AMC Bondholders Enter Confidential Talks, Sparking Debt Slump

January 23, 2026 · by Fintool Agent

The meme stock's latest act: bondholders behind closed doors.

A group of Amc Entertainment bondholders has initiated confidential talks with the theater chain, prompting some of its notes to tumble amid concerns that another debt restructuring may be afoot—just six months after CEO Adam Aron declared the company was "unquestionably on offense."

Holders of AMC's 15% bonds due February 2029 are entering restricted discussions with management, according to people familiar with the matter. The notes dropped more than 5 cents on the dollar Friday to 98.5 cents—the steepest decline since the bonds were issued in July 2025.

AMC shares fell 5.5% to $1.56 on Friday, extending their decline from a 52-week high of $4.08. The stock is now down roughly 62% from that peak.

Six Months After "Transformative" Deal

The timing is striking. In July 2025, AMC completed what it called "transformative capital markets transactions" designed to strengthen its financial foundation. The company:

- Raised $244 million in new financing

- Exchanged $590 million of existing notes for $857 million of new Senior Secured Notes due 2029

- Equitized $143 million of exchangeable debt into common shares

- Fully redeemed its 2026 debt maturities

"Around 90% of our term loan lenders rallied behind this forward-looking plan, a level of support that demonstrates their tremendous confidence in the direction in which AMC is headed," Aron said at the time.

Now, bondholders are back at the table.

The Debt Mountain

AMC's balance sheet tells the story of a company that survived the pandemic through creative financing—but at a heavy cost.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Total Debt | $8.28B | $8.30B | $8.27B | $8.20B |

| Cash & Equivalents | $632M | $379M | $424M | $366M |

| Net Income | $(136M) | $(202M) | $(5M) | $(298M) |

| Working Capital Deficit | $(846M) | — | $(964M) | $(1,036M) |

The company's working capital deficit ballooned to over $1 billion in Q3 2025. Cash has declined from $632 million at year-end 2024 to just $366 million—burning through 42% of its liquidity in nine months.

