Earnings summaries and quarterly performance for WASTE MANAGEMENT.

Executive leadership at WASTE MANAGEMENT.

James C. Fish, Jr.

Chief Executive Officer

Charles C. Boettcher

Executive Vice President and Chief Legal Officer

Christopher P. DeSantis

Senior Vice President — Operations

David L. Reed

Executive Vice President and Chief Financial Officer

Donald J. Smith

Senior Vice President — Operations

John A. Carroll

Vice President and Chief Accounting Officer

John J. Morris, Jr.

President and Chief Operating Officer

Johnson Varkey

Senior Vice President and Chief Information Officer

Kimberly G. Stith

Senior Vice President and Chief Human Resources Officer

Michael J. Watson

Senior Vice President and Chief Customer Officer

Rafael E. Carrasco

Senior Vice President — Enterprise Strategy and President — WM Healthcare Solutions

Tara J. Hemmer

Senior Vice President and Chief Sustainability Officer

Board of directors at WASTE MANAGEMENT.

Andrés R. Gluski

Director

Bruce E. Chinn

Director

Kathleen M. Mazzarella

Non-Executive Chair of the Board

Maryrose T. Sylvester

Director

Sean E. Menke

Director

Thomas L. Bené

Director

Victoria M. Holt

Director

William B. Plummer

Director

Research analysts who have asked questions during WASTE MANAGEMENT earnings calls.

James Schumm

TD Cowen

8 questions for WM

Konark Gupta

Scotiabank

8 questions for WM

Noah Kaye

Oppenheimer & Co. Inc.

8 questions for WM

Toni Kaplan

Morgan Stanley

8 questions for WM

Trevor Romeo

William Blair

8 questions for WM

Bryan Burgmeier

Citigroup Inc.

7 questions for WM

Kevin Chiang

CIBC Capital Markets

7 questions for WM

Stephanie Moore

Jefferies

7 questions for WM

Faiza Alwy

Deutsche Bank

6 questions for WM

Sabahat Khan

RBC Capital Markets

6 questions for WM

Tobey Sommer

Truist Securities, Inc.

6 questions for WM

Tyler Brown

Raymond James Financial, Inc.

6 questions for WM

Jerry Revich

Goldman Sachs Group Inc.

5 questions for WM

Tami Zakaria

JPMorgan Chase & Co.

4 questions for WM

David Manthey

Robert W. Baird & Co. Incorporated

3 questions for WM

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

3 questions for WM

Adam Bubes

Goldman Sachs Group, Inc.

2 questions for WM

Brian Butler

Stifel, Nicolaus & Company, Incorporated

2 questions for WM

Patrick Brown

Raymond James

2 questions for WM

Rob Wertheimer

Melius Research LLC

2 questions for WM

Seth Weber

Wells Fargo

2 questions for WM

George Bancroft

Gabelli Funds

1 question for WM

Harold Ander

Jefferies

1 question for WM

Shlomo Rosenbaum

Stifel Financial Corp.

1 question for WM

William Griffin

Barclays

1 question for WM

William with Barclays

Barclays

1 question for WM

Recent press releases and 8-K filings for WM.

- Full-year operating expenses fell to 59.5% of revenue, the first time below 60%, with each quarter improving sequentially in 2025.

- Legacy Operating EBITDA margin expanded 150 bps, cash flow from operations grew over 12% to $6.04 billion, and free cash flow rose nearly 27% to $2.94 billion in 2025.

- 2026 guidance calls for Operating EBITDA growth of 6.2% at midpoint (7.4% normalized), free cash flow up nearly 30%, a 14.5% dividend increase, and a new $3 billion share repurchase program.

- Sustainability investments accelerated: commissioned 7 renewable natural gas facilities, upgraded 5 recycling plants, and Recycling segment EBITDA grew over 22% despite ~20% lower commodity prices.

- Operating EBITDA in Q4 grew >8% year-over-year in the collection & disposal segment, with margin up 160 bps and operating expenses down to 58.5% of revenue; full-year opex fell to 59.5%, the first sub-60% annual result in company history.

- Full-year Operating EBITDA margin expanded 40 bps to 30.1%, overcoming a 140 bps headwind from the Healthcare Solutions acquisition and alternative fuel tax credit expiry; the legacy business delivered 180 bps of margin expansion when normalized.

- 2026 guidance calls for 6.2% Operating EBITDA growth at midpoint (7.4% excluding wildfire cleanup volumes), free cash flow up ~30%, and the board approved a 14.5% dividend increase alongside a $3 billion share repurchase program.

- Sustainability investments commissioned 7 new renewable natural gas facilities and upgraded 5 recycling plants, helping the recycling segment deliver 22% EBITDA growth despite ~20% lower commodity prices.

- Healthcare Solutions integration is ahead of plan, with cross-sell synergies exceeding $50 million and SG&A reduced from 11% to 10.3% of revenue, targeting sub-10% by year-end.

- Operating EBITDA margin expanded to 30.1% for 2025 (up 40 bp Y/Y), driving 12% growth in cash flow from operations to $6.04 B and a 27% jump in free cash flow to $2.94 B.

