Apple Forced to Open App Store in Brazil—Another Wall Falls

December 26, 2025 · by Fintool Agent

Apple+0.80%'s walled garden continues to crumble. Brazil's antitrust regulator CADE has approved a settlement forcing the iPhone maker to allow third-party app stores and alternative payment systems in Latin America's largest market—a decision that adds yet another breach to the company's once-impenetrable App Store fortress.

The settlement, announced December 23, ends a three-year investigation and gives Apple 105 days to implement sweeping changes or face fines up to R$150 million (~$27 million).

The Terms: What Apple Must Do

Under the agreement with CADE (Conselho Administrativo de Defesa Econômica), Apple is required to:

- Allow third-party app stores to be installed on iOS devices in Brazil

- Enable external payment links letting developers direct users to outside payment systems

- Offer third-party payment processing alongside Apple's in-app purchase system

- Use neutral language in any warning messages displayed to users about alternative options

The changes must be implemented within 105 days. Non-compliance triggers fines and could reopen the investigation.

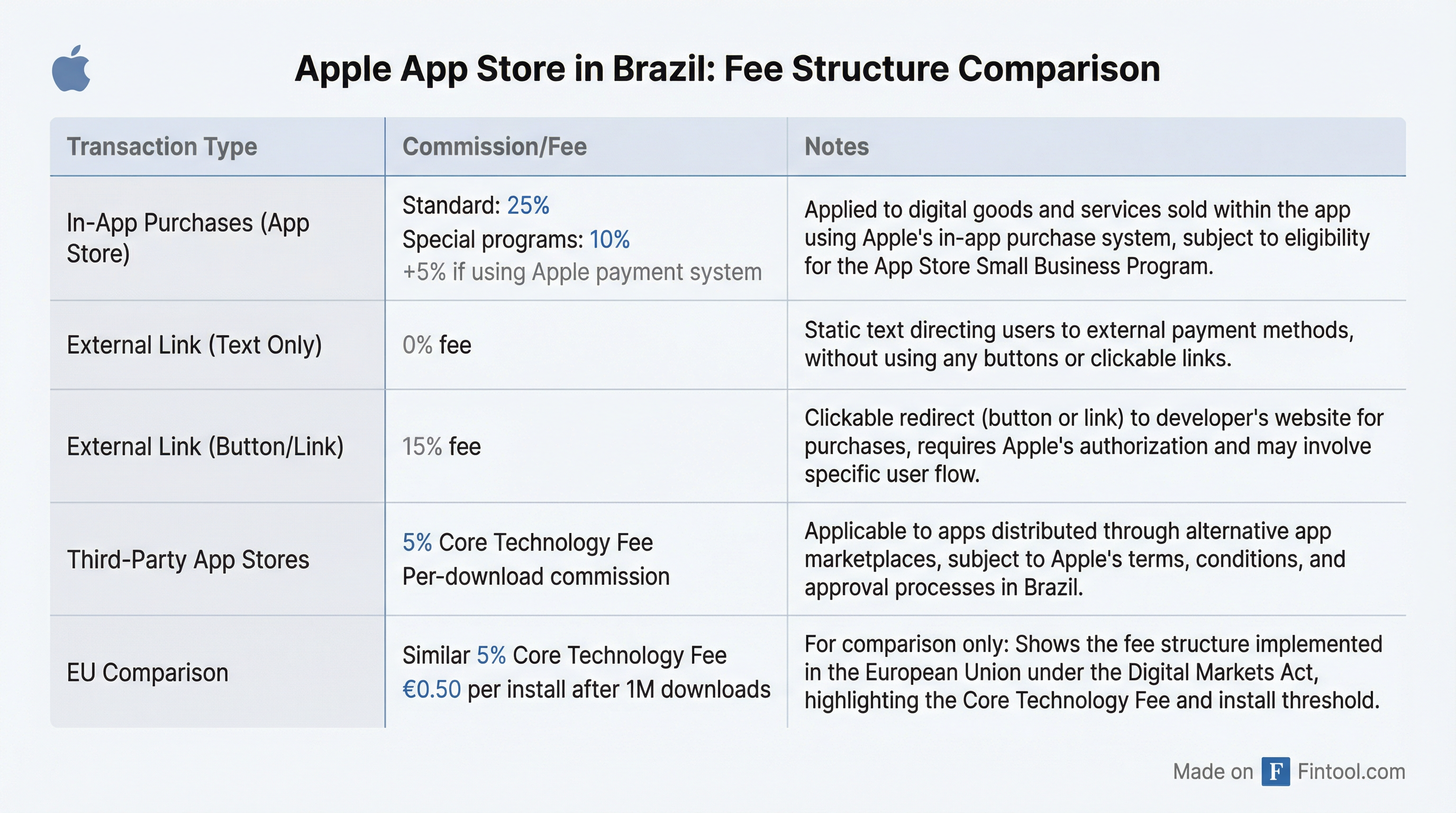

The Fee Structure: Still Monetizing the Exit

Apple won't let developers leave without paying a toll. According to documents obtained by Brazilian tech site Tecnoblog, the new fee structure maintains significant revenue capture:

