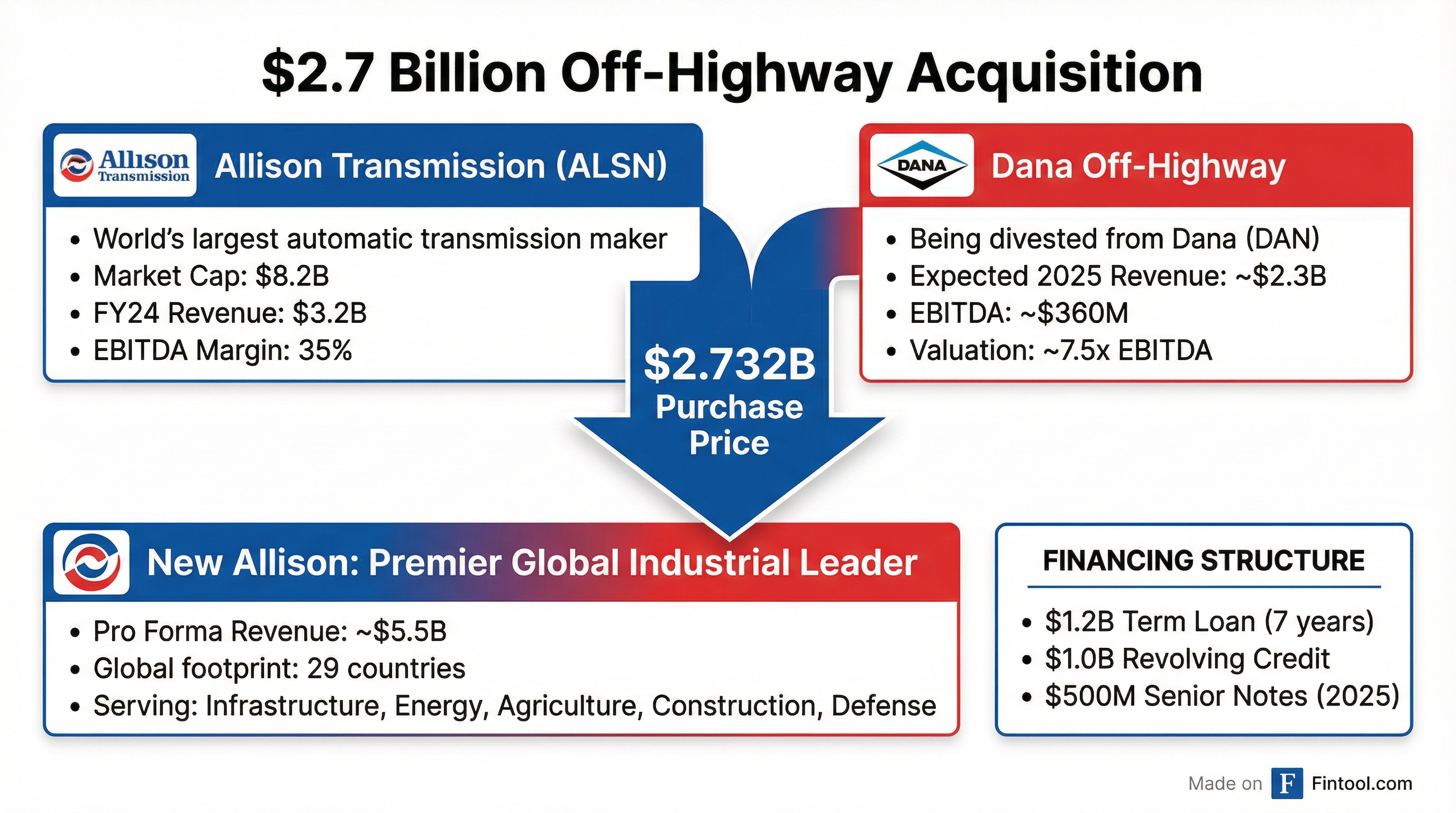

Allison Transmission Closes $2.7 Billion Dana Off-Highway Acquisition, Creating Industrial Powerhouse

January 2, 2026 · by Fintool Agent

Allison Transmission Holdings has completed its $2.732 billion acquisition of Dana Incorporated's Off-Highway Drive & Motion Systems business, closing a transformational deal that creates a $5.5 billion revenue global industrial leader.

The transaction, announced in June 2025 and closed on January 1, 2026, marks the largest acquisition in Allison's 111-year history and fundamentally expands the Indianapolis-based company's addressable market beyond commercial vehicles into agriculture, construction, mining, and energy sectors.

