Earnings summaries and quarterly performance for WEYERHAEUSER.

Executive leadership at WEYERHAEUSER.

Board of directors at WEYERHAEUSER.

Al Monaco

Director

Deidra Merriwether

Director

James O’Rourke

Director

Kim Williams

Director

Lawrence Selzer

Director

Mark Emmert

Director

Nicole Piasecki

Director

Rick Holley

Chairman of the Board

Sara Grootwassink Lewis

Director

Research analysts who have asked questions during WEYERHAEUSER earnings calls.

Ketan Mamtora

BMO Capital Markets

6 questions for WY

Mark Weintraub

Seaport Research Partners

6 questions for WY

George Staphos

Bank of America

5 questions for WY

Hamir Patel

CIBC Capital Markets

5 questions for WY

Matthew McKellar

RBC Capital Markets

5 questions for WY

Anthony Pettinari

Citigroup Inc.

4 questions for WY

Hong Zhang

JPMorgan Chase & Co.

4 questions for WY

Kurt Yinger

D.A. Davidson & Co.

4 questions for WY

Michael Roxland

Truist Securities

4 questions for WY

Susan Maklari

Goldman Sachs Group Inc.

3 questions for WY

Charles Barone

Goldman Sachs

2 questions for WY

Niccolo Piccini

Truist Securities

2 questions for WY

Brad Barton

Bank of America

1 question for WY

Buck Horne

Raymond James Financial, Inc.

1 question for WY

Matt McKellar

RBC Capital Markets

1 question for WY

Recent press releases and 8-K filings for WY.

- Weyerhaeuser targets $1.5 billion of incremental Adjusted EBITDA by 2030 versus a 2024 baseline, driven by growth initiatives across its Timberlands, Strategic Land Solutions and Wood Products segments.

- Over the past five years, segments have delivered leadership results: Timberlands generated ~$650 million in Adjusted EBITDA, Strategic Land Solutions ~$340 million, and Wood Products ~$370 million, with #1 margins in manufacturing businesses.

- Since 2021, the company has returned >$6 billion to shareholders—including $1.1 billion in share repurchases—and raised its base dividend by >5% annually, while investing $2.3 billion in capital expenditures.

- Maintains an investment-grade profile (Moody’s Baa2, S&P BBB), targets a 3.5× net leverage ratio and holds $1.75 billion of available revolving liquidity.

- The board declared a quarterly base cash dividend of $0.21 per share, payable March 20, 2026, to shareholders of record as of March 10, 2026.

- Under its cash return framework, the company aims to return 75–80% of annual Adjusted Funds Available for Distribution (Adjusted FAD) to shareholders.

- Management retains the flexibility to deliver variable cash returns through a supplemental dividend, opportunistic share repurchases, or a combination of both.

