Earnings summaries and quarterly performance for WORLD ACCEPTANCE.

Executive leadership at WORLD ACCEPTANCE.

Chad Prashad

President and Chief Executive Officer

Clinton Dyer

Executive Vice President, Chief Branch Operations Officer

Jason Childers

Senior Vice President, Information Technology

John Calmes Jr.

Executive Vice President, Chief Financial and Strategy Officer, and Treasurer

Lindsay Caulder

Senior Vice President, Human Resources

Luke Umstetter

Senior Vice President, General Counsel, Chief Compliance Officer, and Secretary

Scott McIntyre

Senior Vice President, Accounting

Board of directors at WORLD ACCEPTANCE.

Research analysts who have asked questions during WORLD ACCEPTANCE earnings calls.

Recent press releases and 8-K filings for WRLD.

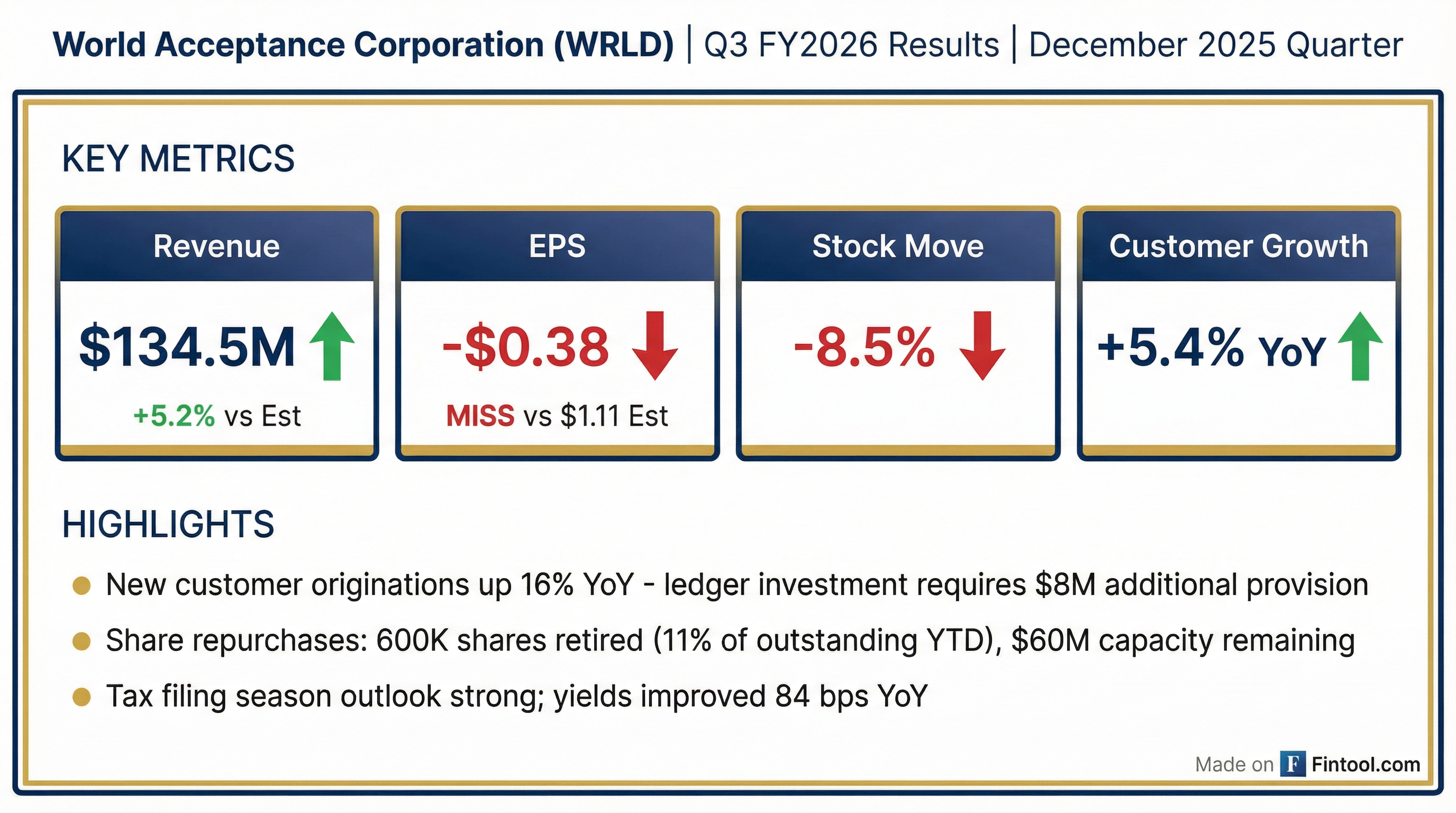

- World Acceptance Corporation originated 16% more new customer volume and ended Q3 2026 with 25% more outstanding ledger in active new customers year-over-year, requiring an $8 million additional provision for this segment.

- The company's customer base grew 5.4% organically year-over-year, and yields improved by 84 basis points year-over-year.

- In the first nine months of the year, the company repurchased nearly 600,000 shares, reducing outstanding shares by 11%, and has over $60 million remaining capacity for repurchases.

- Management is optimistic about the upcoming tax season, expecting an increase in tax filing volume and revenue due to anticipated larger refunds.

- Personnel expenses are projected to decrease, with the incentive line for share-based compensation expected to come down starting in Q4, and a 3-5% headcount reduction planned for the current quarter.

- World Acceptance Corporation experienced significant growth in Q3 2026, with new customer volume increasing by 16% and the outstanding ledger in active new customers growing by 25% year-over-year. The customer base expanded 5.4% organically.

- The company repurchased nearly 600,000 shares in the first nine months of the fiscal year, reducing outstanding shares by 11%, and has over $60 million remaining capacity for repurchases.

- Yields improved by 84 basis points year-over-year, and the company anticipates a decrease in incentive compensation expense starting in Q4.

- Management is optimistic about the current tax filing season, expecting increased demand and larger refunds.

