WESTERN DIGITAL (WDC)·Q2 2026 Earnings Summary

Western Digital Beats on EPS and Revenue as Data Center AI Demand Surges

January 29, 2026 · by Fintool AI Agent

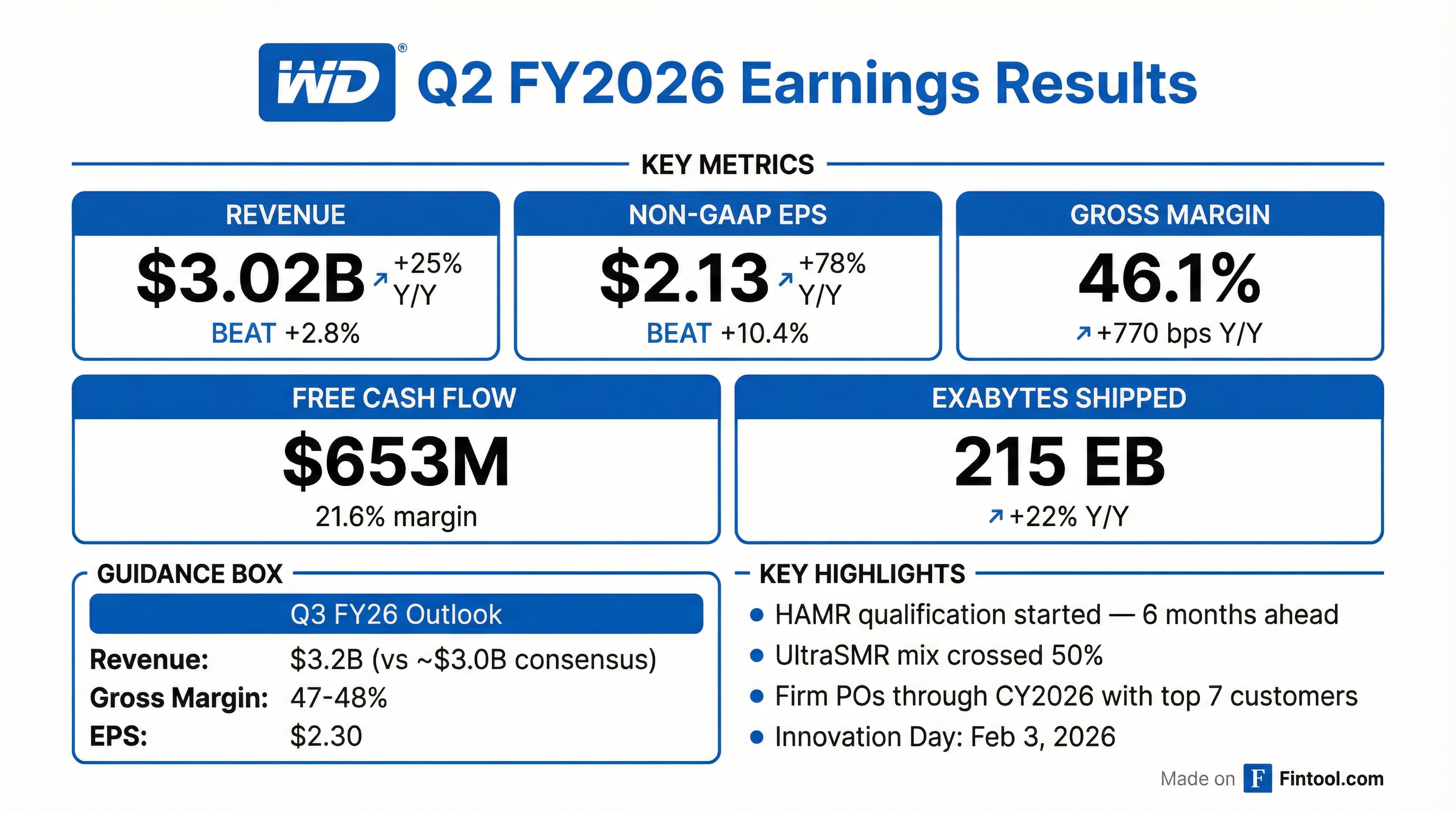

Western Digital delivered a strong Q2 FY2026, beating both revenue and EPS estimates as hyperscaler demand for high-capacity enterprise HDDs continues to accelerate. Revenue of $3.02B topped consensus by 2.8%, while non-GAAP EPS of $2.13 beat by 10.4%. The company guided Q3 revenue to $3.2B—approximately 40% above year-ago levels—signaling sustained momentum in the AI-driven data storage market.