- 2026 guidance calls for Operating EBITDA of $8.15 B–$8.25 B (+6.2% midpoint, excl. $150 M accretion expense), free cash flow growth of nearly 30%, a 14.5% dividend increase, and a $3 B share repurchase program.

- Healthcare Solutions integration continues: Q4 SG&A improved to 20.8% of revenue (–350 bp Y/Y), and 2026 pricing set at 4.2% (top-line growth 3%) with cross-sell synergies on track.

- Sustainability investments drove 22% Recycling Operating EBITDA growth despite ~20% lower commodity prices; commissioned 7 RNG facilities, upgraded 5 recycling plants, and added facilities in 4 new markets in 2025.

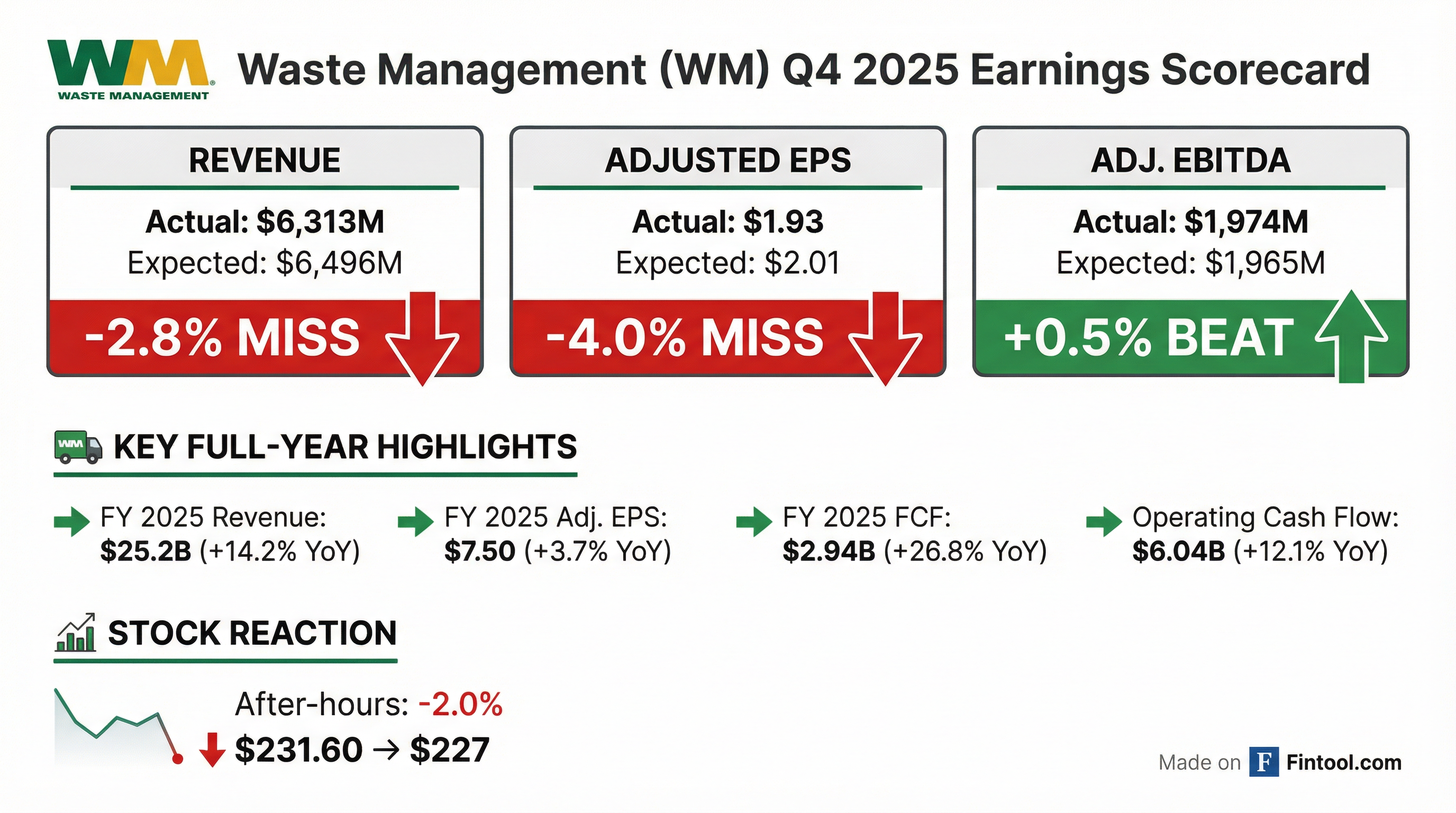

- Revenue reached $6.31 B in Q4 (+7.1% YoY) and $25.20 B for FY 2025 (+14.2%).

- Operating EBITDA was $1.925 B in Q4 (margin 30.5%, adj. 31.3%) and FY adj. margin of 30.1%, a full-year record.

