Apollo Deploys $7 Billion to Finance Nvidia GPUs for Musk's xAI in AI Infrastructure Play

February 9, 2026 · by Fintool Agent

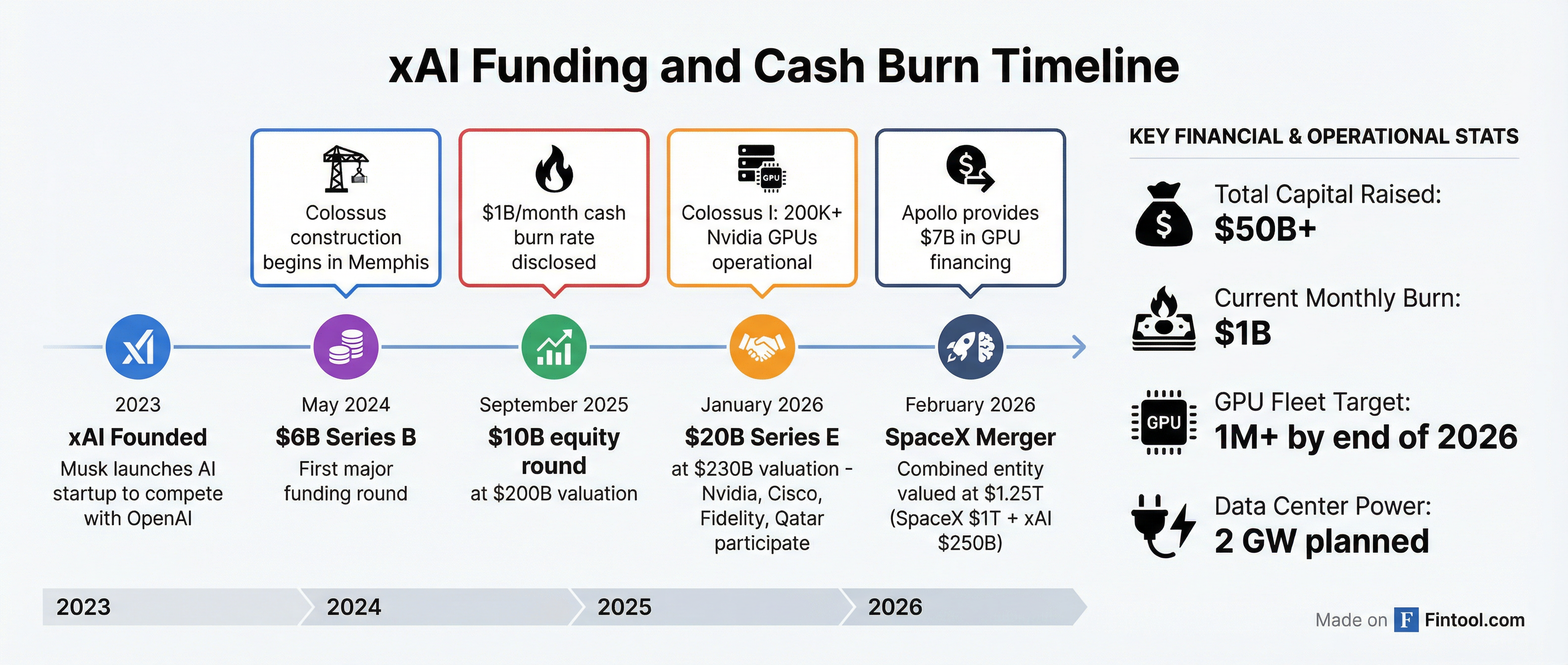

Apollo Global Management is nearing completion of its second major GPU financing deal for Elon Musk's xAI in just five weeks, bringing the alternative asset manager's total commitment to roughly $7 billion—a striking example of how private credit is stepping in to finance the capital-intensive AI infrastructure buildout that traditional corporate balance sheets cannot absorb.

