Earnings summaries and quarterly performance for WESTERN DIGITAL.

Executive leadership at WESTERN DIGITAL.

Irving Tan

Chief Executive Officer

Ahmed Shihab

Executive Vice President and Chief Product Officer

Brad Feller

Senior Vice President and Chief Accounting Officer

Brian Davis

Executive Vice President and Chief Sales and Marketing Officer

Cynthia Tregillis

Executive Vice President, Chief Legal Officer and Secretary

Kris Sennesael

Executive Vice President and Chief Financial Officer

Vidyadhara Gubbi

Executive Vice President and Chief of Global Operations

Board of directors at WESTERN DIGITAL.

Research analysts who have asked questions during WESTERN DIGITAL earnings calls.

Aaron Rakers

Wells Fargo

6 questions for WDC

Ananda Baruah

Loop Capital Markets LLC

6 questions for WDC

Karl Ackerman

BNP Paribas

6 questions for WDC

Thomas O’Malley

Barclays Capital

6 questions for WDC

Vijay Rakesh

Mizuho

5 questions for WDC

Asiya Merchant

Citigroup Global Markets Inc.

4 questions for WDC

Erik Woodring

Morgan Stanley

4 questions for WDC

Steven Fox

Fox Research

4 questions for WDC

Wamsi Mohan

Bank of America Merrill Lynch

4 questions for WDC

Amit Daryanani

Evercore

3 questions for WDC

Christopher Muse

Cantor Fitzgerald

3 questions for WDC

Mark Miller

The Benchmark Company LLC

3 questions for WDC

Timothy Arcuri

UBS

3 questions for WDC

Ashley Greninger

Bank of America

2 questions for WDC

CJ Muse

Cantor Fitzgerald

2 questions for WDC

Eddy Orabi

TD Cowen

2 questions for WDC

Hannah Engberson

Evercore

2 questions for WDC

Harlan Sur

JPMorgan Chase & Co.

2 questions for WDC

Joseph Moore

Morgan Stanley

2 questions for WDC

Mike Cadiz

Citigroup

2 questions for WDC

Kris Shankar

TD Cowen

1 question for WDC

Matthew Bryson

Wedbush Securities Inc.

1 question for WDC

Mehdi Hosseini

Susquehanna Financial Group

1 question for WDC

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

1 question for WDC

Srinivas Pajjuri

Raymond James & Associates, Inc.

1 question for WDC

Recent press releases and 8-K filings for WDC.

- AI and cloud are driving a structural shift in HDD demand, with customers viewing hard drives as strategic components of their AI and cloud stacks, prompting deeper engineering engagement and a faster innovation roadmap.

- Strong multi-year visibility: Top hyperscalers have firm purchase orders through 2026 (all top 7), with some extending to 2027 and 2028, reflecting long-term secular growth and reduced cyclicality.

- Innovation roadmap includes ramping average nearline capacity from 23 TB to 32 TB (40% boost) in H2 2026, targeting 40 TB SMR drives (+75%) later in 2026, dual-track ePMR and HAMR for up to 60 TB by 2028, plus high-bandwidth and power-optimized HDDs.

- Financial targets: aiming for >50% gross margin, >40% operating margin, >30% free cash flow margin, and $20+ EPS within 3–5 years; strong balance sheet with $3.1 B debt retired, $1.6 B convertible remaining, and $6 B share-buyback authorization alongside dividends.

- Western Digital reports strong AI and cloud-driven demand, with firm purchase orders from its top 7 hyperscalers through 2026, two of its top 5 through 2027 and one through 2028, underpinning a mid-20% nearline exabyte CAGR outlook to 2028.

- The company is dual-tracking its 40 TB ePMR drives (shipping in volume H2 2026, scaling to 60 TB by 2028) alongside HAMR (customer qualification in H1 2027) on interchangeable platforms to boost areal density without adding unit capacity.

- CFO guidance calls for mid-to-high single-digit ASP/TB growth in 2026, stable pricing thereafter, and through-cycle targets of >50% gross margin, >40% operating margin, >30% free cash flow margin, and ~$20 earnings in 3–5 years.

- Capital allocation includes monetizing the remaining SanDisk stake, retiring $3.1 B of debt, retaining only a $1.6 B 2028 convertible, and returning cash via a $4 B share repurchase plus dividend growth.

- WD sees a structural shift as hyperscalers treat HDDs as strategic for AI/cloud, securing firm purchase orders into 2026–28 (top 5 customer POs to 2028) and full 2026 coverage for the top 7, with robust downside protection in contracts .

- Innovation roadmap targets ~25% exabyte CAGR in nearline, shipping 32 TB drives today versus 23 TB prior average, introducing 40 TB ePMR (H2 ’26) and dual-track ePMR/HAMR to 60 TB with plug-and-play interchangeability ** **.

- ASP per TB to rise mid–high single digits in CY 2026, then remain stable thereafter; cost per TB to decline via areal-density gains and supply-chain value engineering .

- Financial model floors set at 50%+ gross margin, 40%+ operating margin, 30%+ free-cash-flow margin and $20 EPS over 3–5 years, with scope to exceed these targets .

- Monetized SanDisk shares to retire $3.1 B debt, retains ~$1 B in stake; announced new $4 B share buyback plus dividend growth, with the $1.6 B convertible callable in late 2026 .

- WD rebranding and strong AI focus: repositioned as a storage infrastructure partner with 90% of revenue driven by AI and cloud, more than 2x gross profit YoY, and inclusion in the Nasdaq 100 and top S&P 500 performers.

- Expanded capacity roadmap: world’s highest capacity 40 TB UltraSMR ePMR HDD in qualification for H2 2026, ramping HAMR HDDs in 2027, extending ePMR to 60 TB and HAMR to 100 TB+ by 2029.

- New performance architecture: High Bandwidth Drive and Dual Pivot technologies deliver 2x current bandwidth (scaling to 8x) and 2x sequential IO gains (up to 4x combined) at HDD economics.

- Power-optimized HDDs: purpose-built drives using 20% less power enable sub-second access for cold AI data, reducing TCO for warm-to-cold storage tiers.

- Platform expansion: an intelligent open-API software layer (launching 2027) will extend hyperscale storage economics to mid-scale AI customers without architectural disruption.

- WD unveiled a series of HDD technology innovations including its pulled-forward HAMR ramp to H1 2027 with a capacity roadmap from 40 TB to 100 TB, plus high-bandwidth drives using dual-pivot triple-stage actuators to double throughput by late 2027/early 2028.

- Introduced power-optimized HDDs reducing power consumption by 20% at the cost of 5–10% sequential I/O while boosting capacity by 10 TB at the 100 TB point, available for qualification in 2027.

- CFO announced an updated long-term financial model targeting >20% revenue CAGR, >50% gross margin, >40% operating margin, >30% free cash flow margin, and > $20 EPS over the next 3–5 years, driven by mid-20s exabyte demand growth and a stable pricing environment.

- Capital allocation plans include monetizing 7.5 M SanDisk shares (~$5 B) to reduce net debt to ~$1.6 B, and returning 100% of free cash flow via dividends and an expanded $4 B share buyback authorization in addition to the $2 B plan.

- Nearline storage demand is expected to grow at a 25%+ CAGR over the next five years, with HDDs retaining about 80% share in hyperscale environments.

- Drive roadmap highlights shipping 3.5 M units of 32 TB HDDs last quarter (projecting ~4 M this quarter), qualification of 40 TB ePMR drives, and a HAMR roadmap scaling from 40 TB to 100 TB by 2029 with volume ramp in H1 2027.

- Manufacturing innovation includes vertical laser testing in photonics labs and parallel customer qualification to boost HAMR yields and reduce qualification time by months.

- Platform offering: an open API–based storage platform launching in 2027 will allow non-hyperscale customers to adopt UltraSMR, high-bandwidth and high-capacity HDD features without extensive integration.

- Financial outlook targets >20% revenue CAGR, >50% gross margin, >40% operating margin, >30% free cash flow margin, and >$20 EPS over the next 3–5 years, with full free cash flow returned to shareholders and net debt reduction.

- WD rebranded to a “data-centric” company at the heart of AI and cloud, simplifying its name to WD and emphasizing six strategic pillars focused on customers, innovation, operations, culture, sustainability and financial discipline.

- The company shipped 3.5 million 32 TB drives last quarter and projects to ship just under 4 million units this quarter, marking one of the fastest ramps of a high-capacity HDD ever.

- HAMR drives are in customer qualification with two hyperscalers, starting at 40–44 TB per drive and targeting 100 TB HDDs by 2029 using in-house laser technology boosting areal density to 10 TB per platter.

- Introduced High Bandwidth Drive leveraging a triple-stage actuator to deliver 2× sequential and 1.7× random read/write throughput, with scalability up to eight concurrent tracks and customer trials underway for a 50 TB launch.

- Updated long-term financial model targets: >20% revenue CAGR, >50% gross margin, >40% operating margin, >30% free cash flow margin and >$20 EPS over 3–5 years; also announced an additional $4 billion share repurchase authorization.

- WD has pivoted to data-centric, cloud and AI markets with six strategic pillars, securing long-term hyperscaler agreements through 2027–28 and shipping 3.5 M 32 TB drives last quarter (nearly 4 M projected this quarter).

- Announced a dual roadmap: an extended ePMR platform delivering 40 TB drives now in hyperscaler qualification and a HAMR ramp from 40–44 TB up to 100 TB by 2029 via new vertical-emitting lasers and multi-platter designs.

- CFO guidance targets >20% revenue CAGR, >50% gross margin, >40% operating margin, >30% free cash flow margin, and >$20 EPS over the next 3–5 years.

- Committed to capital returns: returned 100% of free cash flow in the last two quarters, net leverage <1.5×, authorized a $4 B share buyback, and plans to monetize a $5 B SanDisk stake to achieve a net cash positive position.

- Western Digital’s board authorized an additional $4.0 billion for share repurchases, effective immediately.

- As of February 2, 2026, approximately $484 million remained under the prior authorization.

- Repurchases may be made on the open market or in privately negotiated transactions, including under a Rule 10b5-1 plan, and can be suspended at any time.

