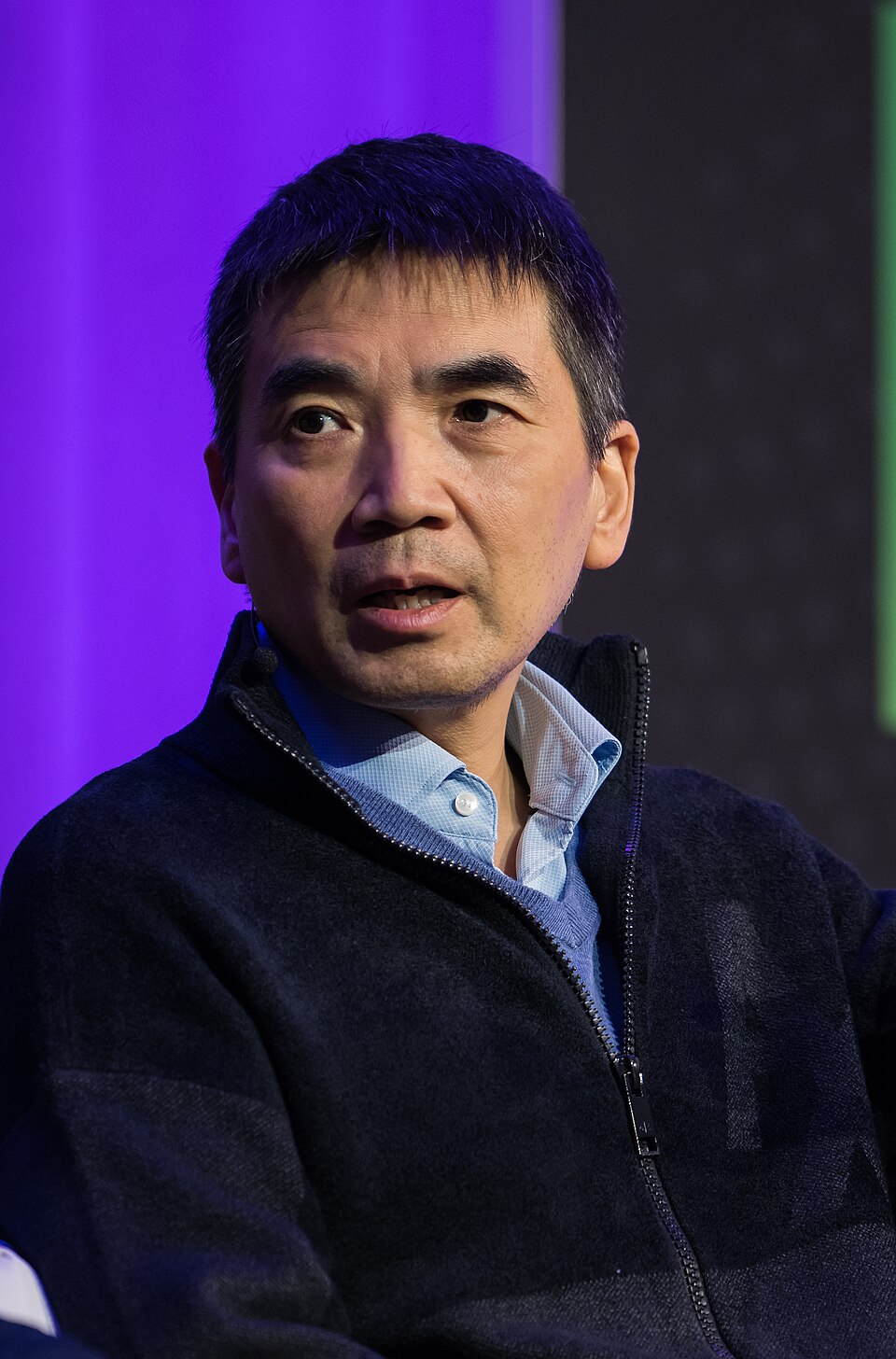

Eric S. Yuan

About Eric S. Yuan

Founder of Zoom Communications, Inc.; Chairman, President and CEO since June 2011; age 55 as of March 31, 2025; B.S. in Applied Math (Shandong University of Science & Technology) and M.Eng. (China University of Mining & Technology) . He also serves on Intuit’s board, bringing public-company operating and governance experience . Fiscal 2025 performance context: revenue $4,665.4 million; non‑GAAP income from operations $1,837.9 million; operating cash flow $1,945.3 million . Over the SEC’s pay‑versus‑performance window, a $100 investment in ZM (1/31/2020 base) was worth $113.94 in FY2025; peer index comparator stood at $288.90 .

Past Roles

| Organization | Role | Years | Strategic impact (disclosed) |

|---|---|---|---|

| Cisco Systems | Corporate Vice President of Engineering | May 2007–Jun 2011 | Senior engineering leadership |

| WebEx Communications | Various roles, most recently VP of Engineering | Aug 1997–May 2007 | Senior engineering leadership through Cisco acquisition |

External Roles

| Organization | Role | Years | Notes |

|---|---|---|---|

| Intuit, Inc. | Director | Current (as of Mar 31, 2025) | Public company board service |

Fixed Compensation

- CEO pay levels reflect substantial equity-heavy mix historically; company shifting to higher cash bonus and lower annual equity grants over FY2026–FY2027 .

- Mr. Yuan receives no additional pay for director service .

| Component | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Base Salary ($) | 402,962 | 10,039 | 453,462 |

| Target Bonus % of Salary | — (not disclosed) | — (not disclosed) | 8% (increased to 64% effective Feb 1, 2025 for FY2026) |

| Actual Bonus Paid ($) | — | 721 | 38,268 |

| Other Compensation ($) | 1,245,563 (primarily security/transport) | 1,825,347 (primarily security/transport) | 1,972,751 (incl. $1,942,875 personal/residential security; $29,876 ground transport) |

Performance Compensation

Annual Cash Incentive (Officer Incentive Plan) – FY 2025

| Metric | Weight | Threshold | Target | Maximum | Actual | Payout % | Weighted Payout % |

|---|---|---|---|---|---|---|---|

| Revenue ($m) | 80% | 4,416.0 | 4,600.0 | 5,980.0 | 4,665.4 | 104.7% | 83.8% |

| Non‑GAAP Income from Operations ($m) | 20% | 1,384.0 | 1,730.0 | 2,595.0 | 1,837.9 | 112.5% | 22.5% |

| Total | 100% | — | — | — | — | — | 106.3% |

Payout received by Yuan: $38,268 (106.3% of target) .

Performance‑Vesting RSUs (One‑year) – FY 2025

- Target grant value for CEO: $1,000,000; vesting based on same revenue and non‑GAAP operating income metrics; capped at 100% of target .

- Certified RSUs for Yuan: 15,093 (vested in full on April 9, 2025, one‑year from 4/9/2024 grant) .

| Metric | Weight | Threshold | Target | Actual | Vesting % |

|---|---|---|---|---|---|

| Revenue | 80% | $4,508.0m (60%) | $4,600.0m (100%) | $4,665.4m | 100% |

| Non‑GAAP Income from Operations | 20% | $1,557.0m (60%) | $1,730.0m (100%) | $1,837.9m | 100% |

| Total | 100% | — | — | — | 100% |

Longer‑term/time‑vesting RSUs (Selected awards outstanding as of Jan 31, 2025)

| Grant Date | Vesting Schedule | Unvested RSUs |

|---|---|---|

| 07/08/2022 | 16 equal quarterly installments (4 years) | 229,688 |

| 07/11/2023 | 12 equal quarterly installments (3 years) | 181,036 |

| 04/09/2024 (P‑RSU) | Vests 4/9/2025 upon certified performance (achieved) | 15,093 |

Stock vested in FY2025 for Yuan: 287,665 shares (value realized on vesting $19,341,225) .