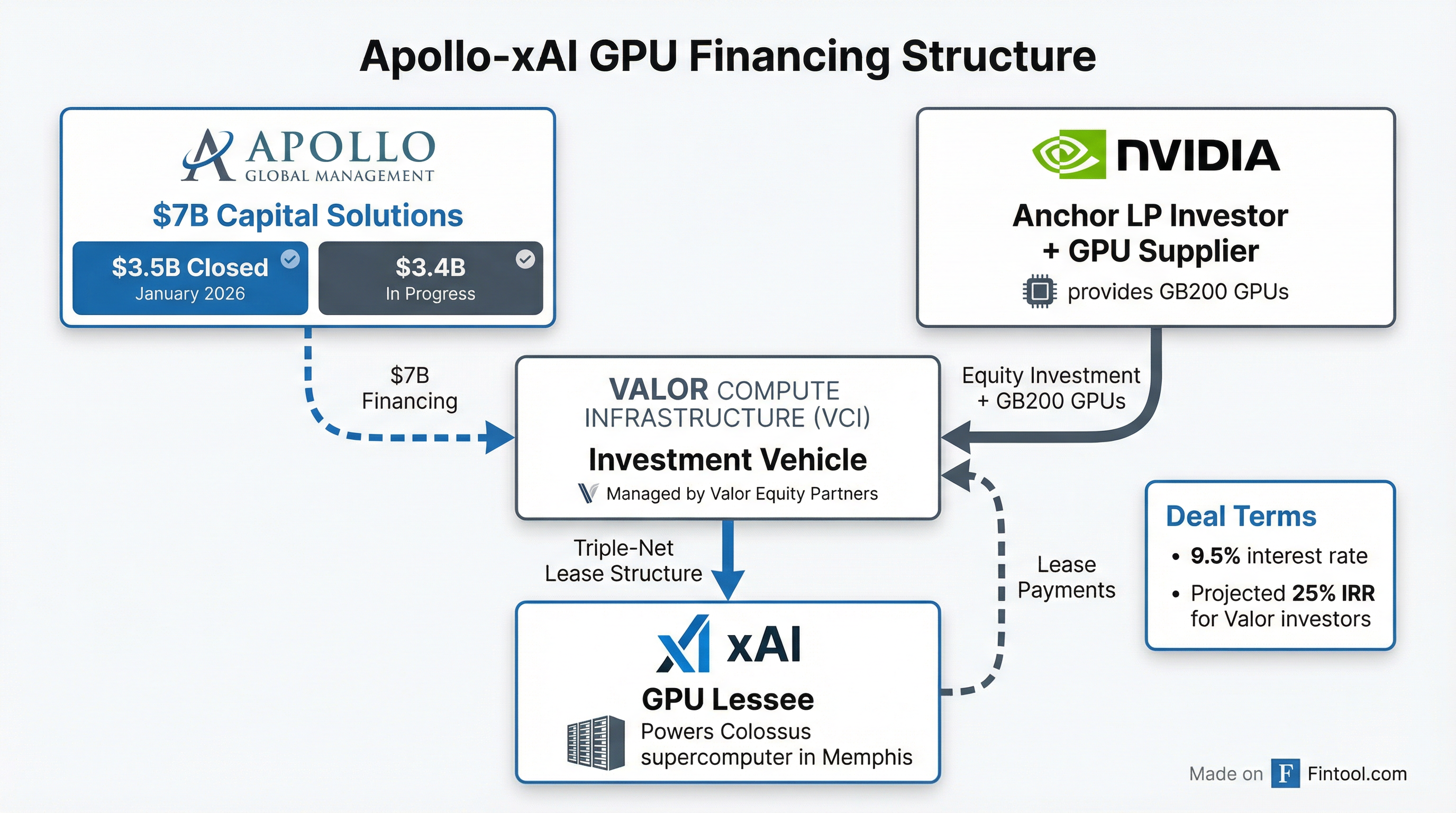

The $3.4 billion loan being finalized this week follows a $3.5 billion capital solution Apollo closed in January. Both deals finance investment vehicles managed by Valor Equity Partners that purchase Nvidia Corporation chips and lease them to xAI under triple-net lease structures.

The transactions underscore a profound shift in AI financing: the largest AI infrastructure deals are no longer flowing through traditional equity markets or corporate debt, but through asset-backed private credit arranged by alternative asset managers.

The Economics of AI's Capital Problem

xAI's infrastructure needs are staggering. The company is burning approximately $1 billion per month—$12 billion annually—as it races to catch OpenAI and Anthropic while building out the Colossus supercomputer facility in Memphis, Tennessee.

That facility currently operates 200,000-230,000 Nvidia H100 GPUs, with plans to expand to over 1 million H100-equivalent chips by the end of 2026. At current pricing, that expansion alone could require $20-30 billion in GPU procurement.