- The expanded program reflects WD’s strategy to balance reinvestment, debt reduction, and shareholder returns.

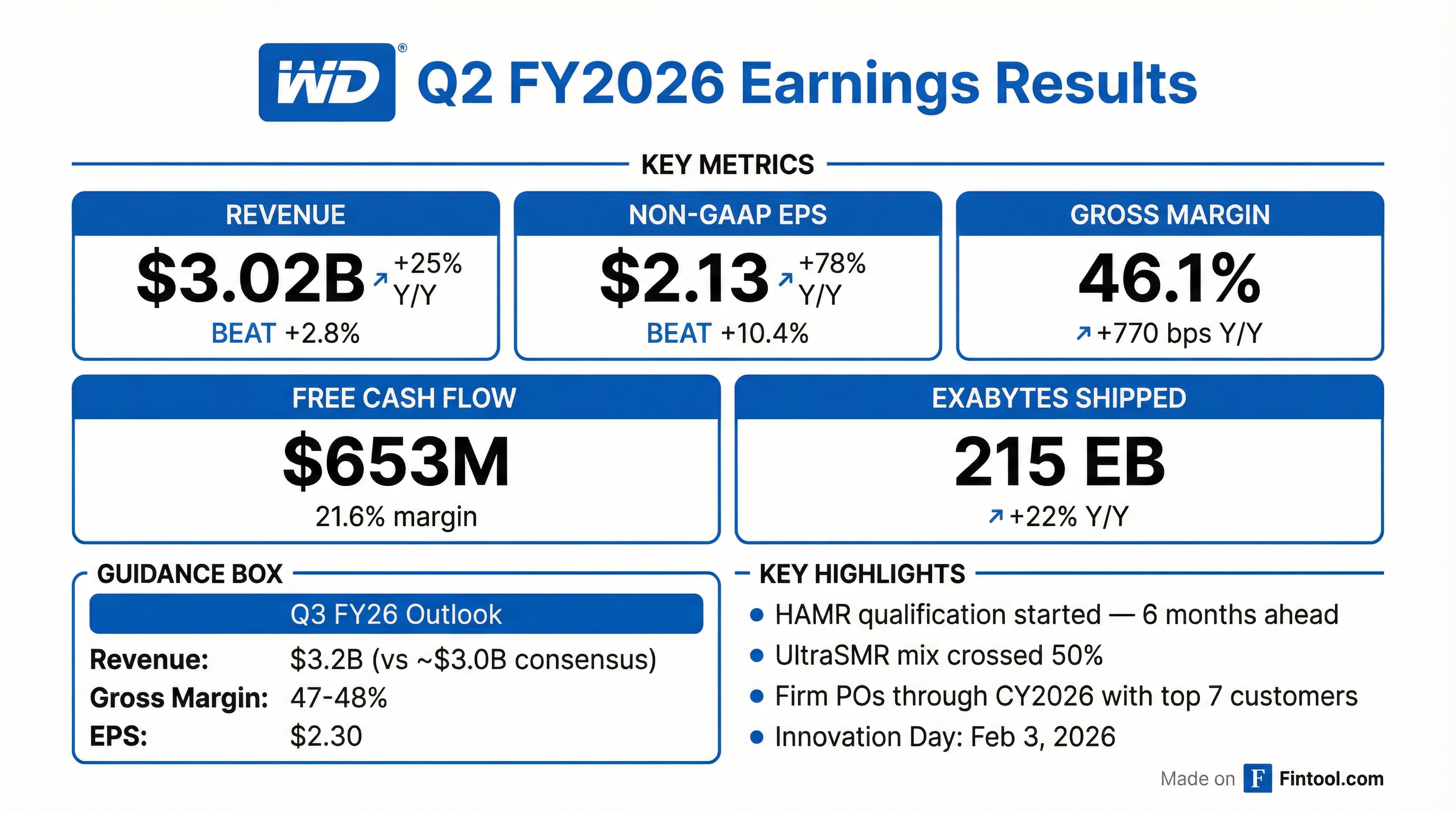

- Q2 revenue of $3.0 billion, up 25% YoY; EPS $2.13; shipped 215 EB of capacity (+22% YoY), including 103 EB from 3.5 million ePMR drives at up to 32 TB.

- Cloud revenue $2.7 billion (89% of total, +28% YoY); Client $176 million (+26% YoY); Consumer $168 million (–3% YoY).

- Gross margin 46.1%, up 770 bps YoY (220 bps QoQ); operating margin 33.8%; free cash flow $653 million (21.6% FCF margin) on $745 million OCF and $92 million CapEx.

- Board approved $12.50 per-share dividend payable March 18, 2026; repurchased $615 million of stock (3.8 million shares), bringing total capital returned since Q4 FY25 to $1.4 billion.

- Q3 FY 2026 outlook: revenue $3.2 billion ± $100 million (≈40% YoY growth), gross margin 47–48%, opex $380–390 million, EPS $2.30 ± 0.15.

Fintool News

In-depth analysis and coverage of WESTERN DIGITAL.

Quarterly earnings call transcripts for WESTERN DIGITAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more