Earnings summaries and quarterly performance for WOLFSPEED.

Executive leadership at WOLFSPEED.

Board of directors at WOLFSPEED.

Research analysts who have asked questions during WOLFSPEED earnings calls.

Brian Lee

Goldman Sachs Group, Inc.

4 questions for WOLF

Christopher Rolland

Susquehanna Financial Group

3 questions for WOLF

Jed Dorsheimer

William Blair & Company, L.L.C.

3 questions for WOLF

Colin Rusch

Oppenheimer & Co. Inc.

2 questions for WOLF

George Gianarikas

Canaccord Genuity

2 questions for WOLF

Harsh Kumar

Piper Sandler & Co.

2 questions for WOLF

Joe Cardoso

JPMorgan Chase & Co.

2 questions for WOLF

Jonathan Dorsheimer

William Blair & Company, L.L.C.

2 questions for WOLF

Joseph Cardoso

JPMorgan Chase & Co.

2 questions for WOLF

Joshua Buchalter

TD Cowen

2 questions for WOLF

Samik Chatterjee

JPMorgan Chase & Co.

2 questions for WOLF

Craig Irwin

ROTH Capital Partners

1 question for WOLF

Jack Egan

Charter Equity Research

1 question for WOLF

Joseph Moore

Morgan Stanley

1 question for WOLF

Lanny

TD Cowen

1 question for WOLF

Recent press releases and 8-K filings for WOLF.

