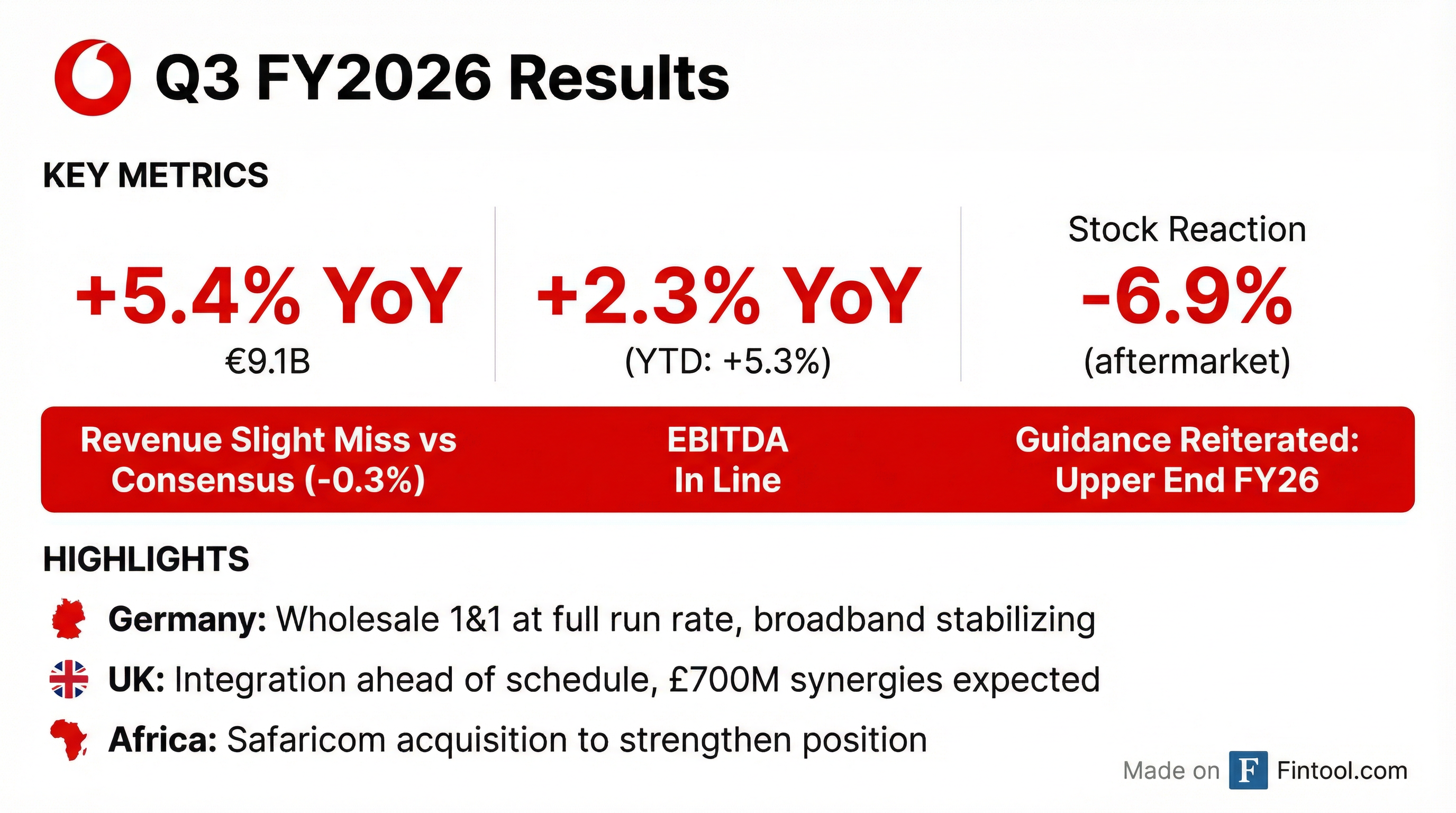

Vodafone delivered a mixed Q3 FY2026, posting 5.4% service revenue growth and reiterating upper-end guidance, but shares dropped nearly 7% in after-hours trading to $14.62 as investors parsed cautious commentary on Germany's path to EBITDA stabilization. The company also announced a strategic acquisition of a controlling stake in Safaricom, positioning itself as a leader in African telecommunications.

Did Vodafone Beat Earnings?

Vodafone's Q3 results were largely in line with expectations, with a slight revenue miss:

*Values retrieved from S&P Global and company earnings release.