Equity Ownership & Alignment

- Dual‑class structure; each Class B share carries 10 votes; Class B convertible 1:1 into Class A .

- Hedging, short sales, derivatives, margin and pledging are prohibited; executive/director trading limited to 10b5‑1 plans .

| Holder | Class A Shares | Class B Shares | % of Class B | % Total Voting Power |

|---|---|---|---|---|

| Eric S. Yuan | 83,548 | 21,620,585 | 51.1% | 31.6% |

Vesting overhang and potential supply: as of Jan 31, 2025, Yuan had 425,817 unvested RSUs across 2022/2023/2024 grants (229,688 + 181,036 + 15,093) with scheduled quarterly and one‑year vesting; no options outstanding .

Employment Terms

- At‑will employment via offer letter; covered by Severance and Change in Control Plan (Aug 2022) .

- Clawbacks: pre‑IPO recoupment policy (2019) and Nasdaq‑compliant Dodd‑Frank clawback (Nov 2023) .

- CIC economics: double‑trigger within 3 months before to 12 months after CIC (6 months’ base cash; 6 months’ COBRA; 100% equity acceleration); outside CIC, 12 months’ acceleration of time‑based equity; P‑RSUs vest per terms (generally at target in CIC) .

| Scenario (as of Jan 31, 2025) | Cash Severance ($) | COBRA ($) | Equity Accel ($) | Total ($) |

|---|---|---|---|---|

| Involuntary Termination in connection with CIC | 225,000 | 17,958 | 37,020,530 | 37,263,488 |

| Involuntary termination not in connection with CIC (partial equity accel) | — | — | 25,117,662 (12 months time‑based) | 25,117,662 |

| Certain CIC transactions without termination (awards not assumed) | — | — | 37,020,530 | 37,020,530 |

| Death/Disability equity acceleration | — | — | 37,020,530 | 37,020,530 |

Perquisites/security: company pays for CEO personal and residential security and ground transportation due to risk profile; FY2025 amounts: $1,942,875 security; $29,876 ground transport (approx. 2% personal use) .

Board Governance

- Roles: Chairman and CEO; not independent; Lead Independent Director: Dan Scheinman empowers independent oversight (exec sessions, agendas, coordination) .

- Board structure: 10 directors; 9 independent; classified into three staggered classes .

- Committees: Audit (Chadwick chair), Compensation (Scheinman chair; members McDermott, Scheinman, Subotovsky), Nominating & Corporate Governance (Subotovsky chair) — all independent .

- Attendance: Board held 4 meetings in FY2025; each incumbent director attended ≥75% of applicable meetings; 5 of 9 attended 2024 annual meeting .

- Director compensation: CEO receives no additional board fees .

Dual‑role implications: Board cites founder knowledge and unified leadership benefits; mitigations include Lead Independent Director, majority‑independent board and committees .

Say‑on‑Pay & Shareholder Feedback

- Say‑on‑pay support ~81.7% in prior year; program adjustments included sunsetting supplemental grants, introducing performance‑vesting RSUs, and shifting mix toward cash over FY2026 (reducing dilution) .

Compensation Committee Analysis

- Independent committee with Aon (Radford) as independent advisor; uses market/peer data; assesses compensation risk (no material adverse risk) .

- Practices: no tax gross‑ups on severance/CIC; double‑trigger only; clawbacks; no hedging/pledging .

Performance & Track Record

| Measure | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue ($m) | 4,393 | 4,527 | 4,665 |

| Net Income ($000s) | 103,711 | 637,462 | 1,010,238 |

| Non‑GAAP Income from Operations ($m) | — | 1,774.9 | 1,837.9 |

| Total Shareholder Return ($100 base on 1/31/2020) | $98.30 | $84.68 | $113.94 |

Management transitions: New CFO (Michelle Chang) appointed Oct 7, 2024; in April 2025 the CAO resigned (effective May 2, 2025), with CFO assuming principal accounting officer role .

