Affirm Hits $1.12B Revenue, 30% Margins as BNPL Model Proves Profitable

February 6, 2026 · by Fintool Agent

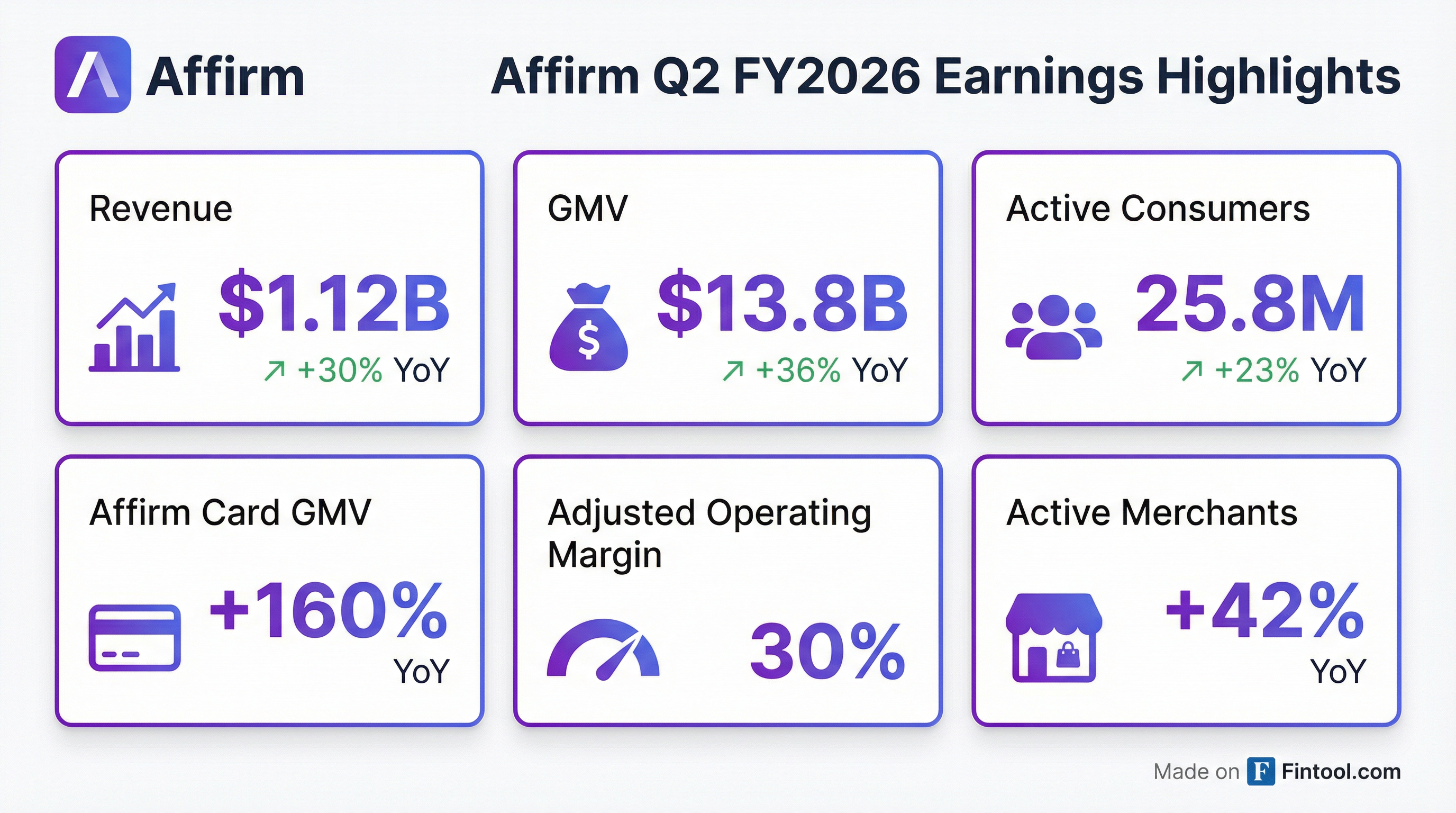

Affirm Holdings delivered a statement quarter: $1.12 billion in revenue (+30% YoY), $337 million in adjusted operating income, and a 30% adjusted operating margin—the best profitability the buy-now-pay-later pioneer has ever posted . The results cement what CEO Max Levchin has long argued: honest lending can be a sustainable, highly profitable business.

Yet shares fell 4% on Friday, closing at $57.03, as investors weighed whether the company's Q3 guidance—roughly in-line with expectations—signals the limits of growth or simply reflects seasonal patterns.

The Numbers

Affirm crushed estimates on nearly every metric that matters:

| Metric | Q2 FY25 | Q2 FY26 | YoY Change |

|---|---|---|---|

| Revenue | $866M | $1,123M | +30% |

| GMV | $10.1B | $13.8B | +36% |

| Active Consumers | 21.0M | 25.8M | +23% |

| Trans. per Active Consumer | 5.3 | 6.4 | +21% |

| Adjusted Operating Income | $130M | $337M | +159% |

| Adjusted Operating Margin | 23% | 30% | +700 bps |

EPS came in at $0.37, beating the $0.28 consensus by 32% . GAAP operating income hit $118 million with a 10% margin—the company's strongest GAAP profitability to date .

The Card Is Working

The Affirm Card—a debit card that converts purchases into installment plans at checkout—has become Affirm's breakout product. In Q2:

- Card GMV surged 160% YoY

- Active cardholders jumped 121% YoY

- 0% APR deals on the card rose 190% YoY

"The card is doing really well. We have a lot more planned for the card, so we don't intend to slow it down," Levchin told analysts. "Probably my personal focus on the product side of things is still predominantly on the card and adjacent things."

The card's success represents a strategic pivot from purely merchant-integrated checkout to direct consumer acquisition. Cardholders transact more frequently, convert at higher rates, and—crucially—don't require individual merchant integrations.

Funding Costs Hit 2021 Lows

A less visible but equally important driver: Affirm's cost of capital is plummeting. CFO Rob O'Hare noted the company just priced an asset-backed securities deal with spreads under 100 basis points and a weighted average yield below 4.6%—levels not seen since before the Fed's rate-hiking cycle began .

"We haven't seen that kind of cost of financing since the reserve," O'Hare said. "The market is still very constructive... it's a reflection of the continued vote of confidence that the market has in our ability to control credit outcomes."

Funding capacity reached $28 billion in Q2, up from $22.6 billion a year ago . The platform portfolio now stands at $36.6 billion, with equity capital requirements falling to just 4% of the portfolio—a sign of improved capital efficiency .

Merchant Flywheel Accelerates

Active merchant growth accelerated to 42% YoY—the fastest pace in years—driven by wallet partnerships that bring thousands of merchants onto the platform simultaneously .

| Category | Q2 FY26 GMV Mix | YoY Growth |

|---|---|---|

| General Merchandise | 35% | +8% |

| Fashion/Beauty | 15% | +34% |

| Travel/Ticketing | 10% | +23% |

| Electronics | 8% | +41% |

| Home/Lifestyle | 7% | +44% |

| Other | 15% | +114% |

The "Other" category's explosive 114% growth signals Affirm's long-tail expansion beyond traditional retail into services, subscriptions, and new verticals. Recent deals—including Wayfair in the UK, Virgin Media O2, and a B2B partnership with QuickBooks—underscore the broadening merchant base .

Credit Trends Stable

Delinquencies remain contained. The 30+ day delinquency rate stood at 2.7% in Q2, down from 2.8% in Q1 and roughly flat year-over-year . The 90+ day rate ticked up slightly to 0.8% from 0.7% in the prior quarter but remains within historical norms .

Management emphasized that consumers who enter the platform through 0% APR promotional offers—like the company's "Big Nothing" holiday campaign—willingly take interest-bearing products later.

"We have really good evidence... folks that come in through a 0% APR loan are quite happy to use us for both interest-bearing and non-interest-bearing products," Levchin said. "That is factually correct that people who sign up with a 0% deal do not mind other offers that we give them."

Guidance: Strong, But Not Strong Enough?

Affirm raised its full-year outlook:

| Metric | Prior Guide | New Guide |

|---|---|---|

| FY26 Revenue | $4.0B | $4.08B - $4.14B |

| FY26 GMV | $47B | $48.3B - $48.85B |

The company guided Q3 revenue of $970M-$1.0B and GMV of $11.0B-$11.25B—roughly in-line with Street expectations . That sequential deceleration is typical for post-holiday quarters but may have disappointed investors hoping for an upside surprise.

Why Shares Fell

The 4% decline reflects a market grappling with contradictions:

- Valuation anxiety: At ~33x forward revenue (based on $18.8B market cap and ~$4.1B FY26 revenue), Affirm trades at a hefty premium even after the selloff

- Q3 guidance: The in-line outlook left no room for beat-and-raise momentum traders

- Broader tech pressure: The software sector faced headwinds all week following Anthropic's "Claude Cowork" announcement, which sparked fears about AI disruption across enterprise software

The stock is down 43% from its 52-week high of $100, though it remains up 85% from its 52-week low of $30.90.

The Bigger Picture

Affirm's Q2 proves the BNPL model can work. After years of skepticism—about credit losses, consumer overspending, and unsustainable unit economics—the company delivered:

- Profitable growth: 30% revenue growth with 30% adjusted operating margins

- Sustainable credit: Delinquencies stable despite macro uncertainty

- Capital efficiency: Funding costs at 4-year lows, equity requirements declining

- Product-market fit: The Affirm Card creates direct consumer relationships

For investors, the question shifts from "Can BNPL work?" to "How much should we pay for it?"

What to Watch

- Investor Forum (May 12): Management will update the medium-term financial framework and discuss product roadmap

- Bank charter application: Affirm has applied for a bank charter; approval would significantly reduce funding costs

- International expansion: UK partnerships with Wayfair, VMO2, and Shopify are scaling

- Agentic commerce: Levchin acknowledged exploring integration with AI assistants like ChatGPT, though "no announcements" yet

Related: Affirm Holdings