Earnings summaries and quarterly performance for Allison Transmission Holdings.

Executive leadership at Allison Transmission Holdings.

David Graziosi

Chair, President and Chief Executive Officer

Dana Pittard

Vice President, Defense Programs

Eric Scroggins

Vice President, General Counsel and Assistant Secretary

Fred Bohley

Chief Operating Officer

John Coll

Senior Vice President, Global Marketing, Sales and Service

Ryan Milburn

Vice President, Engineering and Technology Development

Scott Mell

Chief Financial Officer and Treasurer

Teresa van Niekerk

Vice President, Chief Procurement Officer

Thomas Eifert

Vice President, Quality, Planning & Program Management

Board of directors at Allison Transmission Holdings.

Research analysts who have asked questions during Allison Transmission Holdings earnings calls.

Kyle Menges

Citigroup

6 questions for ALSN

Tami Zakaria

JPMorgan Chase & Co.

6 questions for ALSN

Ian Zaffino

Oppenheimer & Co. Inc.

5 questions for ALSN

Jerry Revich

Goldman Sachs Group Inc.

5 questions for ALSN

Luke Junk

Robert W. Baird & Co.

5 questions for ALSN

Angel Castillo Malpica

Morgan Stanley

4 questions for ALSN

Robert Wertheimer

Melius Research

3 questions for ALSN

Rob Wertheimer

Melius Research LLC

3 questions for ALSN

Timothy Thein

Raymond James

3 questions for ALSN

Tim Thein

Raymond James Financial

3 questions for ALSN

Angel Castillo

Morgan Stanley & Co. LLC

2 questions for ALSN

Isaac Sellhausen

Oppenheimer & Co. Inc.

1 question for ALSN

Sherif El-Sabbahy

Bank of America

1 question for ALSN

Recent press releases and 8-K filings for ALSN.

