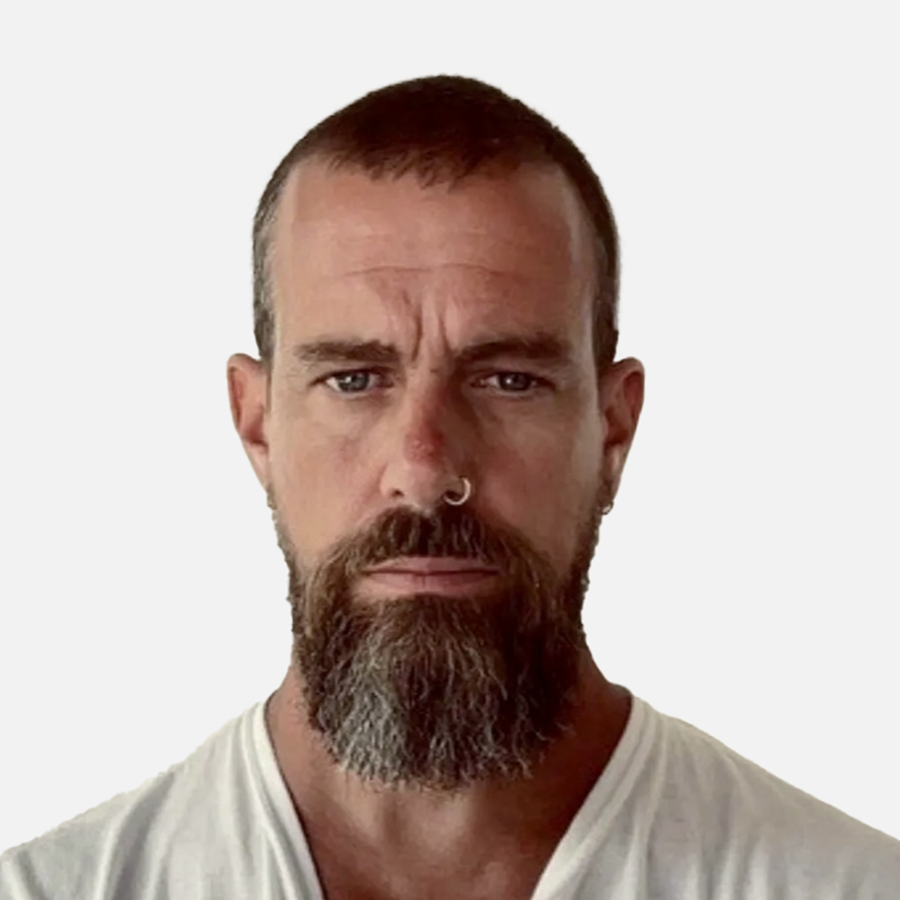

Jack Dorsey

About Jack Dorsey

Co-founder of Block (ticker: XYZ), Jack Dorsey serves as Block Head (principal executive officer) and Chairperson of the Board (director since 2009; Chair since 2010; title changed from CEO to Block Head in April 2022). Age 48 as of April 25, 2025. Background includes two tenures as CEO of Twitter and director roles at Twitter (2007–2022). Block’s pay-versus-performance disclosure shows TSR of $135.85 on a $100 investment since 12/31/2019 and 2024 net income of $2.897 billion, providing context on performance under current leadership .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Block, Inc. | Co-founder; CEO/President (2009–Apr 2022); Block Head (Apr 2022–present); Chairperson (since Oct 2010) | 2009–present | Selected for board due to founder perspective and technology/innovation experience . |

| Block, Inc. (Square) | Square Head (for 2023 and a portion of 2024) | 2023–2024 | Leadership of Square ecosystem during transition period . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Twitter, Inc. | President & CEO (May 2007–Oct 2008); CEO (Jul 2015–Nov 2021) | 2007–2021 | Led platform during significant growth phases . |

| Twitter, Inc. | Director | 2007–2022 | Board service through May 2022 . |

Fixed Compensation

Summary compensation for Jack Dorsey (no equity or bonus; $2.75 annual salary at his request):

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Salary ($) | 2.75 | 2.75 | 2.75 |

| Stock Awards ($) | — | — | — |

| Option Awards ($) | — | — | — |

| All Other Comp ($) | — | — | — |

| Total ($) | 2.75 | 2.75 | 2.75 |

- At his request, Dorsey receives no cash or equity compensation other than $2.75 annual salary; compensation committee affirmed alignment via his significant ownership .

Performance Compensation

- None. Dorsey waived equity and bonus; no performance-based cash plan applies to him .

For reference on company incentive design (other NEOs): Block uses a simplified structure emphasizing equity (approx. 50% options, 50% RSUs) with time-based vesting; no company-wide performance cash bonus in 2024 .

Equity Ownership & Alignment

| Item | Value |

|---|---|

| Class A shares beneficially owned | 1,000,000 (via GRATs) |

| Class B shares beneficially owned | 47,844,566 (79.7% of Class B) |

| Percent of total voting power | 41.3% |

| Ownership vehicles | Jack Dorsey Revocable Trust (35,763,992 Class B); Start Small, LLC (12,080,574 Class B); GRATs hold Class A |

| Ownership guidelines (Block Head) | Greater of 5x salary or $2 million; all executives/directors met or are on track |

| Hedging/pledging | Prohibited by Insider Trading Policy |

| Vested/unvested awards | No outstanding equity awards or vesting for Dorsey in 2024 (no option exercises/RSU vesting) |

Implications: Alignment is driven by founder holdings and voting control; no scheduled vesting-driven sell pressure for Dorsey (policy also prohibits hedging/pledging) .