- World Acceptance Corporation (WRLD) reported strong growth in Q3 2026, with 16% more new customer volume and 25% more outstanding ledger in active new customers year-over-year, requiring an $8 million additional provision for this segment.

- The company's customer base expanded 5.4% organically year-over-year, and yields improved by 84 basis points. First pay defaults on new customers were 19% lower compared to Q3 2021.

- WRLD repurchased nearly 600,000 shares in the first nine months of the year, reducing outstanding shares by 11%, and has over $60 million remaining capacity for repurchases.

- Management expects incentive compensation to decrease starting in Q4 and anticipates a very strong tax year due to increased demand and larger refunds.

- World Acceptance reported a Q3 loss of $0.19 per share against expectations for a profit, despite revenues beating consensus at approximately $141.3 million. This loss was influenced by higher loss provisions, incentive compensation, and temporary operational inefficiencies.

- The company demonstrated strong momentum in customer growth, with new-customer origination volume rising about 16% and outstanding new-customer ledger growing roughly 25%, the strongest new-account acquisition since Q3 2021. Organic customer count grew 5.4% and organic ledger rose 2.4% year-over-year.

- Credit quality improved, with first-pay defaults on new customer cohorts about 19% lower and gross yields improving by 84 basis points year over year. Management expressed confidence that tighter underwriting and improving portfolio fundamentals should support lower losses and stronger returns over time.

- World Acceptance repurchased nearly 600,000 shares, reducing outstanding shares by approximately 11%, with about $60 million of repurchase capacity remaining.

- The company plans modest field-office headcount cuts (3%-5%) and expects incentive compensation expenses to decline.

- World Acceptance Corporation reported a net loss of $0.9 million for the third quarter of fiscal 2026, a $14.3 million decrease from net income in the prior-year quarter, despite total revenues increasing 1.9% to $141.3 million.

- The company's gross loans outstanding increased 1.5% to $1.40 billion as of December 31, 2025, and its unique customer base grew 4.1% year over year, reflecting a resumed strategy of targeted growth focusing on new customers.

- The provision for credit losses rose $7.3 million to $51.4 million in Q3 FY26, and net charge-offs as a percentage of average net loans increased to 18.7%, primarily due to the higher proportion of new customers.

