WOLFSPEED (WOLF)·Q2 2026 Earnings Summary

Wolfspeed Q2 FY2026: Revenue Meets Guidance, AI Datacenter Surges 50%, but Weak Q3 Outlook Sinks Shares

February 4, 2026 · by Fintool AI Agent

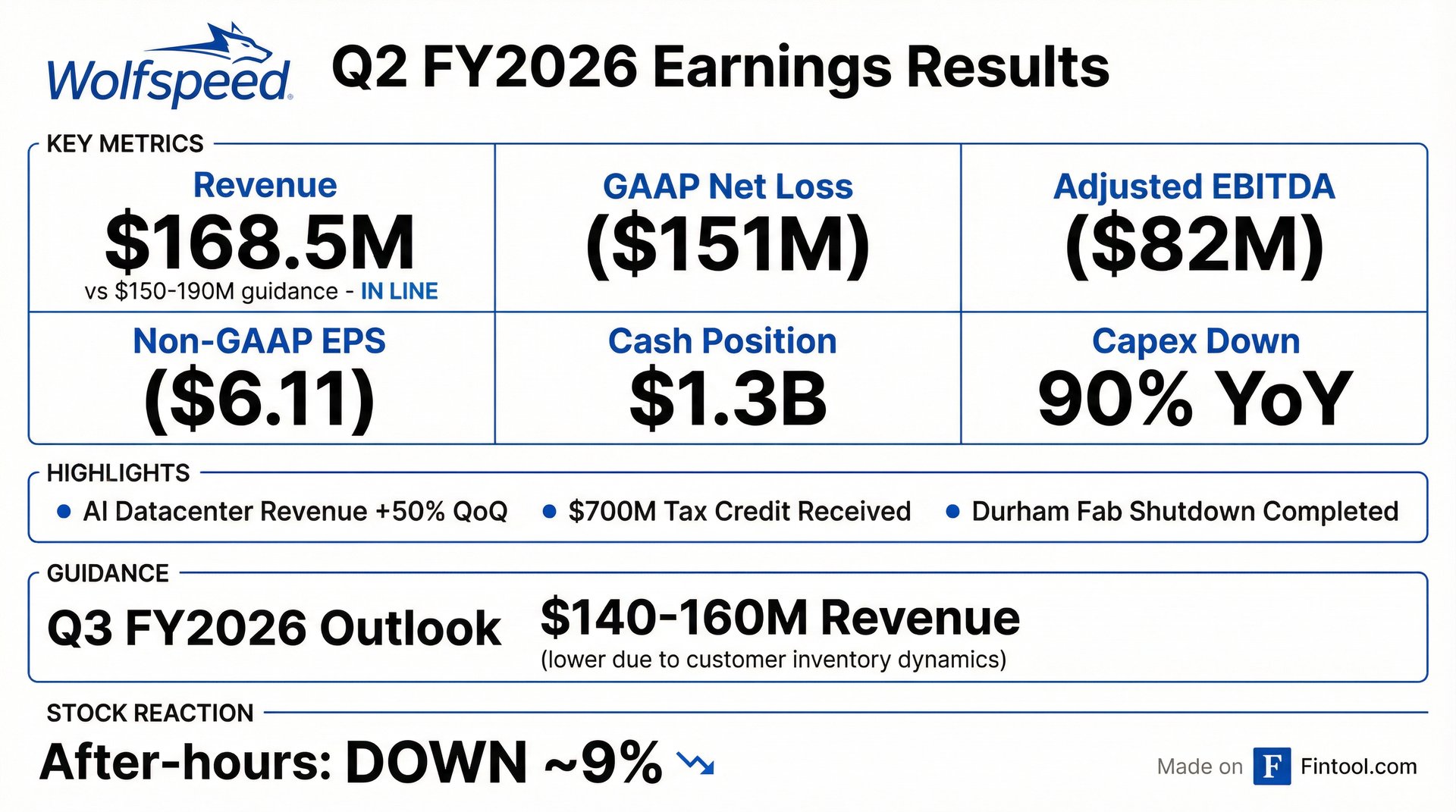

Wolfspeed (NYSE: WOLF) reported Q2 FY2026 results that landed within the company's guidance range, but investors focused on the weak Q3 outlook. Revenue of $168.5M came in near the midpoint of the $150-190M guidance range, while AI datacenter revenue surged 50% sequentially . The stock dropped ~9% after-hours on guidance for Q3 revenue of just $140-160M .

Did Wolfspeed Beat Earnings?

