Earnings summaries and quarterly performance for WEC ENERGY GROUP.

Executive leadership at WEC ENERGY GROUP.

Scott Lauber

President and Chief Executive Officer

Margaret Kelsey

Executive Vice President, General Counsel and Corporate Secretary

Michael Hooper

Executive Vice President and Chief Operating Officer

Robert Garvin

Executive Vice President, External Affairs

Xia Liu

Executive Vice President and Chief Financial Officer

Board of directors at WEC ENERGY GROUP.

Cristina Garcia-Thomas

Director

Danny Cunningham

Director

Gale Klappa

Non-Executive Chairman

Glen Tellock

Director

John Lange

Director

Maria Green

Director

Mary Ellen Stanek

Director

Thomas Lane

Independent Lead Director

Ulice Payne, Jr.

Director

Warner Baxter

Director

William Farrow III

Director

Research analysts who have asked questions during WEC ENERGY GROUP earnings calls.

Andrew Weisel

Scotiabank

6 questions for WEC

Carly Davenport

Goldman Sachs

5 questions for WEC

Julien Dumoulin-Smith

Jefferies

4 questions for WEC

Nicholas Campanella

Barclays

4 questions for WEC

Paul Patterson

Glenrock Associates

4 questions for WEC

Durgesh Chopra

Evercore ISI

3 questions for WEC

Jeremy Tonet

JPMorgan Chase & Co.

3 questions for WEC

Paul Fremont

Ladenburg Thalmann

3 questions for WEC

Brian Russo

Jefferies

2 questions for WEC

Michael Sullivan

Wolfe

2 questions for WEC

Neil Kalton

Wells Fargo Securities

2 questions for WEC

Shahriar Pourreza

Guggenheim Partners

2 questions for WEC

Steve D'Ambrisi

RBC Capital Markets

2 questions for WEC

Alex on for Shar Pourreza

Wells Fargo

1 question for WEC

Anthony Crowdell

Mizuho Financial Group

1 question for WEC

Sophie Karp

KeyBanc Capital Markets Inc.

1 question for WEC

Recent press releases and 8-K filings for WEC.

- 2026 adjusted EPS guidance of $5.51–$5.61 (midpoint $5.56) underpins a ~6.7% CAGR in EPS since 2015.

- $33.3 billion 2026–2030 capital plan with $12.6 billion allocated to regulated renewables and $7.4 billion to thermal generation and LNG capacity.

- Illinois utilities (Peoples Gas, North Shore Gas) seek ROE increase from 9.38% to 10.10%, with rate order expected Q4 2026 effective Jan 1, 2027.

- WEC raised its 2026–2030 capital plan by $1 billion to $37.5 billion, supporting 7–8% long-term EPS growth with average annual depreciation of $1.6 billion at utilities and $190 million at ATC.