Both stocks rose on the first trading day following the close. Allison gained 0.7% to $98.59 while Dana—now a more focused light- and commercial-vehicle drivetrain company—surged 3.5% to $24.59, touching new 52-week highs.

Deal Structure and Financing

The $2.732 billion purchase price was funded through a combination of debt financing:

| Financing Component | Amount | Maturity |

|---|---|---|

| Term Loan Facility | $1.2 billion | January 2033 |

| Revolving Credit Facility | $1.0 billion (expanded from $750M) | January 2031 |

| 2025 Senior Notes | $500 million | 2033 |

Citibank, Barclays, Bank of America, and JPMorgan led the syndication. The deal valued Dana Off-Highway at approximately 7.5x expected 2025 EBITDA—a premium reflecting the strategic nature of the assets and their technology portfolio.

Strategic Rationale: Beyond Transmissions

For Allison, the acquisition represents a decisive pivot from its core automatic transmission business into the broader mobility and industrial drivetrain market. The company will now operate two global business units:

Allison Commercial Duty – The legacy business serving North American on-highway commercial vehicles, where Allison commands dominant market share in medium- and heavy-duty automatic transmissions.

Allison Off-Highway Drive and Motion Systems – The newly acquired division serving:

- Agricultural equipment

- Construction machinery

- Mining vehicles

- Energy sector applications

- Industrial mobility solutions

The Off-Highway unit brings manufacturing presence across 29 countries, diversifying Allison's geographic exposure beyond North America (which represented 77% of 2024 revenues).

Craig M. Price, who served as Dana's Senior VP and President of Off-Highway since September 2024, will lead the new division with a compensation package including $1 million in RSUs and a target bonus of 100% of his £423,530 base salary.

Financial Profile: Margin Dilution, But Growth

The combination creates meaningful scale but also introduces margin dilution. Allison's standalone business generates industry-leading profitability:

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Allison Revenue | $2.77B | $3.04B | $3.23B |

| Allison EBITDA Margin | 34.2%* | 35.6%* | 35.2%* |

| Allison Net Income | $531M | $673M | $731M |

*Values retrieved from S&P Global

Dana's Off-Highway business, while technologically strong, operates at lower margins typical of the fragmented off-highway drivetrain market. The acquired business generated approximately $2.3 billion in revenue with EBITDA around $360 million, implying a margin of roughly 15.6%—less than half of Allison's standalone profitability.

The integration challenge will be extracting synergies to lift the combined margin profile while avoiding disruption to Dana Off-Highway's global customer relationships.

What Dana Gets: Debt Reduction and Focus

For Dana, the divestiture represents the culmination of a strategic refocusing. The company will use approximately $2.3 billion in net proceeds to:

- Pay down ~$2 billion in debt through tender offers for outstanding senior notes

- Return $1 billion to shareholders via buybacks and/or special dividends through 2027

Dana simultaneously launched tender offers for approximately $1 billion of its outstanding notes, including the full redemption of its 2027 and 2028 senior notes.

Post-divestiture, Dana becomes a more focused supplier of drivetrains and propulsion systems for light- and commercial-vehicles, with particular emphasis on electrification solutions. CEO R. Bruce McDonald stated: "We are now a more focused company, dedicated to serving light- and commercial-vehicle customers with both traditional and electrified systems."

Market Context: Cyclical Headwinds

The deal closes amid challenging conditions for the off-highway equipment market. Dana's Off-Highway segment saw net income decline year-over-year in the first nine months of 2025, driven by:

- European weakness: Construction/mining equipment production down 8% YoY

- Agricultural headwinds: Farm equipment production in Europe down 5% YoY

- Transaction costs: $54 million in divestiture-related expenses

This softness contributed to Dana's decision to divest at what some viewed as mid-cycle valuations. For Allison, the timing represents a countercyclical bet—acquiring quality assets during a period of market weakness with expectations of recovery.

What to Watch

Integration execution: Allison must demonstrate it can manage a global manufacturing footprint while preserving customer relationships built over decades.

Margin trajectory: Investors will monitor whether Allison can drive operational improvements at Off-Highway while maintaining its legacy business's profitability.

End market recovery: The off-highway equipment market's cyclical recovery will be critical to validating the deal thesis.

Dana's transformation: The slimmed-down Dana will need to demonstrate that its refocused strategy can drive improved returns for shareholders.

Related