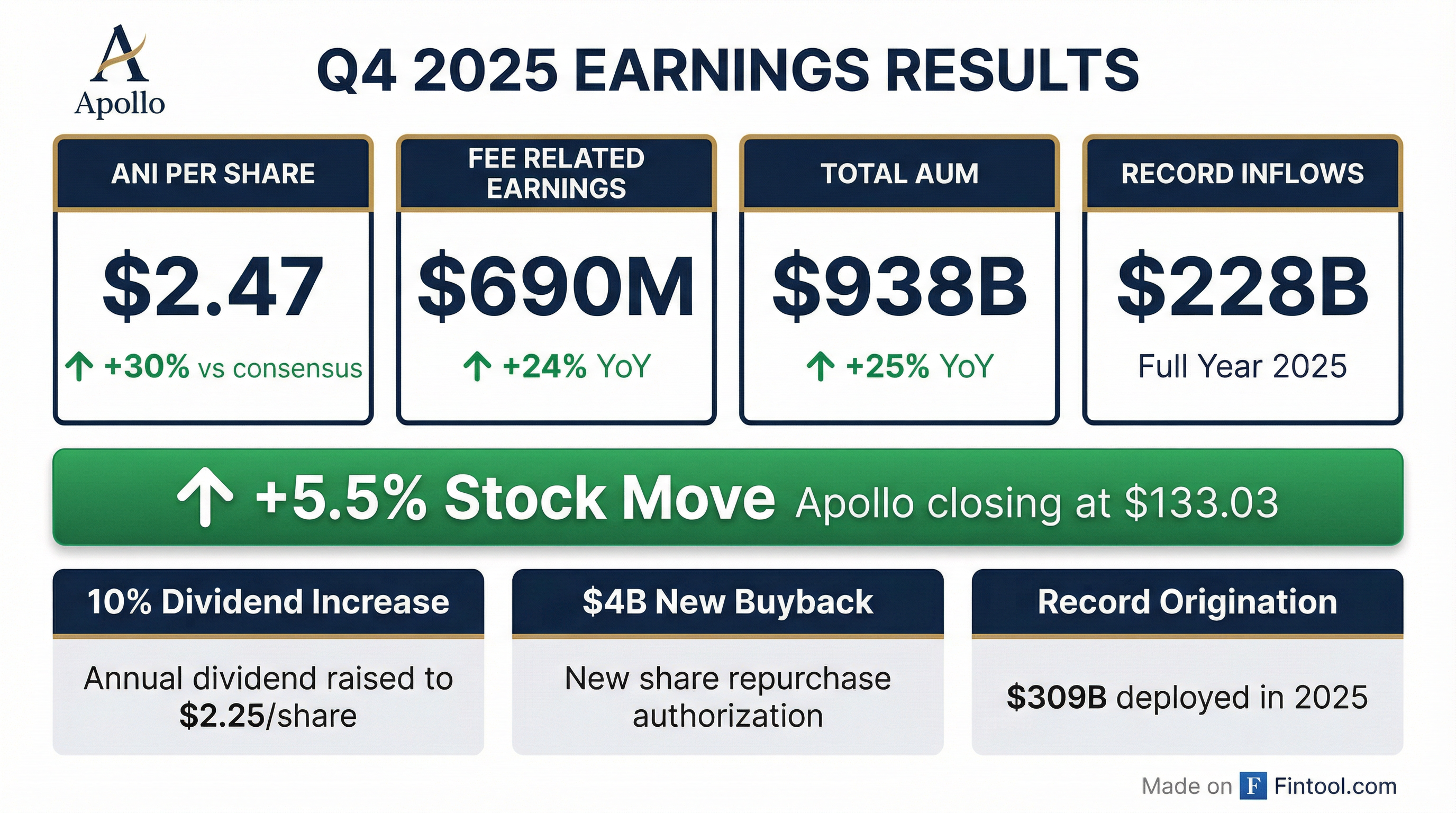

Earnings summaries and quarterly performance for Apollo Global Management.

Executive leadership at Apollo Global Management.

Marc Rowan

Chair and Chief Executive Officer

James Belardi

Chairman, Chief Executive Officer and Chief Investment Officer of AHL

James Zelter

President

John Zito

Co-President of AAM

Kristiane Kinahan

Chief Accounting Officer

Martin Kelly

Chief Financial Officer

Scott Kleinman

Co-President of AAM

Whitney Chatterjee

Chief Legal Officer

Board of directors at Apollo Global Management.