Traditional financing options are unattractive at xAI's scale:

- Equity dilution: xAI raised $20 billion at a $230 billion valuation in January, but continuous equity raises would erode Musk's ownership

- Corporate debt: xAI's cash burn and limited revenue command premium rates—its June 2025 bond carried a 12.5% coupon, roughly double what established tech companies pay

- Outright purchase: Tying up tens of billions in GPU hardware destroys liquidity when cash burn is already exceeding revenue

The Apollo-Valor structure solves this by turning GPUs into financeable assets. An investment vehicle acquires the chips, then leases them to xAI under triple-net terms where the lessee bears operating costs. The vehicle generates cash flow from lease payments while Apollo earns interest income and Valor investors collect distributions.

Nvidia's Clever Positioning

What makes the deal structure particularly notable is Nvidia's dual role. The chipmaker invested as an "anchor Limited Partner" in Valor Compute Infrastructure alongside selling its GB200 GPUs into the vehicle.

This accomplishes three things for Nvidia:

- Guaranteed chip sales to one of the world's largest AI clusters

- Equity upside in the financing vehicle as GPU values appreciate

- Risk mitigation by ensuring xAI can access capital to continue purchasing chips

Nvidia shares rose 2.5% Monday to $190.04, extending the stock's outperformance as investors recognize the chipmaker's expanding role in AI infrastructure financing—not just as a supplier, but as a financial participant in the buildout.

Apollo's AI Infrastructure Thesis

Apollo has been systematically building its AI infrastructure exposure. The firm estimates global data center infrastructure will require "several trillion dollars of investment" over the next decade, with $300-400 billion annually potentially financed through debt markets.

Since 2022, Apollo-managed funds have deployed over $40 billion into next-generation infrastructure spanning compute capacity, digital platforms, and renewable energy.

"This transaction represents a hallmark, downside-protected investment for Apollo in the AI infrastructure space," said Apollo Partner Christopher Lahoud. The firm characterizes these deals as "asset-backed" with the underlying GPU hardware providing collateral value.

Apollo shares edged up 0.7% to $133.95, trading below their 50-day moving average of $140.72 despite the firm's expanding position in one of the hottest infrastructure themes in markets.

| Metric | Apollo (APO) | Nvidia (NVDA) |

|---|---|---|

| Current Price | $133.95 | $190.04 |

| Day Change | +0.7% | +2.5% |

| 52-Week High | $164.76 | $212.19 |

| Market Cap | $77.7B | $4.63T |

| YTD Performance | -4.8% vs 50-day MA | +3.5% vs 50-day MA |

The xAI-SpaceX Merger Context

The GPU financing comes just days after Musk announced that SpaceX is acquiring xAI, creating a combined entity valued at approximately $1.25 trillion—$1 trillion for SpaceX and $250 billion for xAI.

The merger effectively provides xAI with a lifeline to SpaceX's cash-generative operations. SpaceX generated an estimated $8 billion in profit in 2025, but even that would be overwhelmed by xAI's $12 billion annual burn rate if it continues unabated.

Musk has framed the combination around "space-based AI"—orbital data centers that could bypass terrestrial power constraints. But the more immediate reality: xAI needed access to SpaceX's profitable operations and an eventual path to public markets.

The Broader Private Credit Opportunity

Apollo's xAI deals are part of a larger transformation in AI financing. Morgan Stanley estimates that nearly $3 trillion will be needed to support AI infrastructure through 2028, with more than half—around $1.5 trillion—coming from external capital. Private credit, particularly asset-backed finance, is expected to contribute over $800 billion.

The hyperscalers—Alphabet, Amazon, Meta, Microsoft, and Oracle—have announced over $1.5 trillion in capex over the next five years. But even these cash-rich giants are diversifying their funding sources, with Google parent Alphabet selling $20 billion in bonds just today.

For alternative asset managers like Apollo, this creates what the firm calls a "multi-trillion-dollar opportunity" in digital infrastructure financing.

What to Watch

Near-term catalysts:

- Final close of the $3.4 billion deal, expected this week

- Any disclosure of lease terms or implied returns to Valor investors

- xAI's Grok 5 launch, currently in training and expected Q1 2026

Risks to monitor:

- GPU price depreciation if next-generation chips (Blackwell, Rubin) accelerate obsolescence

- xAI's path to profitability—management targets 2027, but burn rate remains elevated

- Regulatory scrutiny of the combined SpaceX-xAI entity, particularly regarding defense contracts

Investment implications:

- Apollo's AI infrastructure thesis is playing out in real-time, with ~$7 billion deployed to a single counterparty in five weeks

- Nvidia benefits from guaranteed chip demand plus equity participation in the financing vehicle

- The deal structure—private credit financing triple-net leased GPUs—could become a template for AI infrastructure financing industry-wide

Related: