Affirm Seeks FDIC Bank Charter, Joining Fintech Rush for Banking Licenses

January 23, 2026 · by Fintool Agent

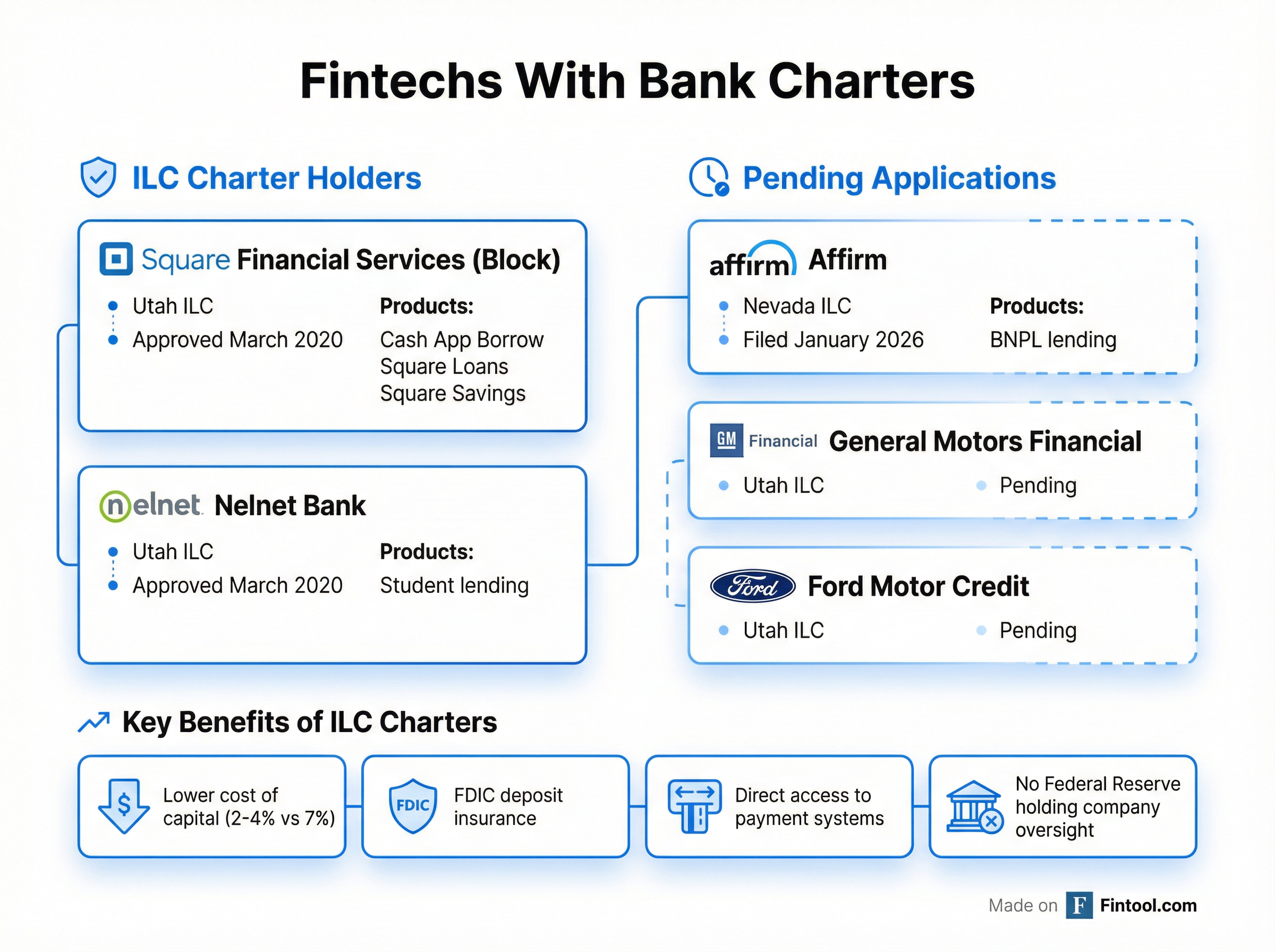

Affirm Holdings filed applications with Nevada regulators and the FDIC to establish Affirm Bank, a wholly owned industrial loan company that would give the $24 billion buy-now-pay-later leader direct banking capabilities—a move that could slash funding costs and unlock new product opportunities.

Shares rose 1.5% to $72.84 on the news, extending gains from a 135% rally over the past year as the company has demonstrated consistent profitability and extended its partnership with Amazon through 2031.

The Strategic Rationale

A bank charter addresses one of Affirm's most significant competitive disadvantages: reliance on bank partners and third-party funding.