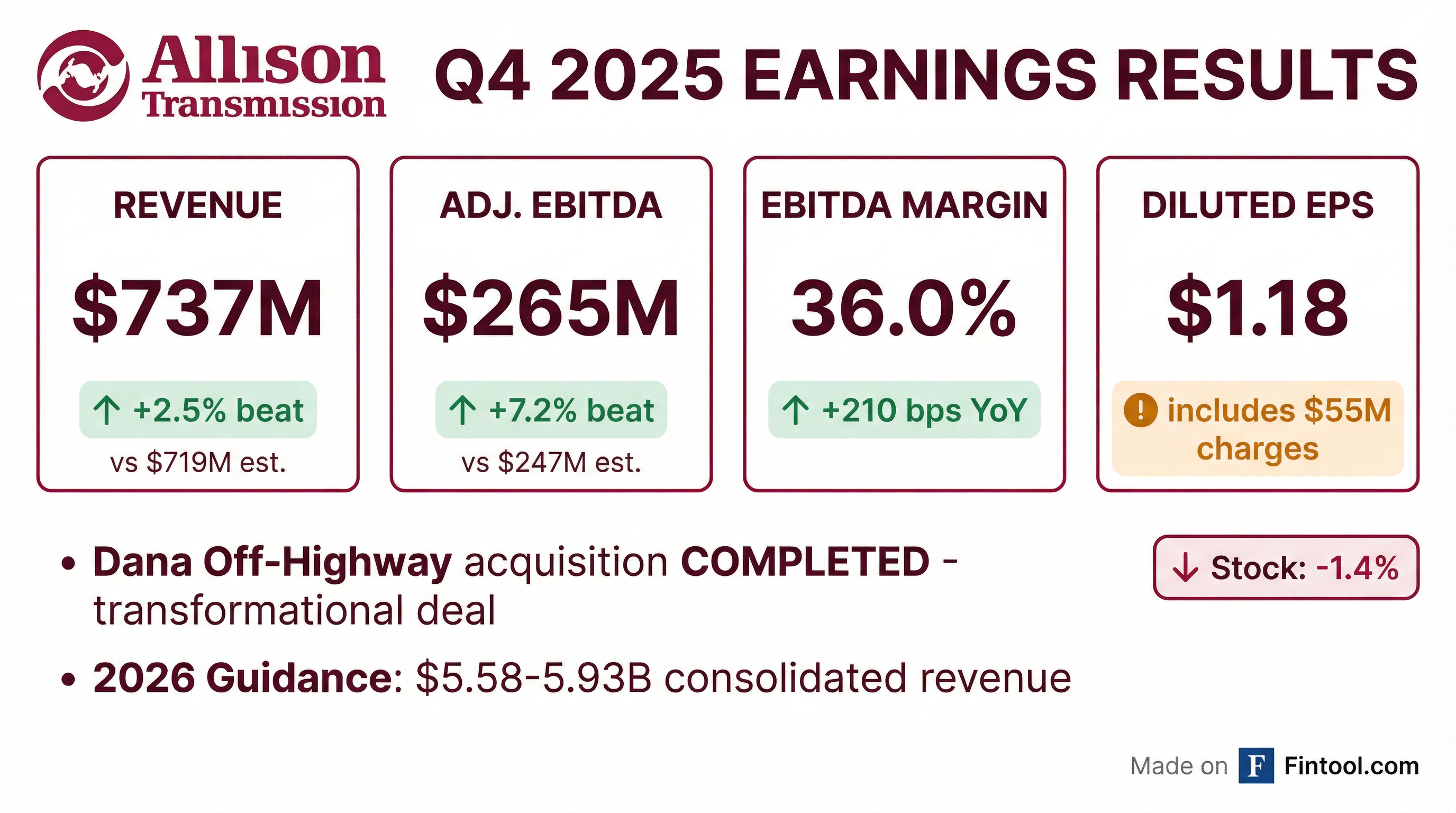

- Allison Transmission Holdings completed the acquisition of the Off-Highway Drive & Motion Systems business of Dana Incorporated, establishing two new business units: Allison Transmission and Allison Off-Highway Drive & Motion Systems.

- For Q4 2025, net sales decreased 7% year-over-year to $737 million, while adjusted EBITDA margin increased over 200 basis points to 36%, and adjusted diluted earnings per share were $1.68.

- The company provided 2026 consolidated guidance, projecting net sales between $5.575 billion and $5.925 billion and adjusted EBITDA between $1.364 billion and $1.515 billion, with a midpoint implying a 25% adjusted EBITDA margin.

- Allison expects to capture approximately $120 million of annual run rate synergies from the acquisition over the next few years, but these synergies are not assumed in the 2026 guidance.

- The 2026 outlook anticipates continued softness in the North America on-highway end market and that key Allison Off-Highway end markets will remain at or near trough levels.

- Allison Transmission Holdings completed the acquisition of the Off-Highway Drive & Motion Systems business from Dana Incorporated in January, creating a combined entity with 14,000 employees operating in 25 countries.

- For Q4 2025, Allison Transmission (excluding the acquired business) reported net sales of $737 million, a 7% decrease year-over-year, and an adjusted EBITDA margin of 36%, up over 200 basis points. Full-year 2025 adjusted EBITDA margin was 37.5%.

- The company provided 2026 consolidated guidance, forecasting net sales between $5.575 billion and $5.925 billion, consolidated net income between $600 million and $750 million, and consolidated adjusted EBITDA between $1.364 billion and $1.515 billion.

- Allison expects to realize approximately $120 million of annual run rate synergies from the acquisition over the next few years, though no cost synergies are included in the 2026 guidance. The company also plans for accelerated debt reduction and continued share repurchases and dividend payments.

- Allison Transmission completed the acquisition of Dana's Off-Highway Drive & Motion Systems business in January, establishing two business units: Allison Transmission and Allison Off-Highway Drive & Motion Systems.

- For Q4 2025, Allison Transmission (legacy business) reported net sales of $737 million, a 7% decrease year-over-year, and its adjusted EBITDA margin increased over 200 basis points to 36%.

- Full year 2025 revenue for Allison Transmission was down 7% year-over-year, but adjusted EBITDA margin increased by 140 basis points to 37.5%. The company also repurchased $328 million of common stock and increased its quarterly dividend.

- For the full year 2026, the consolidated company (including the acquired Off-Highway business) expects net sales in the range of $5.575 billion-$5.925 billion and adjusted EBITDA in the range of $1.364 billion-$1.515 billion.

- Allison anticipates capturing approximately $120 million of annual run rate synergies over the next few years from the acquisition, though no synergies are assumed in the 2026 guidance.

