Earnings summaries and quarterly performance for Apple.

Executive leadership at Apple.

Board of directors at Apple.

Research analysts who have asked questions during Apple earnings calls.

Amit Daryanani

Evercore

7 questions for AAPL

David Vogt

UBS Group AG

7 questions for AAPL

Erik Woodring

Morgan Stanley

7 questions for AAPL

Michael Ng

Goldman Sachs

7 questions for AAPL

Samik Chatterjee

JPMorgan Chase & Co.

7 questions for AAPL

Wamsi Mohan

Bank of America Merrill Lynch

7 questions for AAPL

Richard Kramer

Arete Research

6 questions for AAPL

Aaron Rakers

Wells Fargo

5 questions for AAPL

Atif Malik

Citigroup Inc.

5 questions for AAPL

Ben Reitzes

Melius Research LLC

4 questions for AAPL

Krish Sankar

TD Cowen

4 questions for AAPL

Benjamin Reitzes

Melius Research

3 questions for AAPL

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

3 questions for AAPL

Aatif Malik

Citi

1 question for AAPL

Benjamin Bollin

Cleveland Research Company

1 question for AAPL

Recent press releases and 8-K filings for AAPL.

- Europe’s smartphone market declined about 1% to 134.2 million units in 2025 amid subdued demand and new eco-design and USB-C regulations.

- Apple shipped a record 36.9 million iPhones in Europe (up 6% year-over-year), capturing a 27% market share driven by strong replacement demand for iPhone 16, 16e, 16 Pro Max and 17 Pro Max.

- Samsung remained the region’s largest vendor with 46.6 million shipments, followed by Xiaomi at 21.8 million; HONOR entered the top five and Motorola shipped 7.7 million units (down 5%, but with double-digit Q4 growth).

- Omdia warns the market could be weaker in 2026 due to RAM and processor supply constraints.

- Apple is fast-tracking three AI wearables—smart glasses (N50), an AirTag-sized pendant, and camera-equipped AirPods—to connect with the iPhone and feed visual context into a revamped Siri interface.

- The smart glasses target production in late 2026 for a likely 2027 launch, while camera-equipped AirPods could arrive as soon as late 2026; the pendant remains early-stage with a 2027 aim.

- Apple shares jumped about 2.7%, whereas EssilorLuxottica’s ADRs fell over 7%, underscoring investor enthusiasm and competitive impact.

- The initiative is led by Apple’s internal Vision Products Group and reflects a strategic shift toward AI hardware under CEO Tim Cook.

- Apple to open CarPlay to third-party AI voice assistants (OpenAI’s ChatGPT, Google’s Gemini, Anthropic’s Claude), marking the first non-Apple assistants directly accessible inside CarPlay.

- Siri remains the default assistant with its dedicated button and wake phrase; third-party AI apps must be launched manually and cannot hijack Siri controls.

- Apple is investing in its own AI capabilities, including the Q.AI acquisition and a partnership to integrate Google’s Gemini into future Siri/Foundation Models, and developing a “World Knowledge Answers” enhancement for Siri.

- CEO Tim Cook warns of a global memory chip shortage likely to push up component costs; analysts believe Apple’s supplier relationships may help secure needed parts.

- Global tablet shipments projected to grow 9.8% to 162 million units in 2025, with Q4 volumes at 44 million units (+9.8% YoY).

- Apple led the market in Q4 2025 with 19.63 million iPads shipped (44.9% share; +16.5% YoY).

- Samsung’s Q4 shipments fell 9.2% to 6.44 million units, while Huawei and Xiaomi gained momentum with 14.8% and 10.1% growth, respectively.

- Omdia warns that after pandemic-driven peak demand and seasonal promotions, tablet market growth is nearing a slowdown, with intensified pressures expected in 2026.

- Apple plans mass production of in-house Baltra AI server chips in 2026.