Did Western Digital Beat Earnings?

Yes—comfortably on both lines.

Exabyte shipments reached 215 EB, up 22% year-over-year, including 103 EB from the latest-generation ePMR drives with capacities up to 32 TB. The company shipped over 3.5 million units of its flagship ePMR products—a testament to hyperscaler confidence in drive quality and scalability.

This marks Western Digital's fourth consecutive EPS beat. The company has delivered an average EPS surprise of +11% over the past four quarters.

What Did Management Guide?

Q3 FY2026 guidance came in well above street expectations:

CFO Kris Sennesael highlighted that guidance "underscored continued favorable trends in our business, alongside our disciplined approach to free cash flow, capital returns, and long-term value creation for shareholders."

The Q3 revenue guidance of $3.2B at midpoint implies ~40% year-over-year growth, a significant acceleration from Q2's 25% Y/Y growth. This reflects ramping hyperscaler orders and continued share gains in enterprise HDDs.

Management expects to ship close to 4 million drives in Q3, up from 3.5 million in Q2.

What Changed From Last Quarter?

The margin expansion story is accelerating:

Key developments this quarter:

-

Gross margin at multi-year highs — 46.1% non-GAAP gross margin (+770 bps Y/Y) reflects favorable product mix, disciplined pricing, and manufacturing cost controls

-

UltraSMR crossed 50% mix — More than half of Nearline exabytes now ship on UltraSMR, driving margin expansion

-

HAMR qualification started — Pulled forward by 6 months; first hyperscaler qualification began this month, second imminent

-

Capital returns intensified — Returned >100% of FCF through $615M in buybacks and $48M in dividends

-

Acquired laser IP — Strategic acquisition of IP and talent for internal laser capabilities to support HAMR development

How Did the Stock React?

Muted reaction despite the beat—the stock had already run up heading into the print.

The stock rallied ~11% in the two days leading up to the print, suggesting the beat was partially priced in. Despite the strong guidance, shares gave back gains on earnings day as investors took profits. Year-to-date, WDC remains up significantly, with shares trading near 52-week highs ($285.42).

Q&A Highlights: What Analysts Asked

On Gross Margin Sustainability (Aaron Rakers, Wells Fargo):

CFO Kris Sennesael confirmed the incremental gross margin is running at approximately 75% on a year-over-year basis. "I'm very comfortable with an incremental gross margin higher than 50%, and definitely 75% is higher than 50%."

Key margin drivers:

- Pricing: Stable environment with ASP per terabyte up 2-3% last quarter

- Cost: Cost per terabyte declining ~10% year-over-year

- Mix: Continued upshift to higher-capacity drives

On Long-Term Agreements (Eric Woodring, Morgan Stanley):

CEO Irving Tan revealed the company is "pretty much sold out for calendar 2026" with firm purchase orders from top 7 customers. The LTA pricing reflects "a structural shift in the value that we deliver to them, especially in the impact that we have to their total cost of ownership as the business moves more and more towards inference."

On UltraSMR Mix (Ashley Greninger, Bank of America):

UltraSMR mix crossed 50% of the total Nearline exabyte portfolio—a milestone for the software-based technology. Top 3 customers are fully on board, with 2-3 more in the adoption process.

"UltraSMR gives a 20% capacity uplift over CMR and a 10% capacity uplift over the industry-standard SMR. But equally important... UltraSMR is a software-based solution, so it's very accretive for us from a margin standpoint."

On HAMR Progress (Carl Ackerman, BNP Paribas; Vijay Rakesh, Mizuho):

Western Digital pulled forward HAMR qualification by half a year. Key updates:

- Qualification started this month with one hyperscaler

- Second hyperscaler qualification "imminent"

- HAMR ramp expected to start at the beginning of CY2027

- HAMR will be neutral to accretive to gross margins at scale

- CapEx expected to stay within 4-6% of revenue even with HAMR ramp

On SanDisk Stake (Eric Woodring):

The company still holds 7.5 million SanDisk shares and intends to monetize them before February 21st (one-year anniversary of the spinoff), likely through a debt-for-equity swap to further reduce debt.

On AI Inference Tailwinds (Carl Ackerman):

Management was bullish on agentic AI driving storage demand: "As the AI value changes from model training to inference, more data is going to get created... and in order to enable the inference delivery, more data needs to get stored."

What Did Management Say About AI?

CEO Irving Tan painted a bullish picture of AI-driven demand across the entire data lifecycle:

"The growth and impact of AI continues to accelerate across numerous industries. As generative AI models become the norm and agentic AI scales to drive business productivity, it is clear that AI is becoming a true strategic enabler of business transformation."

On the data storage implications:

"As more data is generated and the value of data increases, the demand to store it is expanding at a rapid rate. As AI capabilities expand, cloud continues to grow as well, and both are driving the search and demand for higher density storage solutions."

The company's positioning in high-capacity enterprise HDDs (20TB+) is benefiting from:

- Hyperscaler capacity buildouts for AI training data storage

- Cloud infrastructure expansion requiring dense, cost-effective storage

- Growing data volumes from AI inference workloads

Cloud represented 89% of total revenue at $2.7B, up 28% year-over-year.

Margin Trends: The Real Story

Western Digital's margin trajectory has been remarkable post-Sandisk spinoff:

This ~1,600 bps gross margin expansion over 8 quarters reflects:

- Mix shift to higher-margin enterprise drives (UltraSMR now >50% of Nearline EB)

- Pricing discipline in a tight supply environment (ASP/TB up 2-3% Y/Y)

- Cost efficiency (cost/TB down ~10% Y/Y)

- Operating leverage as revenue scales (OpEx declining as % of revenue)

CFO Kris Sennesael on sustainability: "When you look at it last quarter, the cost per terabyte was coming down on or about 10% on a year-over-year basis. So when you put this all together, we continue to drive further gross margin expansion. We believe in the next couple of quarters and beyond, we will continue to be able to do that."

Capital Allocation

Western Digital is returning capital aggressively:

The company declared a quarterly dividend of $0.125 per share, payable March 18, 2026, to shareholders of record as of March 5, 2026.

Since launching the $2 billion share repurchase authorization in May 2025, the company has already deployed $1.3 billion repurchasing approximately 13 million shares. Management indicated "there is no hesitation" to continue.

Balance Sheet Snapshot

Free cash flow generation remains strong at $653 million (21.6% FCF margin), funding aggressive capital returns.

Forward Catalysts

February 3, 2026 — Innovation Day (New York):

Management will share:

- Updated roadmaps for HAMR and ePMR products

- Details on core innovations for drive performance, energy efficiency, and throughput

- Financial model update

- More detail on the recently acquired laser IP for HAMR

CY2027 — HAMR Production Ramp:

With HAMR qualification pulled forward and started with hyperscalers, production ramp is expected to begin at the start of CY2027. This will deliver higher capacity drives at neutral-to-accretive margins.

February 21, 2026 — SanDisk Stake Monetization:

Expect debt-for-equity swap before one-year spinoff anniversary to reduce debt further.

Strategic Investment in Quantum:

Western Digital announced a strategic investment in Qolab, combining WDC's material science and precision manufacturing expertise with Qolab's quantum hardware design. The aim is to advance nanofabrication processes that improve qubit performance and scalability.

Key Risks to Monitor

- Customer concentration — Top 7 customers represent the vast majority of Nearline demand; LTAs mitigate but don't eliminate dependency

- HAMR execution — Qualification underway, but scaling to production volumes in CY2027 carries technology and yield risk

- Demand volatility — AI spending cycles could moderate; management noted hyperscalers are "masters of managing economics" across storage tiers

- Competitive dynamics — Seagate also accelerating HAMR; pricing discipline could erode if supply tightness eases

The Bottom Line

Western Digital delivered a clean beat-and-raise quarter with several notable developments:

The positives:

- EPS beat by 10%, guidance raised materially above street

- Gross margins expanding at 75% incrementals with runway to continue

- UltraSMR now >50% of mix—a margin-accretive milestone

- HAMR qualification pulled forward 6 months; production on track for early CY2027

- Sold out through CY2026 with multi-year LTAs extending visibility

The questions:

- Can 75% incremental margins persist as mix shifts and competition intensifies?

- How will HAMR ramp affect near-term margins and CapEx?

- AI storage demand is strong today, but how cyclical will it prove?

Innovation Day on February 3rd is the next major catalyst—management will unveil updated product roadmaps, margin frameworks, and details on the acquired laser IP. Investors seeking visibility into CY2027 and beyond should tune in.

Segment Performance

The Cloud segment—driven by Nearline drives for hyperscalers—continues to dominate. Client showed surprising strength (+26% Y/Y), while Consumer remains a small and declining portion of the business post-Sandisk spinoff.

Related Links: