APi Group Signals Strong Q4 at Citi Conference as Data Centers Hit 10% of Sales

February 17, 2026 · by Fintool Agent

Api Group CEO Russ Becker delivered a bullish message at the Citi 2026 Global Industrial Tech and Mobility Conference today, confirming that Q4 2025 was the company's "best quarter of the year" for margin expansion and signaling continued momentum heading into 2026.

The fire and life safety giant, which reports fourth quarter results on February 25, also disclosed that data center work is poised to reach 10% of revenue in 2026, up from 8% in 2025—a significant acceleration in a market where hyperscalers are racing to build out AI infrastructure.

APG shares rose 0.9% to $44.79 on the session, within striking distance of the 52-week high of $46.11. The stock has gained 119% over the past year as the company executes on its 10/16/60+ strategic framework.

Q4 Preview: 'Best Quarter' for Margins

CFO David Jackola provided color ahead of next week's earnings release, noting that Q4 continued the trajectory of sequential margin improvement the company guided to throughout 2025.

"Fourth quarter was our best quarter of the year from a year-over-year margin expansion perspective," Jackola said. "The backlog's strong, there's a lot of momentum, and nothing really that looks to knock us off the momentum in the business right now."

The company previously indicated it expects full-year 2025 results at or above the midpoint of guidance: $7.875 billion in net revenues and $1.030 billion in adjusted EBITDA.

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $1,601* | $1,730* | $1,826* | $1,861* | $1,719* | $1,990* | $2,085* |

| EBITDA Margin (%) | 10.3%* | 11.8%* | 11.8%* | 10.5%* | 10.4%* | 12.5%* | 12.9%* |

*Values retrieved from S&P Global

The margin trajectory underscores APi's progress toward its 2028 target of 16%+ adjusted EBITDA margin, part of the 10/16/60+ framework announced at the May 2025 Investor Day.

Data Centers: From 8% to 10% of Revenue

One of the most notable disclosures was the quantification of APi's data center exposure. Becker confirmed the segment represented 8% of 2025 revenue and is "probably headed towards 10% in 2026."

The CEO emphasized the strategic calculus behind taking on large data center projects, noting that while project work is "gravy" relative to the company's inspection-first model, hyperscaler relationships are increasingly valuable.

"These data centers, the size and the complexity of them—they're not super complex, but the size makes it complex. They're in remote locations," Becker explained. "One of our clients has a project in northern Louisiana, and not everybody can man a project in northern Louisiana. We can."

Importantly, data center projects are commanding premium margins. Becker noted that when committing resources to large-scale hyperscaler work, "you need to make sure that you're getting a higher margin on the work that you're doing, and you should."

The Specialty Services segment is actually more exposed to data centers as a percentage of revenue than the Safety Services segment—a detail that surprised some investors given the company's fire and life safety focus.

