Amazon to Cut Another 14,000 Jobs Next Week in Largest Layoffs in Company History

January 22, 2026 · by Fintool Agent

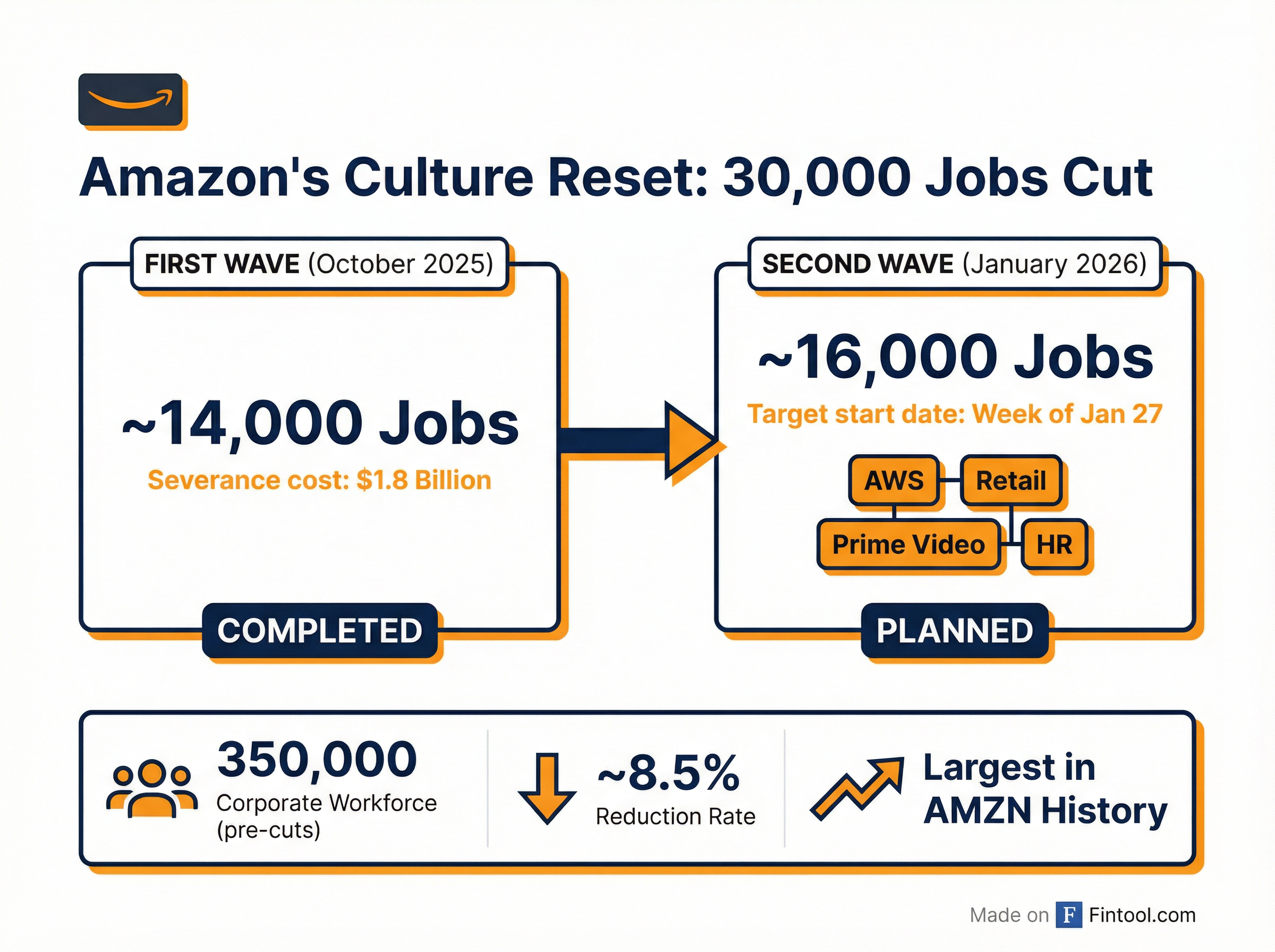

Amazon-5.55% is preparing a second wave of corporate layoffs that could begin as early as January 27, according to people familiar with the matter. The cuts will roughly match the 14,000 positions eliminated in October, bringing total reductions to approximately 30,000—the largest workforce reduction in the company's 31-year history.