Brian Leach

Director

David Simon

Director

Gary Cohn

Lead Independent Director

Jessica Bibliowicz

Director

Kerry Murphy Healey

Director

Lynn Swann

Director

Marc Beilinson

Director

Mitra Hormozi

Director

Pamela Joyner

Director

Patrick Toomey

Director

Research analysts who have asked questions during Apollo Global Management earnings calls.

Patrick Davitt

Autonomous Research

7 questions for APO

Glenn Schorr

Evercore ISI

6 questions for APO

Alexander Blostein

Goldman Sachs

5 questions for APO

Brennan Hawken

UBS Group AG

5 questions for APO

John Barnidge

Piper Sandler

5 questions for APO

Michael Cyprys

Morgan Stanley

5 questions for APO

William Katz

TD Cowen

5 questions for APO

Ben Budish

Barclays PLC

4 questions for APO

Brian Bedell

Deutsche Bank

4 questions for APO

Kenneth Worthington

JPMorgan Chase & Co.

4 questions for APO

Steven Chubak

Wolfe Research

4 questions for APO

Wilma Burdis

Raymond James Financial

4 questions for APO

Craig Siegenthaler

Bank of America

3 questions for APO

Michael Brown

Wells Fargo Securities

3 questions for APO

Alex Blostein

Goldman Sachs Group, Inc.

2 questions for APO

Benjamin Budish

Barclays PLC

2 questions for APO

Bill Katz

TD Securities

2 questions for APO

Ken Worthington

JPMorgan

2 questions for APO

Mike Brown

UBS

2 questions for APO

Daniel Fannon

Jefferies Financial Group Inc.

1 question for APO

Kyle Voigt

Keefe, Bruyette & Woods

1 question for APO

Recent press releases and 8-K filings for APO.

- Pomerantz LLP has filed a class action lawsuit against Apollo Global Management, Inc. (NYSE: APO) alleging securities fraud or other unlawful business practices.

- The lawsuit follows reports from the Financial Times and CNN concerning discussions between top Apollo executives, including CEO Marc Rowan, and Jeffrey Epstein regarding tax arrangements, which resulted in stock price declines of 5.72% on February 3, 2026, and 5% on February 23, 2026.

- Investors who purchased Apollo securities during the Class Period have until May 1, 2026, to ask the Court to appoint them as Lead Plaintiff.

- Unions have urged the SEC to investigate Apollo over Epstein ties, questioning the accuracy and completeness of the firm's communications to investors.

- A securities fraud class action lawsuit has been filed against Apollo Global Management, Inc. (APO) by the Law Offices of Frank R. Cruz.

- The lawsuit covers a Class Period from May 10, 2021, to February 21, 2026, and shareholders have until May 1, 2026, to file a lead plaintiff motion.

- The complaint alleges that Apollo made materially false and misleading statements by failing to disclose that CEO Marc Rowan and former CEO Leon Black frequently communicated with Jeffrey Epstein regarding Apollo's business, contradicting the company's claims of no business dealings with Epstein.

- Apollo's stock price experienced significant declines in February 2026 following news reports detailing the company's connections to Jeffrey Epstein, including drops of 5.7%, 5.4%, and 5% on separate occasions.

- A securities class action lawsuit has been filed against Apollo Global Management (APO) and certain current and former executives concerning previously undisclosed information about Apollo’s business relationship with Jeffrey Epstein.

- The lawsuit alleges that Apollo's CEO, Marc Rowan, consulted Epstein on Apollo’s tax affairs, contradicting the firm's prior assurances that it "never did any business" with Epstein (excluding Leon Black).

- Reports by The Financial Times and CNN on these ties caused Apollo's share price to fall over 15% by February 23, 2026, wiping out over $12 billion of market capitalization in just over three weeks.

- The Class Period for the lawsuit is May 10, 2021, to February 21, 2026, with a Lead Plaintiff Deadline of May 1, 2026.

- Ambiq Micro reported full year 2025 net sales of $72.5 million and fourth quarter net sales of $20.7 million, which exceeded guidance and marked the highest quarterly net sales of 2025, demonstrating sequential growth in net sales every quarter of the year.

- The company achieved a GAAP gross margin of 42.7% and a non-GAAP gross margin of 45.5% in Q4 2025, with full year 2025 gross profit being the highest in Company history.

- For the first quarter of 2026, Ambiq expects net sales between $21.0 million and $22.0 million and a non-GAAP gross margin between 44.0% and 45.0%.

