Agios Wins Historic FDA Approval: AQVESME Becomes First Oral Therapy for Broad Thalassemia Population

December 24, 2025 · by Fintool Agent

Agios Pharmaceuticals secured FDA approval for AQVESME (mitapivat), establishing the first and only medicine approved for anemia in both non-transfusion-dependent and transfusion-dependent alpha or beta thalassemia patients. The stock surged 15% on Christmas Eve, trading at $28.24 on volume more than double the average.

The approval marks a watershed moment for a rare blood disorder that has lacked disease-modifying oral treatment options. With a wholesale acquisition cost of $425,000 per patient per year and an addressable U.S. population of 4,000 patients at launch, AQVESME represents a multi-hundred-million-dollar commercial opportunity for Agios.

A First-in-Class Treatment for an Underserved Population

Thalassemia is an inherited blood disorder affecting approximately 6,000 diagnosed adults in the United States, characterized by defective hemoglobin synthesis that leads to chronic anemia and life-threatening complications including blood clots, heart failure, and liver disease.

Until now, treatment options have been severely limited:

- Transfusion-dependent patients relied on chronic blood transfusions and oral chelators, burdened by secondary iron overload and compliance challenges

- Non-transfusion-dependent patients had no approved disease-modifying therapy—only occasional transfusions

- Alpha thalassemia patients had zero approved therapies of any kind

AQVESME addresses all of these gaps as an oral, twice-daily pyruvate kinase (PK) activator that works regardless of genotype or transfusion status.

Pivotal Trial Data: Clinically Meaningful Responses

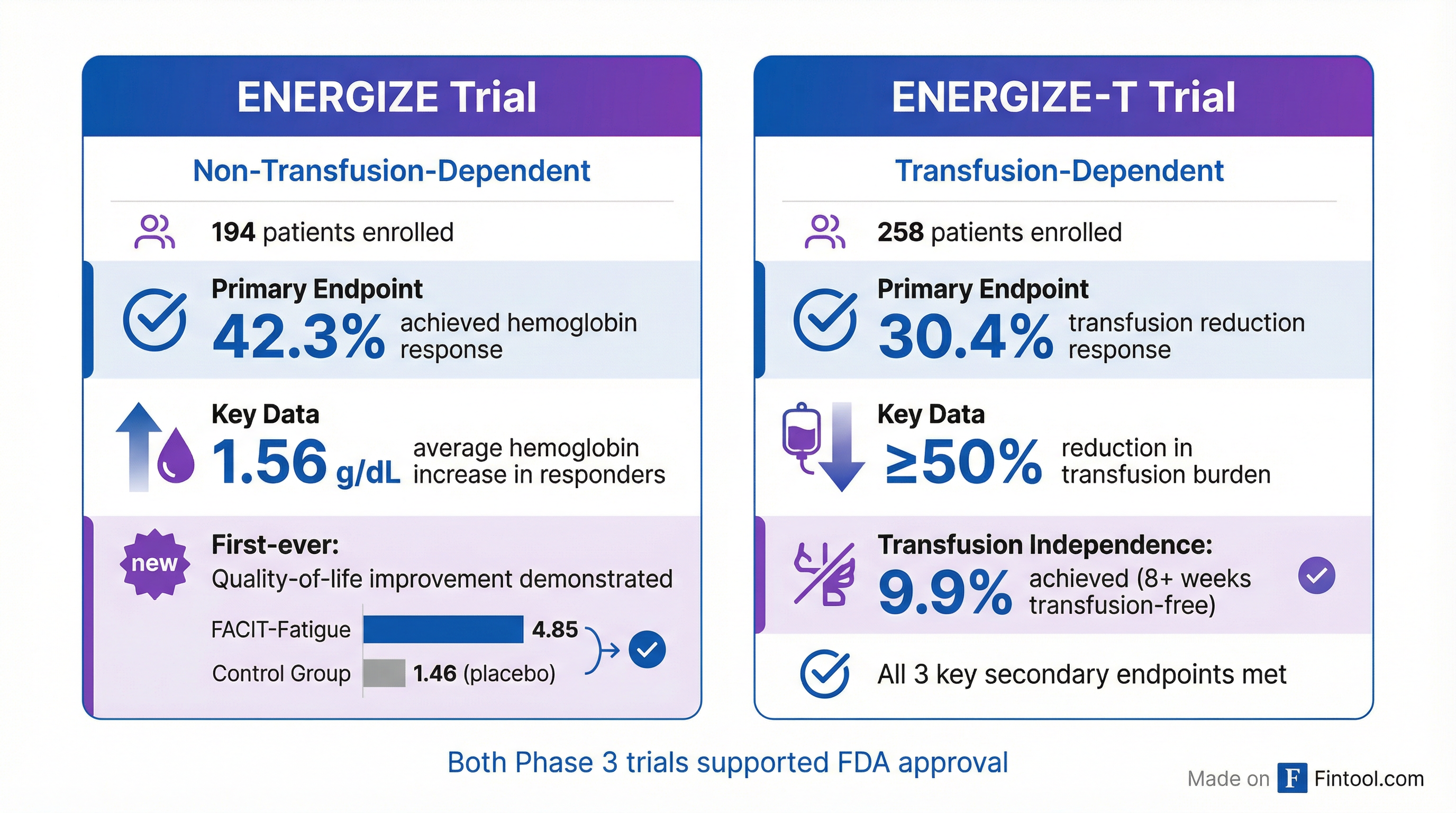

The FDA approval was supported by two global Phase 3 trials—ENERGIZE and ENERGIZE-T—enrolling 452 patients across both non-transfusion-dependent and transfusion-dependent populations.