Employment Terms

Change-in-control and severance economics specific to the Block Head differ from other NEOs:

| Scenario (as of 12/31/2024) | Cash Comp ($) | Health Benefits ($) | Equity Acceleration |

|---|---|---|---|

| Termination without cause (outside CoC period) | 2.06 (75% of base salary) | 222 (9 months COBRA equivalent) | — (none for Dorsey) |

| Termination without cause or for good reason (within CoC period) | 2.75 (100% base salary) | 443 (12 months COBRA equivalent) | — (Dorsey has no outstanding awards) |

- Block Head agreement excludes the Transition Period clause applicable to other NEOs; NEOs (not the Block Head) may receive partial time-based vesting outside CoC and full acceleration within CoC; no tax gross-ups; 280G cutback applies .

Board Governance

- Dual role: Chairperson and principal executive officer (Block Head); Board uses a Lead Independent Director (Roelof Botha) with enumerated oversight authorities due to non-independence of the Chair/CEO .

- Board composition: 10 directors; 6 independent; all committees (Audit & Risk; Compensation; Nominating & Governance) are 100% independent .

- Attendance: In 2024, the board held four meetings; each director attended at least 75% of board and committee meetings during their service .

- Committee leadership: Audit & Risk (Chair: Paul Deighton); Compensation (Chair: Mary Meeker); Nominating & Governance (Chair: Randall Garutti) .

Director Compensation (context)

- Employee directors receive no additional director compensation (Dorsey was the only employee-director in 2024) .

- Outside Director policy (amended April 1, 2025): annual cash retainer $50,000; annual equity retainer $275,000 RSUs; chair/member retainers increased (e.g., Audit Chair $35,000; Audit member $17,500; Comp Chair $25,000; Comp member $12,500; N&G Chair $20,000; N&G member $10,000); Lead Independent Director additional $70,000 RSUs; outside director awards fully vest on change in control .

Performance & Track Record (company context)

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| TSR ($100 initial investment at 12/31/2019) | 347.89 | 258.17 | 100.45 | 123.64 | 135.85 |

| Net Income (Loss) ($000s) | 213,105 | 166,284 | (540,747) | 9,772 | 2,897,047 |

Say-on-pay support was ~98% in 2024 and management maintained the equity-heavy, simplified compensation design following shareholder feedback .

Compensation Structure Analysis

- Founder-led pay posture: Dorsey’s $2.75 salary and no equity/bonus indicates alignment via substantial ownership rather than pay package; no guaranteed or discretionary bonuses; no equity awards to reprice or modify .

- Risk controls: Robust clawbacks (SEC/NYSE restatement policy and severance clawback), stock ownership guidelines, and prohibitions on hedging/pledging are in place .

- Dilution context: 2025 Equity Incentive Plan seeks 80,000,000 shares (~13% of outstanding) for future grants; plan excludes repricing without shareholder approval and lacks evergreen and excise tax gross-ups; outside director awards single-trigger on CoC; others rely on double-trigger concepts via Award/Service Agreements .

Compensation Peer Group (benchmarking context)

Affirm; Airbnb; Autodesk; Coinbase; DoorDash*; eBay; Fiserv; Global Payments; Intuit; Palo Alto Networks; PayPal; ServiceNow; Shopify; Snap; Toast*; Twilio; Uber; Workday; Zoom. Block ranked at the 88th percentile on TTM GAAP revenue and 45th percentile on market cap at the time of peer selection. Pay Governance engaged in 2024; independence affirmed .

Related Party Transactions (conflict checks)

- 2024–2025 related-party items disclosed involve Roc Nation (director Shawn Carter), Shake Shack services (former director/CEO Randall Garutti), and a St. Louis lease (director James McKelvey). No related-party transactions involving Dorsey were disclosed .

Say-on-Pay & Shareholder Feedback

- 2024 say-on-pay approval: approximately 98% in favor; committee retained equity-heavy, simplified structure and annual frequency for future votes .

Expertise & Qualifications

- Founder/operator with extensive technology and innovation leadership; selected for the board for founder perspective and industry experience .

Investment Implications

- Alignment: Dorsey’s minimal cash pay and lack of equity grants focuses incentives on long-term value via sizable voting control (41.3% VP) and ownership; absence of vesting events reduces forced selling pressure .

- Governance: Combined Chair/CEO structure is counterbalanced by a strong Lead Independent Director and fully independent committees; policy suite (clawbacks, ownership guidelines, hedging/pledging bans) lowers governance risk .

- Dilution/headcount incentives: The 2025 EIP’s 80M-share authorization (~13% incremental dilution) supports talent retention but bears monitoring for grant discipline and shareholder dilution over time .

- Shareholder sentiment: Strong say-on-pay support (98%) and stable design suggest low near-term compensation controversy risk .