Earnings summaries and quarterly performance for AMC ENTERTAINMENT HOLDINGS.

Executive leadership at AMC ENTERTAINMENT HOLDINGS.

Board of directors at AMC ENTERTAINMENT HOLDINGS.

Adam Sussman

Director

Anthony Saich

Director

Denise Clark

Director

Gary Locke

Director

Hawk Koch

Director

Kathleen Pawlus

Director

Keri Putnam

Director

Marcus Glover

Director

Philip Lader

Lead Independent Director

Sonia Jain

Director

Research analysts who have asked questions during AMC ENTERTAINMENT HOLDINGS earnings calls.

Chad Beynon

Macquarie

4 questions for AMC

Alicia Reese

Wedbush Securities

2 questions for AMC

Eric Wold

B. Riley Securities

2 questions for AMC

James Goss

Barrington Research

1 question for AMC

Jordan Bender

JMP Securities

1 question for AMC

Recent press releases and 8-K filings for AMC.

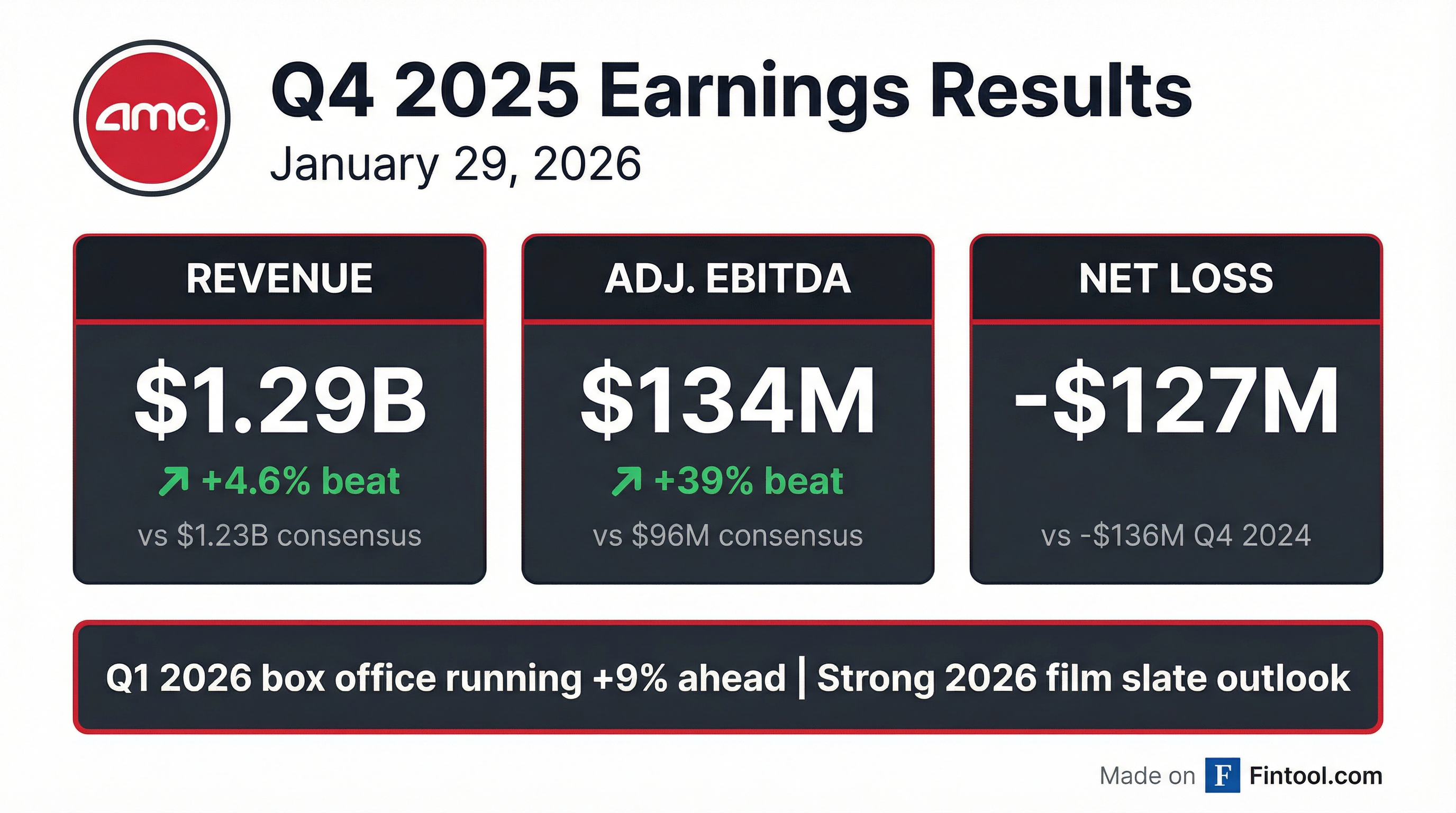

- AMC Entertainment Holdings reported full-year 2025 consolidated revenue of over $4.8 billion, a 4.6% increase from 2024, and adjusted EBITDA of approximately $388 million, a nearly 13% year-over-year improvement. For Q4 2025, total revenue was $1.29 billion and adjusted EBITDA was $134 million.

- The company ended 2025 with $428 million in cash (excluding restricted cash) and generated positive free cash flow of $51 million for the nine months ending December 31, 2025, despite a full-year use of $366 million. Capital expenditures for 2025 totaled $200 million, with 2026 CapEx expected to be between $175 million-$225 million.

- Operationally, AMC achieved record-setting per-patron revenue and profit metrics and continued to optimize its theater portfolio, closing 21 locations and opening 3 in 2025. Strategic initiatives included expanding premium large format screens and a successful collaboration with Netflix, with the company expressing optimism for a stronger film slate in 2026.

- AMC Entertainment reported Q4 2025 total revenue of approximately $1.29 billion and full-year 2025 consolidated revenue exceeding $4.8 billion, representing a 4.6% increase from 2024. Adjusted EBITDA for Q4 was $134 million, and for the full year 2025, it was approximately $388 million, marking a nearly 13% year-over-year improvement.

- The company ended 2025 with $428 million in cash (excluding restricted cash) and reported a $366 million use of cash for free cash flow for the full year, though it generated $51 million in positive free cash flow for the nine months ending December 31, 2025.