Wolfspeed's Q2 FY2026 results came in near the middle of guidance, which itself was already set low following Chapter 11 emergence:

Key context: The Q2 FY2026 revenue of $168.5M represents a decline from Q1's $197M, which management had flagged due to customers building inventory ahead of the Durham fab closure and second-sourcing during the bankruptcy process .

The company did not provide specific gross margin guidance due to fresh-start accounting complications. Non-GAAP gross margin of (34)% included $48M of underutilization costs and $23M of inventory fair value step-ups from fresh-start accounting .

What Did Management Guide?

The bigger story was Q3 FY2026 guidance, which disappointed investors:

Why the Q3 weakness? Management cited three headwinds :

- Accelerated Q1 purchases — customers pulled forward orders before Durham fab closure

- Second-sourcing during bankruptcy — customers diversified supply chains during Chapter 11 process

- Weaker EV demand — the broader electric vehicle market remains soft

What Changed From Last Quarter?

Several key developments since Q1 FY2026:

Balance Sheet Transformation

The company emerged from Chapter 11 with a dramatically improved capital structure:

The massive cash improvement came from receiving $700M in Section 48D Advanced Manufacturing Tax Credits . Wolfspeed used $175M to retire first lien debt and saw $80M debt reduction via 1.5M share conversions from second lien converts, delivering $25M in annual interest savings .

Equity update: CFIUS clearance enabled distribution of 16.85M shares to Renesas, plus final 2% equity recovery (~871K shares) to legacy shareholders. Total shares outstanding: 45.1M .

Operating Cost Reductions

Management accelerated cost cuts:

Product Line Revenue Mix

Power Products now dominate as Materials revenue declines:

The shift to Power Products reflects the transition from 150mm to 200mm technology, with Materials revenue declining as third-party substrate sales normalize.

How Did the Stock React?

Wolfspeed shares fell sharply in after-hours trading:

Context: WOLF had already declined ~50% from its 52-week high of $36.60, reflecting ongoing concerns about EV demand weakness and the restructuring process. The stock is down ~9% YTD from its January 2, 2026 close of $18.93.

The negative reaction appears driven by:

- Q3 guidance below Q2 levels, suggesting no near-term recovery

- Continued negative gross margins

- EV demand headwinds persisting longer than expected

Key Management Quotes

CEO Robert Feurle on the turnaround:

"With a stronger capital structure following our financial restructuring, we are operating with discipline to maintain balance sheet strength while upholding our commitment to disruptive innovation. We completed the shutdown of our Durham 150mm device fab roughly one month ahead of schedule and have shifted production to our 200mm device fab in Mohawk Valley."

On AI datacenter opportunity:

"The AI revolution is fundamentally reshaping data center requirements and accelerating the shift from general-purpose facilities to purpose-built AI infrastructure that demands unprecedented power density and efficiency, playing directly into Wolfspeed's strength. Our devices are already embedded in critical AI data center power systems, and we have doubled our data center revenue in the last three quarters."

On 300mm technology leadership:

"In materials, we demonstrated our capabilities in 300mm silicon carbide wafer production, a critical step towards entering emerging markets beyond power devices."

CFO Gregor van Issum on capital discipline:

"During the quarter, we took decisive actions to strengthen our balance sheet. First, we maximized the value of our 48D Advanced Manufacturing Tax Credit, receiving approximately $700 million ahead of schedule. We used some of the proceeds to retire approximately $175 million of outstanding debt, an important step to reduce our leverage and interest expense."

Fresh Start Accounting Impact

This is the first quarter with fresh-start accounting following Chapter 11 emergence on September 29, 2025 . Assets and liabilities were remeasured to fair value, anchored to the court-approved enterprise value of $2.6 billion .

Important note: Prior period financials are not directly comparable due to fresh-start accounting. The "Successor" period (Sept 30, 2025 onward) reflects the reorganized company, while "Predecessor" reflects pre-emergence results. Adjusted EBITDA is largely unaffected by Fresh Start Accounting impacts on a go-forward basis .

Key Highlights Worth Watching

1. AI Datacenter Revenue (+50% QoQ)

While still a small part of the business, AI datacenter revenue has doubled over the last three quarters, with 50% growth from Q1 to Q2 . Management is collaborating with partners on the transition from legacy 400-volt architectures to next-generation 800-volt AI platforms .

2. Customer Wins

New design wins announced with Toyota (onboard charging for BEVs) and Hopewind (industrial and renewable energy inverters) .