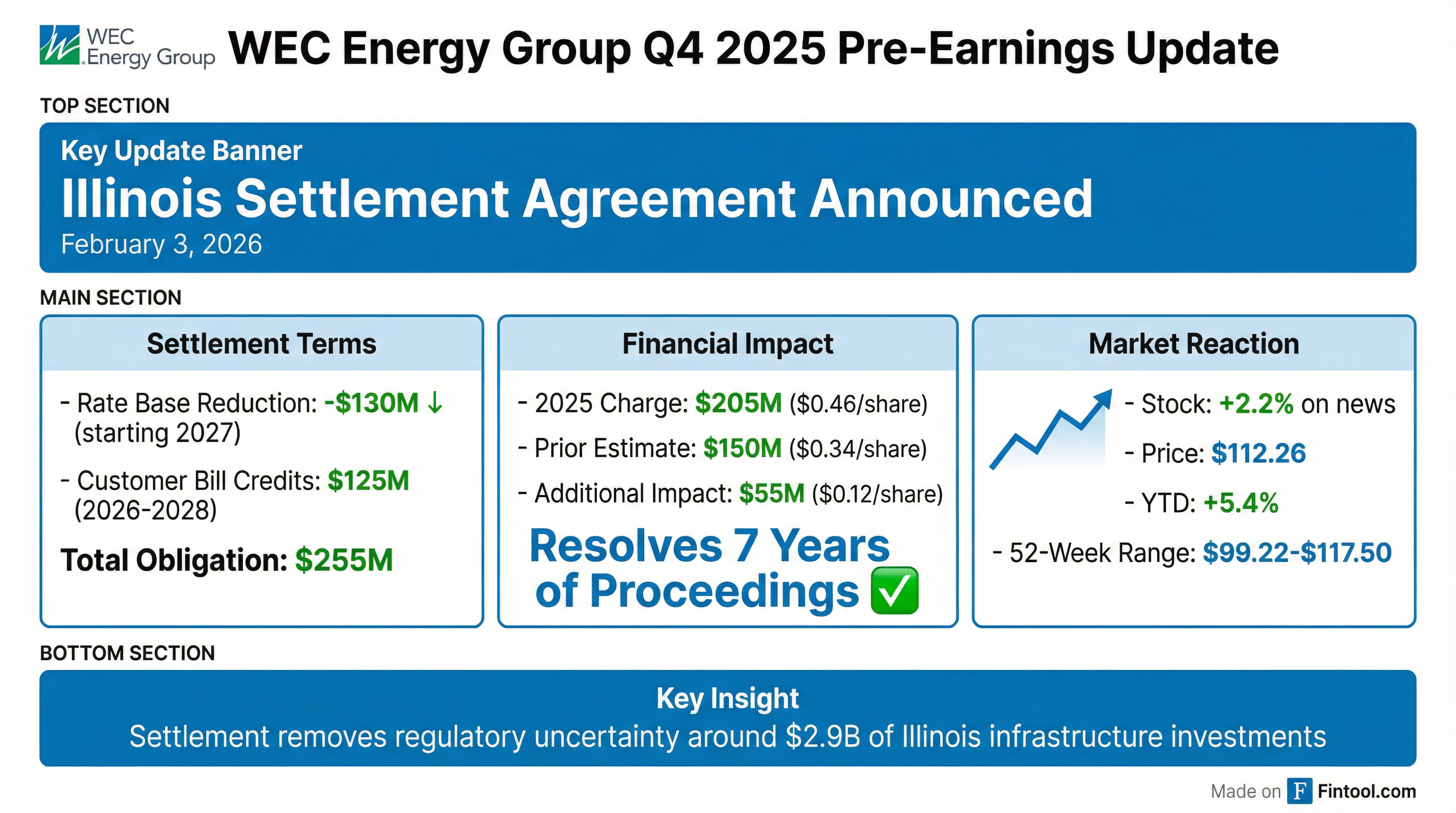

- Proposed settlement in Illinois would resolve $2.3 billion of open rider dockets, including a $130 million QIP rate base reduction and $125 million of cash credits over three years, subject to ICC approval.

- Forecasts show 2.6 GW of new demand in the I-94 corridor through 2030 (including 500 MW from Microsoft), with weather-normalized sales growth of 6.0–8.0% electric and 0.7–1.0% gas for 2028–2030.

- Maintains credit ratings of A- (S&P) and Baa1 (Moody’s), targeting FFO/Debt >15% and CFO Pre-WC/Debt >16% for 2026–2030.

- On February 23, 2026, WEC Energy Group entered into an Underwriting Agreement to issue an additional $400 million aggregate principal amount of its 4.75% Senior Notes due January 15, 2028 under its Form S-3 shelf registration.

- The notes were priced at 101.222% of par plus accrued interest, with net proceeds of approximately $404.9 million (before offering expenses and excluding ~$2.16 million of accrued interest).

- These Additional 2028 Notes join the $450 million original series issued January 11, 2023, bringing total outstanding to $850 million; legal and tax opinions were filed as exhibits.

- Reiterated 2026 EPS guidance of $5.51–$5.61 per share (midpoint $5.56) and targets 7–8% long-term EPS CAGR over 2026–2030.

- Approved a 6.7% dividend increase to $3.81 annualized—the 23rd consecutive year of raises—and plans 6.5–7% dividend growth with a 65–70% payout ratio.

- Increased its 2026–2030 capital plan by $1 billion to $37.5 billion, allocating $12.6 billion to regulated renewables and $7.4 billion to thermal generation to underpin earnings growth.

- Forecasts 2.6 GW of new large-customer demand along the I-94 corridor through 2030, including an estimated $1 billion incremental investment by Microsoft.