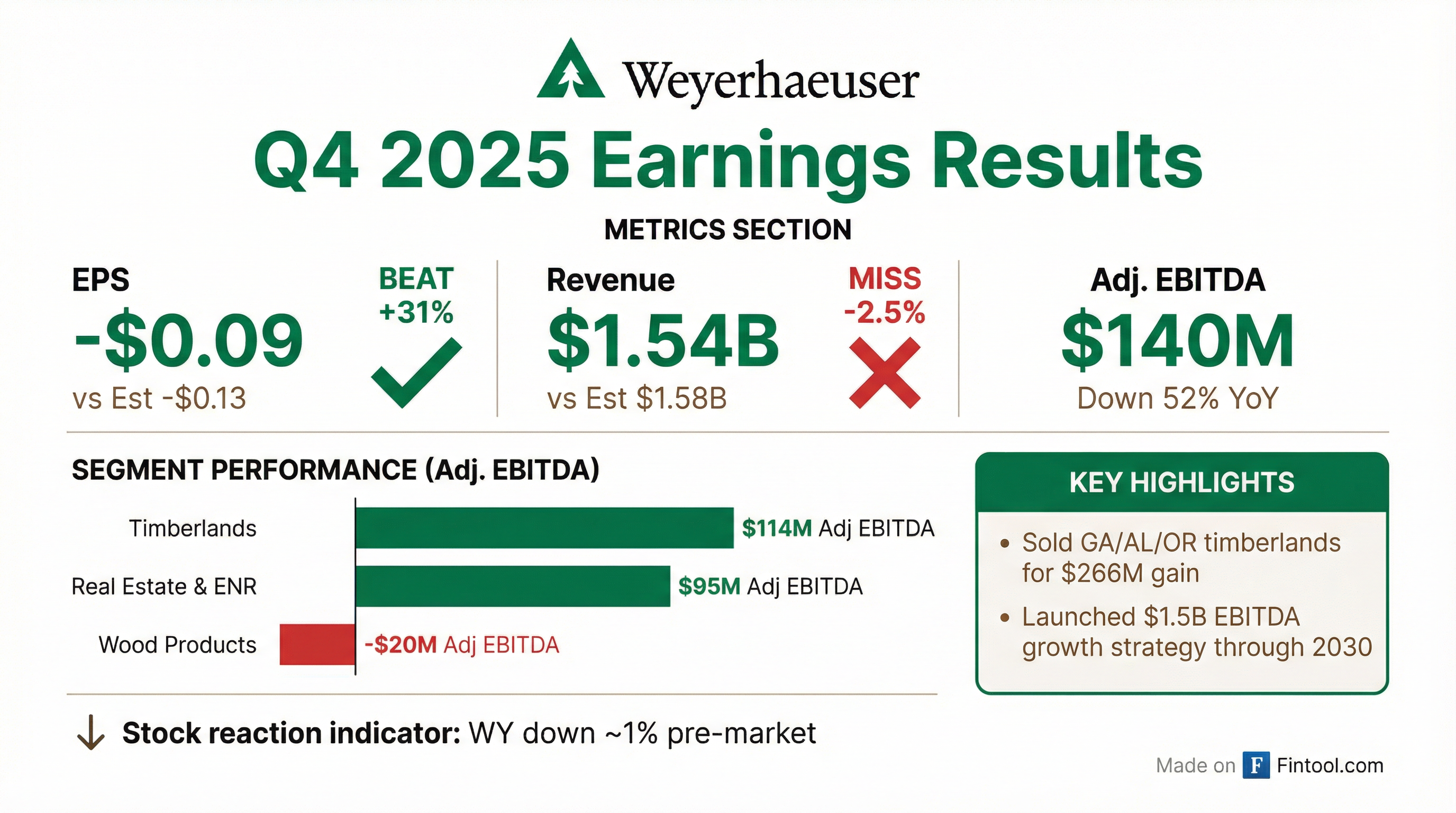

- Weyerhaeuser reported Q4 2025 net sales of $1.54 billion and a gross margin of $161 million.

- Q4 2025 Adjusted EBITDA was $140 million, down $77 million from Q3 2025. Segment contributions were timberlands $114 million and real estate, energy & natural resources $95 million ; wood products –$20 million and unallocated items –$49 million.

- Net earnings for Q4 2025 were $74 million, with diluted EPS of $0.10, versus $80 million and $0.11 EPS in Q3 2025.

- For full-year 2025, Adjusted EBITDA fell to $1.021 billion from $1.292 billion in 2024; net earnings were $324 million and diluted EPS $0.45.

- Delivered full-year GAAP earnings of $324 million ( $0.45 per diluted share) on net sales of $6.9 billion, with adjusted EBITDA of $1 billion; Q4 GAAP earnings were $74 million ( $0.10 per share) on net sales of $1.5 billion, with adjusted EBITDA of $140 million.

- Returned $766 million of cash to shareholders in 2025, including a 5 % dividend increase and $160 million of share repurchases; announced a new $1 billion buyback authorization.

- Completed Q4 divestitures of non-core timberlands for $406 million and agreed to sell ~108,000 acres in Virginia for $193 million, further optimizing the Timberlands portfolio.

- Provided Q1 2026 outlook: expects Timberlands earnings and adjusted EBITDA to be comparable to Q4 2025; anticipates seasonally stronger lumber and OSB performance driving modest EBITDA gains in Wood Products.

- Achieved 2021–2025 multi-year targets and outlined an accelerated growth strategy to deliver $1.5 billion of incremental adjusted EBITDA by 2030.

- Weyerhaeuser reported full-year GAAP earnings of $324 million ($0.45/share) on $6.9 billion net sales; Q4 GAAP earnings were $74 million ($0.10/share) on $1.5 billion net sales, with adjusted EBITDA of $140 million and a special-item loss of $67 million (-$0.09/share).

- Timberlands ex-special items contributed $50 million in Q4, with adjusted EBITDA of $114 million, down $34 million sequentially due to lower sales volumes and realizations in the West.

- Lumber posted a Q4 adjusted EBITDA loss of $57 million (14% lower production, 3% lower realizations), OSB a $10 million loss, engineered wood EBITDA of $49 million, and distribution EBITDA down $2 million.

- Generated $562 million of cash from operations in 2025 (or $762 million ex-pension), ended with ~$500 million cash and $5.6 billion debt, returned $766 million to shareholders (including $160 million in buybacks), raised the dividend 5%, and completed a $455 million pension liability transfer (after-tax charge of $111 million).

