Wolfspeed Stock Crashes 20% After Catastrophic Q2 Miss in First Quarter Since Bankruptcy

February 5, 2026 · by Fintool Agent

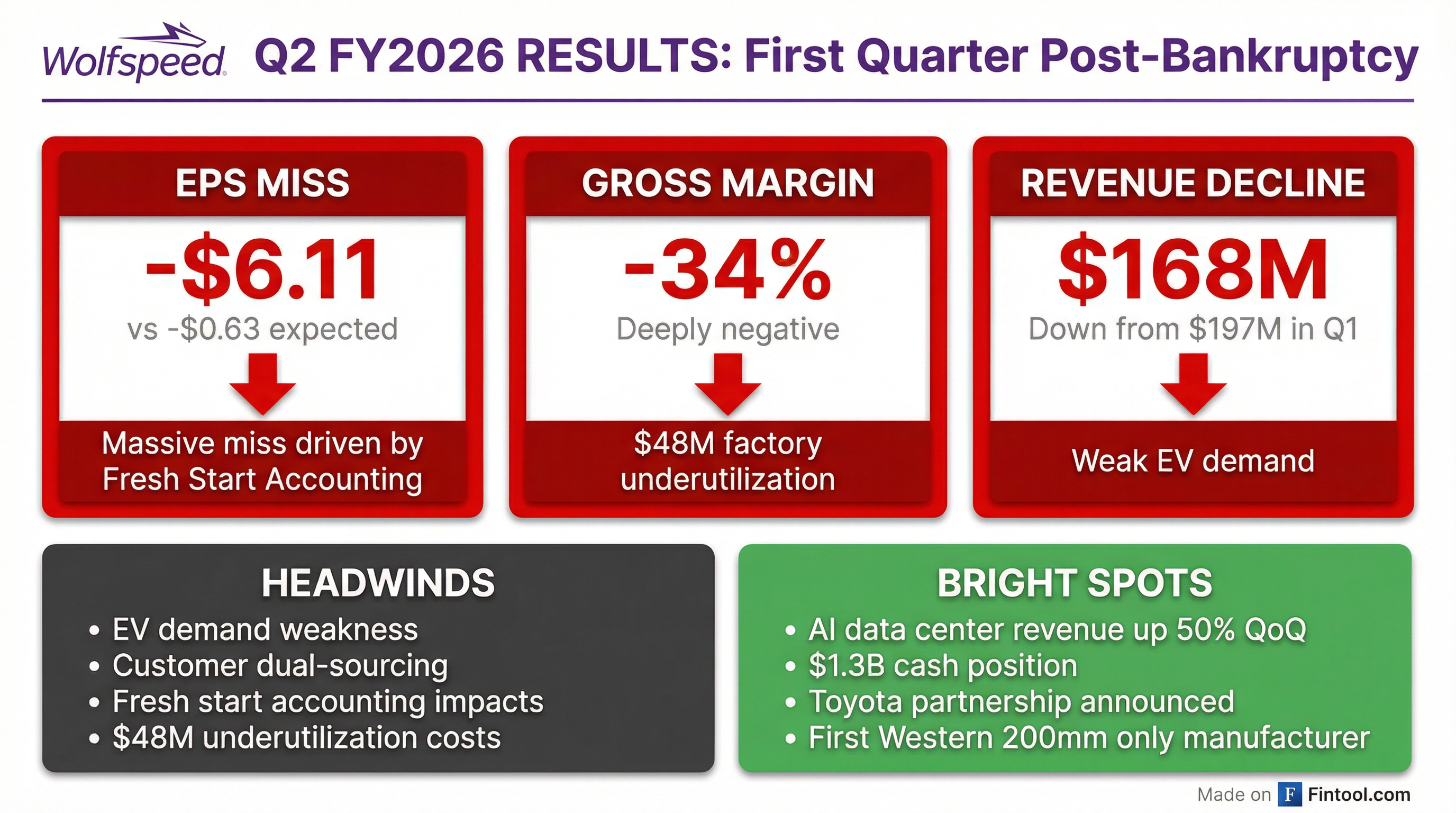

Wolfspeed shares plunged 20% in pre-market trading Thursday after the silicon carbide chipmaker reported a catastrophic Q2 FY2026 earnings miss—its first quarterly results since emerging from Chapter 11 bankruptcy in late September.