3. 300mm Technology Demonstration

Wolfspeed demonstrated a single-crystal 300mm silicon carbide wafer — a significant technology milestone that could open markets beyond power devices .

4. Go-to-Market Transformation

CEO Feurle is restructuring the sales organization from product-oriented to application-oriented, organizing around four verticals: Automotive, Industrial & Energy, Aerospace & Defense, and Materials . New hires from major semiconductor companies are helping extend reach into emerging power device opportunities .

5. Cash Preservation

The $1.3B cash position provides runway, but the company remains cash-flow negative. Operating cash outflow was $43M for the quarter, improved by $89M in working capital releases .

Historical Revenue Trend

Revenue has trended lower over the past two years, with Q2 FY2026 marking the lowest quarterly revenue since before FY2024. The Q3 guidance range of $140-160M would represent a trough if achieved.

Risks and Concerns

-

Continued EV demand weakness — Management expects softness to persist through FY2026

-

Negative gross margins — Even with fresh-start accounting benefits, gross margins remain deeply negative

-

Customer defection risk — Second-sourcing during bankruptcy may have permanently shifted some customers

-

Path to profitability unclear — No specific timeline or financial targets provided for breakeven

-

Cash burn continues — Despite $1.3B in liquidity, operating cash flow remains negative

Forward Catalysts

- Long-range plan unveiling — Management confirmed update on long-term financial targets and capital allocation plans in H1 calendar 2026

- Mohawk Valley utilization — Factory utilization is "one of the main levers" for margin improvement as demand accelerates

- AI datacenter growth — Rack power trajectory from 100kW → 600kW (2028) → 1MW (2029-2030) creates expanding opportunity

- Debt refinancing — Management actively exploring L1 refinancing options; interest rate step-up provides window for material savings

- 300mm substrate applications — Optical-grade SiC for AR/VR thermal management in early customer discussions

- EV market inflection — 20% EV penetration today → ~50% by end of decade per industry forecasts

Q&A Highlights

AI Datacenter Opportunity Deep Dive (Susquehanna)

Analyst Christopher Rolland asked about specific AI datacenter applications. CEO Robert Feurle provided detailed color on the opportunity :

"What's happening in the AI data center space, especially in the rack side, is that today you're around about the 100 kW-ish per rack... That's kind of moving in 2 years from now to, like, 600 kW per rack into, like, 1 MW per rack, like in the 2029, 2030 timeframe."

Key applications where Wolfspeed is focused :

- Energy generation — Grid-to-rack power conversion at high voltages

- Energy storage systems — Buffering for renewable integration

- Solid-state transformers — Transition from traditional transformers underway

- UPS systems — Uninterruptible power supply in datacenters

- Cooling systems — 40% of datacenter energy consumed for cooling

300mm Substrate Beyond Power Devices

Management highlighted 300mm silicon carbide potential in emerging markets :

"Silicon carbide, from a materials perspective, has unique properties. And one unique property is thermal conductance... There's clear interest to explore now to see, is there a way to use this thermal conductance in some type of improvement for the system architecture?"

AR/VR opportunity: Optical-grade silicon carbide for next-generation systems requiring high brightness and effective thermal management .

Balance Sheet Refinancing Options (Goldman Sachs, William Blair)

CFO Gregor Von Esson addressed first lien debt refinancing :

"We are very much aware of the situation and opportunity potential in the convert area, which we're deeply looking into at the moment, alongside other options... The interest rate will step up, and at that moment, also, some of the make whole premiums step down. So in our view, that is definitely a very high cost of capital there and something to be looked at."

When pressed on potential savings, CFO noted it depends on the instrument but is "looking for making material first steps" and likely "not gonna be in a one-go transaction" .

EV Market Outlook

CEO Feurle provided market context :

"Slightly over 90 million cars getting sold, around about 20% of these cars being EVs. And that portion of EVs is just gonna grow towards end of the decade. I saw some forecasting around about 50% of the cars being sold end of the decade are EVs."

On 800-volt platforms: "For the 800-volt platform... the primary solution is to do the traction and where those silicon carbide" .

US Manufacturing Advantage

CEO Feurle highlighted recent supply chain concerns benefiting Wolfspeed :

"If you saw also what happened recently around rare earth, if you saw kind of what happened last year also around gallium... Certain countries restricted these materials from being exported. A lot of customers are wondering, okay, Wolfspeed, you have the manufacturing capabilities, you have the capacity, and you have this right here in the United States."

The domestic footprint (North Carolina, Mohawk Valley, Arkansas) is increasingly valuable as customers seek supply chain security .