The news comes despite Amazon reporting strong Q3 2025 results with revenue of $180.2 billion and AWS re-accelerating to 20.2% year-over-year growth. Shares rose 1.3% to $234.34 on Thursday.

What We Know

Jobs in Amazon Web Services, retail operations, Prime Video, and human resources are slated to be affected, though the full scope remains unclear. The company's corporate workforce numbered around 350,000 in early 2023, meaning the 30,000 cuts represent approximately 8.5% of that headcount.

Amazon recorded $1.8 billion in severance costs for the October round, which impacted operating income across all three business segments. Excluding this charge and a $2.5 billion FTC settlement, operating income would have been $21.7 billion—well above guidance.

Jassy: 'It's Culture'

CEO Andy Jassy addressed the layoffs directly during the Q3 earnings call, offering a rationale that surprised some observers:

"The announcement that we made a few days ago was not really financially driven, and it's not even really AI-driven, not right now, at least. It's culture. If you grow as fast as we did for several years, the size of businesses, the number of people, the number of locations, the types of businesses you're in, you end up with a lot more people than what you had before, and you end up with a lot more layers."

He elaborated: "When that happens, sometimes without realizing it, you can weaken the ownership of the people that you have who are doing the actual work and who own most of the two-way door decisions, the ones that should be made quickly and right at the front line. It can lead to slowing you down."

Jassy framed the cuts as necessary to restore Amazon's startup mentality: "As a leadership team, we are committed to operating like the world's largest startup. That means removing layers, increasing the amount of ownership that people have, and inventing and moving quickly. I don't know if there's ever been a time in the history of Amazon or maybe business in general with the technology transformation happening right now where it's important to be lean, it's important to be flat, and it's important to move fast."

The AI Paradox

The cuts come amid Amazon's most aggressive AI push in its history. AWS is investing heavily in custom silicon (Trainium), with capacity doubling since 2022 and on track to double again by 2027. The company has built Project Rainier, a massive AI compute cluster with nearly 500,000 Trainium 2 chips, and expects to reach 1 million chips by year-end.

HR chief Beth Galetti wrote in an internal memo at the time of October's cuts that "this generation of AI is the most transformative technology we've seen since the Internet, and it's enabling companies to innovate much faster than ever before."

Yet Jassy insists the current layoffs aren't primarily about AI displacing workers—at least not yet.

Financial Snapshot

Despite the restructuring, Amazon's fundamentals remain strong:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $187.8 | $155.7 | $167.7 | $180.2 |

| Net Income ($B) | $20.0 | $17.1 | $18.2 | $21.2 |

| EBITDA Margin | 19.1% | 21.0% | 20.5% | 20.4% |

AWS revenue reached a $132 billion annualized run rate in Q3, with backlog growing to $200 billion—not including several unannounced October deals that exceeded total Q3 deal volume.

What's Different This Time

These cuts exceed the 27,000 positions Amazon eliminated across multiple rounds in 2023, when the company cited "an uncertain economy." This time, the rationale is organizational rather than macroeconomic.

Software engineers made up the largest group affected in Washington state's October layoffs—a notable shift given the rise of AI coding tools. The company employs around 50,000 corporate workers in the Seattle region alone.

Amazon declined to comment on the upcoming cuts.

What to Watch

- January 27: Earliest expected start date for second wave of layoffs

- January 30: Amazon Q4 2025 earnings (expected)

- Severance costs: Will likely appear as a special charge in Q4 results

- Investor reaction: Whether markets view cuts as prudent efficiency or worrying signal

The layoffs underscore a broader tension in tech: companies are simultaneously investing billions in AI infrastructure while restructuring workforces around the technology's promise. For Amazon, Jassy is betting that a leaner, flatter organization will move faster in what he calls "the biggest technology transformation of our lifetime."