Block Cuts Up to 10% of Workforce in Third Major Layoff Round

February 8, 2026 · by Fintool Agent

Jack Dorsey's Block is preparing to cut up to 10% of its workforce—roughly 1,100 positions—through annual performance reviews, marking the fintech company's third significant layoff round in two years as it pushes toward profitability targets despite accelerating gross profit growth.

The cuts are happening across multiple teams as managers conduct year-end evaluations through late February, according to Bloomberg. Block had fewer than 11,000 employees as of late November 2025.

Shares of Block closed Friday at $55.97, up 4.8% on the day, though the stock remains down approximately 37% from its 52-week high and has declined 13% year-to-date.

A Pattern of Workforce Reductions

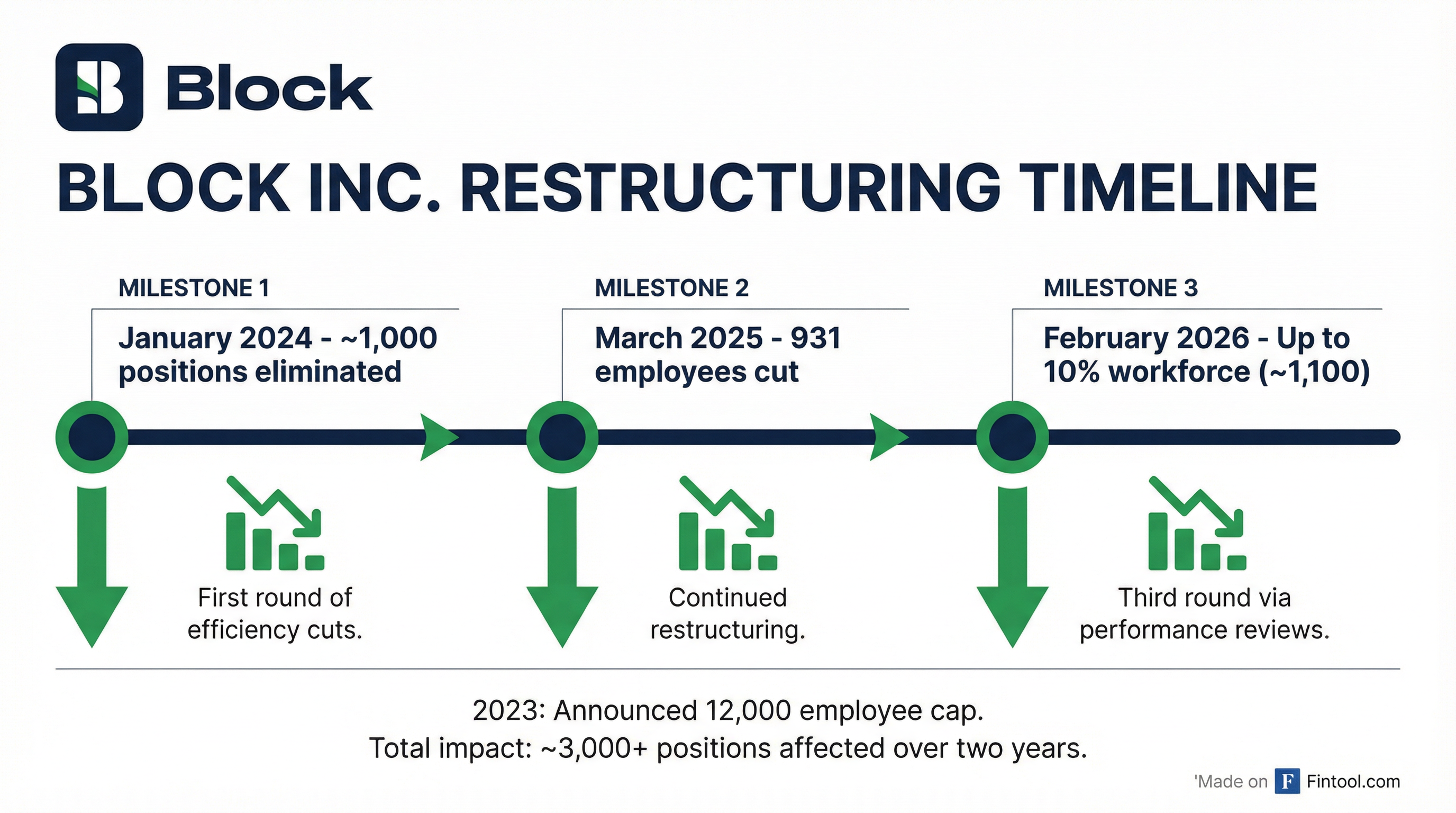

This marks Block's third major workforce reduction in roughly two years:

| Period | Layoffs | Context |

|---|---|---|

| January 2024 | 1,000 positions | Initial restructuring under 12,000 employee cap |

| March 2025 | 931 employees | Continued efficiency push |

| February 2026 | Up to 1,100 (10%) | Performance review-based cuts |

Block announced in 2023 that it would implement an "absolute cap" of 12,000 employees, which it achieved in 2024. The company has since stated its intention to remain below this cap through "performance management, centralization of teams and functions to reduce duplication, and prioritization of our scope."

Through the first nine months of 2025, Block recorded $79.5 million in severance and restructuring expenses related to these efficiency efforts.

Financial Performance: Growth Meets Margin Pressure

The layoffs come as Block navigates a challenging position: strong topline growth that hasn't translated into consistent earnings beats.

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($B) | $5.77 | $5.96 | $6.16 | $5.98 | $6.03 | $5.77 | $6.05 | $6.11 |

| Gross Profit ($B) | $2.04 | $2.11 | $2.25 | $2.27 | $2.33 | $2.30 | $2.55 | $2.68 |

| Net Income ($M) | $102 | $472 | $195 | $284 | $1,946 | $190 | $538 | $462 |

| EBITDA Margin % | 1.9% | 5.9% | 6.5% | 6.9% | 3.0% | 7.3% | 9.5% | 8.2% |

In Q3 2025, Block missed Wall Street estimates on both revenue ($6.11B vs. $6.31B expected) and adjusted EPS ($0.54 vs. $0.66 expected), sending shares down nearly 10% in after-hours trading.*

However, the quarter also showcased Block's growth engines firing:

- Gross profit: $2.68 billion, up 18% YoY (accelerating from 14% in Q2)

- Cash App gross profit: Up 24% YoY to $1.6 billion, driven by Cash App Borrow

- Square gross profit: Up 9% YoY to $1.0 billion

- Monthly actives: Reached 58 million in September

*Values retrieved from S&P Global

The Rule of 40 Push

Block's efficiency drive centers on achieving "Rule of 40"—the benchmark where gross profit growth plus adjusted operating income margin equals at least 40%—by 2026.

At its November 2025 Investor Day, Block outlined ambitious targets:

- 2026 gross profit target: ~$12 billion (mid-teens growth through 2028)

- Share buyback expansion: $5 billion increase to repurchase program

- Q4 2025 guidance: 20% adjusted operating income margin, approaching Rule of 40

"We remain committed to disciplined growth and driving cost efficiencies," CFO Amrita Ahuja said on Block's Q3 earnings call. "We were below our 12,000-person cap at the end of the year, and we intend to remain below for the foreseeable future."

What's Being Prioritized—And What's Not

Block has been reshaping its portfolio since 2024, integrating Cash App with its merchant-oriented Square platform while making strategic bets on Bitcoin and AI:

Growing investments:

- Cash App Borrow: Originations up 134% YoY, reaching $22 billion annualized in Q3

- Bitcoin mining (Proto): Generated first revenue in Q3 2025 with hardware sales

- AI tool (Goose): Internal automation tool now used by "nearly every single person in the company"

- Square Bitcoin: Launching Bitcoin payments to all Square merchants

Scaling back:

- TBD: Winding down decentralized technology arm

- TIDAL: Reducing investments in music streaming platform

"Our goal is to automate our company as much as possible and really take away a bunch of the mundane tasks that we have to do to serve our customers so that we can focus on more creativity," Dorsey said on the Q3 call.

Forward Estimates

Analysts expect Block to deliver the following for Q4 2025, to be reported February 26:

| Metric | Q4 2025 Est. | Q1 2026 Est. | Q2 2026 Est. |

|---|---|---|---|

| EPS | $0.65* | $0.69* | $0.81* |

| Revenue | $6.28B* | $6.24B* | $6.64B* |

| EBITDA | $912M* | $936M* | $1.04B* |

| Analyst Coverage | 29 analysts* | 26 analysts* | 26 analysts* |

*Values retrieved from S&P Global

Broader Industry Context

Block's layoffs come amid a broader wave of corporate job cuts. U.S. employers announced 108,435 layoffs in January 2026—the highest total for the month since 2009, according to outplacement firm Challenger, Gray & Christmas.

The fintech sector has been particularly affected as companies that scaled aggressively during the pandemic adjust to higher interest rates and tighter valuations. Block's Q4 earnings report on February 26 will provide the first look at whether sustained headcount reductions are translating into the margin expansion investors have been waiting for.

What to Watch

- February 26: Block Q4 2025 earnings release (after market close)

- Margin trajectory: Will cuts accelerate the path to Rule of 40?

- Cash App monetization: Can 24% gross profit growth sustain?

- Bitcoin ecosystem: Proto mining revenue contribution and Square Bitcoin adoption

Related

- Block, Inc. (xyz) — Company profile

- Paypal Holdings (pypl) — Peer comparison

- Affirm Holdings (afrm) — Fintech competitor