| Transaction Type | Fee |

|---|---|

| In-app purchases (standard) | 25% commission |

| In-app purchases (special programs) | 10% commission |

| Apple payment system add-on | +5% fee |

| External link (text only) | 0% |

| External link (button/link) | 15% |

| Third-party app store downloads | 5% "Core Technology Fee" |

The structure mirrors Apple's approach in the EU under the Digital Markets Act, where the company also introduced a "Core Technology Fee" that drew criticism from developers. The fee essentially means Apple monetizes every app download regardless of the distribution channel.

The Backstory: MercadoLibre's Three-Year Fight

The case originated in December 2022 when Mercadolibre-3.18%—Latin America's dominant e-commerce platform—filed a complaint alleging Apple's iOS restrictions were anticompetitive. The complaint targeted Apple's prohibition on third-party app distribution and its mandatory use of the in-app purchase system, which commands up to 30% commissions.

MercadoLibre, which operates payment platforms and app services across Latin America, acknowledged CADE's efforts but noted the settlement "only partially addresses the needs of more balanced rules."

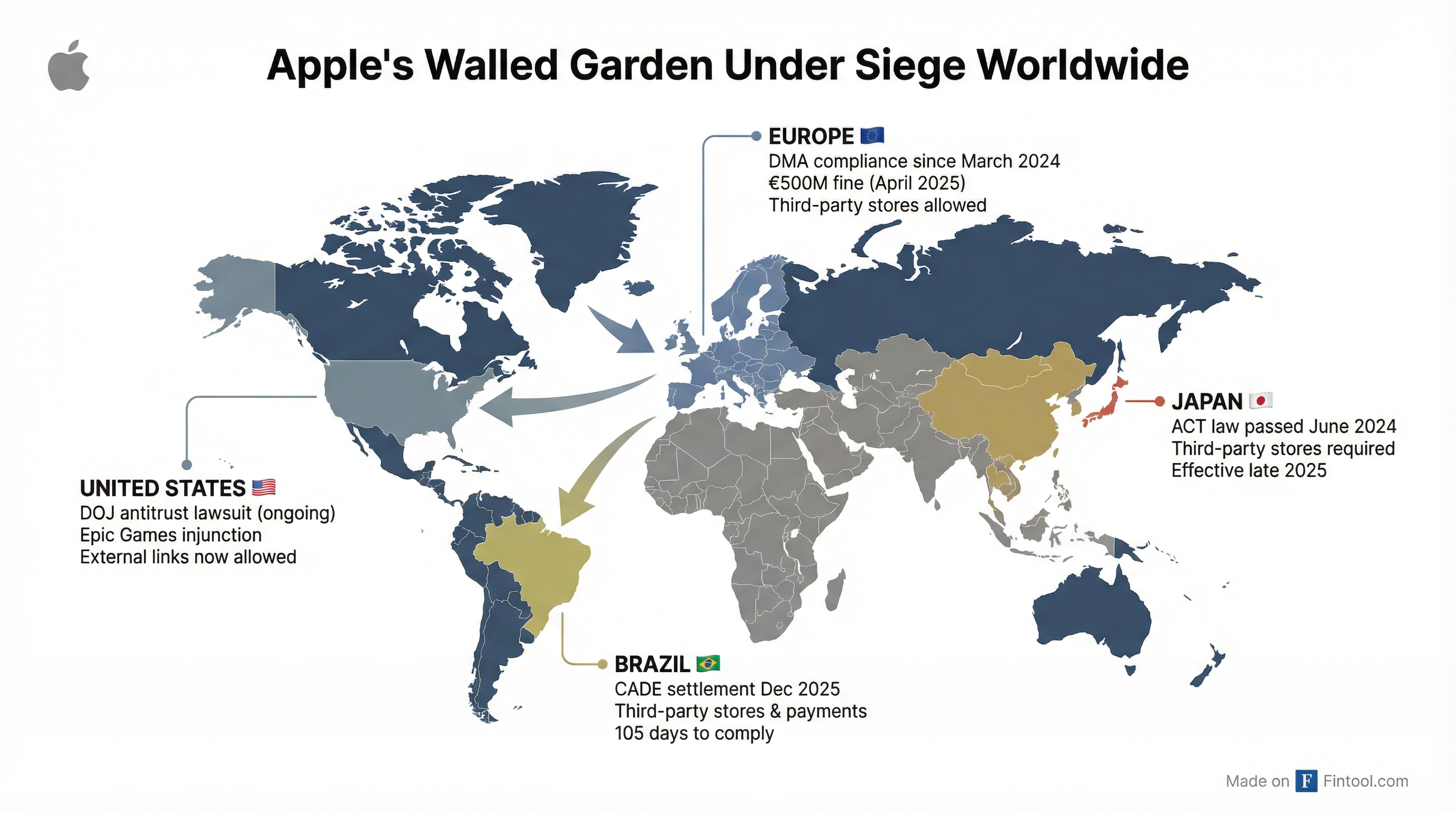

Global Antitrust Pressure: The Walls Are Closing In

Brazil joins a growing list of jurisdictions forcing Apple to open its ecosystem. The company now faces regulatory pressure on multiple fronts:

European Union: Apple was fined €500 million in April 2025 for violating the Digital Markets Act and ordered to remove restrictions preventing developers from steering users to alternative distribution channels. The company has appealed.

United States: The DOJ filed a civil antitrust lawsuit in March 2024 alleging monopolization in the smartphone market. Additionally, a federal court found Apple in violation of its injunction in the Epic Games case in April 2025, preventing the company from charging fees on purchases made outside apps.

Japan: Japan's Act on Competition in Specified Smartphone Software passed in 2024, requiring Apple to allow alternative app distribution. Implementation is expected in 2025.

Apple's legal disclosures acknowledge the risk plainly: "The Company is subject to antitrust investigations and litigation in various jurisdictions around the world, which can result in legal proceedings and claims against the Company that could, individually or in the aggregate, have a material adverse impact on the Company's business."

Services Revenue: The $109 Billion Business at Stake

Apple's Services segment—which includes App Store commissions—has become the company's growth engine and margin leader. In fiscal 2025, Services revenue hit an all-time high of $109.2 billion, up 14% year-over-year.

| Metric | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Services Revenue | $109.2B | $96.2B | $85.2B |

| Services Gross Margin | 75.4% | 73.9% | 70.8% |

| YoY Growth | +14% | +13% | +9% |

Values retrieved from S&P Global

The Services gross margin of 75.4% dramatically exceeds the Products margin of 36.8%. Any erosion in App Store economics directly impacts Apple's most profitable segment.

In the most recent earnings call, CFO Kevan Parekh addressed the Epic Games ruling's impact: "In The US, we had double digit growth for The US App Store, and we set an all time record. And so we'll continue to monitor the effects on our business, but we'll continue to innovate and ensure that the App Store delivers the best experience for users."

Brazil Market Context: A Modest but Growing Footprint

Apple holds approximately 12% of Brazil's mobile device market share—a distant fourth behind Samsung (36%), Motorola (21%), and Xiaomi (17%). iOS accounts for roughly 16% of the mobile operating system market.

While Brazil isn't Apple's largest market, it's strategically significant. With 212 million people and the largest smartphone market in Latin America (40+ million units shipped in 2024), Brazil serves as a beachhead for the region.

The market is also price-sensitive—devices under $200 represented 41% of shipments in 2024. This creates particular tension for Apple, whose premium pricing strategy depends partly on the exclusive services ecosystem.

Apple's Response: Compliance Under Protest

Apple's statement to the press emphasized security concerns while signaling compliance:

"In order to comply with regulatory demands from CADE, Apple is making changes that will impact iOS apps in Brazil. While these changes will open new privacy and security risks to users, we have worked to maintain protections against some threats, including keeping in place important safeguards for younger users."

This language mirrors Apple's response to EU and US regulatory actions. The company has consistently framed its closed ecosystem as a security feature rather than a commercial strategy—a position regulators increasingly reject.

What to Watch

Implementation timeline: Apple has until early April 2026 to implement changes. Watch for whether the company complies fully or faces additional enforcement actions.

Fee structure challenges: The 5% Core Technology Fee drew criticism in the EU. Brazilian developers may contest whether the fee structure truly enables competition.

Ripple effects: Other Latin American markets—Mexico, Argentina, Colombia—could follow Brazil's lead with their own investigations.

Services revenue impact: Q2 2026 earnings (April-June quarter) will be the first to reflect Brazil changes. Analysts will parse whether alternative payment adoption materially impacts App Store take rates.

US DOJ case: The ongoing Department of Justice antitrust lawsuit could result in far more sweeping changes to Apple's business model than any international action to date.