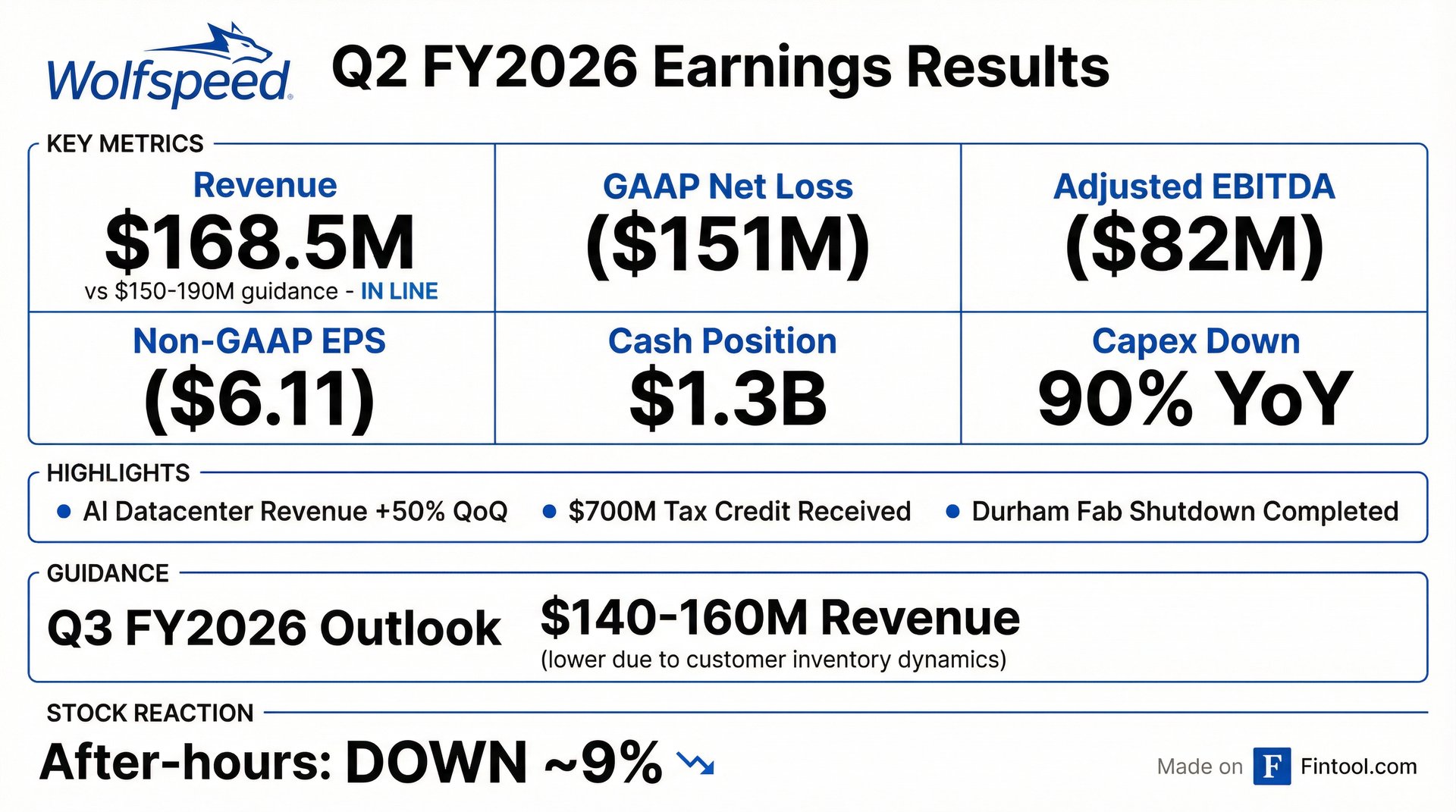

- Wolfspeed reported Q2 2026 revenue of $168 million and an Adjusted EBITDA of $(82) million, ending the quarter with a cash balance of $1.3 billion and net debt of $600 million.

- The company projects Q3 2026 revenue between $140 million and $160 million, anticipating sequential improvement in gross margin, though it is expected to remain negative.

- Key operational achievements include 50% quarter-over-quarter growth in AI data center revenue and a 90% year-over-year reduction in CapEx to $31 million in Q2.

- Following the adoption of Fresh Start Accounting, Wolfspeed recorded $3.7 billion in debt forgiveness and an increase in its share count from 26 million to 45.1 million.

- Wolfspeed reported total revenue of $168 million for Q2 FY2026, comprising $118 million in power revenue and $50 million in materials revenue. The non-GAAP gross margin was -34%, negatively impacted by Fresh Start Accounting adjustments, inventory reserves, and underutilization costs.

- The company achieved 50% quarter-over-quarter growth in AI data center revenue and completed the shutdown of all 150mm manufacturing ahead of schedule, fully transitioning its device platform to 200mm manufacturing.

- Wolfspeed strengthened its financial position by receiving $700 million in 48D tax credits, reducing $175 million of first lien debt, and converting approximately $80 million of second lien convert debt, which is expected to result in $25 million in annual interest savings. The quarter ended with $1.3 billion in cash and short-term investments.

- The company adopted Fresh Start Accounting in Q2 FY2026, which splits the income statement into predecessor and successor periods and impacts the comparability of financial results due to fair value adjustments.

- Wolfspeed completed a financial restructuring, significantly strengthening its balance sheet with $1.3 billion in cash and short-term investments and reducing net debt to approximately $600 million. This included a $1.1 billion gain from emergence due to $3.7 billion in debt forgiveness and actions delivering $25 million in annual interest savings.

- The company fully transitioned to 200mm manufacturing by shutting down all 150mm operations ahead of schedule and is diversifying its revenue base beyond EVs, achieving 50% quarter-over-quarter growth in AI data center revenue.

- For Q3 fiscal 2026, Wolfspeed forecasts revenues between $140 million and $160 million, citing accelerated Q1 customer purchases, second sourcing, and weaker EV demand. Gross margin is expected to remain negative but improve sequentially.

- Wolfspeed is advancing its technology leadership, including the production of a 300 mm silicon carbide wafer and exploring its application for thermal conductance in high-growth markets like AI data centers.

- Wolfspeed reported Q2 2026 total revenue of $168 million, in line with guidance, with a non-GAAP gross margin of -34% and adjusted EBITDA of negative $82 million.

- The company ended the quarter with $1.3 billion in cash and short-term investments, reducing net debt to approximately $600 million after securing $700 million in tax credits and paying down $175 million of first lien debt.

- Wolfspeed is strategically diversifying its revenue base beyond automotive into industrial and energy, aerospace and defense, and materials, achieving 50% quarter-over-quarter growth in AI data center revenue from Q1 to Q2 2026.

- Operational improvements include the ahead-of-schedule shutdown of all 150mm manufacturing, fully transitioning to 200mm device manufacturing, and reducing non-GAAP operating expenses by $200 million on a run rate basis.

- Wolfspeed reported consolidated revenue of approximately $168 million and a GAAP net loss of $151 million for the second quarter of fiscal 2026, which ended December 28, 2025.

- The company ended the quarter with a strong balance sheet, holding $1.3 billion in cash, cash equivalents, and short-term investments.

- Wolfspeed achieved an approximate $200 million annualized operating expense reduction and a 90% year-over-year decrease in capital expenditures compared to the second quarter of fiscal 2025.

- AI datacenter revenue grew approximately 50% sequentially, reflecting an expanding part of the Company’s business.

- The company received approximately $700 million in Section 48D cash tax refunds and applied $175 million of the proceeds toward the retirement of long-term debt, following its emergence from Chapter 11 bankruptcy and adoption of fresh start accounting.

- Wolfspeed reported consolidated revenue of approximately $168 million and a GAAP net loss of $151 million for the second quarter of fiscal 2026, covering the Successor period from September 30, 2025, to December 28, 2025.

- The company ended the quarter with a strong balance sheet, holding $1.3 billion in cash, cash equivalents, and short-term investments as of December 28, 2025, after receiving $700 million in Section 48D cash tax refunds and using $175 million to retire long-term debt.

- Operational improvements included an annualized operating expense reduction of approximately $200 million and a 90% year-over-year decrease in capital expenditures compared to the second quarter of fiscal 2025.

- Wolfspeed emerged from Chapter 11 bankruptcy on September 29, 2025, and anticipates revenue between $140 million and $160 million for its fiscal third quarter.

- Wolfspeed, Inc. announced on January 30, 2026, that the Committee on Foreign Investment in the United States (CFIUS) formally cleared its equity issuance to Renesas Electronics America Inc., completing the final milestone of its prepackaged restructuring.

- As part of this, Wolfspeed issued 16,852,372 shares of common stock to Renesas and will release the remaining 871,287 shares to legacy pre-petition equity holders, completing their 5% equity recovery.

- Following these issuances, the company's total shares of common stock outstanding will increase to approximately 45.1 million.

- Aris Bolisay, Renesas's vice president of finance, has been appointed to Wolfspeed's Board of Directors, effective February 2, 2026.

- Wolfspeed announced CFIUS clearance for its equity issuance to Renesas Electronics America Inc., completing a key component of its court-approved restructuring plan.

- As part of the restructuring, Renesas, a pre-petition creditor, converted its outstanding unsecured loan into a combination of equity and secured convertible debt, and its vice president of finance, Aris Bolisay, will join Wolfspeed's Board of Directors.

- Following these equity issuances, Wolfspeed's total shares of common stock outstanding will increase to approximately 45.1 million, which includes 16,852,372 shares issued to Renesas and the final 2% equity recovery (871,287 shares) to pre-petition shareholders.

- Wolfspeed has achieved a technological breakthrough by producing a 300mm (12-inch) monocrystalline silicon carbide (SiC) wafer.

- This advancement is a strategic milestone for SiC technology, enabling scalable platforms for AI infrastructure, AR/VR, and advanced power devices.

- The company holds a significant intellectual property portfolio in SiC, with over 2,300 patents globally, positioning it to lead the transition to 300mm technology for mass commercialization.

- Wolfspeed has achieved a significant technological milestone by successfully producing a single crystalline 300mm (12-inch) silicon carbide wafer.

- This breakthrough is crucial for scalable production and enables new levels of performance for next-generation computing platforms, AI infrastructure, immersive AR/VR systems, and advanced high-performance components.

- The 300mm platform will support the integration of high-voltage power systems and advanced thermal solutions, addressing the increasing demands of AI workloads and enabling cost-effective satisfaction of demand for high-voltage grid transmission and industrial systems.

- This development also strengthens the US semiconductor industry and promotes a stable supply chain for critical compound semiconductors.

Fintool News

In-depth analysis and coverage of WOLFSPEED.

Quarterly earnings call transcripts for WOLFSPEED.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more