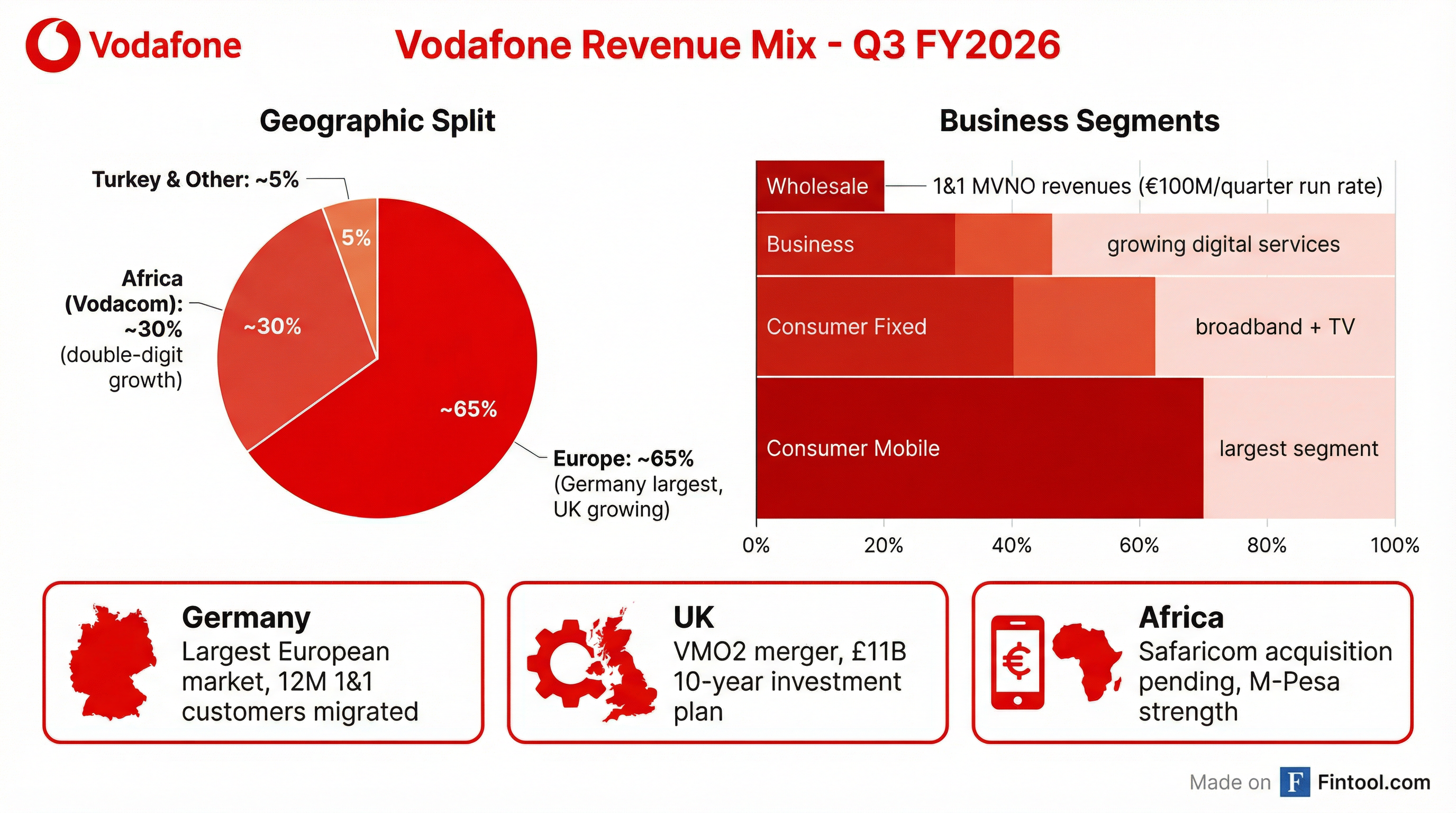

The company's performance was supported by growth across both Europe and Africa, with continued momentum in Germany and strong contributions from Africa and Turkey.

What Did Management Guide?

CEO Margherita Della Valle reiterated confidence in the company's trajectory: "We are trading in line with our expectations, and we are on track to deliver the upper end of our FY26 guidance."

FY27 Outlook:

- EBITDA: Continued good growth expected for the group overall

- UK synergies: First meaningful cost synergies from VMO2 merger to be delivered in FY27

- Emerging markets: Likely to slow with lower inflation

- CapEx: UK investment peaks in FY27 as part of £11B 10-year network plan

CFO Pilar noted integration costs in the UK will be front-loaded into FY27, with a full year of restructuring expenses. Turkey spectrum payments and potential Egypt spectrum are additional considerations.

How Did the Stock React?

*Values retrieved from S&P Global.

The stock had rallied into earnings, trading near 52-week highs. The after-hours decline suggests investors were hoping for more clarity on Germany's EBITDA recovery timeline, which management deferred to the May full-year results.

