Amphenol Chairman Martin Loeffler Retires After 52 Years: CEO Norwitt Named Successor

February 5, 2026 · by Fintool Agent

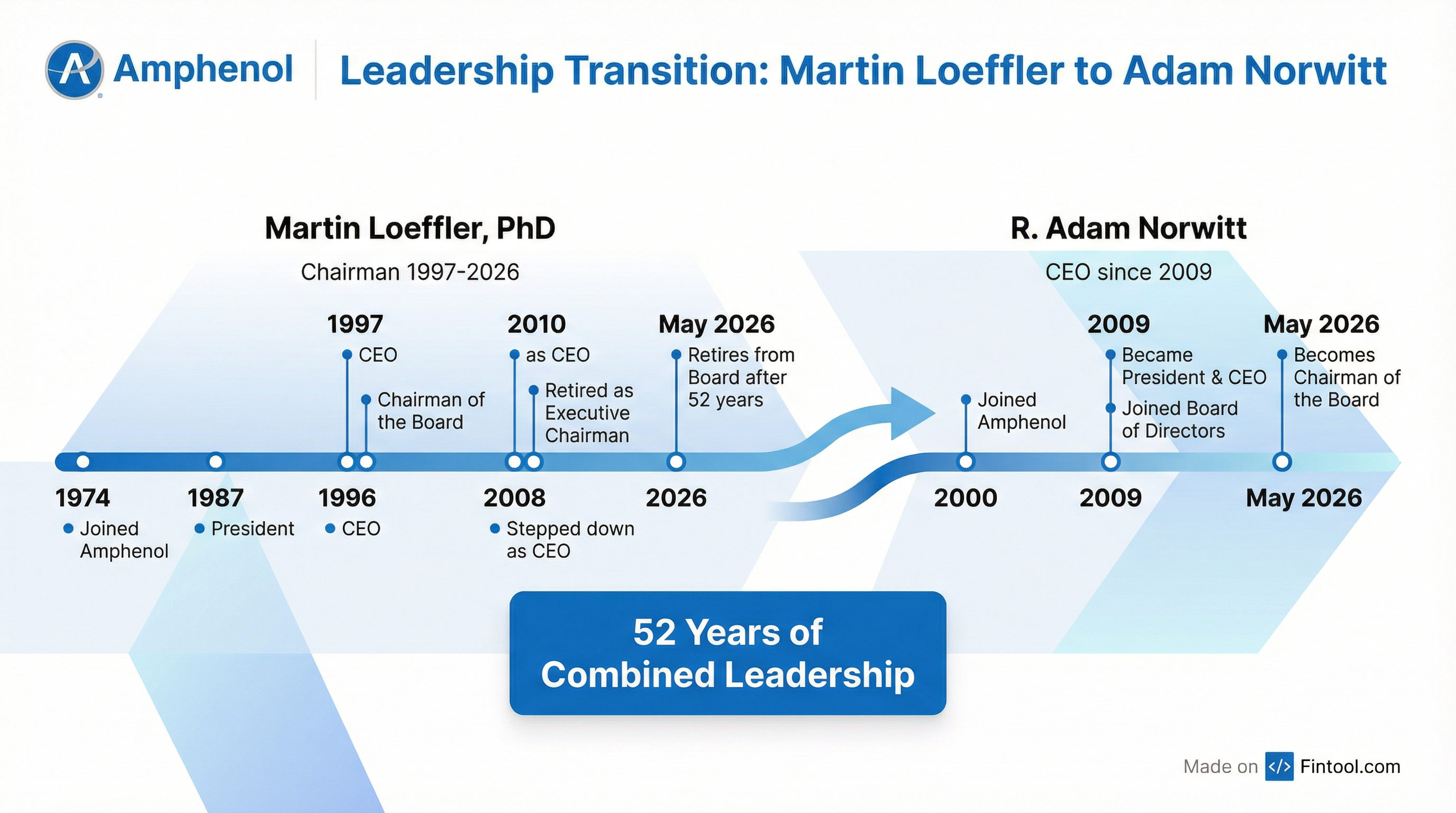

Amphenol Corporation announced that Chairman Martin H. Loeffler will retire from the Board of Directors after more than five decades with the company, concluding one of the longest and most successful tenures in the electronic connector industry.

