Earnings summaries and quarterly performance for VODAFONE GROUP PUBLIC LTD.

Research analysts who have asked questions during VODAFONE GROUP PUBLIC LTD earnings calls.

Akhil Dattani

JPMorgan Chase & Co.

2 questions for VOD

Andrew Lee

Goldman Sachs

2 questions for VOD

David Wright

Bank of America Merrill Lynch

2 questions for VOD

James Ratzer

New Street Research

2 questions for VOD

Ottavio Adorisio

Bernstein

2 questions for VOD

Carl Murdock-Smith

Citigroup

1 question for VOD

Georgios Ierodiaconou

Citigroup Inc.

1 question for VOD

Javier Borrachero Kieselack

Kepler Cheuvreux

1 question for VOD

Joshua Mills

BNP Paribas Exane

1 question for VOD

Maurice Patrick

Barclays Capital

1 question for VOD

Paul Sidney

Berenberg

1 question for VOD

Polo Tang

UBS

1 question for VOD

Robert Grindle

Deutsche Bank

1 question for VOD

Recent press releases and 8-K filings for VOD.

- Vodafone Group Plc announced on February 06, 2026, the purchase of 27,056,765 ordinary shares on February 05, 2026.

- The shares were acquired from Goldman Sachs International at a volume weighted average price of 108.53 pence per share.

- Following this transaction, Vodafone now holds 1,501,537,119 ordinary shares in treasury.

- The total number of ordinary shares in issue, excluding treasury shares, is 23,376,423,638.

- Vodafone Group Plc reported strong Q3 FY26 performance, with total revenue increasing by 6.5% to €10.5 billion and service revenue growing by 7.3% to €8.5 billion.

- The company is on track to deliver at the upper end of its FY26 financial guidance for Adjusted EBITDAaL (€11.3-11.6 billion) and Adjusted free cash flow (€2.4-2.6 billion).

- Organic service revenue grew by 5.4% , notably driven by 13.5% growth in Africa and 0.7% growth in Germany.

- Vodafone has completed €3.5 billion in share buybacks since May 2024, with a new €500 million tranche commencing, and expects to grow the FY26 dividend per share by 2.5%.

- Strategic initiatives include the ongoing integration of Vodafone UK and Three UK , the acquisition of Telekom Romania Mobile Communications S.A. assets , and Vodacom Group's agreement to acquire 20% of Safaricom Plc.

- On February 05, 2026, Vodafone Group Plc announced it purchased 10,606,031 ordinary shares from Merrill Lynch International on February 04, 2026.

- The shares were acquired at a volume weighted average price of 114.19 pence per share, with prices ranging from 111.70 pence to 115.15 pence.

- These purchased shares will be held in treasury, bringing the total treasury shares to 1,474,480,354 and ordinary shares in issue (excluding treasury shares) to 23,403,480,403.

- This transaction marks the completion of the share buyback program initiated on November 11, 2025.

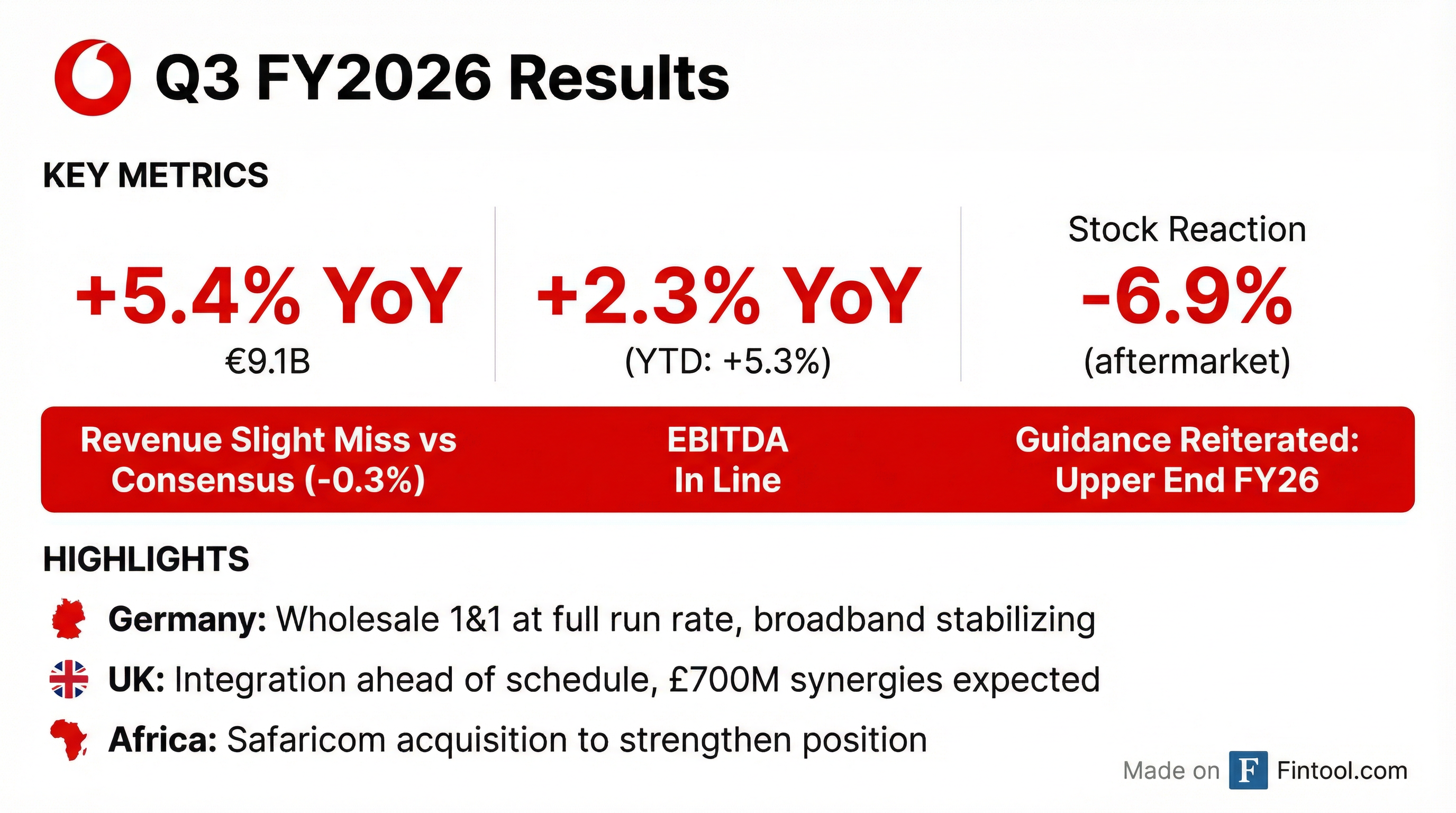

- Vodafone Group reported Q3 2026 service revenue growth of 5.4% and Group EBITDA growth of 2.3% for the quarter, with year-to-date EBITDA growth at 5.3%, and is on track to deliver the upper end of its FY26 guidance.

- In Germany, consumer broadband revenues have stabilized, with new customer ARPUs 21% higher year-on-year due to price actions, and the 1&1 wholesale migration is now at a full run rate of EUR 0.1 billion in quarterly revenue.

- The company is acquiring a controlling stake in Safaricom to strengthen its position in Africa, capitalizing on structural growth opportunities and Vodacom's strong double-digit performance.

- For fiscal year 2027, Vodafone anticipates continued good EBITDA growth for the group, with the UK merger expected to deliver its first meaningful cost synergies and CapEx increasing as it reaches the peak of its investment program.

- Vodafone reported Group service revenue growth of 5.4% and Group EBITDA growth of 2.3% in Q3 2026, and is on track to deliver the upper end of its FY26 guidance.