- 2026 adjusted EPS guidance of $5.51–$5.61, implying ~6.7% growth and supporting a 7–8% long-term EPS CAGR, marking 22 consecutive years of meeting/exceeding guidance

- Raised annual dividend 6.7% to $3.81 per share for the 23rd straight year; targeting 6.5–7% dividend growth and a 65–70% payout ratio

- $33.3 B 2026–2030 capital plan in regulated assets: $12.6 B in renewables, $7.4 B in thermal generation & LNG, and $4.1 B in transmission (ATC share); financed by $20.5–21.5 B cash flow, $14.2–14.8 B incremental debt, and $5.3–5.7 B equity

- Asset base to expand from $34.2 B in 2025 to $59.6 B by 2030, with transmission rising to 58% of total assets

- Maintains S&P A- / Moody's Baa1 ratings and targets FFO/Debt >15% over 2026–2030

- WEC delivered 2025 adjusted EPS of $5.27, up $0.39 YoY and at the top end of guidance, excluding a $0.46 per share one-time Illinois settlement charge.

- Board raised the annual dividend by 6.7% to $3.81, marking the 23rd consecutive year of dividend growth.

- Updated 5-year capital plan to $37.5 billion, targeting 7–8% EPS CAGR from 2026–2030 with acceleration starting in 2028; expects $4–5 billion debt and $900 million–$1.1 billion equity funding in 2026.

- Projects like Microsoft (+500 MW) and Vantage Data Centers (+1.3 GW) drive a forecasted 3.9 GW incremental demand, adding $1 billion to the capex plan.

- 2026 guidance set at Q1 EPS $2.27–$2.37 and full-year EPS $5.51–$5.61, assuming normal weather.

- WEC Energy delivered 2025 adjusted EPS of $5.27, up $0.39 from 2024; utility operations earnings rose $0.63 driven by favorable weather and rate-based growth.

- Board approved a 6.7% dividend increase to an annualized $3.81, marking the 23rd consecutive year of hikes.

- Updated $37.5 billion 5-year capital plan, with forecasted demand growth of 3.9 GW (including 500 MW from Microsoft and 1.3 GW from Vantage) adding $1 billion incremental capex; targets 7–8% EPS CAGR from 2026 to 2030.

- Regulatory update: Illinois settlement incurs a $0.46 per-share one-time charge ($130 million rate-base reduction; $125 million customer credits) and the very-large-customer tariff is pending Public Service Commission order in May; 2027 rate filings forthcoming.

- 2026 EPS guidance set at $5.51–$5.61, Q1 forecast $2.27–$2.37; expects $4–5 billion debt funding and $900 million–$1.1 billion equity issuance.

- WEC delivered full-year 2025 adjusted EPS of $5.27, up $0.39 from 2024, excluding a $0.46 one-time Illinois settlement charge.

- Board approved a 6.7% dividend increase to $3.81 per share, marking the 23rd consecutive annual raise.

- Executing a $37.5 billion, five-year capital plan, bolstered by 500 MW of incremental Microsoft data center demand and forecasting 3.9 GW of load growth over five years.

- 2026 outlook includes Q1 EPS of $2.27–$2.37 and full-year EPS guidance of $5.51–$5.61, with a long-term 7–8% EPS CAGR through 2030.

- Full-year GAAP net income was $1.6 billion or $4.81 per share; adjusted EPS rose to $5.27, up 8.0% versus 2024.

- Q4 2025 GAAP net income was $316.6 million or $0.97 per share; adjusted EPS was $1.42.

- Consolidated revenues for 2025 were $9.8 billion, an increase of $1.2 billion over 2024.

- The company reaffirmed 2026 guidance of $5.51 to $5.61 EPS and projects a 7–8% compound annual EPS growth over the next five years.

- The board declared a quarterly dividend of $0.9525 per share, up 6.7%, marking the 23rd consecutive year of increases.

- WEC reported GAAP net income of $1.6 billion, or $4.81 per share for FY2025, versus $1.5 billion, $4.83 per share in FY2024.

- Excluding a $0.46 per share settlement charge, adjusted EPS was $5.27, an 8.0% increase over 2024’s $4.88.

- FY2025 revenues rose to $9.8 billion, up $1.2 billion year-over-year.

- The company reaffirmed FY2026 EPS guidance of $5.51–$5.61 and raised its quarterly dividend 6.7% to $0.9525 per share, marking 23 consecutive years of increases.

Quarterly earnings call transcripts for WEC ENERGY GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more