The Wallingford, Connecticut-based company appointed President and CEO R. Adam Norwitt to the additional role of Chairman, effective at the 2026 Annual Meeting of Stockholders expected in May. The planned succession comes as Amphenol reaches new heights—the stock has returned 88% since January 2025, and the company just reported record revenue of $23.1 billion for fiscal 2025.

A Legacy Five Decades in the Making

Loeffler, 80, joined Amphenol in 1974 with a PhD in physics from the University of Innsbruck, Austria, initially working as a researcher in semiconductors before rising through general management and international operations roles.

His ascent to leadership reshaped the company:

| Role | Period |

|---|---|

| President | 1987-2006 |

| CEO | 1996-2008 |

| Chairman of the Board | 1997-2026 |

| Executive Chairman | 2009-2010 |

During his tenure, Loeffler established the foundation of what the company calls its "entrepreneurial culture"—a decentralized operating model with over 100 operating groups, each led by general managers with full P&L authority.

"I have no doubt that Adam will continue to be an outstanding steward of Amphenol's culture, while further supporting the superior growth and profitability of the Company," Loeffler said in the announcement.

Norwitt: 17 Years of Execution

Norwitt, 55, has served as President and CEO since 2009, when Loeffler stepped back from the CEO role after 12 years. Under Norwitt's operational leadership, Amphenol has more than doubled its revenue in the past four years alone, from $12.6 billion in FY 2022 to $23.1 billion in FY 2025.

"Nearly 40 years ago, Martin helped establish the foundation of Amphenol's entrepreneurial culture and nurtured that culture through his roles as President, CEO and Chairman," Norwitt said. "This entrepreneurial culture has been the key enabler of Amphenol's extraordinary growth and performance."

The succession planning appears textbook. Presiding Director David P. Falck, who has served on the board since 2013, will continue as Lead Independent Director to maintain governance oversight.

Financial Track Record: From $6B to $23B

Loeffler's tenure as Chairman coincided with remarkable value creation. Here's how the numbers have evolved:

| Metric | FY 2016 | FY 2020 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue ($B) | $6.3 | $8.6 | $15.2 | $23.1 |

| Net Income ($B) | $0.8 | $1.2 | $2.4 | $4.3 |

| EBITDA Margin (%) | 23.0%* | 22.7%* | 25.5%* | 30.2%* |

*Values retrieved from S&P Global

That's a 15.5% revenue CAGR over nine years, with net income growing even faster at 20%+ annually. The company achieved record adjusted operating margins of 26.2% in FY 2025, up 450 basis points from the prior year.

Stock Performance: 88% in 13 Months

Amphenol shares closed at $130.00 on February 4, 2026—down 11.6% on the day—but still up 88% from $69.01 at the start of January 2025. The single-day decline appears unrelated to the succession announcement; analysts attribute it to post-earnings guidance concerns and a broader tech selloff rather than leadership transition fears.

| Metric | Value |

|---|---|

| Market Cap | $159 billion |

| 52-Week High | $167.04 (Jan 27, 2026) |

| 52-Week Low | $56.45 (Apr 7, 2025) |

| YTD Return (Jan 2025-Feb 2026) | +88% |

The AI and Data Center Tailwind

Amphenol's recent performance surge is largely attributable to its exposure to artificial intelligence infrastructure. The company's IT Datacom segment—which supplies high-speed connectors and cable assemblies for data centers—saw sales more than double year-over-year in Q4 2025.

"The revolution in AI continues to create a unique opportunity for Amphenol, given our leading high-speed and power interconnect products," Norwitt said on the Q4 2025 earnings call.

The company's January 2026 acquisition of CommScope's connectivity business for $4.1 billion in expected annual revenue further expands its data center footprint.

What to Watch

The leadership transition appears well-orchestrated with minimal disruption risk:

- Continuity: Norwitt has worked alongside Loeffler for 26 years and led as CEO for 17 years. The strategy isn't changing.

- Governance: Lead Independent Director David Falck remains in place to ensure board independence.

- No disagreement: The 8-K explicitly states Loeffler's retirement "is not the result of a disagreement with the Company on any matter relating to the Company's operations, policies or practices."

For investors, the more pressing question is valuation. At 39x trailing earnings and a $159 billion market cap, Amphenol is priced for continued AI-driven growth. The Q1 2026 guidance calling for 43-45% year-over-year revenue growth suggests management sees no slowdown.

The succession becomes effective in May 2026 at the Annual Meeting. Until then, Martin Loeffler's 52-year run continues—but the torch is already passing.

Related Companies: Amphenol