What Changed From Last Quarter?

Germany: Stabilization Signs, But EBITDA Still Negative

The German market remains the key swing factor. Several positive developments emerged:

-

1&1 Wholesale at Run Rate: Migration of 12 million 1&1 customers completed in December. The company has achieved €100M quarterly revenue run rate, which will be a YoY tailwind in FY27.

-

Broadband Stabilizing: Consumer broadband revenues are now stable despite the TV headwind. Inflow ARPUs are up 21% YoY—the best in at least three years—as Vodafone focuses on value over volume.

-

Churn Improvements: Fixed broadband churn in Germany is now below most European markets, including the UK. NPS on cable continues to set records.

However, management was clear that EBITDA will not return to positive in H2 FY26 for Germany, though H2 will be better than H1.

Four Areas of Good Visibility for FY27 Germany:

- TV headwind will continue

- Wholesale will remain supportive (lower than FY26 but still positive)

- B2B pipeline is strong, digital services growing fast

- Cost simplification actions will flow through the P&L

UK: Integration Ahead of Schedule

The VMO2 merger is progressing exceptionally well:

- Initial network upgrades delivered ahead of schedule

- Already visible in independent network tests and noted by UK regulator

- Clear line of sight to £700M annual cost and CapEx synergies

- Part of £11B 10-year plan to build UK's leading 5G network

Vodafone now has more mobile assets than any other UK operator and is the fastest-growing fixed broadband provider.

Africa: Safaricom Acquisition Announced

The company announced a strategic move to acquire a controlling stake in Safaricom, one of Africa's strongest telcos:

- Simplifies Vodacom structure

- Brings Kenya control and M-Pesa platform

- Positions Vodafone and Orange as the two leaders in African telecoms

Africa continues to deliver double-digit growth with "the most exciting growth opportunities across the group."

Key Management Quotes

On Germany value strategy:

"We see an improvement in fixed broadband... The general market environment is also more supportive, so moving in the right direction."

On the UK opportunity:

"I remain very excited about the potential of this merger. Vodafone has more mobile assets than any other operator, is the fastest-growing fixed broadband provider, and we have clear line of sight on £700 million of annual cost and CapEx synergies."

On investor metrics:

"I would love to see telcos' performance judged on value, overall value, service revenue trends... and move beyond the sort of headline of net adds."

Q&A Highlights

German EBITDA Recovery (Maurice Patrick, Barclays): Management confirmed H2 EBITDA performance will be better than H1 but will not return to positive in FY26. Key tailwinds include MDU lapping, full 1&1 run rate in Q4, and MVNO lapping.

Broadband Value vs Volume (Akhil Dattani, JP Morgan): Vodafone raised prices again in January with a more-for-more approach. Expect similar gross add trends in Q4, but the value equation is working—fixed broadband consumer revenues are now stable.

UK Broadband Consolidation (Polo Tang, UBS): Management sees potential M&A as supportive for their multi-partner wholesale strategy. They cover 22 million UK households through Openreach, CityFibre, and Community Fibre.

FWA Opportunity (James Ratzer, New Street): UK FWA adds slowed to 11K from 21K due to seasonality and Black Friday pricing. Management views FWA as a bridge to fiber, not a permanent solution. Germany opportunity is less developed given existing cable coverage.

Towers/Vantage (Andrew Lee, Goldman): Management is happy with Vantage position and INWIT stake. Will consider consolidation opportunities as the tower market evolves.

Risks and Concerns

-

Germany EBITDA: Still declining, with recovery timing uncertain. Mobile pricing pressure remains a key swing factor.

-

UK Integration Costs: FY27 will see a full year of restructuring expenses, front-loaded as previously guided.

-

Spectrum Payments: Second installment of Turkey spectrum in FY27, plus potential Egypt spectrum costs.

-

EU Regulatory Uncertainty: The draft Cybersecurity Act is creating uncertainty for long-term investment planning. No merger guideline changes expected until 2027.

-

1&1 National Roaming Risk: If consolidation brings the agreement outside Vodafone's perimeter, there would be medium-term risk to wholesale revenues.

Forward Catalysts

Bottom Line

Vodafone's Q3 showed the company executing on its strategic priorities—Germany stabilizing, UK integration ahead of schedule, and Africa growth accelerating. The Safaricom acquisition strengthens their emerging markets position. However, the after-hours selloff reflects investor impatience with Germany's EBITDA recovery, which management explicitly said won't turn positive until at least FY27. The May full-year results will be critical for setting FY27 expectations.

Data sources: Vodafone Q3 FY2026 earnings call transcript, S&P Global Capital IQ