- The company is developing proprietary AI-focused data centers to support Apple Intelligence, extending its hardware stack into the cloud.

- This strategy aims to enhance performance and sovereignty by reducing reliance on third-party cloud providers, controlling cost, security, and scalability.

- Apple’s iPhone ASP reached US$1,032 in Q4 2025, up 11.5% YoY as the premium iPhone 17 mix drove strong pricing power.

- iPhone shipments totaled 82.6 million units in Q4 2025, capturing 24.6% of global smartphone volume, a 10.6% year-over-year increase.

- For full-year 2025, Apple shipped 242.8 million iPhones, growing 9.9% YoY and securing 19.3% market share, marking its first annual lead in global smartphone shipments.

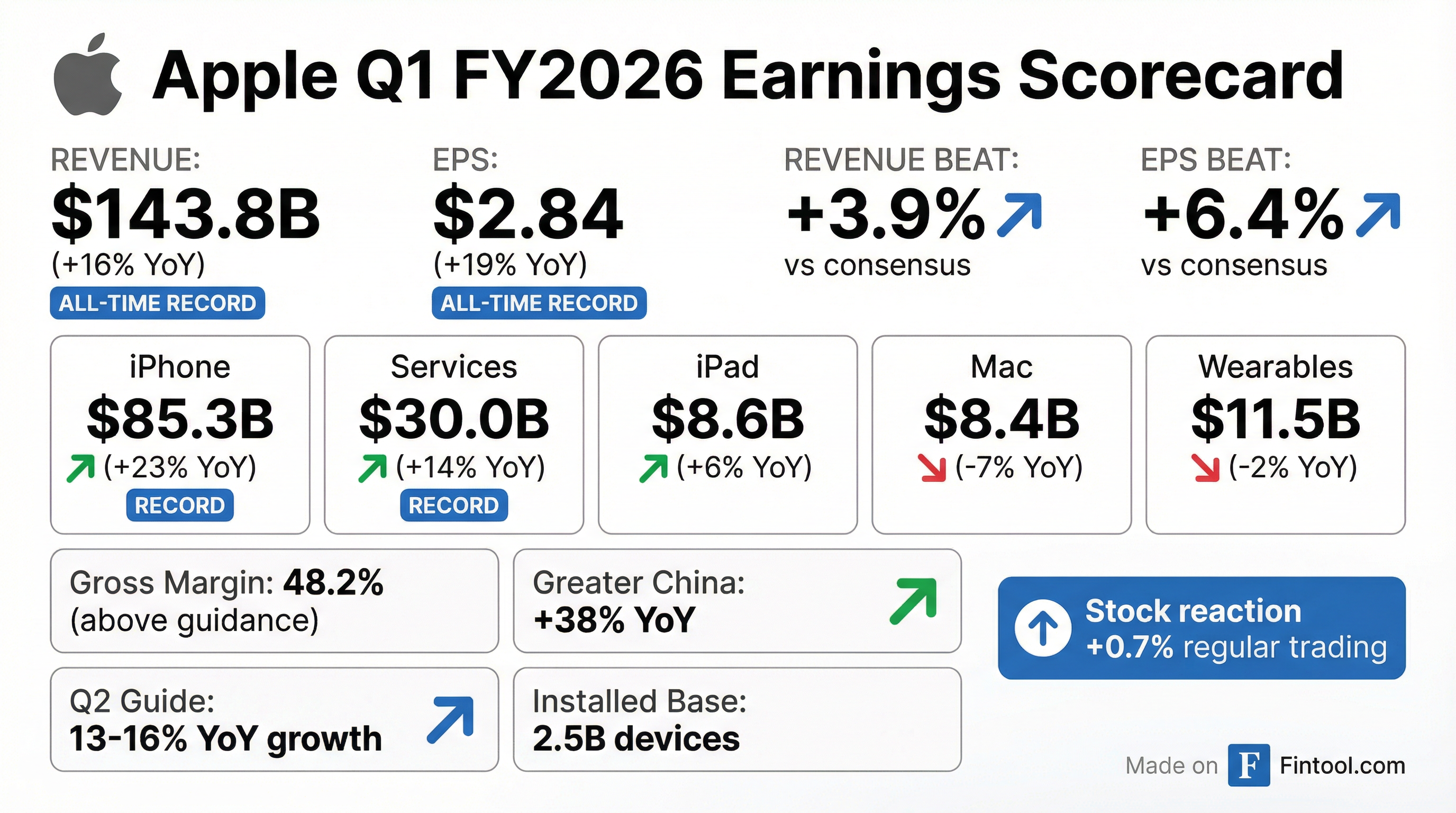

- Apple posted record $143.8 billion quarterly revenue, up 16% year over year, with iPhone sales hitting a record $85 billion, a 23% increase.

- Greater China revenue surged 38% to $25.5 billion, more than double Apple's overall growth, driven by strong iPhone 17 demand and in-store traffic.

- Services reached all-time highs, complementing robust hardware sell-through across regions.

- CEO Tim Cook highlighted India as a strategic growth market, achieving record quarterly revenue across iPhone, Mac, and iPad.

- Apple posted record fiscal Q1 2026 revenue of $143.8 billion and net profit of $42.1 billion (EPS $2.84)

- iPhone revenue rose 23% to $85.3 billion, driven by all-time unit performance and a rebound in Greater China

- Services revenue hit a record $30 billion, with the installed base topping 2.5 billion active devices

- Greater China revenue jumped 38% to $25.53 billion, transforming the region into a headline-strength market

- Declared a $0.26 quarterly dividend, issued no forward guidance, and emphasized AI investments, including partnerships like Q.ai

- Revenue of $143.8 billion (+16% YoY) and EPS of $2.84 (+19% YoY), both all-time quarterly records.