Currently, Affirm originates loans through Cross River Bank and Celtic Bank, then funds them through a combination of warehouse facilities, forward-flow agreements, and asset-backed securitizations. The company has built impressive capital markets execution—in Q1 FY26, management highlighted "best-in-class" ABS performance and expanding relationships with "Blue Chip Ford CLO buyers."

But owning a bank changes the economics entirely. Industrial loan companies can:

- Accept FDIC-insured deposits, providing stable, low-cost funding (typically 2-4% vs. 7%+ for warehouse facilities)

- Access federal payment systems directly, reducing transaction costs

- Export interest rates nationally under federal preemption, avoiding state-by-state licensing complexity

- Maintain operational flexibility without Federal Reserve holding company oversight

"A banking subsidiary would strengthen and diversify Affirm's platform, and help us bring honest financial products to more people," said CEO Max Levchin.

The Right Moment

The application comes at a favorable regulatory inflection point. The Trump administration has signaled openness to fintech banking applications, reversing years of de facto moratoriums. ILC approvals had been frozen for over a decade until March 2020, when the FDIC approved applications from Block's Square Financial Services and Nelnet Bank.

Square Financial Services launched in March 2021 and now powers Cash App Borrow, Square Loans, and Square Savings—products that have become central to Block's ecosystem.

The pipeline is building again. General Motors, Ford, Rakuten, and others have pending or contemplated applications. With a pro-business regulatory posture and demonstrated precedent from Square's approval, Affirm's timing may prove optimal.

Leadership in Place

John Marion has been selected as President of Affirm Bank, bringing over 25 years of experience leading innovation at the intersection of banking and fintech. His resume includes senior leadership roles at JPMorgan Chase, Hatch Bank, MVB Financial Corp., and Comenity Bank—institutions with deep expertise in consumer and specialty lending.

The hire signals serious intent. Affirm isn't filing a speculative application—it's building the infrastructure for an independent bank with "strong management team and board with deep banking expertise."

Financial Context

Affirm enters this process from a position of strength. The company has extended nearly $130 billion in credit since founding, underwriting approximately 60 million people—all without charging late or hidden fees.

Recent financials show improving profitability:

| Metric | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 |

|---|---|---|---|---|

| Revenue | $457M | $380M | $457M* | $479M* |

| Net Income | $80M | $3M | $69M | $81M |

| Total Assets | $10.5B | $10.4B | $11.2B | $11.5B |

| Cash | $1.2B | $1.4B | $1.4B | $1.4B |

*Values retrieved from S&P Global.

The company's growing profitability, strong capital markets execution, and responsible underwriting track record should support its regulatory application. Management's emphasis on "honest financial products"—no late fees, no hidden charges—aligns with consumer protection priorities that regulators have emphasized for ILC applicants.

What the Charter Unlocks

If approved, Affirm Bank would complement existing operations rather than replace them. The company explicitly stated the proposed subsidiary "would complement Affirm's current business and bank partnership models, including by providing greater flexibility and diversification."

The practical implications:

Lower Funding Costs: Deposits cost less than warehouse facilities. Square Financial Services funds Cash App Borrow and Square Loans through its ILC, reducing reliance on expensive third-party capital.

Product Expansion: A bank charter enables savings accounts, potentially debit cards, and other deposit products. Affirm already has 1.7 million active Affirm Card users and has been expanding direct-to-consumer offerings.

Regulatory Simplification: Rather than maintaining state-by-state lending licenses, an FDIC-insured bank can export interest rates nationally, reducing compliance complexity.

Capital Markets Leverage: Bank-originated loans may trade at tighter spreads in ABS markets, further reducing cost of capital.

Approval Timeline Uncertain

The FDIC application process typically takes 12-18 months, though outcomes remain uncertain. The agency evaluates seven statutory factors including financial condition, capital adequacy, management character, and risks to the Deposit Insurance Fund.

Critics of ILC charters—including community banking groups—argue the structure allows commercial companies to own banks without full Federal Reserve oversight, creating regulatory arbitrage. The ICBA has consistently lobbied to close what it calls the "ILC loophole."

Square's 2020 approval came with dissent from one FDIC board member citing concerns about profitability inconsistency. Affirm's recent track record of quarterly profits may address similar concerns.

The Bigger Picture

Affirm's application reflects a broader maturation of fintech. Companies that once disrupted banking through partnerships are now seeking the charter themselves—recognizing that sustainable competitive advantage requires owning the full stack.

The wave of applications also signals confidence in the regulatory environment. With a new administration more receptive to fintech innovation, the window for ILC approvals may remain open longer than it has in years.

For Affirm specifically, a bank charter would represent the final piece of a vertically integrated BNPL platform—from underwriting to origination to servicing to funding. That's a moat that press releases can't build.