- Strategic highlights include the unveiling of Atomiq®, the world’s first ultra-low-power NPU SoC, and the completion of an upsized initial public offering and a follow-on offering, generating $102.7 million and $76.8 million in net proceeds, respectively.

- A class action lawsuit has been filed against Apollo Global Management, Inc. (APO) by Robbins LLP on behalf of investors who purchased securities between May 10, 2021, and February 21, 2026.

- The lawsuit alleges that Apollo Global failed to disclose that Jeffrey Epstein was involved in the company's business, with leaders like Rowan and Black frequently communicating with him in the 2010s regarding business matters.

- News reports detailing Epstein's involvement led to significant drops in Apollo Global's stock price, including a $1.35 per share fall on February 2, 2026, a $6.34 drop on February 3, 2026, a $6.81 drop over two trading days from February 17, 2026, and a $5.99 (approximately 5%) drop on February 23, 2026.

- Shareholders interested in serving as lead plaintiff in the class action must submit their papers by May 1, 2026.

- In December 2025, Apollo Global Management (Apollo Funds) entered into a Memorandum of Understanding (MOU) with Capital Power to form an investment partnership.

- This partnership is established to pursue the acquisition of merchant U.S. natural gas generation assets.

- The total potential committed equity for the partnership is up to US$3 billion, with Capital Power committing US$750 million.

- The MOU contemplates Capital Power operating the acquired assets and receiving management and performance fees.

- A securities class action lawsuit has been filed against Apollo Global Management, Inc. (APO) in the United States District Court for the Southern District of New York.

- The lawsuit covers securities purchased or acquired between May 10, 2021, and February 21, 2026.

- The complaint alleges that Apollo Global leaders, including Rowan and Black, frequently communicated with Jeffrey Epstein in the 2010s regarding the company's business, making Apollo's assertion of no business with Epstein untrue and leading to materially false and misleading statements.

- The deadline for investors to contact the firm to discuss their rights or interests regarding this class action and to potentially serve as lead plaintiff is May 1, 2026.

- Apollo Global Management, Inc. (NYSE: APO) is facing a securities fraud class action lawsuit.

- The lawsuit alleges the company failed to disclose material information regarding an undisclosed relationship with Jeffrey Epstein and communications between its leadership figures (Marc Rowan and Leon Black) and Epstein concerning company business.

- The alleged misconduct occurred during the class period from May 10, 2021, to February 21, 2026.

- Investors have until May 1, 2026, to file lead plaintiff applications in the United States District Court for the Southern District of New York.

- Faruqi & Faruqi, LLP is investigating potential claims against Apollo Global Management, Inc. (APO) and reminds investors of the May 1, 2026 deadline to seek the role of lead plaintiff in a federal securities class action.

- The complaint alleges that Apollo Global and its executives violated federal securities laws by making false and/or misleading statements and/or failing to disclose that executives, including Marc Rowan and Black, frequently communicated with Jeffrey Epstein in the 2010s regarding the company's business, contradicting previous assertions that Apollo never did business with Epstein.

- Investors who purchased or acquired Apollo securities between May 10, 2021 and February 21, 2026 and suffered losses are encouraged to contact the law firm.

- News reports on February 1, 2026, and February 21, 2026, detailing the entanglement with Jeffrey Epstein, led to Apollo's stock falling 5.7% over two trading days to $126.85 on February 3, 2026, and dropping $5.99 (approximately 5%) to $113.73 on February 23, 2026.

- The United Food and Commercial Workers International Union (UFCW) launched a website, DontAcquireHeritageGrocers.com, to warn potential acquirers of Heritage Grocers Group about significant labor and operational risks.

- Apollo Global Management [NYSE: APO], as the owner of Heritage Grocers Group through Apollo Fund IX, is actively seeking to sell the grocer.

- The UFCW's warning highlights issues such as union organizing drives, labor-related litigation, leadership instability, and poor operating performance leading to debt rating downgrades.

Fintool News

In-depth analysis and coverage of Apollo Global Management.

Apollo CFO Affirms 20%+ FRE Growth at UBS Conference, Says Rates Likely to Stay Higher

Apollo Nears $3.4B Loan to Finance Nvidia Chips for Musk's xAI

Apollo Deploys $7 Billion to Finance Nvidia GPUs for Musk's xAI in AI Infrastructure Play

Quarterly earnings call transcripts for Apollo Global Management.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more