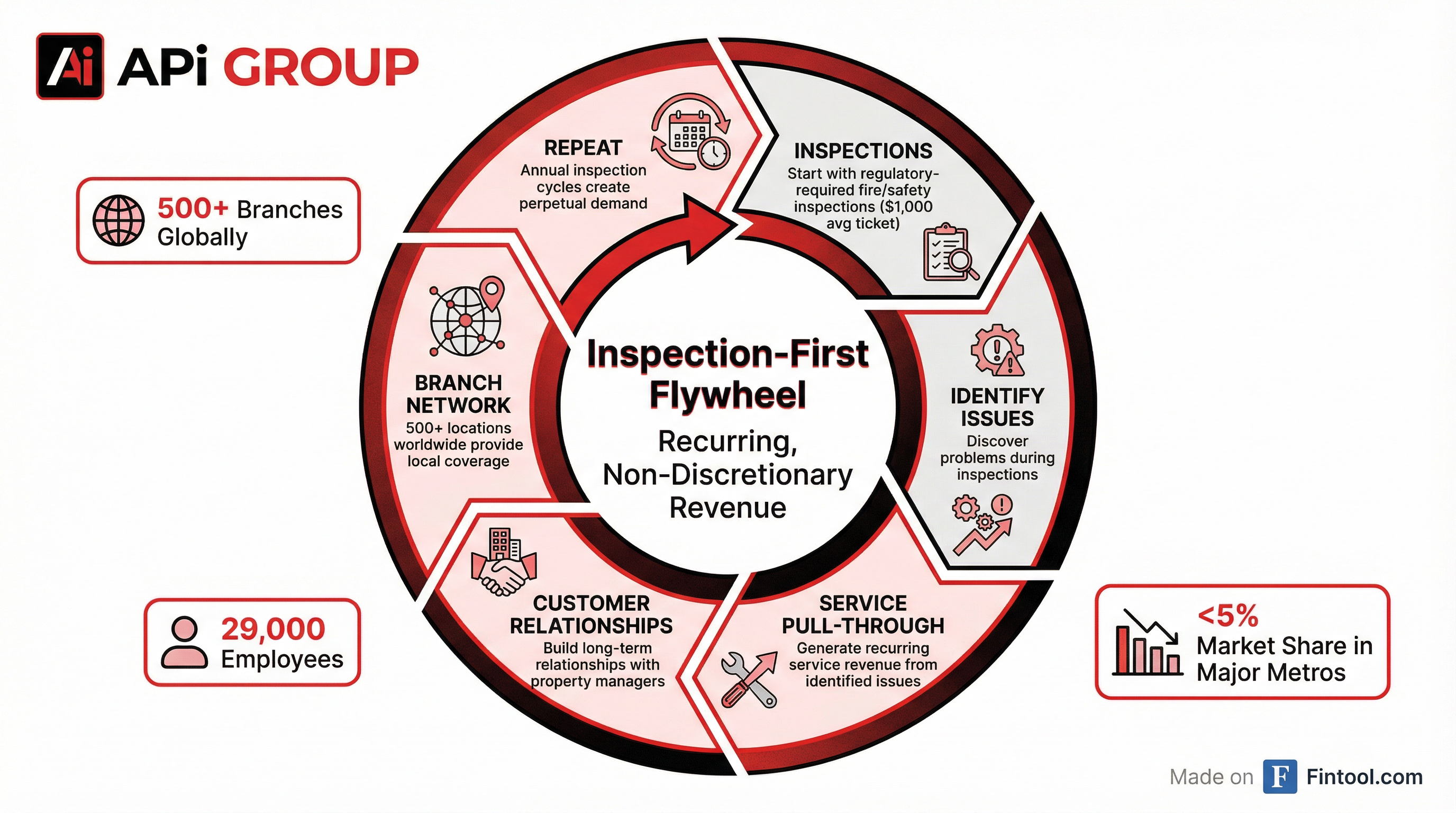

The Inspection-First Flywheel

Becker spent considerable time explaining why competitors haven't successfully replicated APi's inspection-first model, which generates recurring revenue from statutorily mandated fire safety inspections.

"The majority of our competitors remain small, family-owned businesses," Becker said. "For those small and family-owned businesses, it's much easier for them to grab a new installation project, say, a $1 million installation project, versus building up a really robust inspection department $1,000 at a time."

APi's advantage lies in its branch network—the company claims no more than 5% market share in any major metropolitan area, suggesting substantial runway for organic growth. "For us, and our ability to continue to drive inspection growth, which leads to pull-through service work, the opportunity is boundless," Becker added.

The inspection-first strategy targets having 60% or more of revenue from inspection, service, and monitoring—up from approximately 54% today.