- In Germany, fixed broadband churn is below the majority of European markets, with inflow ARPU up 21% year-over-year, and the EUR 0.1 billion quarterly revenue run rate from the 1&1 transfer is now achieved. Germany's EBITDA performance is expected to be better in H2 2026 than H1.

- The company is acquiring a controlling stake in Safaricom to strengthen its position in Africa and expects continued good growth for overall group EBITDA into fiscal 2027.

- Vodafone remains confident in the multi-year outlook for adjusted free cash flow growth for 2027, despite an anticipated step up in UK CapEx in fiscal 2027, which marks the peak of its GBP 11 billion investment program.

- Vodafone reported strong Q3 2026 results, with Group service revenue growing by 5.4% and Group EBITDA by 2.3%, and is on track to deliver the upper end of its FY 2026 guidance.

- In Germany, consumer broadband revenues have stabilized, supported by new customer ARPUs being 21% higher year-on-year, and the EUR 0.1 billion quarterly revenue run rate from the 1&1 wholesale agreement has been achieved.

- The company is acquiring a controlling stake in Safaricom to strengthen its position in Africa, where Vodacom is already delivering double-digit growth.

- For fiscal year 2027, Vodafone anticipates continued good EBITDA growth for the group, with the UK investment program peaking and the first meaningful cost synergies expected.

- Vodafone Group has reached an agreement with Vodafone Idea Limited ("Vi") to settle the Contingent Liability Adjustment Mechanism (CLAM) and outstanding Vodafone Group service charges.

- The settlement involves Vodafone making a €219 million cash payment and setting aside 3,280 million of its shares in Vi (equivalent to a 3.03% shareholding) for Vi's benefit.

- This agreement results in no net cash payment by Vodafone, as Vi will settle €219 million of outstanding Vodafone Group service charges.

- Both the outstanding service charges and Vodafone's investment in Vi shares are carried at nil value on Vodafone's balance sheet.

- This agreement closes all material open issues between Vodafone and Vi.

- Vodafone's African subsidiary, Vodacom, will acquire an additional 20% effective stake in Safaricom Plc, increasing its total ownership to 55% and leading to full consolidation by both Vodacom and Vodafone.

- The acquisition involves Vodacom purchasing 15% from the Government of Kenya for a cash consideration of €1.36 billion and 5% from Vodafone for €0.45 billion.

- This strategic move aims to gain controlling ownership of Safaricom, Kenya's largest telecoms company with a market capitalization of €7.7 billion, and its successful M-Pesa fintech business.

- Safaricom demonstrated strong performance in the six months to September 30, 2025, with service revenue in Kenya up 9.3% and M-Pesa revenue growing 14%. The acquisition is anticipated to close in the first quarter of the 2026 calendar year, subject to regulatory approvals.

- Vodafone Group Plc reported total revenue of €19.6 billion for H1 FY26, an increase of 7.3%, and service revenue of €16.3 billion, up 8.1%. However, operating profit decreased by 9.2% to €2.2 billion, and basic earnings per share from continuing operations was 3.38 eurocents, compared to 3.92 eurocents in H1 FY25.

- The company completed the merger of Vodafone UK and Three UK on May 31, 2025, forming VodafoneThree, and acquired Telekom Romania Mobile Communications S.A. on October 1, 2025. Additionally, Vodafone T\u00fcrkiye acquired 100 MHz of spectrum for US$627 million (€539 million) on October 16, 2025.

- Vodafone announced an interim dividend per share of 2.25 eurocents and committed to a progressive dividend policy, expecting to grow the full year dividend by 2.5% for FY26.

- The Group also commenced a share buyback programme of up to €500 million on November 11, 2025.

- Vodafone Group Plc has announced the commencement of a share repurchase program for its ordinary shares.

- The program has a maximum consideration of €500 million.

- The share buyback program begins on November 11, 2025, and is scheduled to conclude no later than February 4, 2026.

- The primary objective of the program is to reduce share capital, with repurchased shares to be held as treasury shares for cancellation or allocation to employee share awards.

Quarterly earnings call transcripts for VODAFONE GROUP PUBLIC LTD.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more