ENERGIZE Trial (Non-Transfusion-Dependent):

- 42.3% of patients achieved the primary endpoint of hemoglobin response (≥1 g/dL increase)

- Average hemoglobin increase of 1.56 g/dL in responders—a level associated with significantly reduced risk of adverse morbidity outcomes

- First trial ever to demonstrate quality-of-life improvement in non-transfusion-dependent patients, with FACIT-Fatigue scores improving 4.85 points vs. 1.46 for placebo

ENERGIZE-T Trial (Transfusion-Dependent):

- 30.4% achieved the primary endpoint of transfusion reduction response (≥50% reduction in transfused units)

- 9.9% achieved complete transfusion independence for 8+ consecutive weeks

- Statistical significance achieved across all three key secondary endpoints evaluating transfusion reduction

The REMS Reality: Manageable Monitoring Requirements

The approval comes with a Risk Evaluation and Mitigation Strategy (REMS) program due to observations of hepatocellular injury in five patients across pivotal trials. The program requires:

- Physician, patient, and pharmacist education and certification

- Liver testing at baseline and every four weeks for the first 24 weeks

- A black box warning advising against use in patients with cirrhosis

However, physician feedback has been reassuring. In market research, 94% of hematology oncologists reported prior REMS experience, and about two-thirds anticipated no to minimal impact from REMS at launch. KOLs specifically stated the black box warning is "consistent with expectations for medicines requiring a REMS and does not present additional hurdles for prescribing."

Commercial Launch Strategy

Agios has built a capital-efficient U.S.-focused commercial model with approximately 40 dedicated sales representatives ready to deploy. The company has identified and validated target prescribers managing the initial addressable population.

Key launch dynamics:

| Metric | Detail |

|---|---|

| U.S. Diagnosed Adults | 6,000 patients |

| Addressable at Launch | 4,000 patients |

| WAC Pricing | $425,000/patient/year |

| REMS Operational | Late January 2026 |

| Time to First Dose | 10-12 weeks initially |

| Physician Intent | 86% plan to prescribe within 6 months |

The 4,000 addressable patients include those receiving transfusions, older patients with comorbidities, and individuals with hemoglobin at or below 10 g/dL experiencing anemia-related complications. Transfusion-dependent patients—roughly half of this group—are expected to initiate therapy first given their more frequent healthcare interactions.

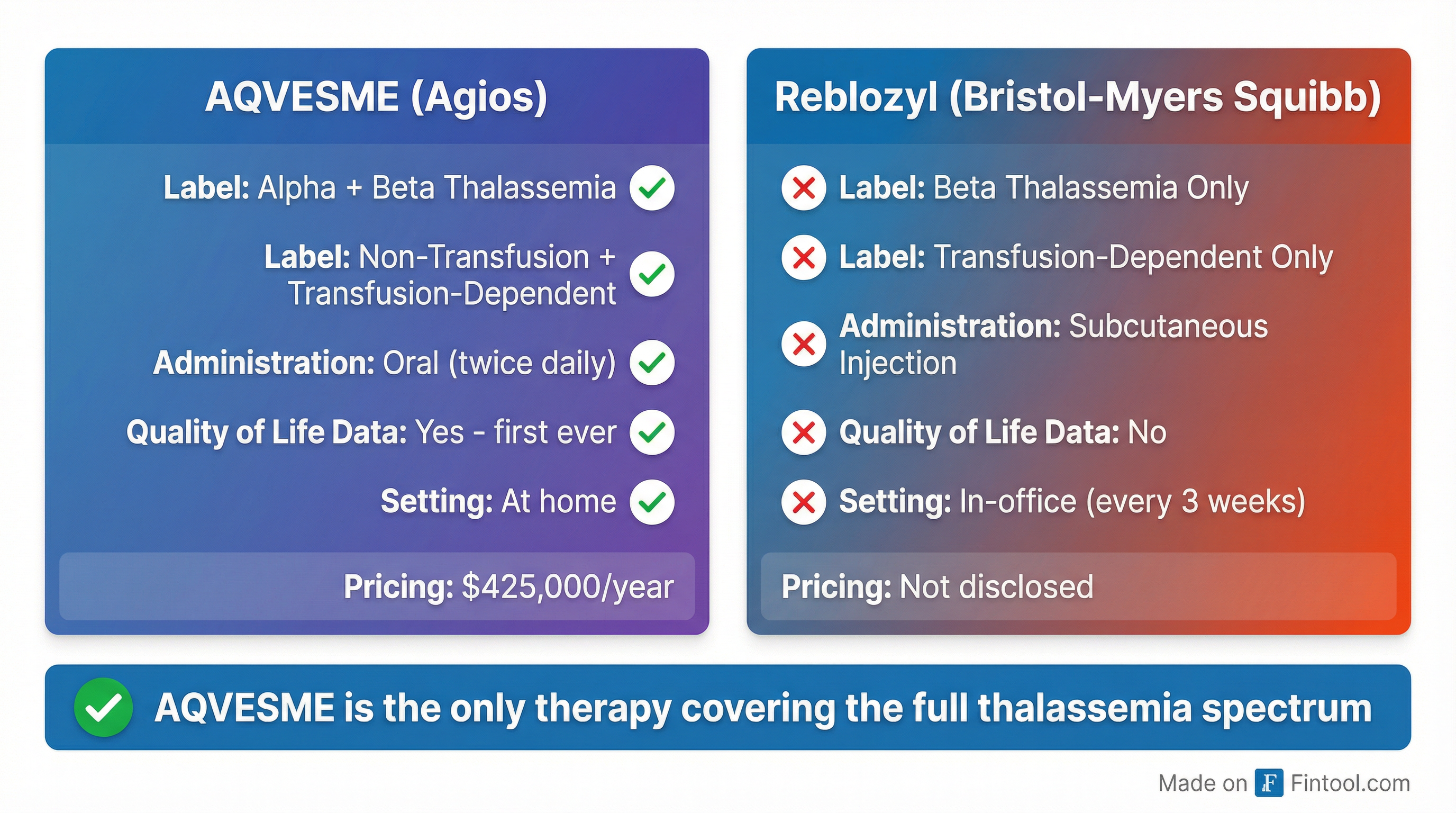

Competitive Advantage Over Luspatercept

AQVESME's value proposition becomes clear when compared to Bristol-myers Squibb's Luspatercept (Reblozyl), the only other approved therapy in the thalassemia space:

Key differentiators favoring AQVESME:

- Broader label: Covers alpha AND beta thalassemia; transfusion-dependent AND non-transfusion-dependent

- Oral administration: Twice-daily pills vs. in-office subcutaneous injections every three weeks

- Quality-of-life data: First therapy to demonstrate QoL improvement in non-transfusion-dependent patients

- Patient retention: Luspatercept has seen high dropout rates due to lack of efficacy or injection burden

According to management, Luspatercept has achieved "very low penetration in thalassemia" due to its narrow label (transfusion-dependent beta only) and the burden of in-office injections.

Financial Position and Investment Thesis

Agios enters this launch from a position of balance sheet strength:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $10.7 | $8.7 | $12.5 | $12.9 |

| Net Loss ($M) | ($96.5) | ($89.3) | ($112.0) | ($103.4) |

| Cash & Equivalents ($M) | $76.2 | $79.0 | $80.9 | $92.7 |

The company reported approximately $1.3 billion in cash and investments at Q3 2025, providing substantial runway to fund the U.S. launch and pipeline development. Management has committed to providing an update on proactive measures to reduce operating expenses and extend cash runway in early 2026.

Next Catalysts: Sickle Cell Disease Looms Large

Beyond thalassemia, Agios has a significant near-term catalyst in sickle cell disease—a larger market with approximately 100,000 diagnosed patients in the U.S.

Management expects to engage with the FDA in Q1 2026 to review Phase 3 RISE UP data for mitapivat in sickle cell disease and determine the regulatory path forward. Notably, the sickle cell trials have not shown the hepatocellular injury observed in thalassemia, which could support a cleaner label without REMS requirements.

The separate brand name strategy (AQVESME for thalassemia vs. PYRUKYND for other indications) provides pricing flexibility and regulatory isolation—if sickle cell is approved, it could potentially carry a different price point and label profile.

Additional pipeline catalysts:

- Tebapivat in lower-risk MDS: Phase 2b data expected early 2026

- AG-181 for PKU: Phase 1 multiple ascending dose trial ongoing

- AG-236 for polycythemia vera: Phase 1 trial underway

What to Watch

Near-term:

- REMS program implementation (targeting late January 2026)

- Q1 2026 FDA meeting on sickle cell disease regulatory path

- Early prescription volume and REMS certification rates

Medium-term:

- Revenue ramp trajectory (Q2 2026 expected to show more meaningful sales)

- Operating expense reduction measures

- European Commission decision on thalassemia label (early 2026)

Longer-term:

- Peak penetration rates in the 4,000-6,000 patient addressable market

- Sickle cell disease approval potential (100,000 patient opportunity)

- Pipeline readouts in MDS, PKU, and polycythemia vera

The AQVESME approval represents exactly the kind of first-in-class, transformative therapy that can anchor a sustainable rare disease franchise. For investors, the question now is whether Agios can execute on the commercial launch while managing cash burn—and whether sickle cell disease can become the larger prize.

Related Companies: Agios Pharmaceuticals · Bristol-myers Squibb