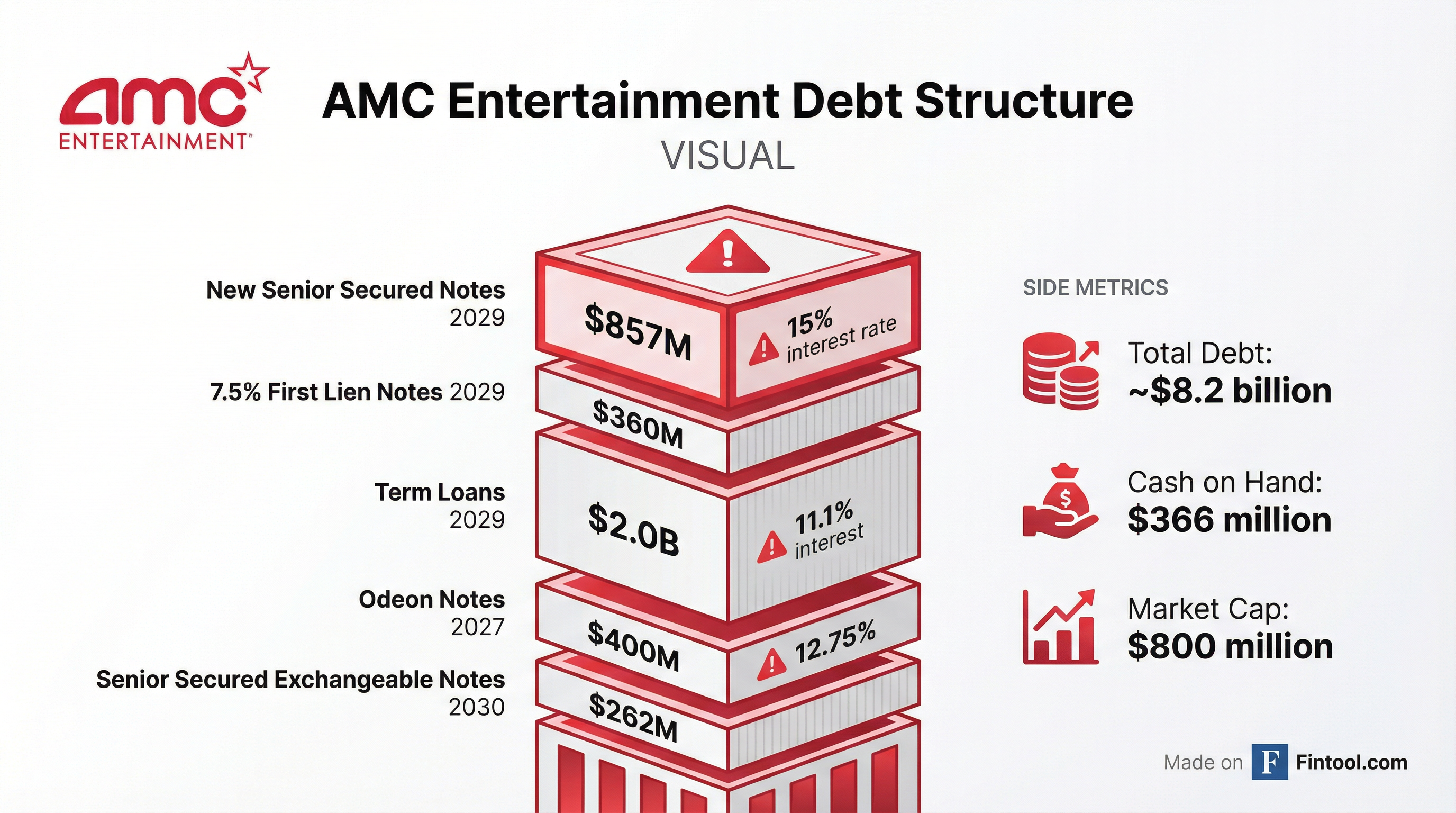

The debt structure is complex and expensive. AMC's borrowings carry interest rates ranging from 6% to 15%, with much of it secured against the company's assets. The 15% notes at the center of the current discussions—among the highest-yielding corporate bonds in the market—reflect the risk premium creditors demand for AMC exposure.

Market Cap vs. Debt: A Mismatch

Perhaps the most telling metric: AMC's market capitalization of roughly $800 million sits against $8.2 billion in debt—a 10-to-1 leverage ratio that leaves equity holders deeply subordinated to creditors.

The stock's journey mirrors retail investor sentiment. AMC became the quintessential "meme stock" during 2021, when Reddit traders drove shares to astronomical heights. Management capitalized on the mania, raising $4.5 billion in equity over six years to keep the company afloat.

"Our shareholder base, especially our retail shareholder base, who stayed with us all these years because of their belief in our future, their willingness to let equity come into our coffers, to keep our cash reserves robust and healthy and strong, are why we've made it," Aron said on the Q3 2025 earnings call.

But that goodwill has limits. Since COVID, outstanding shares have increased by over 500 million on a split-adjusted basis through at-the-market sales, note conversions, and other equity issuances.

What Confidential Talks Typically Mean

In distressed credit parlance, "confidential" or "restricted" discussions between bondholders and a company often signal the early stages of debt restructuring negotiations. By entering these talks, bondholders gain access to material non-public information about the company's finances—but also agree to trading restrictions on their positions.

The process can lead to several outcomes:

- Consensual restructuring: Bondholders agree to extend maturities, reduce interest rates, or convert debt to equity

- Exchange offers: Existing bonds are swapped for new securities with different terms

- Chapter 11 bankruptcy: If negotiations fail, formal court-supervised restructuring

AMC has navigated multiple rounds of debt restructuring since the pandemic. The company's 2024 refinancing transactions pushed most maturities to 2029-2030, buying time but not solving the fundamental leverage problem.

The Bull Case: Box Office Recovery

Management remains publicly optimistic. On the Q3 2025 earnings call, Aron pointed to improving fundamentals:

- Domestic market share grew to 24% (vs. 15% each for Regal and Cinemark)

- Contribution margin per patron up 54% versus 2019

- Record admissions revenue per patron of $12.25

- Strong food and beverage performance at $7.74 per patron

"If you look at the nine-month period from April 1 to December 31 of 2025, the industry has not been on the $9 billion pace that it will probably be on for 2025 calendar year, but a $10 billion pace," Aron said. "It sure would be nice if that's the pace that we have going forward."

CFO Sean Goodman noted that AMC expected to be free cash flow positive for the nine-month period ending December 2025, assuming box office trends continued.

What to Watch

The confidential nature of the talks means details will likely remain scarce until formal agreements are reached—or discussions break down. Key indicators to monitor:

- Bond price movements: Further declines would signal growing concern about credit quality

- Equity dilution: Any exchange of debt for equity would further dilute existing shareholders

- Rating agency actions: Credit downgrades could trigger covenant issues

- Box office performance: Q4 2025 and Q1 2026 results will test management's optimism

- Cash burn trajectory: With $366 million and $20+ million in quarterly interest, liquidity runway is limited

For the retail investors who made AMC a household name, the bondholders' move is a sobering reminder: in any capital structure, debt gets paid first.

Related: