WORLD ACCEPTANCE (WRLD)·Q3 2026 Earnings Summary

World Acceptance Misses EPS on New Customer Investments; Stock Down 9%

January 27, 2026 · by Fintool AI Agent

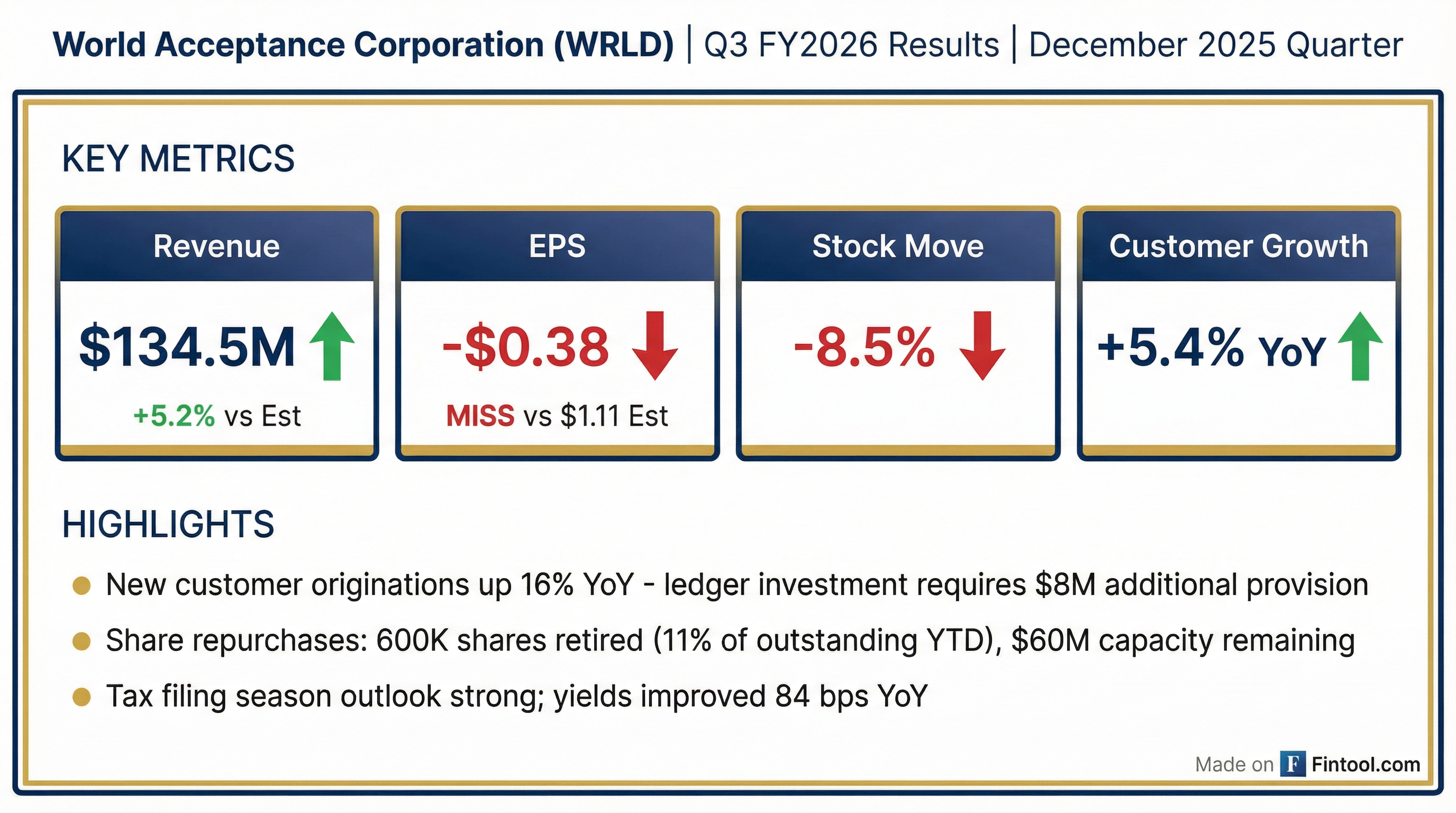

World Acceptance Corporation (WRLD) reported fiscal Q3 2026 results this morning, delivering a revenue beat but a significant EPS miss that sent shares tumbling 8.5%. The consumer finance company posted revenue of $134.5M (+5.2% vs consensus) but reported EPS of -$0.38 vs estimates of $1.11, as strategic investments in new customer originations required $8M in additional loan loss provisions.

Did World Acceptance Beat Earnings?

*Values retrieved from S&P Global

World Acceptance beat on the top line but significantly missed on the bottom line. The disconnect reflects management's deliberate decision to invest heavily in customer acquisition. New customer originations increased 16% YoY, with the outstanding ledger in the new customer segment up 25% compared to Q3 FY2025.

This growth came at a cost: approximately $8 million in additional loan loss provisions versus the same quarter last year, as new customers represent the company's riskiest segment.

What Changed From Last Quarter?

The big shift: Growth mode is back. After two years of portfolio contraction, World Acceptance is now expanding aggressively:

CEO Chad Prashad emphasized this is the strongest new customer quarter since calendar 2021: "The third quarter had the highest new customers since the same quarter of calendar 2021. Already, early performance indicates that these continue to be good investments in line with expectations."

Credit quality metrics are holding up despite the growth push—first pay defaults are running 19% lower than the fiscal 2022 cohort on a relative basis.

How Did the Stock React?

WRLD shares opened at $126.50 and sold off throughout the morning session, closing at $115.72—down 8.5% for the day. The stock is now trading near its 52-week low of $104.99, well below both the 50-day moving average ($144.50) and 200-day moving average ($154.05).

*Values retrieved from S&P Global

The sell-off reflects investor concern over the EPS miss magnitude, though management's commentary positioned the shortfall as intentional investment rather than portfolio deterioration.

Key Management Quotes

On investment philosophy:

"Our new customers are, again, our riskiest customer segment. This 25% increase in the new customer outstanding portfolio required around an $8 million additional provision for this customer segment in the same quarter last year... Already, early performance indicates that these continue to be good investments in line with expectations." — Chad Prashad, President & CEO

On yield improvements:

"Yields improved 84 basis points year-over-year, as income has also improved. We expect this trend to continue due to improved rates in a few states, continued discipline with credit limits and underwriting, improving customer retention as longer-tenured customers are also lower risk for us." — Chad Prashad, President & CEO

On tax season outlook:

"On the tax filing side, we do remain optimistic this will be a very strong tax year for us... We are expecting to see larger returns, larger refunds this year. A lot of those are probably due to some of the tax law changes last year that would affect our customer base in particular." — Chad Prashad, President & CEO

Capital Allocation: Aggressive Buybacks Continue

World Acceptance has been an aggressive buyer of its own shares:

At yesterday's closing price, the remaining buyback capacity could retire approximately 9% of outstanding shares. Combined with the 11% already retired this fiscal year, the company could reduce its share count by 20% in FY2026 alone.

G&A Expense Dynamics

G&A growth was driven by three factors, all of which management characterized as temporary or deliberate:

-

Share-based compensation: A December grant from last year has now been fully expensed. CFO Johnny Calmes noted incentive compensation should decline "starting with Q4."

-

Personnel overstaffing: The company intentionally overstaffed branches in anticipation of turnover among underperformers. Management expects a 3-5% headcount reduction "pretty quickly within this quarter."

-

Field incentives: Branch-level incentives elevated but expected to "tighten a little bit as we move forward."

Q&A Highlights

On consumer health: The company has not seen degradation in collections or credit quality despite macro concerns. There has been a "slight increase in demand" and a "significant decrease in cost of acquisition for higher credit quality new customers."

On tariff/regulatory risk: When asked about a potential 10% credit card rate cap, Prashad estimated it would severely restrict credit access for anyone below 750-780 credit score, which could drive demand for installment loans. The company's own credit card portfolio remains small (a few million dollars outstanding across 46 states).

On branch staffing reduction: The 3-5% headcount reduction is related to "underperformers" based on collections ability, overall performance, and engagement. The company overstaffed proactively to ensure smooth transitions.

Management Transition

CEO Prashad announced the upcoming retirement of Clint Dyer after 30 years with the company: "Clint's added tremendous value to our branch leadership over the decades and has produced many of our key leaders under his mentorship."

Tobin Turner is stepping in to lead branch operations, bringing "deep knowledge of analytics and marketing as well as retail operations."

Forward Catalysts

Historical Performance

*Values retrieved from S&P Global

World Acceptance has consistently beaten revenue estimates in 6 of the last 8 quarters, but the last two quarters have seen significant EPS misses as the company prioritizes growth investments.

The Bottom Line

World Acceptance's Q3 results represent a tale of two narratives. Bulls will point to:

- Strongest customer acquisition since 2021

- Credit quality holding (first pay defaults down 19% vs prior peak)

- Aggressive buybacks reducing share count 20%+ this year

- Tax season tailwinds ahead

- Yield improvement trajectory intact

Bears will counter with:

- Significant EPS miss two quarters running

- Investment period of uncertain duration

- Stock near 52-week lows despite buybacks

- Consumer finance sector macro concerns

The market voted with the bears today, but management's confidence in new customer quality will be tested in coming quarters as these cohorts season.