- For Q4 2025, Allison Transmission Holdings reported Net Sales of $737 million, a 7% decrease from Q4 2024, and Net Income of $99 million, a 43% decrease, primarily due to a $29 million impairment of long-lived assets and $26 million of acquisition-related expenses.

- Despite lower net sales, Adjusted EBITDA was $265 million, a 2% decrease, with an Adjusted EBITDA Margin of 36.0%, an increase of 210 basis points.

- Adjusted Free Cash Flow increased by 24% to $169 million in Q4 2025, driven by higher net cash provided by operating activities.

- For full year 2026, the company provided guidance for consolidated Net Sales of $5,575 million to $5,925 million and consolidated Adjusted EBITDA of $1,365 million to $1,515 million.

- The Allison Off-Highway acquisition is expected to be accretive to Net Income and EPS in 2026, accelerating future global growth opportunities.

- Allison Transmission reported full year 2025 net sales of $3 billion, net income of $623 million, and Adjusted EBITDA of $1,130 million.

- The company achieved record net sales in the Outside North America On-Highway end market and a 26 percent increase in net sales in the Defense end market for full year 2025, while also repurchasing $328 million of common stock.

- Allison completed the acquisition of the Dana Off-Highway business on January 1, 2026, which is projected to be accretive to net income and Diluted EPS in 2026. For full year 2026, the company forecasts consolidated net sales between $5,575 and $5,925 million and consolidated Adjusted EBITDA between $1,365 and $1,515 million.

- Allison Transmission Holdings reported full year 2025 net sales of $3 billion, net income of $623 million, and diluted EPS of $7.33.

- For the fourth quarter of 2025, the company recorded net sales of $737 million and net income of $99 million.

- The company completed the acquisition of the Dana Off-Highway business on January 1, 2026, which is expected to expand its global market presence and product portfolio.

- Allison Transmission Holdings provided full year 2026 guidance, projecting consolidated net sales between $5,575 million and $5,925 million and consolidated net income between $600 million and $750 million.

- In 2025, the company repurchased $328 million of its common stock, representing 4 percent of outstanding shares.

- Allison Transmission Holdings, Inc. completed its acquisition of Dana Incorporated’s Off-Highway Drive & Motion Systems business for approximately $2.7 billion on January 2, 2026.

- The combined company is projected to form a $5.5 billion revenue global enterprise with operations spanning 29 countries.

- Craig M. Price was appointed President and Business Unit Leader of the new Allison Off-Highway Drive and Motion Systems, effective January 1, 2026.

- To finance the acquisition, Allison Transmission, Inc. incurred $1.2 billion in new term loans and made available a $1.0 billion revolving credit facility.

- Allison Transmission Holdings, Inc. completed its acquisition of the Off-Highway Drive & Motion Systems business of Dana Incorporated for approximately $2.7 billion on January 2, 2026.

- The acquisition creates a combined company with an estimated $5.5 billion in revenue and operations spanning 29 countries.

- The combined entity will be headquartered in Indianapolis, Indiana, and led by David Graziosi, Allison's Chair, President, and CEO.

- The company will operate under the Allison name, structured into two business units: Allison Transmission and Allison Off-Highway Drive & Motion Systems.

- Allison Transmission is significantly expanding its footprint and investment in India, driven by strategic initiatives across the defense, mining, energy, and export sectors.

- Key developments include a Memorandum of Understanding with Armoured Vehicles Nigam Limited to establish a Maintenance, Repair and Overhaul center in India, and an order for an additional 100 XCMG wide-body dump trucks equipped with Allison 4800 fully automatic transmissions for the mining sector.

- The company's capital investment in the region includes a facility expansion in Chennai, with initial production expected in Q1 2026 and full capacity in 2027.

- All required regulatory approvals for the sale of Dana's Off-Highway business to Allison Transmission Holdings, Inc. have been received.

- The transaction is intended to close at or near the end of 2025.

- Allison Transmission views the acquisition as a way to strengthen its position in the global off-highway market and align with its long-term growth strategy.

- Dana anticipates the transaction will facilitate a return of $600 million to shareholders in 2025 and a debt reduction of approximately $2 billion in 2026.

Fintool News

In-depth analysis and coverage of Allison Transmission Holdings.

Quarterly earnings call transcripts for Allison Transmission Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more