- AMC has significantly strengthened its balance sheet, reducing total debt by approximately $1.8 billion since the end of 2020 and addressing all 2026 debt maturities by pushing them out to 2029. A refinancing transaction was launched to extend approximately $2.4 billion of debt from 2027 and 2029 to 2031.

- Management is optimistic for 2026, expecting the North American box office to increase by approximately $500 million to more than $1 billion compared to 2025 due to a richer movie slate, which is anticipated to lead to a meaningful increase in adjusted EBITDA and improved free cash flow.

- For Q4 2025, AMC generated $1.29 billion in total revenue, $134 million of adjusted EBITDA, and $127 million of cash from operating activities. Full-year 2025 consolidated revenue grew 4.6% to over $4.8 billion, with adjusted EBITDA increasing nearly 13% to approximately $388 million.

- The company continued to strengthen its balance sheet, reducing total debt by approximately $1.8 billion since the end of 2020 and addressing all 2026 debt maturities by pushing them out to 2029. A refinancing transaction for approximately $2.4 billion of debt maturing in 2027 and 2029 was launched to extend maturities to 2031. AMC ended 2025 with $428 million of cash.

- AMC maintained a strong market position, capturing more than 1 out of 4 of all U.S. box office dollars, and continued its theater portfolio transformation by closing 21 locations and opening 3 in 2025.

- Management is optimistic about the 2026 movie slate, expecting the North American box office to grow by approximately $500 million to more than $1 billion compared to 2025, which is anticipated to drive substantial adjusted EBITDA growth due to operating leverage. Capital expenditures for 2026 are projected to be between $175 million and $225 million.

- AMC monetized over $24 million from a partial sale of its Hycroft Mining Company stake in November 2025, with remaining holdings valued at approximately $39 million, significantly exceeding the initial $29 million investment.

- AMC Entertainment is seeking to refinance approximately $2.5 billion of existing borrowings, comprising a $750 million term loan B and about $1.73 billion of other secured debt.

- The refinancing package is intended to address a $2 billion term loan due in 2029 and $400 million of 12.75% senior notes maturing next year, aiming to manage an onerous, expensive debt load.

- The CCC-rated theater chain currently has a $2 billion term loan priced at 1-month SOFR plus 700 basis points.

- AMC's financial profile includes a market capitalization of approximately $650 million, reported revenue of $4.867 billion, a three-year revenue decline of about -15.9%, and a net margin of -13.16%.