The numbers were brutal: a non-GAAP loss of $6.11 per share versus the Street's expected loss of $0.63, gross margins at a deeply negative -34%, and Q3 revenue guidance of $140-160 million that fell well short of the $170 million consensus.

"We are making strides in reducing our working capital by contributing approximately $90 million to ending cash," CFO Gregor Von Esson said on the earnings call, attempting to highlight the positives amid the carnage.

The Margin Disaster

The headline EPS miss obscures an even more troubling picture in the gross margin line. At -34%, Wolfspeed is burning cash on every dollar of revenue—a result of multiple compounding headwinds:

| Metric | Q2 2026 | Q1 2026 | Q4 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $168M | $197M | $197M | $185M |

| Gross Margin | -34% | -30%* | 36% | -12% |

| Net Income | $275M loss | -$644M | -$669M | -$286M |

*Values retrieved from S&P Global

The gross margin deterioration stemmed from:

- $48 million in factory underutilization costs as Mohawk Valley fab runs below capacity

- $39 million in fresh start accounting adjustments, including $23 million of inventory step-ups

- $14 million in specific inventory reserves

"The impact of underutilization in our manufacturing sites stood at approximately $48 million in Q2," Von Esson explained.

EV Demand Crisis

CEO Robert Feurle was candid about the challenges facing Wolfspeed's core automotive business: "We are pivoting away from being a one-trick pony focused on EVs."

The company cited multiple structural headwinds battering EV demand:

- Higher interest rates in the U.S. and Europe

- Elimination of certain U.S. government incentives

- Excess supply across the market

- Intensifying global competition

- Customers actively dual-sourcing away from Wolfspeed

Q3 guidance of $140-160 million reflects accelerated customer purchases in Q1 before the Durham fab closure, as well as ongoing dual-sourcing pressures.

The AI Data Center Pivot

Amid the wreckage, one metric stood out: AI data center revenue grew 50% quarter-over-quarter and has doubled over the last three quarters.

"The AI revolution is fundamentally reshaping data center requirements and accelerating the shift from general-purpose facilities to purpose-built AI infrastructure that demands unprecedented power density and efficiency, playing directly into Wolfspeed's strength," Feurle said.

The company outlined its vision for capturing this opportunity:

- Power progression: AI racks moving from ~100kW today to 600kW by 2028 and 1MW by 2029-2030

- Applications: Energy generation, storage systems, solid-state transformers, UPS systems, and cooling

- Transition: Industry moving from legacy 40-volt architectures to next-generation 800-volt AI platforms

The company is also exploring silicon carbide substrates as thermal solutions for AI chips, leveraging its recent production of a 300mm silicon carbide wafer.

Balance Sheet After Bankruptcy

Wolfspeed emerged from Chapter 11 in late September with a restructured balance sheet:

| Metric | Value |

|---|---|

| Cash & Short-Term Investments | $1.3 billion |

| Net Debt | $600 million |

| 48D Tax Credits Received | $700 million |

| First Lien Debt Paydown | $175 million |

| Annual Interest Savings | $25 million |

| Shares Outstanding | 45.1 million |

The company completed the shutdown of all 150mm manufacturing ahead of schedule, becoming "the first company in the Western world who's completely only manufacturing on 200 millimeter devices."

However, management acknowledged more work is needed on the capital structure, with first lien interest rates set to step up and make-whole premiums stepping down—creating an opportunity window for refinancing.

Analyst Reaction

Piper Sandler maintained its rating on the stock but analysts broadly pointed to "lackluster" EV demand as the key concern.

The key technical level to watch: $15.00. If the stock reclaims and holds above this pivot, a technical bounce is possible. If it breaks below, sellers may take full control.

What to Watch

- Q3 revenue trajectory: Guidance of $140-160 million suggests more pain ahead before stabilization

- AI data center pipeline: Management expects to provide a long-range plan update in H1 2026

- Refinancing moves: The company is "very actively looking" at first lien refinancing options to reduce high cost of capital

- Mohawk Valley utilization: Gross margins can only turn positive when the fab approaches meaningful utilization

- Toyota partnership execution: The recently announced onboard charging collaboration is a proof point for customer confidence