- iPhone revenue reached $85.3 billion (+23% YoY); Services revenue was $30 billion (+14% YoY); active device base surpassed 2.5 billion.

- Gross margin of 48.2%, up 100 bps sequentially; Q2 revenue expected to grow 13–16% YoY with gross margin of 48–49%.

- Returned nearly $32 billion to shareholders—including $25 billion in share repurchases—and ended Q1 with $145 billion in cash and marketable securities (net cash $54 billion).

- Board declared a quarterly dividend of $0.26 per share, payable February 12, 2026.

- Apple delivered $143.8 B revenue, up 16% YoY, marking its best quarter ever.

- iPhone revenue reached $85.3 B (+23% YoY; all-time record) and Services hit $30 B (+14% YoY; record in developed & emerging markets).

- Gross margin expanded to 48.2%, with net income of $42.1 B, EPS of $2.84 (+19% YoY), and operating cash flow of $53.9 B (all-time high).

- Active installed base surpassed 2.5 B devices, reaching an all-time high across all product categories and regions.

- For Q2 FY26, Apple guides 13–16% YoY revenue growth, 48–49% gross margin, $18.4–18.7 B in OpEx, and expects to return ~$32 B to shareholders (including $25 B buybacks and $3.9 B dividends); net cash stood at $54 B at quarter end.

Fintool News

In-depth analysis and coverage of Apple.

Apple to Manufacture Mac Mini in Houston, Expanding US Production Beyond Servers

West Virginia Sues Apple Over Child Abuse Material, Citing Internal Admission as 'Greatest Platform for Distributing Child Porn'

Apple Accelerates AI Wearables Push: Smart Glasses, Pendant, and Camera AirPods in Development

Apple Brings Agentic Coding to Xcode 26.3, Integrating Claude and Codex

Apple Posts Record $143.8B Quarter on 'Staggering' iPhone Demand and China Rebound

Apple Reports Record Quarter: iPhone Sales Surge 23% to $85B as China Turnaround Stuns Wall Street

Quarterly earnings call transcripts for Apple.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more