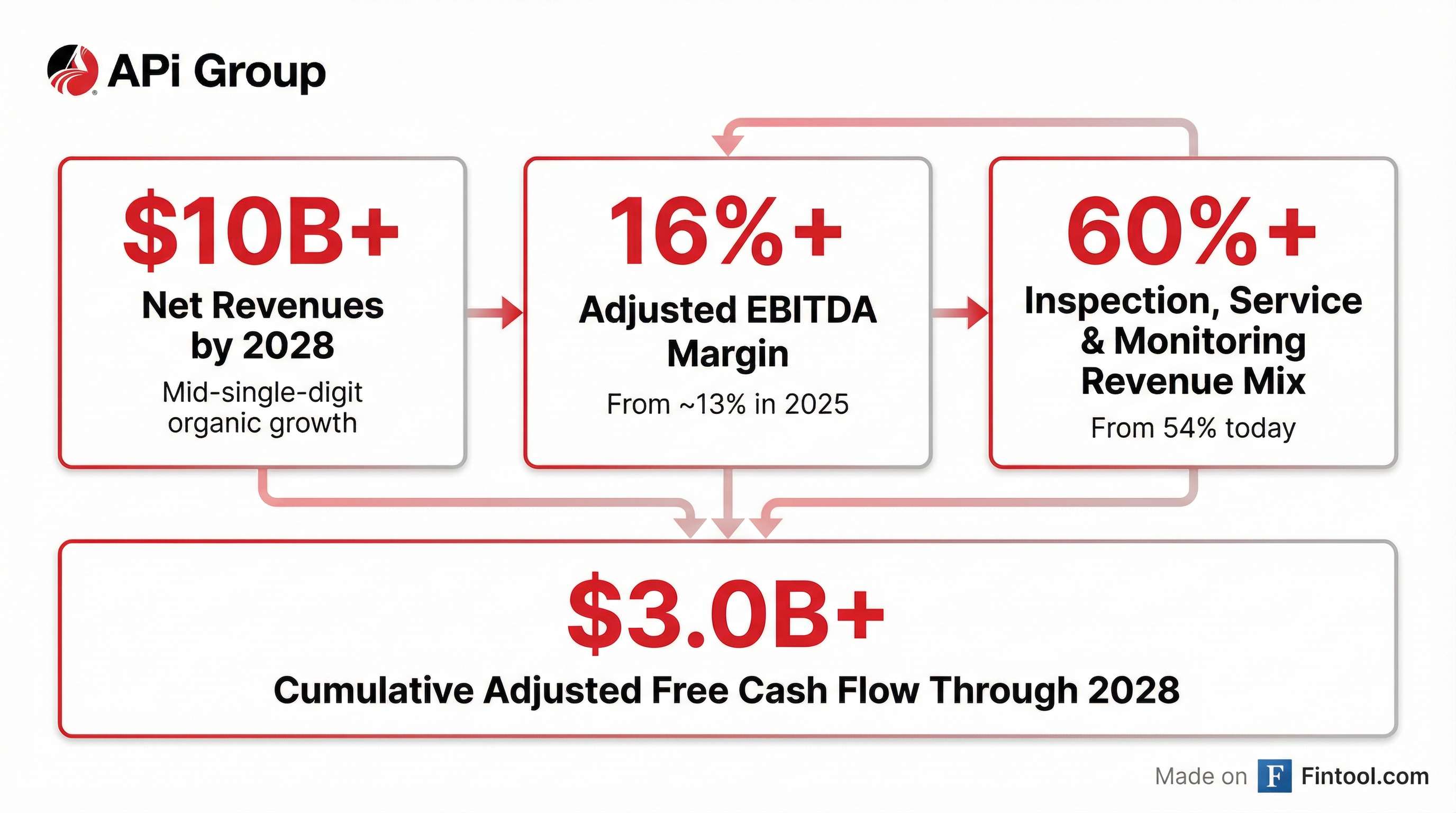

10/16/60+ Framework: On Track for 2028

The conference provided an opportunity for management to reaffirm confidence in the company's 2028 targets:

- $10B+ net revenues with mid-single-digit organic growth

- 16%+ adjusted EBITDA margin (up from ~13% in 2025)

- 60%+ of revenue from inspection, service, and monitoring

- $3.0B+ cumulative adjusted free cash flow through 2028

Becker emphasized that achieving these targets doesn't require transformational technology or dramatic strategic pivots. "The drums that we need to beat to achieve those goals aren't changing," he said. "We don't need technology to necessarily enable us to achieve our goals. Technology will help us achieve our goals, but it's not an excuse to not achieve our goals."

Branch Optimization: The Leadership Variable

Management disclosed progress on branch-level margin optimization. At the May 2025 Investor Day, APi reported its North American safety branches had a median margin of 17%, while international branches sat at 13%.

Becker expects approximately 100 basis points of improvement in median branch margins over the course of 2026, with a long-term goal of every branch achieving 20% or higher margins.

"A really high-performing branch, it's got nothing to do with the playbook. It's got everything to do with the branch leader," Becker explained. "We've been on this journey of leadership development since 2003. We have a 20-year jump in North America on the international business."

The international business, acquired through the 2021 Chubb acquisition from Carrier, remains a margin expansion opportunity. Roughly 40% of international branches still operate below the 10% margin threshold that management considers suboptimal.

M&A: CertaSite Done, Elevator and International Pipeline Building

APi completed the acquisition of CertaSite on February 2, 2026, adding approximately $90 million in annual revenue with a 90%+ inspection/service revenue mix.

Becker acknowledged paying a "healthier multiple" for CertaSite but defended the strategic fit: "90%+ of their revenue is inspection and service work. It's straight down the fairway."

The M&A pipeline is expanding on multiple fronts:

Bolt-on acquisitions: Still achievable at 5-7x EBITDA, though private equity competition drives multiples higher for targets in the $20-40 million EBITDA range.

Elevator services: APi is taking a "walk before you run approach" to building out its elevator service platform, with several live bolt-on deals in progress. The company sees a path to $1 billion+ in elevator revenue.

International: For the first time since acquiring Chubb, APi is actively pursuing bolt-on acquisitions in its international markets. "We've got some really good stuff going on in the international business for really the first time since we've owned Chubb," Becker said.

Transformational deals: When asked about larger acquisitions, Becker was diplomatic but clear: "When the time is right... The beautiful thing about where we're at today is we don't have to do anything."

AI Investment: Field Productivity Focus

APi has stood up a dedicated AI team with five employees, led by "a really smart leader," focused on developing tools to make field workers' jobs "easier, more efficient, more productive."

Becker provided a concrete example: "You can see a day where AI designs the fire alarm system for a new tenant improvement project... AI is taking it from 0-85%, and our designer is taking it from 85%-100%."

The company is also investing in a major system implementation project, with a pilot deployment expected in the first half of 2026. "The clean data that we're getting as a result of this system work, I think, is really going to enable us to do a lot more with AI once that system is providing the solid foundation for our business," Jackola noted.

Tariff Exposure: 'Out in Front of the Wave'

Management addressed commodity and tariff concerns head-on, noting the company monitors hot-rolled coil prices weekly as an indicator for pipe costs.

"Even before President Trump won the election, in his previous administration, he used tariffs as a hammer. He ran on tariffs. If you didn't know he was gonna use tariffs as a hammer, then shame on you," Becker said. "We feel like we have been out in front of that wave since day one."

The company conducts monthly procurement updates with approximately 250 leaders and has been advising business units to build tariff protection into project proposals.

Analyst Estimates and Valuation

Consensus estimates reflect confidence in APi's trajectory:

| Metric | Q4 2025E | FY 2026E |

|---|---|---|

| Revenue | $2.09B* | $8.44B* |

| EPS | $0.42* | $1.71* |

| EBITDA | $288M* | $1.17B* |

*Values retrieved from S&P Global

At current prices, APG trades at approximately 26x forward earnings—a premium to industrial services peers that management believes is justified by the recurring revenue model and margin expansion runway.

What to Watch

February 25: Q4 2025 earnings release (pre-market) and conference call at 8:30 AM ET.

February 18: Management presents at Barclays 2026 Industrial Select Conference at 7:30 AM ET.

Key questions for the earnings call: Margin trajectory sustainability, data center pipeline visibility, international M&A cadence, and any update on larger deal appetite.

Related Companies: Api Group