- Q1 2026 outlook: expect Timberlands EBITDA and wood products earnings to be comparable or slightly higher vs. Q4; full-year interest expense of ~$255 million, effective tax rate of 8–12%, and total CapEx of $400–450 million plus ~$300 million for the new Arkansas EWP facility.

- Full-year 2025 GAAP earnings were $324 million or $0.45 per share on $6.9 billion of net sales; excluding special items, earnings were $143 million or $0.20 per share, with $1 billion of adjusted EBITDA.

- Q4 2025 GAAP earnings were $74 million or $0.10 per share; excluding special items, a loss of $67 million (–$0.09 per share), and $140 million of adjusted EBITDA.

- Timberlands delivered Q4 adjusted EBITDA of $114 million (down $34 million QoQ) on softer volumes/pricing; full-year Real Estate & ENR adjusted EBITDA was $411 million, and Climate Solutions reached $119 million, up 42% YoY.

- Wood Products posted a Q4 adjusted EBITDA loss of $20 million (Lumber –$57 million; OSB –$10 million; EWP +$49 million) amid historically weak markets.

- Returned $766 million of cash to shareholders (5% dividend increase and $160 million of share repurchases) and closed divestitures totalling $406 million, with an additional $193 million sale pending.

- Full year net earnings of $324 million and Adjusted EBITDA of $1 billion in 2025

- Returned $766 million in total cash to shareholders, including $160 million of share repurchases in 2025

- Completed prior $1 billion share repurchase program and authorized a new $1 billion buyback in 2025

- Exceeded 2025 Climate Solutions financial target with significant year-over-year growth

- Launched a new strategy to accelerate growth through 2030 and enhanced timberlands portfolio via strategic transactions

- Weyerhaeuser outlined a multi-year growth program to deliver an incremental $1.5 billion of Adjusted EBITDA by 2030 over its 2024 baseline, funded by $1.5–$2.5 billion of gross investments while maintaining an investment-grade rating.

- Timberlands and Strategic Land Solutions growth driven by higher yields per acre, increasing harvestable acres, and $35 million of additional value from conservation, mitigation, and renewable energy opportunities.

- Wood Products expansion anchored on a $500 million TimberStrand plant in Arkansas (startup H1 2027) expected to double TimberStrand capacity, boost EWP capacity by 24%, and deliver over $100 million of annual EBITDA at full run-rate.

- Real estate to monetize 150,000 acres in the Sun Belt at premiums of 2–20× timber value, and Construction Materials to add 13 quarries (+25%) to serve 18 markets by 2030.

- Climate Solutions reached $100 million of Adjusted EBITDA in 2025 and aims for $250 million of annual EBITDA by 2030, including $170 million incremental from forest carbon, renewables, biocarbon (Amium JV), and other initiatives.

- Weyerhaeuser will deliver an incremental $1.5 billion in Adjusted EBITDA by 2030 over its 2024 baseline, comprising $1 billion from targeted business initiatives and $500 million from pricing improvements.

- Growth initiatives span timberlands optimization, Strategic Land Solutions (real estate and climate solutions), wood products enhancements—including a $500 million TimberStrand facility in Arkansas—and enterprise-wide OPEX and AI-driven projects to unlock synergies.

- The plan entails $1.5 – $2.5 billion of gross investments while maintaining an investment-grade balance sheet, projected to increase enterprise value by over $20 billion and triple adjusted funds available for distribution by 2030.

- At its 2025 Investor Day, Weyerhaeuser unveiled a multi-year growth program designed to deliver $1.5 billion of incremental adjusted EBITDA by 2030 over a 2024 baseline, driven by initiatives across timberlands, Strategic Land Solutions, wood products, and enterprise functions.

- The company has optimized its timberland portfolio by divesting 1.3 million acres of lower‐value land and acquiring 530 000 acres of high‐productivity timberlands, doubling harvest volumes on acquired lands and adding an average $60 million of annual cash flow per acquisition over five years.

- Weyerhaeuser’s Climate Solutions business reached its $100 million adjusted EBITDA target in 2025, while operational excellence and integration efforts have generated $500 million in margin improvements since 2014 and $100 million in wood products synergies since 2020.

- The capital allocation framework commits to returning 75 – 80% of Adjusted Funds After Distributions (FAD) to shareholders; since 2021, $8.6 billion has been deployed, including $6 billion in dividends and buybacks, while retaining 20 – 25% of cash flow for growth.

- Leveraging its integrated platform and investment in technology and innovation, Weyerhaeuser targets over $100 million of annual synergies and is expanding automation projects, including advanced mill automation and robotics in maintenance.

Quarterly earnings call transcripts for WEYERHAEUSER.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more