- AMC Entertainment Holdings, Inc. has entered into a Sales and Registration Agreement and a Master Confirmation to issue and sell shares of its Class A common stock.

- The aggregate offering price of the shares that may be sold pursuant to these agreements is up to $150,000,000.

- The company intends to use the net proceeds to strengthen its balance sheet, bolster liquidity, repay, redeem or refinance existing debt, and reinvest in its core business under the AMC GO Plan.

- Sales will be made through "at-the-market offerings" and collared forward sale transactions, with Goldman Sachs & Co. LLC, B. Riley Securities, Inc., and Yorkville Securities, LLC acting as sales agents.

- AMC Entertainment Holdings, Inc. announced an agreement with certain holders of its Muvico, LLC Senior Secured Notes due 2029, providing flexibility to refinance its existing term loan credit agreement and 12.75% Odeon Senior Secured Notes due 2027 to extend maturity and reduce interest expense.

- As consideration for the agreement, AMC will pay a consent fee to the 2029 Noteholders, which will be a maximum of up to 17,806,866 shares of Class A common stock, with the total Consent Premium valued at $18,919,794.32.

- For the three months ended December 31, 2025, preliminary results include total revenues of approximately $1,288.3 million, a net loss of approximately $(127.4) million, and Adjusted EBITDA of approximately $134.1 million. Cash and cash equivalents at December 31, 2025, were $428.5 million, excluding restricted cash.

- For the full year ended December 31, 2025, preliminary results show total revenues of approximately $4,848.9 million, a net loss of approximately $(632.4) million, and Adjusted EBITDA of approximately $387.5 million.

- AMC Entertainment Holdings has reached an agreement with lenders to provide debt refinancing flexibility for its Muvico, LLC Senior Secured Notes due 2029, with the goal of extending maturity and reducing interest expense.

- Preliminary results for the fourth quarter ended December 31, 2025, include total revenues of approximately $1,288.3 million, a net loss of approximately $(127.4) million, and Adjusted EBITDA of approximately $134.1 million.

- For the full year ended December 31, 2025, preliminary results show total revenues of approximately $4,848.9 million, a net loss of approximately $(632.4) million, and Adjusted EBITDA of approximately $387.5 million.

- The company reported cash and cash equivalents of $428.5 million as of December 31, 2025.

- AMC's CEO expressed optimism for 2026, noting the first quarter box office year-to-date is approximately 9% ahead of the same period last year, with a strong film slate expected to drive significant industry growth.

- AMC Theatres successfully collaborated with Netflix to screen the Stranger Things series finale in 231 U.S. theatres on New Year's Eve and New Year's Day, attracting over 753,000 fans.

- This event generated more than $15.0 million in two days from mandatory $20 per-person food and beverage credits.

- Following this success and a prior collaboration for Netflix's KPop Demon Hunters, both companies are actively discussing additional programming to be shown on AMC's screens in 2026 and beyond.

- This partnership is supported by a significant overlap in customer base, as approximately two-thirds of AMC Stubs loyalty program members in the U.S. are also Netflix subscribers.

- AMC Entertainment reported over 5.5 million moviegoers visited its global theaters from December 25-28, marking the company's second-busiest Thursday-through-Sunday weekend of 2025.

- Internationally, AMC's ODEON locations attracted over 1.7 million patrons, making it the busiest international weekend of the year for the company.

- Despite the strong holiday turnout, AMC continues to face financial headwinds, including a negative operating margin and a distressed Altman Z-Score.

- AMC's market capitalization was approximately $866.88 million.

- The company operates approximately 860 theatres and 9,600 screens globally, maintaining its position as the largest movie exhibition company worldwide.

- AMC Entertainment achieved its best pre-Christmas holiday weekend since 2021, with over 4 million moviegoers visiting AMC and ODEON Cinemas locations from Thursday through Sunday.

- This strong performance was driven by the successful opening of "AVATAR: FIRE & ASH" in AMC’s U.S. theatres and internationally at ODEON Cinemas.

- The film "Avatar: Fire and Ash" also contributed to IMAX's biggest opening weekend of 2025, generating $43.6 million globally and marking its fifth biggest debut in IMAX history.

Fintool News

In-depth analysis and coverage of AMC ENTERTAINMENT HOLDINGS.

Quarterly earnings call transcripts for AMC ENTERTAINMENT HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more