- General and administrative expenses increased 16.1% to $78.1 million, largely due to a 24.9% increase in personnel expense, including a $5.0 million increase in share-based compensation.

- The company repurchased 102,559 shares for approximately $15.0 million during the third quarter of fiscal 2026, bringing the fiscal year-to-date repurchases to 11.0% of outstanding shares, while its debt to equity ratio increased to 1.9:1.

- World Acceptance Corporation reported a net loss of $0.9 million and a net loss per diluted share of $0.19 for the third fiscal quarter ended December 31, 2025, a decrease from net income of $13.4 million in the prior year's comparable quarter.

- Total revenues for the third quarter of fiscal 2026 increased 1.9% to $141.3 million, driven by a 1.5% increase in gross loans outstanding to $1.40 billion as of December 31, 2025, and a 4.1% increase in the customer base year-over-year.

- The provision for credit losses increased by $7.3 million to $51.4 million in Q3 FY 2026, primarily due to growth in new customers, who carry a substantially higher reserve for loan losses under the company's allowance methodology.

- General and administrative expenses rose 16.1% to $78.1 million in the third quarter of fiscal 2026, largely due to a 24.9% increase in personnel expense, which included a $5.0 million increase in share-based compensation.

- The company repurchased 102,559 shares for approximately $15.0 million during the third fiscal quarter of 2026, contributing to a total of 11.0% of its outstanding shares repurchased fiscal year-to-date.

- World Acceptance Corporation reported $1.61 per share after tax in total impact from three unusual events in Q2 2026, comprising $0.57 from early bond redemption, $0.26 from Mexico operations-related tax expense, and $0.78 from increased provision due to new customer growth.

- The company achieved its most significant new customer growth in four years, with the new customer portfolio 35% larger year over year and new customer origination volume increasing 40% year over year in Q2 2026. This growth contributed to a 1.5% year-over-year increase in the overall portfolio by the end of Q2 2026.

- Long-term incentive compensation expenses were $5.8 million in Q2 2026, marking a $23.9 million net increase year-over-year due to a prior plan reversal in the previous year, making year-over-year comparisons difficult.

- The company repurchased and canceled the remaining $170 million of its bonds and secured a new credit agreement increasing commitments to $640 million. Year to date, 9.1% of shares (approximately $80 million) have been repurchased, with an additional $77 million capacity remaining for this year.

- World Acceptance Corporation reported $1.61 per share after tax in one-off expenses for Q2 2026, which included $0.57 from early bond redemption, $0.26 from discontinued Mexico operations, and $0.78 from increased provision due to new customer growth.

- The company experienced a $23.9 million net increase in long-term incentive compensation expenses year-over-year in Q2 2026, with $5.8 million expensed this quarter and similar amounts expected for Q3 before reducing.

- New customer origination volume increased 40% year-over-year in Q2 2026, contributing to a 1.5% year-over-year portfolio growth and a 130 basis point increase in portfolio yield.

- World Acceptance repurchased 9.1% of its shares year-to-date, totaling approximately $80 million, and has capacity for an additional $77 million in repurchases this year, with a new credit agreement allowing repurchases up to 100% of net income.

- WORLD ACCEPTANCE CORPORATION's 8-K filing details a Credit Agreement outlining servicer termination events and events of default, which include non-compliance with covenants, insolvency, and a change in control.

- The Credit Agreement establishes financial covenants for World Acceptance, requiring its Tangible Net Worth to be not less than $305,000,000, Debt to Tangible Net Worth not greater than 2.25 to 1.00, Liquidity Amount not less than $35,000,000, and unrestricted cash and Cash Equivalents not less than $5,000,000.

- Additional events of default include final non-appealable judgments against World Acceptance Entities exceeding $5,000,000 in aggregate, or $50,000 for the Borrower.

- The agreement also sets Concentration Limits for eligible receivables, such as no more than 37.50% of the aggregate Eligible Receivables Principal Balance from the state with the highest concentration, and limits on receivables with lower credit scores, including no more than 15.00% with a FICO® Score of less than 541.

Quarterly earnings call transcripts for WORLD ACCEPTANCE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more