- Net income of $742 M in Q4 (adj. $780 M; EPS $1.83, adj. $1.93) and $2.71 B for FY 2025 (adj. $3.03 B; EPS $6.70, adj. $7.50).

- Net cash from operations increased 12.1% to $6.04 B, yielding $2.94 B of free cash flow (+26.8%) in 2025.

- 2026 guidance: revenue $26.425–26.625 B (+5.2%), adj. EBITDA $8.15–8.25 B (+6.2%), free cash flow $3.75–3.85 B (+29.4%), return of ~$3.5 B to shareholders and leverage target 2.5–3.0×.

- Q4 revenue of $6.31 billion and full-year revenue of $25.20 billion.

- Q4 adjusted operating EBITDA of $1.97 billion at 31.3% margin and full-year adjusted operating EBITDA of $7.58 billion at 30.1% margin, both company records.

- Operating cash flow grew 12.1% to $6.04 billion, and free cash flow rose 26.8% to $2.94 billion in 2025.

- 2026 guidance forecasts $26.425 billion–$26.625 billion in revenue, $8.15 billion–$8.25 billion in adjusted operating EBITDA, and $3.75 billion–$3.85 billion in free cash flow.

- Q4 adjusted non-GAAP EPS was $1.93, missing consensus by $0.02, and revenue rose 7.1% y/y to $6.31 billion, but fell short of forecasts

- GAAP net income increased to $742 million ($1.83/share) from $598 million ($1.48/share) a year earlier

- 2026 guidance: full-year revenue pegged at $26.43–26.63 billion (midpoint $26.53 billion) and adjusted EBITDA near $8.2 billion

- Margin expansions: operating margin at 18.3% (vs 15.6%) and free-cash-flow margin at 16.1% (vs 6.7%)

- Leverage and valuation metrics show debt/equity ~2.45, P/E in mid-30s, and an Altman Z-Score in the “grey” zone; shares dipped ~2% in extended trading despite YTD outperformance

- WM’s Board approved a 14.5% increase in the 2026 quarterly dividend to $0.945 per share, marking the 23rd consecutive year of dividend growth and raising the annual rate to $3.78.

- The board authorized a $3 billion share repurchase program for 2026, replacing the remaining $1.5 billion authorization from 2023.

- Management plans to return roughly 90% of 2026 free cash flow to shareholders through dividends and buybacks, while targeting $100–$200 million in tuck-in acquisitions.

- WM expects to end 2025 with a leverage ratio of 3.1x after $1 billion of debt reduction, will resume repurchases post-Q4 2025 results, and aims for a 2.5x–3.0x leverage range in 2026.

- Legacy Waste Management margins are up 300 bps since 2022, driven by technology investments, route optimization, higher-margin renewable natural gas projects and increasing landfill pricing as capacity tightens.

- Collection productivity is improving through dynamic routing and replacing rear loaders (700 homes/day) with automated side loaders (900–1,000 homes/day), with the residential fleet conversion about 70% complete.

- The Stericycle acquisition is on track for $250 million of annual cost synergies (double the original estimate), cutting SG&A from ~25% to ~17% of revenue, with a pathway to mid-20s% margins over the next 2–3 years; billing-related revenue credits will reverse as a 2026 tailwind.

- Sustainability CapEx peaks in 2025 to support landfill gas projects (currently $150–160 million EBITDA, rising to $470–500 million by 2027) and recycling plant rebuilds (29 of 31 complete), enabling free cash flow to ramp to about $3.8 billion in 2026, with balanced allocation including dividends and share buybacks.

- WM now accepts polypropylene plastic and paper to-go cups in curbside recycling across more local programs in the U.S.

- Change targets a Widely Recyclable designation for plastic cups (>60% curbside coverage) and a Check Locally designation for paper cups (≥20% community acceptance) from How2Recycle

- WM is investing $1.4 billion in new recycling infrastructure across North America to boost processing capacity for these materials

- Partnerships with Starbucks, The Recycling Partnership, How2Recycle, NextGen Consortium, municipalities and the National League of Cities support guideline updates and awareness efforts

- WM operates about 15,000 collection vehicles, 262 landfills, 350 transfer facilities, and serves over 20 million customers (16 million residential) following last year’s Stericycle acquisition.

- In Q3, collection and disposal margins hit a record 38.4%, legacy business margins were 32%, and overall margins exceeded 30%; the company targets 5–7% annual EBITDA growth with 50 bps margin improvement and $100–200 million of M&A per year.

- Synergies from the Stericycle deal have been increased from $125 million to $300 million by end-2027, with ERP stabilization expected by mid-2026 under WM’s operational model.

- The WM Healthcare segment has an addressable cross-sell market of over $2 billion, and SG&A has been reduced from the upper 20s % of revenue to 19%, reflecting secular growth outpacing core MSW collection.

- Sustainability investments include roughly $1.5 billion in recycling automation and completion of 20 RNG plants on schedule; from 2026, WM plans to shift toward a harvesting cycle with $400 million+ in capital deployment aimed at returning cash to shareholders.

Quarterly earnings call transcripts for WASTE MANAGEMENT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more