Multi‑Year CEO Compensation (as reported)

| Year | Salary ($) | Stock Awards ($) | Non‑Equity Incentive ($) | All Other Comp ($) | Total ($) |

|---|---|---|---|---|---|

| 2023 | 402,962 | 74,311,158 | — | 1,245,563 | 75,959,683 |

| 2024 | 10,039 | 26,246,026 | 721 | 1,825,347 | 28,082,133 |

| 2025 | 453,462 | 963,688 | 38,268 | 1,972,751 | 3,428,169 |

Company states CEO total compensation in FY2025 was ~87% lower vs FY2024 and ~96% lower vs FY2023, driven by lower equity awards (no new four‑year “refresh” in FY2025; supplemental grant program sunset) .

Risk Indicators & Red Flags

- Dual role (CEO + Chair) offset by Lead Independent Director and independent committees .

- Significant perquisite cost for security/transportation (FY2025 ~$1.97m) — justified by third‑party security assessment; disclosed transparently .

- No hedging/pledging allowed; clawbacks in place; no single‑trigger CIC; no tax gross‑ups .

- Executive turnover: CFO transition (Oct 2024) and CAO resignation (Apr 2025) introduce continuity risk; mitigated by CFO assuming principal accounting officer responsibilities .

Equity Ownership & Potential Selling Pressure

| Item | Detail |

|---|---|

| Beneficial ownership | 21,620,585 Class B and 83,548 Class A; 31.6% total voting power; 51.1% of Class B |

| Unvested RSUs (1/31/25) | 229,688 (2022 grant), 181,036 (2023 grant), 15,093 (2024 P‑RSUs) |

| FY2025 Vested shares | 287,665 shares vested; no option exercises |

| Trading/pledging | Trades limited to 10b5‑1; hedging, margin and pledging prohibited |

Employment Contracts, Severance, and CIC

- Severance Plan: double‑trigger equity acceleration to 100% in CIC; 6 months’ salary + COBRA; outside CIC, 12 months’ acceleration of time‑based awards (P‑RSUs per plan terms) .

- Estimated CIC termination value as of 1/31/25: $37.26m total, driven by equity acceleration .

Board Service History, Committees, Independence

- Director since 2011; Chairman; not on standing committees; not independent; Lead Independent Director (Scheinman) provides independent oversight .

- Board/committee meeting cadence and attendance disclosed; CEO receives no separate director fees .

Director Compensation (as it pertains to Yuan)

- No additional compensation for board service (CEO only) .

Related Party Transactions

- Investors’ Rights Agreement includes Mr. Yuan as a party (registration rights) . No loans from the company; hedging/pledging prohibited .

- Perquisite security costs disclosed in detail (see above) .

Compensation Peer Group and Benchmarking

- Committee uses software/tech peers sized ~0.3x–3x ZM revenue/market cap for FY2025 decisions; Aon advises; factors include performance, role scope, internal equity, stockholder feedback .

Investment Implications

- Alignment: Substantial founder stake with 31.6% voting power tightly aligns incentives but concentrates control; dual‑class and CEO/Chair structure mitigated by a robust Lead Independent Director regime .

- Pay‑for‑performance: FY2025 cash and performance‑RSU payouts tied to revenue and non‑GAAP operating income (achieved 106.3% cash payout; 100% P‑RSU vesting), signaling operational execution; shift to higher cash/less equity in FY2026 reduces dilution but modestly raises cash expense .

- Supply/vesting: Quarterly RSU schedules create periodic vesting‑related supply; policy‑mandated 10b5‑1 trading and prohibitions on hedging/pledging moderate execution risk .

- Change‑in‑control: Large equity acceleration (~$37.0m) could affect transaction dynamics; double‑trigger requirement aligns outcomes with broader stockholder events .

- Governance risk: Elevated security perquisites and management turnover (CFO/CAO changes) merit monitoring; say‑on‑pay support ~81.7% and program changes (no supplemental grants; added performance conditions) indicate responsiveness to investors .